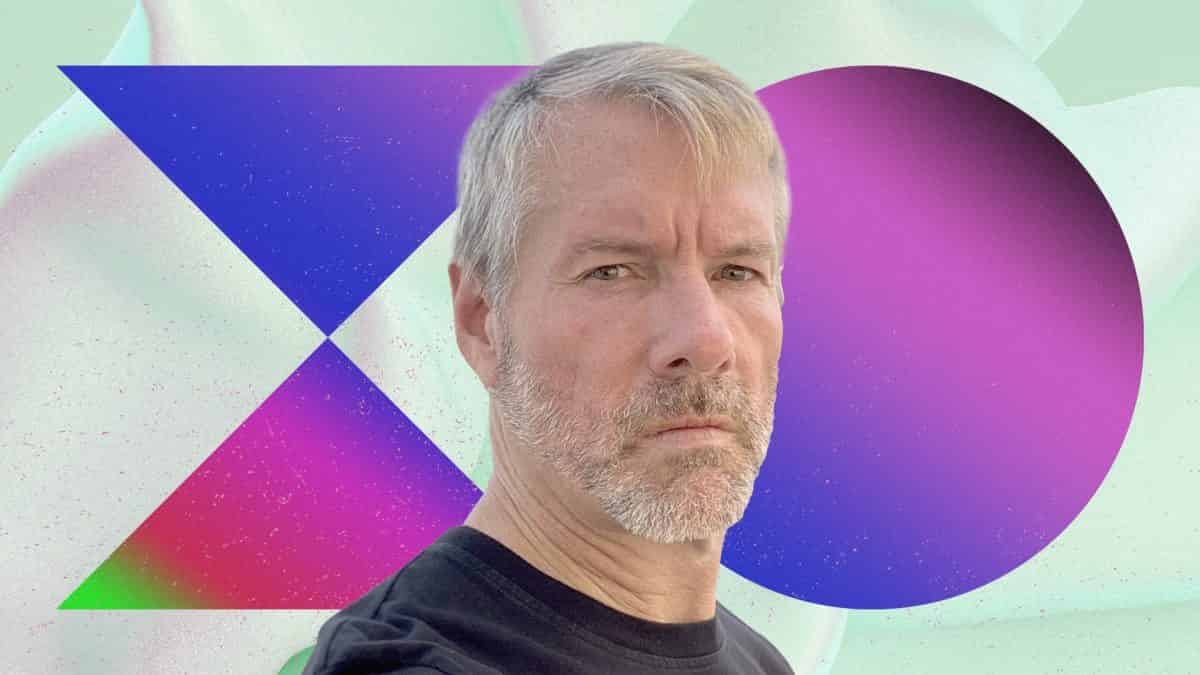

Michael Saylor endorses crypto self-custody following criticism on previous remarks

MicroStrategy founder and bitcoin maxi Michael Saylor expressed support for crypto self-custody in a Wednesday post, seemingly clarifying his stance after facing criticism from the crypto community on his earlier remarks regarding regulated bitcoin custody.

“I support self-custody for those willing and able, the right to self-custody for all, and freedom to choose the form of custody and custodian for individuals and institutions globally,” Saylor said in the X post .

In a recent interview with NZ Herald senior business journalist Madison Reidy, Saylor advocated holding bitcoin via regulated entities such as BlackRock and Fidelity, as he viewed it would be a safer option with less volatility and risk of loss.

In response to concerns regarding increased centralization and government control, Saylor said those views primarily come from "paranoid crypto anarchists," stating that such fears were exaggerated.

Saylor’s comments sparked backlash from several notable figures in the crypto community, including Ethereum co-creator Vitalik Buterin.

“I'll happily say that I think Michael Saylor's comments are batshit insane,” Buterin commented on X earlier Wednesday. “He seems to be explicitly arguing for a regulatory capture approach to protecting crypto. There's plenty of precedent for how this strategy can fail, and for me it's not what crypto is about.”

Buterin’s comments were in reply to Casa co-founder and CTO Jameson Lopp, who argued that self-custody is crucial for maintaining decentralization, enhancing network security, preserving governance participation and promoting continued innovation and scaling without reliance on third parties.

Another bitcoin pioneer Max Keiser’s reaction to Saylor’s remarks appeared to be more pronounced. “The recent comments attacking self-custody demonstrate a regressive tendency to favor the legacy, centralized banking crooks that Bitcoin fixes,” Keiser wrote on X.

Seeking to address his previous comments, Saylor added, “Bitcoin benefits from all forms of investment by all types of entities, and should welcome everyone.”

The debate surrounding crypto self-custody arises as traditional investment products in bitcoin, such as spot bitcoin ETFs, gain momentum. The cumulative net inflows of the 12 spot bitcoin ETFs in the U.S. crossed the $20 billion mark last week, which Bloomberg analyst Eric Balchunas described as “the most difficult” metric to reach in the ETF world.