News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

10xResearch: Should YOU BUY Bitcoin and SELL Bitcoin Miners Before the FOMC Decision

Institutional Crypto Research by Experts

10xResearch·2024/07/31 03:23

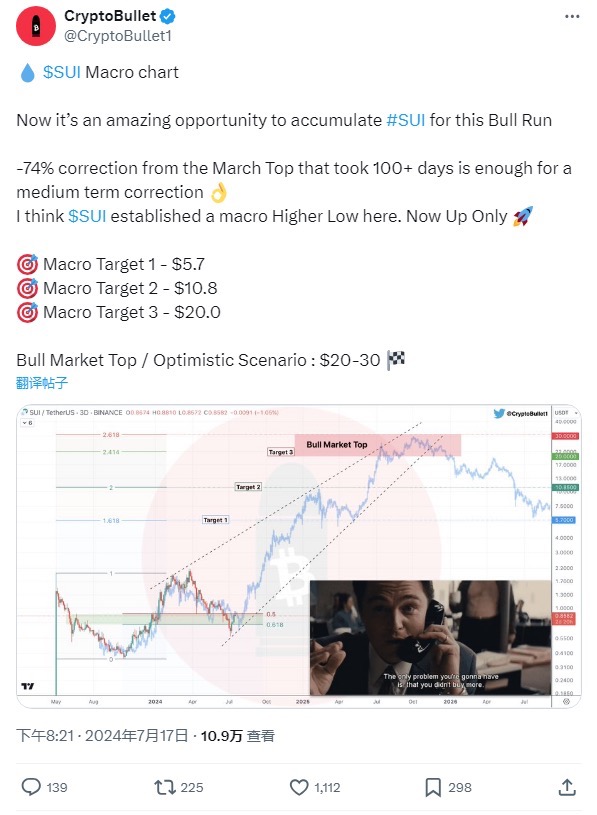

SUI: On-chain TVL doubles, positive news persists, renowned traders remain bullish

远山洞见·2024/07/30 07:24

LiquidSwap (LSD): Aptos' AMM DEX market capitalisation expectations

远山洞见·2024/07/29 02:13

Enter Mongy (MONGY): A comprehensive analysis from narrative to market value

远山洞见·2024/07/26 10:21

TIME (TIMESOL): The perfect blend of time value and meme culture

远山洞见·2024/07/25 02:46

Flash

- 14:05Stablecoin solution provider Stablecore completes $20 million financing, led by NorwestJinse Finance reported that stablecoin solutions provider Stablecore has announced the completion of a $20 million funding round, led by Norwest, with participation from an exchange, Curql, BankTech Ventures, Bank of Utah, EJF Ventures, and Bankers Helping Bankers Fund. Stablecore is a platform that supports community and regional banks and credit unions in offering stablecoins, tokenized deposits, and digital asset products. It can be integrated with existing bank core and digital banking services, enabling financial institutions to provide digital asset products without changing their technological infrastructure.

- 13:52The US Dollar Index (DXY) falls to its lowest level since July 4.Jinse Finance reported that the US Dollar Index (DXY) fell to its lowest level since July 4, with an intraday decline of nearly 0.5%, currently at 96.89.

- 13:45European stocks decline, with Germany's DAX index down 1% intradayChainCatcher news, according to Golden Ten Data, European stocks fell, with the German DAX index dropping 1% during the day, the UK FTSE 100 index down 0.7%, and the Euro Stoxx 50 index down 0.67%.