- Quantum computing may disrupt Bitcoin mining and proof-of-work security.

- Private key risks grow as quantum algorithms like Shor’s evolve.

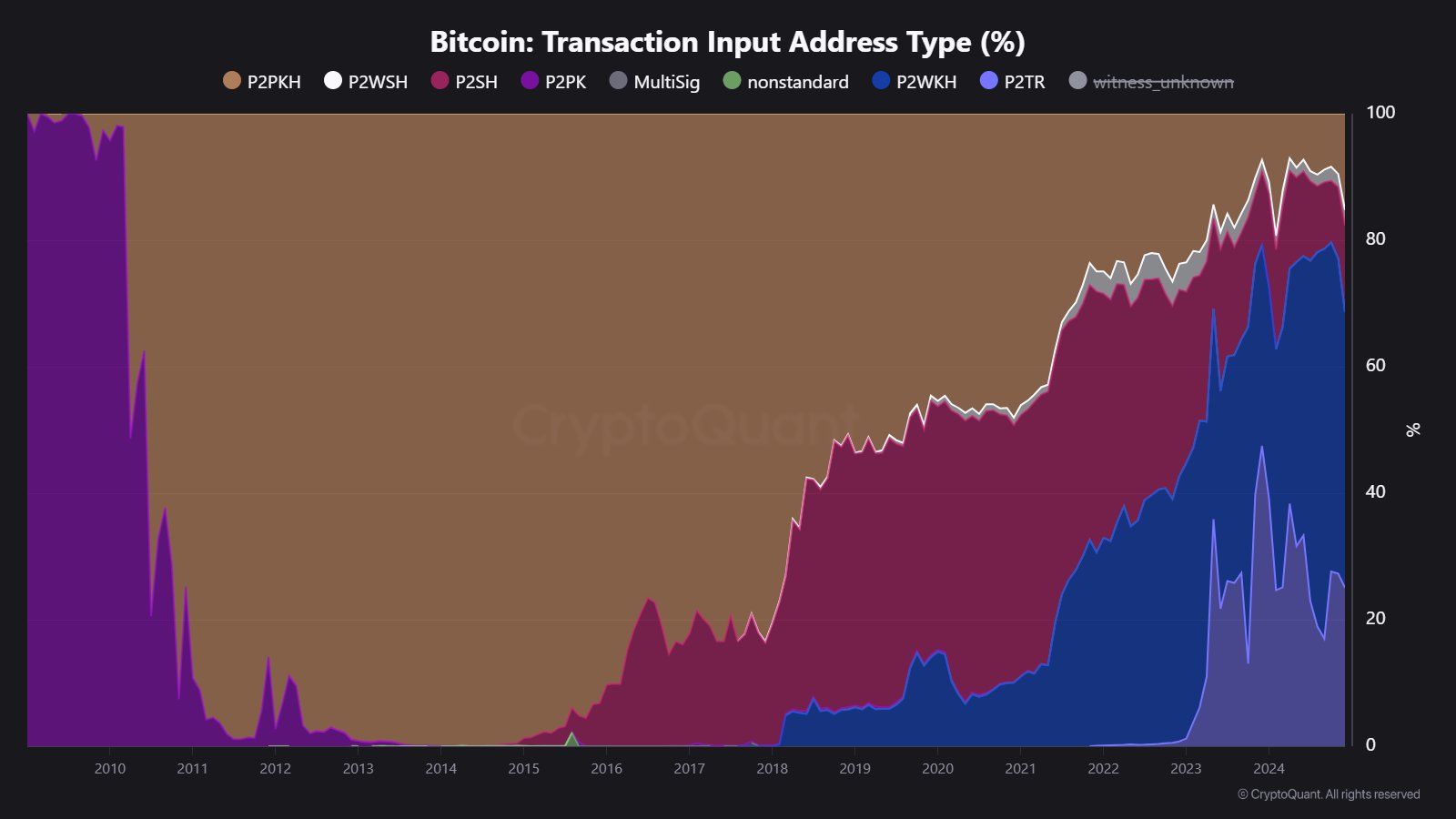

- Bitcoin’s shift to P2PKH addresses reflects proactive security measures.

Quantum computing advances may soon pose a real risk to Bitcoin’s security and mining process. A CryptoQuant report explored how advanced quantum algorithms could disrupt Bitcoin’s proof-of-work system. The report raised concerns about the network’s future resilience.

Bitcoin mining uses computationally intensive tasks to solve cryptographic puzzles. These puzzles rely on the SHA-256 hash function. Quantum computers could speed this up significantly with algorithms like Grover’s. This means miners could find valid hashes much faster than with traditional systems.

Faster Mining vs. Security Risks

Faster Mining vs. Security Risks This “brute-force” calculation could accelerate mining, but it could also compromise Bitcoin’s proof-of-work security model. The network could become vulnerable to attackers. CryptoQuant experts explain:

“A higher amount of non-quantum computing hash rate helps keep the network healthier and more resistant to this potential threat.”

This is because quantum computers could break many cryptographic algorithms much faster than classical computers. This includes algorithms like RSA and ECC, which are common in Bitcoin and other cryptocurrencies. Even more alarming is the potential risk to private key security.

Shor’s algorithm could theoretically derive private keys from public keys. Early Bitcoin addresses like “Pay to Public Key” (P2PK) are particularly vulnerable because their public keys are exposed. “Pay to Public Key Hash” (P2PKH) addresses add a layer of security, but they become susceptible once a transaction occurs because the public key becomes exposed. Reusing addresses increases this risk.

Bitcoin’s Quantum Shield,14% Jump in Secure Address Adoption

Thankfully with more awareness, P2PKH addresses have seen a 14% surge in adoption. This shows efforts to protect against theoretical quantum attacks.

Read also: Trump’s Crypto Agenda: Bitcoin Mining and SEC Overhaul Plans

Meanwhile, the Bitcoin community is exploring quantum-resistant cryptographic algorithms to future-proof the network. These efforts are in response to growing discussions around quantum threats and the shift toward secure address types is encouraging.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.