Bitcoin Price Could Touch $125,000—Here’s How and Why

As Bitcoin continues its impressive rally, the question on everyone's mind is, "How high can Bitcoin go?" With the current price hovering around $98,000, technical indicators and macroeconomic factors suggest that Bitcoin (BTC) could reach $125,000 if certain conditions are met. Let’s break down the analysis and uncover the roadmap to this significant milestone.

How has the Bitcoin Price Moved Recently?

The current Bitcoin price stands at $97,782 , with a 24-hour trading volume of $49.31 billion. Its market capitalization is $1.94 trillion, giving it a dominance of 54.48% in the cryptocurrency market. Over the past 24 hours, Bitcoin's price has risen by 0.53%.

Bitcoin hit its all-time high of $108,239 on December 17, 2024, while its all-time low was recorded at just $0.05 on July 17, 2010. Since reaching its ATH, Bitcoin's lowest point was $91,603 (cycle low), and the highest price since then has been $98,945 (cycle high). The current market sentiment for Bitcoin is neutral, according to price prediction indicators, while the Fear Greed Index reads 73, indicating a sentiment of "Greed."

Bitcoin's circulating supply is currently 19.81 million BTC, with a maximum cap of 21 million BTC. The annual supply inflation rate is 1.10%, meaning 216,110 BTC have been added to circulation over the past year.

Bitcoin Price Prediction: Current Market Outlook

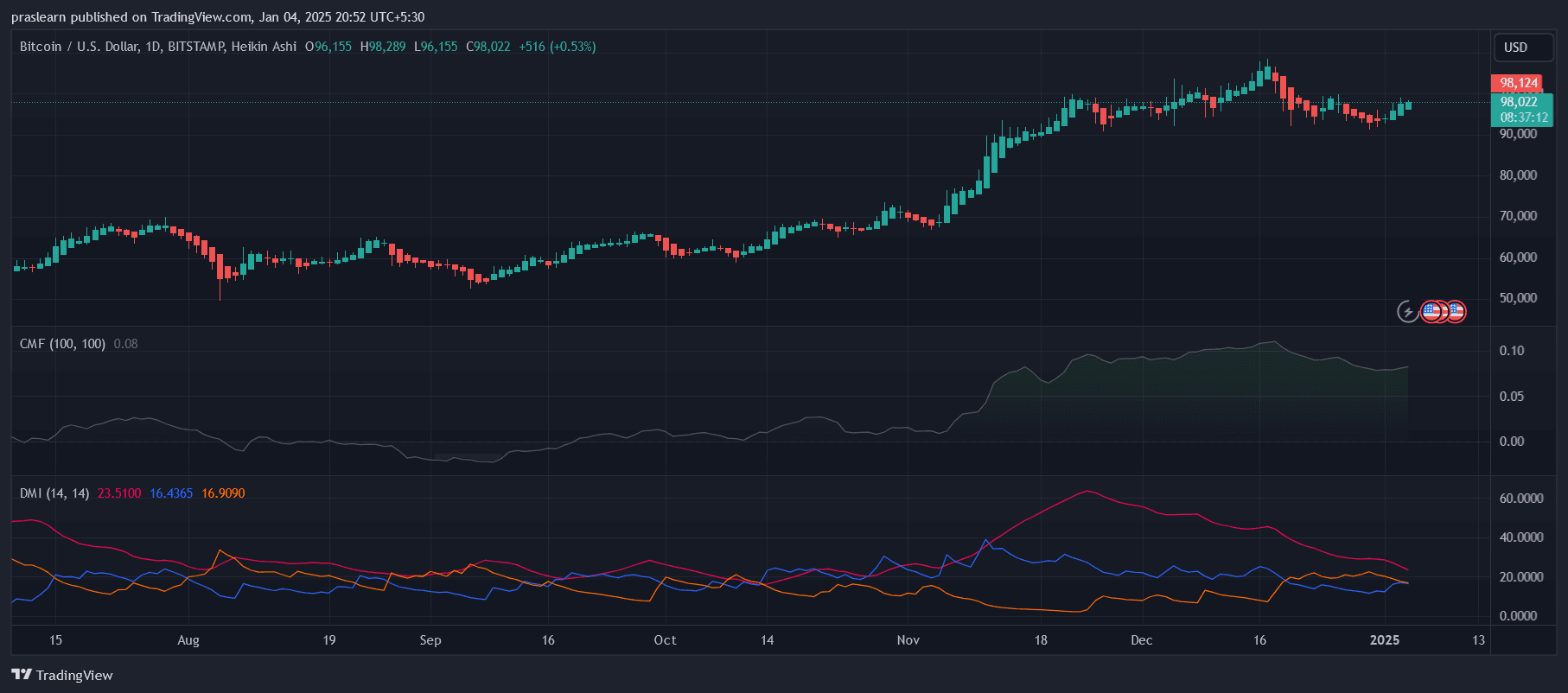

BTC/USD Daily Chart- TradingView

BTC/USD Daily Chart- TradingView Bitcoin has been on a steady upward trajectory over the past several months, fueled by increasing institutional interest, favorable macroeconomic conditions, and strong technical momentum. The cryptocurrency has demonstrated resilience, maintaining its upward trend even in the face of short-term corrections.

