Kaia Price Prediction 2025-35: Will It Hit $10 by 2035?

- A rounding bottom pattern signals a bullish reversal, strengthening KAIA’s price chart.

- Positive funding rates confirm bullish sentiment as long traders dominate the KAIA market.

- CryptoTale projects KAIA could trade between $0.09 and $0.35 during the 2025 bull cycle.

Kaia (KAIA) Overview

| Cryptocurrency | Kaia |

| Ticker | KAIA |

| Current Price | $0.1172 |

| Price Change (30D) | +0.74% |

| Price Change (1Y) | -37.34% |

| Market Cap | $706.71 Million |

| Circulating Supply | 6.02 Billion |

| All-Time High | $0.415 |

| All-Time Low | $0.09078 |

| Total Supply | 6.02 Billion |

What is Kaia (KAIA)?

Kaia (KAIA) is a high-performance, next-generation Layer 1 blockchain engineered to accelerate the mass adoption of Web3 across Asia and beyond. Formed through the strategic merger of Kakao’s Klaytn and LINE’s Finschia blockchains, Kaia blends robust infrastructure with real-world usability to create an enterprise-ready platform tailored for developers and end-users.

Source: Kaia

Source: Kaia Designed for speed, security, and accessibility, Kaia is fully Ethereum-compatible, enabling developers to deploy or migrate Ethereum-based dApps with minimal effort. At the same time, deep integrations with platforms like KakaoTalk and LINE provide a frictionless gateway for everyday users to access blockchain-powered services. Kaia brings the future of decentralized technology into the hands of millions, without sacrificing performance or simplicity.

Core Power: How the KAIA Blockchain Works

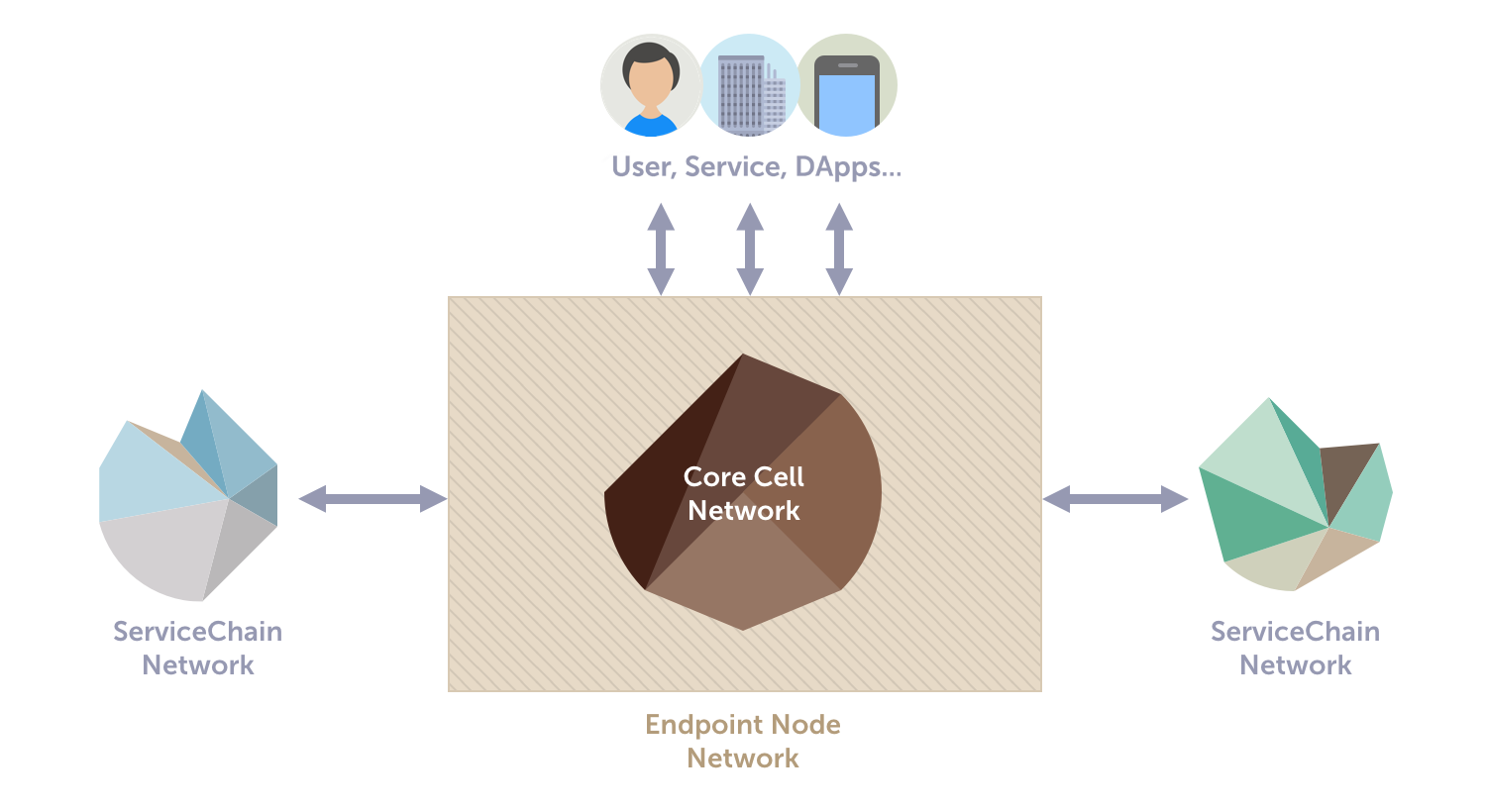

At the core of Kaia’s performance is a purpose-built architecture that eliminates common blockchain bottlenecks and ensures dependable, scalable throughput for global use.

