-

The recent downturn in crypto mining stocks, losing over $12 billion despite Bitcoin’s price stability, signals potential trouble ahead for the market.

-

Analysts suggest this disconnect may indicate broader market stress, particularly as historical trends show decoupling often precedes increased volatility.

-

According to a report by Alphractal, key mining firms are seeing significant valuation drops, emphasizing concerns surrounding miner profitability in a fluctuating landscape.

This article explores the recent decline in crypto mining stocks amidst Bitcoin’s stability, potential market implications, and future outlook for the sector.

The $12 billion retreat

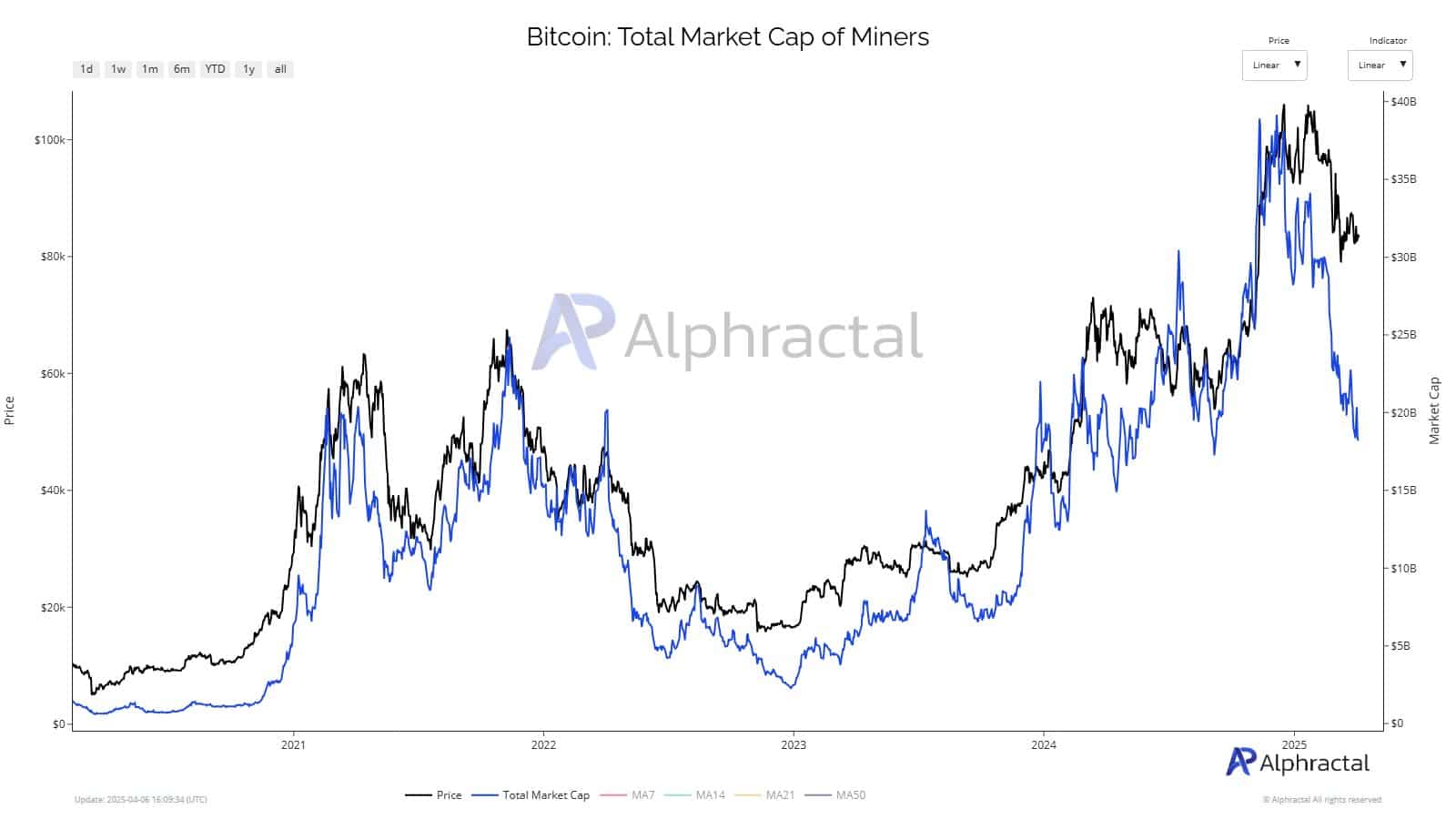

Source: Alphractal

Bitcoin mining stocks have suffered a significant decline, losing over $12 billion since February and reverting to early 2024 levels. This substantial loss has cleared out all gains experienced in the earlier part of the year, with key mining companies witnessing sharp double-digit percentage drops.

The most concerning aspect of this decline is its occurrence when Bitcoin’s price has maintained stability, raising questions about underlying market dynamics.

Decoupling from BTC – A red flag?

Recent trends indicate that miners are moving away from Bitcoin—a development that raises alarms. While Bitcoin has sustained a price above $65,000, the valuations of mining equities have plummeted, leading to a significant drop in correlation.