Key indicators, such as the Chaikin Money Flow (CMF) and Directional Movement Index (DMI), paint a bullish picture. These metrics suggest a strong inflow of capital and a sustained upward trend, which could propel BTC to new all-time highs.

Technical Analysis: A Bullish Picture

Key Indicators at Play

Chaikin Money Flow (CMF):

- The CMF currently stands at +0.08, indicating strong capital inflows. This suggests that institutional investors and large-scale buyers are continuing to accumulate Bitcoin, a critical driver for upward price movement.

- If the CMF value climbs above 0.1, it would signal even stronger demand, pushing BTC closer to the $125,000 mark.

Directional Movement Index (DMI):

- The +DI (positive directional indicator) remains dominant over the -DI (negative directional indicator), confirming the bullish momentum.

- The ADX (Average Directional Index) is trending at 23.5, which indicates a strengthening trend. Once the ADX surpasses 25, Bitcoin could see a significant acceleration in its upward movement.

Key Price Levels

- Immediate Support: Bitcoin has established strong support at $90,000, acting as a safety net for the ongoing rally.

- Critical Resistance: The $100,000 mark is a major psychological and technical barrier. A breakout above this level, supported by high trading volumes, could open the door to $125,000.

Bitcoin Price Prediction: Catalysts for $125,000

Several factors could drive Bitcoin’s price to $125,000, including:

1. Institutional Adoption

Institutional investors continue to view Bitcoin as a hedge against inflation and economic uncertainty. Developments like Bitcoin ETF approvals and corporate treasury allocations are bringing significant capital into the market, further fueling demand.

2. Macroeconomic Conditions

If central banks adopt dovish monetary policies, such as interest rate cuts, Bitcoin's appeal as a store of value could increase, attracting more investors. Additionally, geopolitical tensions often drive demand for decentralized assets like Bitcoin.

3. Technical Breakout

Breaking the $100,000 resistance level with strong trading volumes would likely trigger a parabolic rally, driven by Fear of Missing Out (FOMO) among retail and institutional investors.

How High Can Bitcoin Go?

Based on the current analysis, Bitcoin’s upward trajectory could extend beyond $125,000 under the right conditions. Here are a few scenarios that could unfold:

Scenario 1: $125,000 Target

- This target is realistic if Bitcoin breaks the $100,000 resistance level with high trading volumes.

- A strengthening ADX (above 25) and continued capital inflows (CMF above +0.1) would provide the technical foundation for this move.

Scenario 2: $150,000 and Beyond

- If macroeconomic conditions turn highly favorable—such as significant interest rate cuts or widespread adoption of Bitcoin by institutions—the price could surge beyond $125,000 to $150,000 or higher.

- A post-halving rally in 2025 could serve as the catalyst for such explosive growth.

Scenario 3: Long-Term Potential

- Analysts and market participants speculate that Bitcoin could eventually reach $200,000 or even $500,000 in the long term as adoption grows and Bitcoin solidifies its role as digital gold.

- For this to happen, broader adoption by governments and corporations, combined with enhanced regulatory clarity, would be key.

Risks to Consider

While the outlook is bullish, there are risks that could hinder Bitcoin’s rise:

- Geopolitical Risks: Negative developments, such as regulatory crackdowns or geopolitical conflicts, could dampen investor sentiment.

- Overbought Conditions: If Bitcoin enters overbought territory, a short-term correction could occur, delaying its upward trajectory.

- Failure at $100,000 Resistance: If BTC fails to break the $100,000 psychological barrier, it may consolidate or retrace to lower levels.

Conclusion

Bitcoin’s potential to touch $125,000 hinges on a combination of technical breakouts, institutional adoption, and favorable macroeconomic conditions. The strong inflow of capital, as indicated by the CMF, and the dominance of bullish momentum, as reflected in the DMI, provide a solid foundation for this target.

However, the journey to $125,000 is not without risks. Investors should closely monitor key levels, market sentiment, and macroeconomic developments to gauge Bitcoin’s next moves. For now, all eyes are on the $100,000 level—a breakout here could set the stage for a historic rally.

Bitcoin’s ascent to $125,000 is not just a possibility—it’s a scenario that is becoming increasingly plausible as the stars align for the world’s leading cryptocurrency.