Date: Sat, February 8, 2025 | 08:32 AM GMT

The cryptocurrency market has been under significant selling pressure in recent months, with many altcoins struggling to maintain their bullish momentum. Since the November rally, Bitcoin dominance has surged, putting additional bearish pressure on the altcoin market.

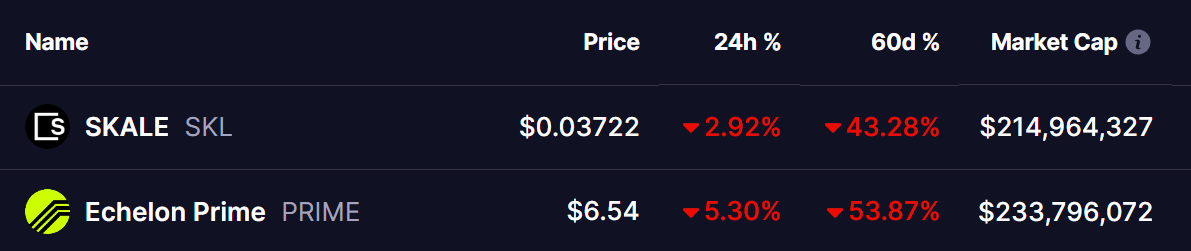

Two notable altcoins—Skale (SKL) and Echelon Prime (PRIME)—have experienced sharp corrections, dropping 42% and 53%, respectively, over the past 60 days. Now, both are approaching critical support zones that could determine their next major moves.

Source: Coinmarketcap

Source: Coinmarketcap Skale (SKL)

The weekly SKL chart shows a descending triangle pattern, a structure often associated with bearish pressure. The downtrend, which began on December 2, was triggered by a rejection from the upper trendline resistance near $0.085. Since then, SKL has been in a steady decline, recently testing a key support zone around $0.034 – $0.037.

Skale (SKL) Weekly Chart/Coinsprobe (Source: Tradingview)

Skale (SKL) Weekly Chart/Coinsprobe (Source: Tradingview) This zone has historically acted as a strong support level, leading to notable rebounds in the past. If SKL can hold this level and see a bounce, it may challenge the 100-day SMA as a key resistance. A breakout above this moving average could open the doors for a retest of the descending trendline.

Echelon Prime (PRIME)

Much like SKL, PRIME has also been consolidating within a descending triangle pattern. The rejection at $18.43 in early December fueled a steep correction, pushing PRIME down to its current support zone around $6.50.

Echelon Prime (PRIME) Weekly Chart/Coinsprobe (Source: Tradingview)

Echelon Prime (PRIME) Weekly Chart/Coinsprobe (Source: Tradingview) However, there’s still room for minor corrections within this support zone, as the MACD indicator remains in bearish territory. That being said, the MACD is showing signs of weakening momentum, which could hint at a potential reversal if a bullish crossover occurs.

If PRIME can hold this critical support, a bounce-back rally could push the price towards the 100-day SMA, and a breakout above this moving average could confirm a trend reversal.

Is a Bounce Back Ahead?

Both SKL and PRIME are currently testing crucial support zones. Their next moves will likely depend on Ethereum (ETH) and overall market sentiment. If ETH continues its recovery, it could provide the necessary momentum for altcoins to reverse their downtrends.

Additionally, the MACD indicators on both charts suggest that bearish momentum is fading. A bullish crossover on these indicators could confirm a potential reversal, leading to a new uptrend for SKL and PRIME.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.