US Dollar Index Nosedives in 2025: What It Means for Bitcoin’s Next Move

The US Dollar Index (DXY) has plunged by more than 10 points since January, marking one of its sharpest year-to-date (YTD) declines since the turbulence of September 2022.

Analysts see this persistent dollar weakening as a prospective tailwind for Bitcoin (BTC), potentially catapulting the pioneer crypto toward new all-time highs (ATH), especially when measured against the greenback.

US DXY Plummets, Could Bitcoin Hit New All-Time Highs?

Data on TradingView shows the US DXY has been on a steady decline since the start of the year, down by almost 10% YTD. After establishing an intra-day high of 110.176 on January 13, it is down by over 10 points to 100.011 as of this writing.

US DXY drops. Source: TradingView

US DXY drops. Source: TradingView According to Bloomberg, the recent slide in the dollar may only be the beginning. Standard Chartered Bank warns that the US dollar faces a “major” risk of depreciation in 2026 if President Donald Trump’s policies add to the national debt without generating corresponding economic growth.

Steve Englander, Head of G10 FX Research at Standard Chartered, said in a recent research note that the US is facing a dangerous mix: ballooning government debt and rising obligations to foreign creditors.

“If the economy or financial markets falter, the downside risk to the USD is higher the greater the accumulation of external liabilities,” Englander told Bloomberg.

He added that foreign creditors may start demanding risk premiums via higher Treasury yields or a weaker dollar if they lose faith in the sustainability of US debt.

“If the debt path is not flattened, borrowing terms may become increasingly onerous as risk premia increase the cost of public and private borrowing,” Englander warned.

These remarks align with recent warnings from Bitcoin pioneer Max Keiser, who highlighted growing US debt risk as “stablecoins work the US dollar to death.”

Further, Keiser warned that surging yields in US bonds could fuel fears of economic instability, boosting Bitcoin’s appeal as a fixed-supply inflation hedge.

Similarly, Standard Chartered’s Geoff Kendrick highlighted Bitcoin’s resilience as a hedge against financial and US Treasury risks.

“I think Bitcoin is a hedge against both TradFi and US Treasury risks,” Kendrick said in an interview with BeInCrypto.

Standard Chartered Signals US Dollar Risk

Trump’s recent round of aggressive tariffs and multi-trillion-dollar tax proposals has already begun to rattle investors.

While markets had initially hoped these policies would spur growth, confidence is fading fast. Foreign investors are currently holding back from exiting US assets outright, but any failure to deliver sustained economic expansion could change that quickly.

“If trade policy remains erratic, investors would be reluctant to increase their exposure to the dollar further, potentially triggering a ‘pronounced’ move downward. Meanwhile, improving economic conditions in Europe and China could compound selling pressure on the dollar by drawing capital away from the US,” Englander added.

Notably, this dollar weakness has been a powerful driver of Bitcoin’s recent surge, with the pioneer crypto serving as a hedge against fiat uncertainty.

“You could argue that Bitcoin hit new all-time highs because the US dollar is very weak right now. Other major currencies will be Bitcoin’s next victims,” analyst Crypto Rover observed.

Bitcoin against foreign currencies. Source: Crypto Rover on X

Bitcoin against foreign currencies. Source: Crypto Rover on X Indeed, when comparing BTC performance against fiat pairs like EUR, GBP, and JPY, Bitcoin’s breakout appears less dramatic than against the USD. This highlights how much of the rally is powered by dollar devaluation.

Nevertheless, while Bitcoin benefits from a weakening dollar in the short term, the broader macro implications are more complex.

Should inflation rise as foreign investors demand higher yields or flee the dollar, even assets like Bitcoin may face volatility amid broader risk-off sentiment.

