$2,200,000,000 Hits Institutional Crypto Products in One Week As Optimism About Election Grows: CoinShares

Digital assets manager CoinShares says that institutional crypto investors dropped billions of dollars into crypto products last week.

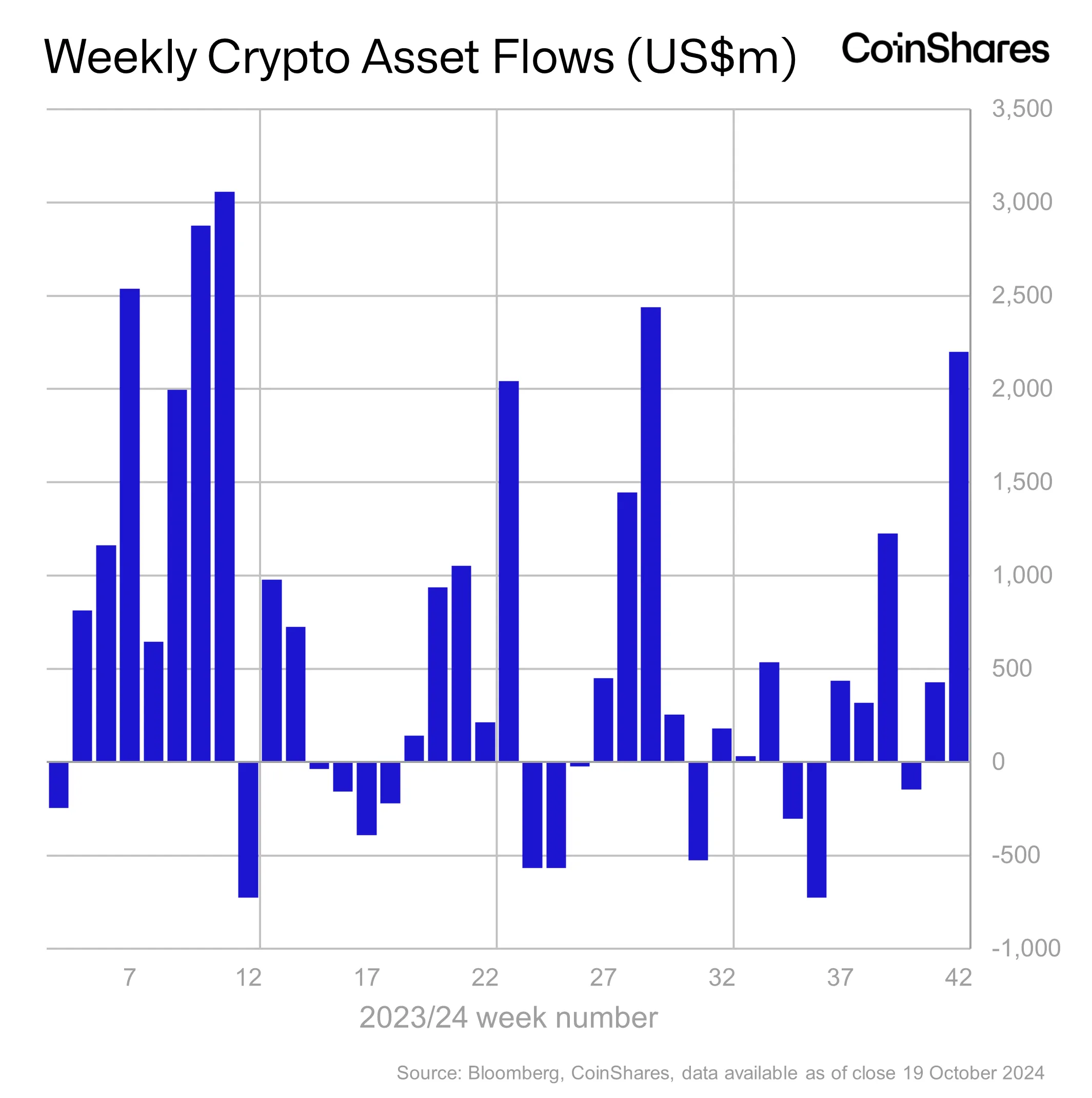

In its latest Digital Asset Fund Flows report , CoinShares says that institutional crypto investment products saw a surge in inflows to the tune of $2.2 billion on net last week.

With last week marking the heaviest inflows in four months, CoinShares attributes the growth to what it interprets as growing optimism for a victory for Republican presidential candidate Donald Trump. Not all recent national polls reflect CoinShares’ view on the matter as Democratic nominee Kamala Harris still holds a lead in many of them.

“Digital asset investment products saw inflows of US$2.2bn, marking the largest weekly increase since July this year. We believe this renewed optimism stems from growing expectations of a Republican victory in the upcoming US elections, as they are generally viewed as more supportive of digital assets.

This, in turn, has led to positive price momentum. As a result, trading volumes in investment products surged by 30%, while price appreciation and inflows have brought total assets under management close to the US$100bn threshold.”

Source: CoinShares/X

Source: CoinShares/X The US brought in the majority of inflows at $2.3 billion, supporting CoinShares’ presidential thesis.

Bitcoin ( BTC ) products raked in $2.13 billion in inflows while Ethereum ( ETH ) broke its downtrend to bring in $58 million in inflows.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X , Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: DALLE3