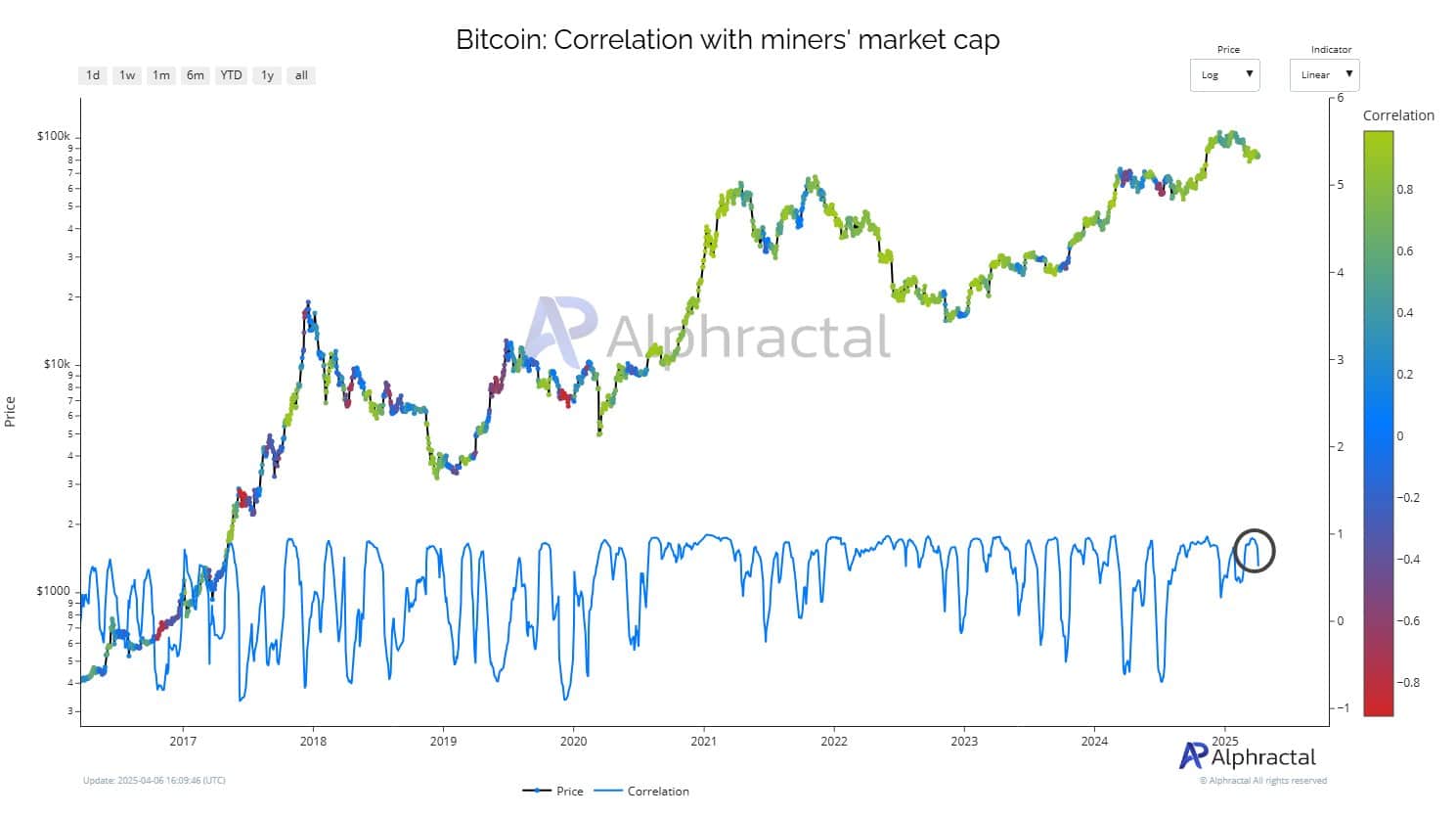

Notably, recent data show that the connection between Bitcoin’s price and the market capitalization of mining firms has sharply decreased, nearing negative territory for the first time since mid-2022.

Source: Alphractal

Historically, such decouplings are significant indicators of increased volatility and can foreshadow dramatic shifts in Bitcoin’s price direction. Whether this situation points to a broader reevaluation of miner valuations, structural stress ahead of Bitcoin’s upcoming halving, or shifts in market sentiment, the current landscape appears quite distinct.

