- Over 2, 000 BTC are queued for sale, creating high selling pressure in the market.

- Buyers have been slow to act, making the market vulnerable to sharp price changes.

- A strong catalyst is essential to balance supply and demand and drive prices higher.

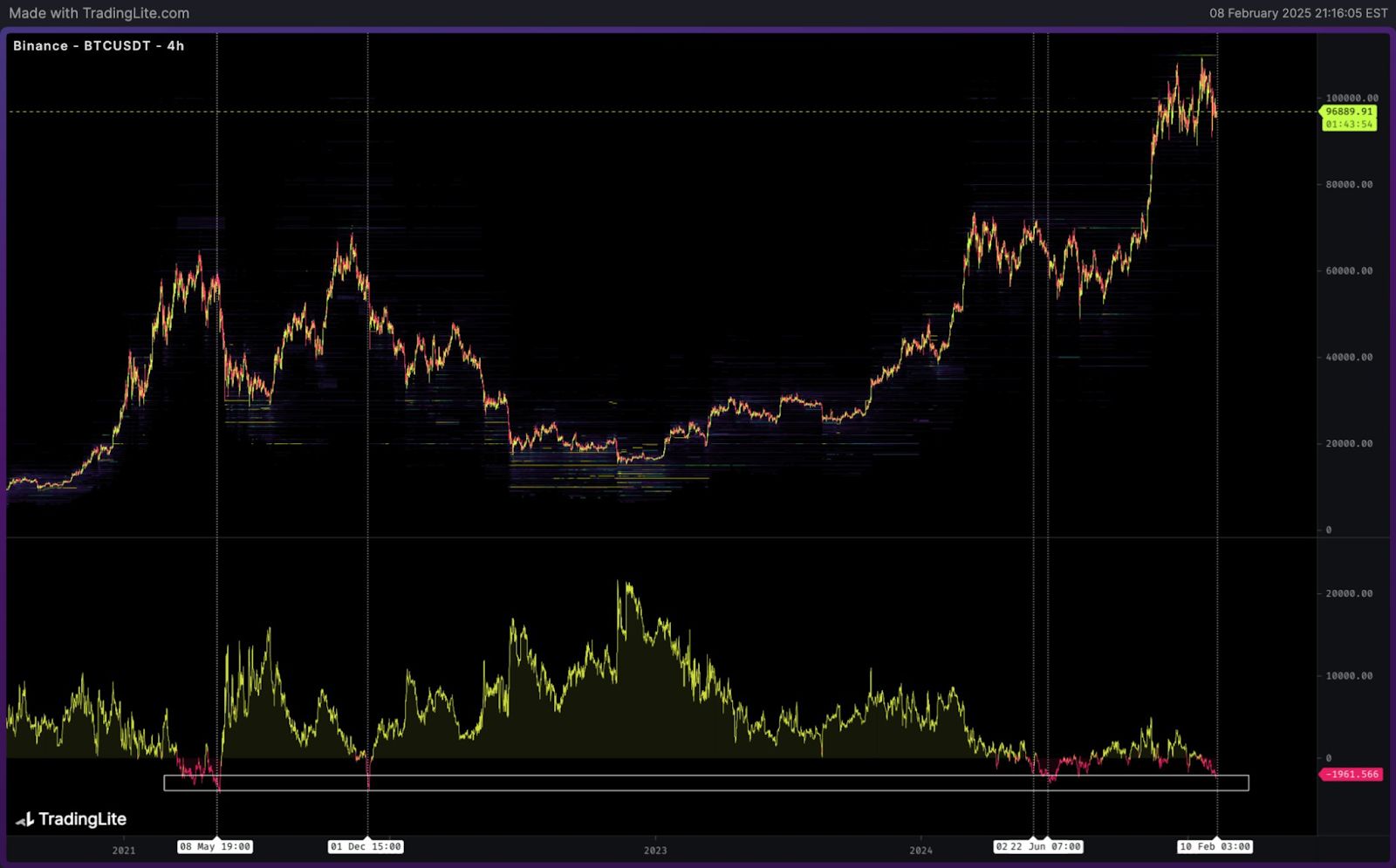

Bitcoin’s market dynamics are in focus as analyst Dom highlights concerns within the BTC spot orderbook. Selling pressure has intensified in the $30,000–$40,000 range, with passive buyers such as institutional investors, including Michael Saylor’s entities and ETFs, stepping in. The primary question is whether these buyers can hold the line and stabilize the market amid increasing selling activity.

Source: Dom

Source: Dom Spot Orderbook Hits Dangerous Levels

According to Dom, the spot order book has reached “dangerous” territory, a condition observed only four times in the last 1,800 days. Over 2,000 BTC are queued for sale, outnumbering buy orders within a tight 50% range of price activity. This imbalance reflects liquidity stress, which could lead to sudden volatility if the market remains saturated with sell orders.

The technical chart reveals this accumulation of sell orders around key price levels, emphasizing the risk of a sharp pullback. Historically, such sell-side dominance often precedes notable corrections unless met with an equal or greater influx of buying pressure.

Buyers Missing in Action

Despite Bitcoin’s recovery from its previous lows, the absence of strong buying momentum remains a concern. Historical patterns indicate that BTC has relied on significant catalysts to push higher, but this hasn’t been evident in recent months. The peaks and valleys in the price chart suggest that the market is waiting for a decisive move, with buyers reluctant to commit at current levels.

Dom asserts that breaking higher will require a robust influx of buyers, an event that has not been observed for months. This lack of participation suggests that traders are cautious, waiting for external drivers such as institutional inflows or favorable macroeconomic events to signal the next move.

Auction Market Theory: Predicting the Next Move

Dom frames the current situation through Auction Market Theory, emphasizing that imbalances in order flow can drive rapid price shifts. If the sell-side pressure continues without a corresponding increase in demand, BTC could face a sharp decline. Conversely, a strong inflow of buyers could stabilize the market and propel Bitcoin to new highs.

Conclusion: Buyers or Sellers—Who Will Prevail?

Bitcoin’s future hinges on the delicate balance between supply and demand. If passive traders hold their ground and new additions emerge, BTC could see a rally. However, failure to attract sufficient buying interest could result in a sharp correction. As traders monitor the orderbook, the question remains: who will take control—buyers or sellers?

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.