News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

OGCommunity (OGC): A Rising Star in the GameFi Sector

远山洞见·2024/07/25 02:41

Exploring CATI (Catizon): Market Expectations and Future Performance

远山洞见·2024/07/24 08:59

Meme New Biaoqing (BIAO) Market Research Analysis

Bitget·2024/07/23 02:54

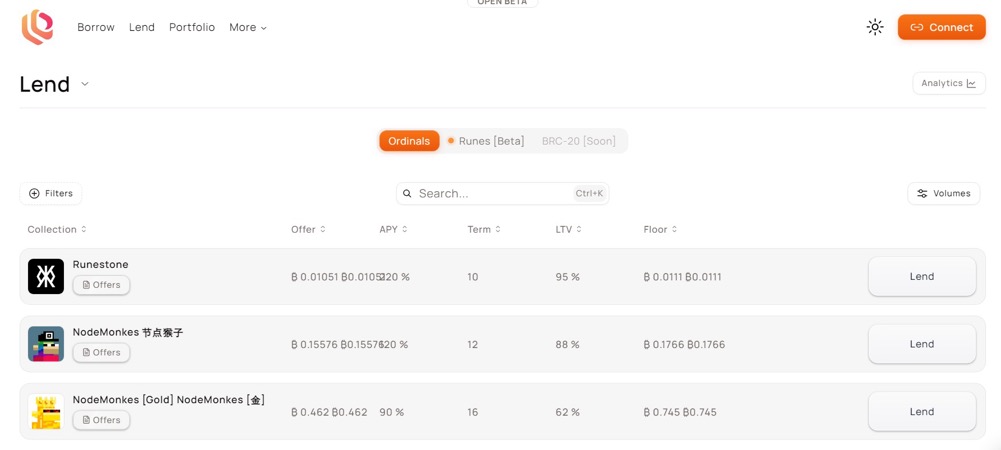

Exploring Liquidium: The Future of Decentralised Bitcoin Lending

远山洞见·2024/07/23 02:29

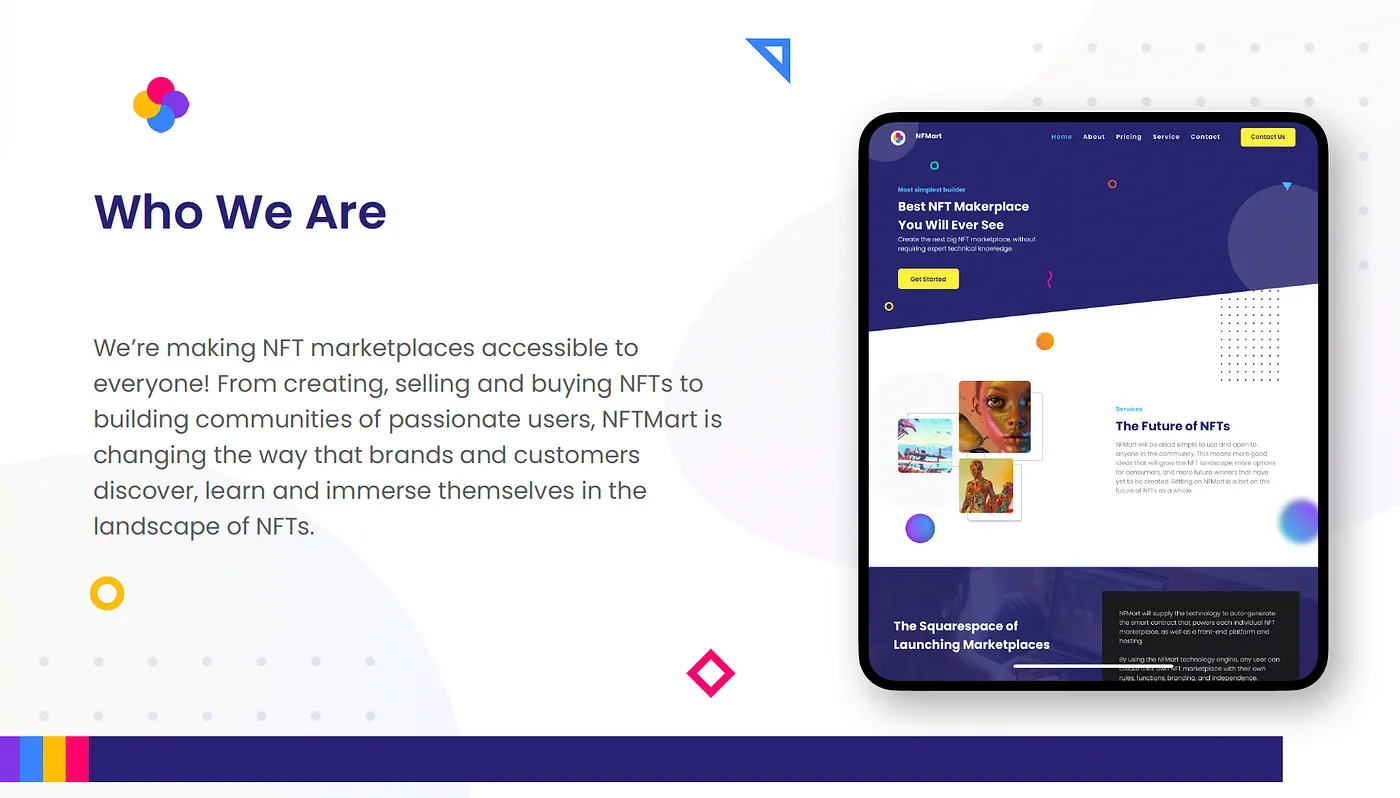

Welcome to NFMart: The Future of NFT Marketplaces

NFMart Blog·2024/07/22 07:21

MIGGLES: The next meme star on the Base chain?

远山洞见·2024/07/22 06:06

NFMart (NFM): Simplifying NFT Market Creation with Generative AI

远山洞见·2024/07/20 04:00

CLOUD: The Sanctum Governance Token

Sanctum Blog·2024/07/19 07:15

Flash

- 22:51Altcoin season index drops to 69Jinse Finance reported that, according to Coinmarketcap data, the Altcoin Season Index is currently at 69, down 3 points from yesterday (which was 72). The index shows that in the past 90 days, about 69 out of the top 100 cryptocurrencies by market capitalization have outperformed bitcoin. It is reported that the CMC Altcoin Season Index is a real-time indicator used to determine whether the current cryptocurrency market is in an altcoin-dominated season. The index is based on the performance of the top 100 altcoins relative to bitcoin over the past 90 days.

- 22:15The probability of the Federal Reserve cutting interest rates by 25 basis points this week is 96.4%.Jinse Finance reported, according to CME "FedWatch": The probability of the Federal Reserve cutting interest rates by 25 basis points this week is 96.4%, and the probability of a 50 basis point cut is 3.6%. The probability of a cumulative 25 basis point rate cut by October is 16.0%, a cumulative 50 basis point cut is 81.0%, and a cumulative 75 basis point cut is 3.0%. (Golden Ten Data)

- 21:47Trump Again Urges U.S. Appeals Court to Approve Dismissal of Federal Reserve Governor CookJinse Finance reported that on September 14 local time, U.S. President Trump made a final request to the U.S. Court of Appeals, seeking permission to dismiss Federal Reserve Governor Cook on the grounds that she is suspected of mortgage fraud. Trump hopes to complete this move before next week's Federal Reserve interest rate decision and once again emphasized that Cook has so far failed to provide a strong rebuttal to the related allegations. (Golden Ten Data)