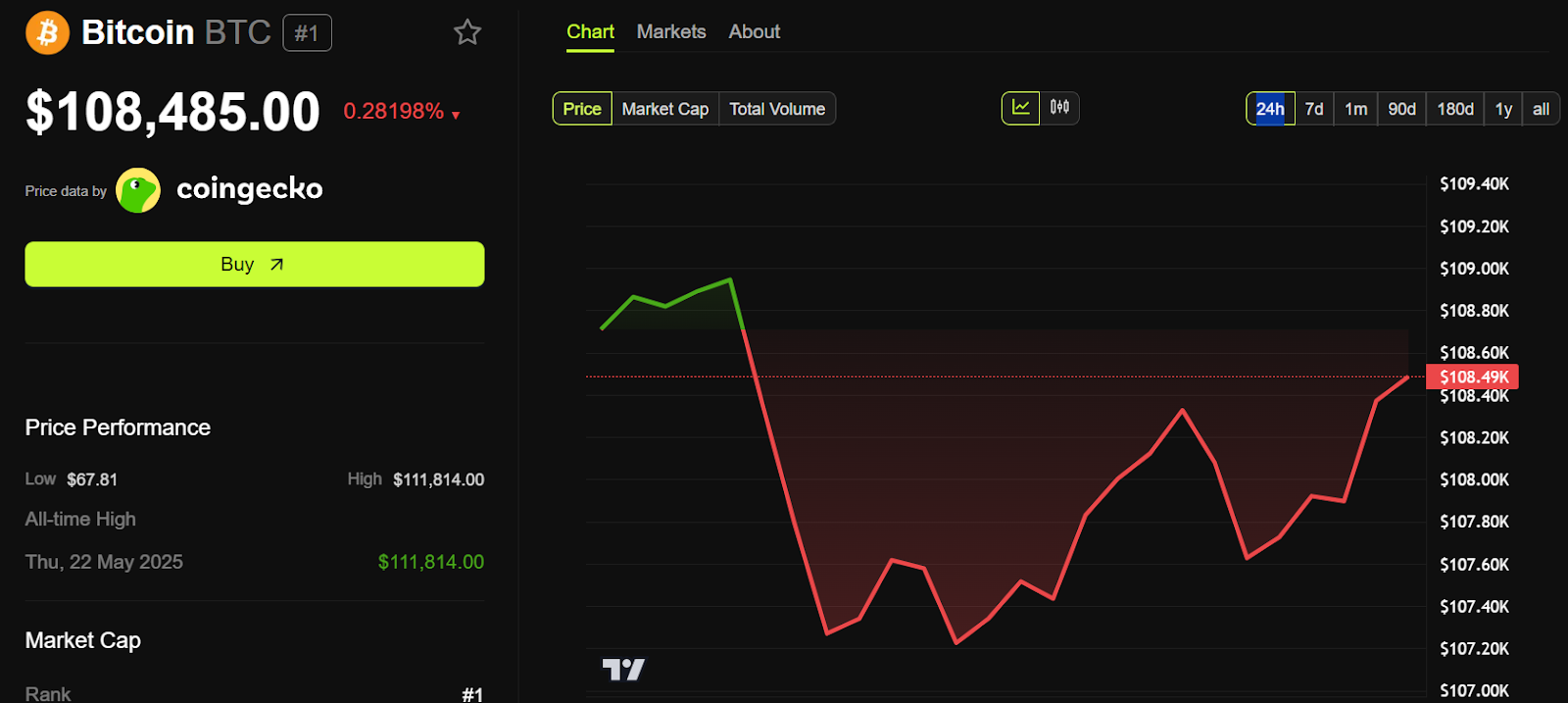

Still, Bitcoin appears to be the clear winner amid fiscal uncertainty, trading for $108,485 as of this writing.

Bitcoin (BTC) Price Performance. Source: BeInCrypto

Bitcoin (BTC) Price Performance. Source: BeInCrypto Investors brace for a potentially unsustainable debt path and continued dollar softness. As a result, Bitcoin’s reputation as a store of value and hedge against fiat erosion is being tested.

While Bitcoin is passing this test, it is also imperative to note that the BTC price is stalling in the $108,000 range. Based on this, capital could start rotating into altcoins.