Miners’ profitability and sentiment under pressure

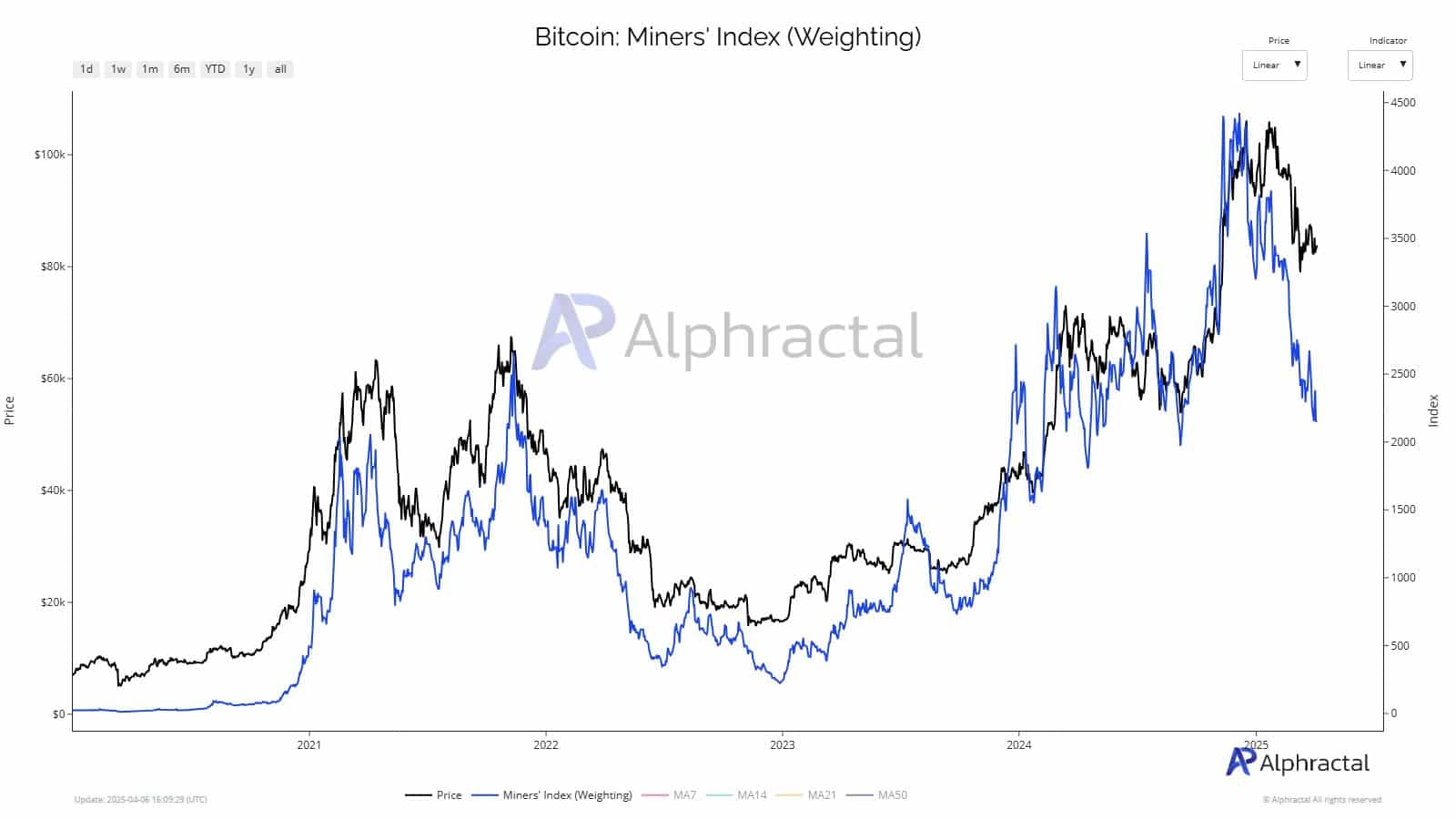

The mining industry’s challenges have been exacerbated by rising operational costs and looming regulatory uncertainties, particularly in light of recent statements from key political figures regarding tariffs. The miners’ profitability index has also highlighted a marked decoupling from Bitcoin’s recent price patterns, indicating severe stress in the sector.

Source: Alphractal

As reported by Galaxy Digital, the trend is shifting toward Spot Bitcoin ETFs, which provide investors exposure without the inherent risks associated with mining operations. CEO Mike Novogratz has noted that these ETF inflows may be a crucial bullish factor for Bitcoin’s price in 2025, suggesting that investors could withdraw from mining stocks and turn toward ETFs or direct Bitcoin purchases.

What this means for the broader market

The growing disconnect between Bitcoin miners’ stocks and BTC’s stable performance raises important questions about market health. Similar inconsistencies observed in early 2022 aligned with broader market corrections, indicating miners may serve as a bellwether for impending market stress. Institutions have begun to recognize the trend—perceived underperformance of mining stocks points to operational and regulatory hurdles, potentially shifting investor focus towards direct Bitcoin exposure or ETF investments.

In a parallel, the tech stock market has recently faced downturns due to geopolitical tensions, signaling that external shocks can complicate crypto dynamics. As history has shown, this divergence could serve as a precursor to significant market shifts, rather than merely a transient event.

Conclusion

The current decline in crypto mining stocks amid Bitcoin’s stability poses significant questions for the market’s future. With potential structural stress and shifting investor sentiments becoming apparent, stakeholders may need to reassess their strategies as the market navigates through these challenging times. The overall outlook remains cautious, advocating for vigilance in monitoring market trends.