Potential Bitcoin price fall to $65K ‘irrelevant’ since central bank liquidity is coming — Analyst

Bitcoin's decline saw the price drop from $88,060 on March 26 to $82,036 on March 29 and led to $158 million in long liquidations. This drop was particularly concerning for bulls, as gold surged to a record high at the same time, undermining Bitcoin’s “digital gold” narrative. However, many experts argue that a Bitcoin rally is imminent as multiple governments take steps to avert an economic crisis.

The ongoing global trade war and spending cuts by the US government are considered temporary setbacks. An apparent silver lining is the expectation that additional liquidity is expected to flow into the markets, which could boost risk-on assets. Analysts believe Bitcoin is well-positioned to benefit from this broader macroeconomic shift.

Take, for example, Mihaimihale, an X social platform user who argued that tax cuts and lower interest rates are necessary to “kickstart” the economy, particularly since the previous year’s growth was “propped up” by government spending, which proved unsustainable.

The less favorable macroeconomic environment pushed gold to a record high of $3,087 on March 28, while the US dollar weakened against a basket of foreign currencies, with the DXY Index dropping to 104 from 107.40 a month earlier.

Additionally, the $93 million in net outflows from spot Bitcoin exchange-traded funds (ETFs) on March 28 further weighed on sentiment, as traders acknowledged that even institutional investors are susceptible to selling amid rising recession risks.

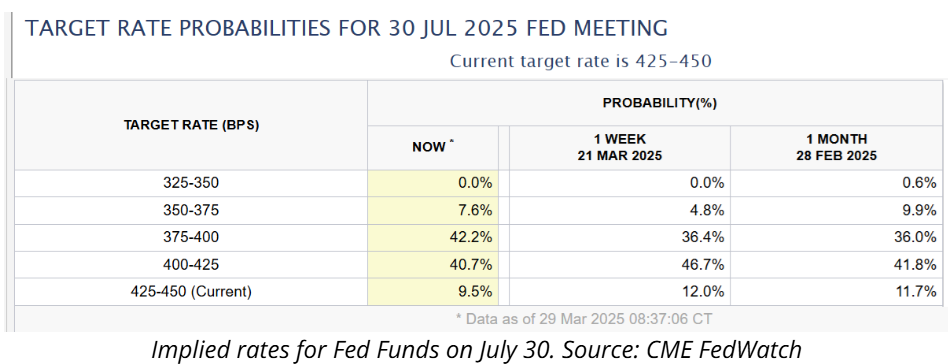

The market currently assigns a 50% probability that the US Federal Reserve will cut interest rates to 4% or lower by July 30, up from 46% a month earlier, according to the CME FedWatch tool.

The crypto market is presently in a “withdrawal phase,” according to Alexandre Vasarhelyi, the founding partner at B2V Crypto. Vasarhelyi noted that recent major announcements, such as the US strategic Bitcoin reserve executive order mark progress in the metric that matters the most: adoption.

Vasarhelyi said real-world asset (RWA) tokenization is a promising trend, but he believes its impact remains limited. “BlackRock’s billion-dollar BUIDL fund is a step forward, but it’s insignificant compared to the $100 trillion bond market.”

Vasarhelyi added:

“Whether Bitcoin’s floor is $77,000 or $65,000 matters little; the story is early-stage growth.”

Gold decouples from stocks, bonds and Bitcoin

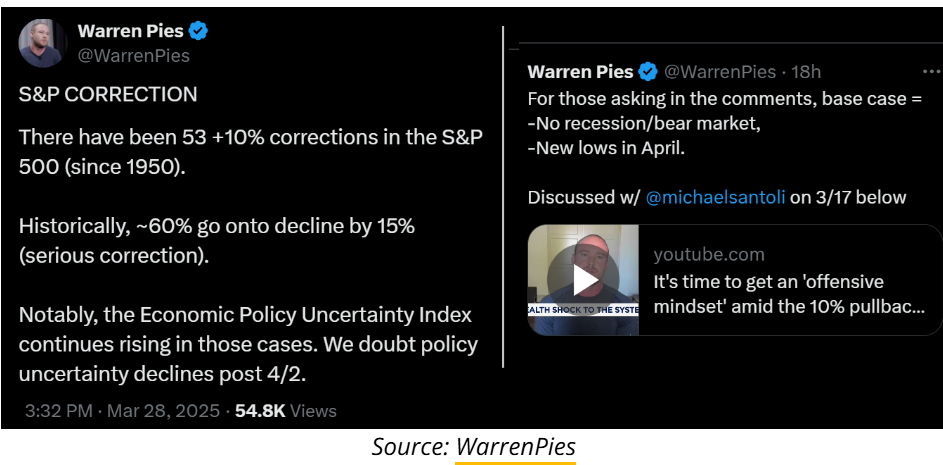

Experienced traders view a 10% stock market correction as routine. However, some anticipate a decline in “policy uncertainty” by early April, which would reduce the likelihood of a recession or bear market.

Warren Pies, founder of 3F Research, expects the US administration to soften its stance on tariffs, which could stabilize investor sentiment. This shift may help the SP 500 stay above its March 13 low of 5,505. However, market volatility remains a factor as economic conditions evolve.

For some, the fact that gold decoupled from the stock market while Bitcoin succumbed to “extreme fear” is evidence that the digital gold thesis was flawed. However, more experienced investors, including Vasarhelyi, argue that Bitcoin’s weak performance reflects its early-stage adoption rather than a failure of its fundamental qualities.

Vasarhelyi said,“Legislative shifts pave the way for user-friendly products, trading some of crypto’s flexibility for mainstream appeal. My take is adoption will accelerate, but 2025 remains a foundation year, not a tipping point.”

Analysts view the recent Bitcoin correction as a reaction to recession fears and the temporary tariff war. However, they expect these factors to trigger expansionist measures from central banks, ultimately creating a favorable environment for risk-on assets, including Bitcoin.