Kaia’s Node Architecture:

Kaia achieves 4,000 transactions per second and 1-second block intervals by leveraging an enhanced version of the Istanbul Byzantine Fault Tolerance (IBFT) consensus algorithm. Based on PBFT principles, this optimized model introduces a committee-based consensus mechanism where a subset of Consensus Nodes (CNs) is selected using Verifiable Random Functions (VRF).

Source: Kaia

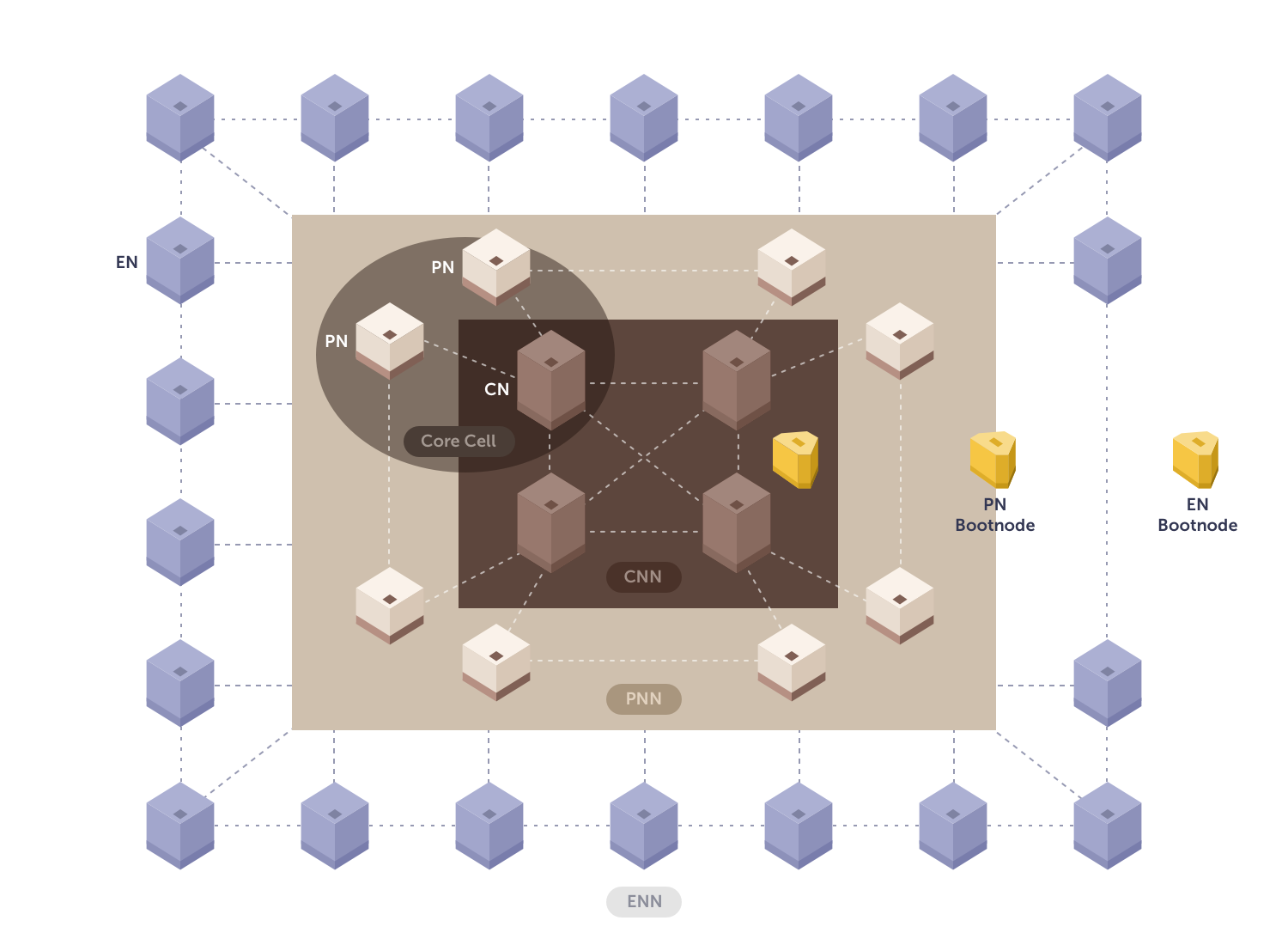

Source: Kaia These nodes propose and validate blocks in a streamlined process that guarantees instant finality, removing the risk of forks and enabling real-time settlement. This system doesn’t just scale — it adapts. By limiting communication overhead to only selected committee members, Kaia avoids the exponential network load often seen in traditional BFT models, even as the number of nodes grows.

This makes Kaia capable of supporting large-scale enterprise applications and consumer services without performance trade-offs. Furthermore, Kaia’s smart infrastructure allows developers to operate their service chains through the service chain network (SCN), a lightweight, application-specific blockchain connected to the main chain via endpoint nodes (ENs).

Source: Kaia

Source: Kaia These ENs, alongside Proxy Nodes (PNs) and CNs, make up the network’s backbone, efficiently handling transaction routing, smart contract execution, and API interactions. Developers also benefit from full EVM compatibility, including support for Solidity and popular tools like Remix and Hardhat. This allows them to build with familiar frameworks while accessing the next generation of blockchain performance.

The KAIA Token & Ecosystem: Fuel for the Web3 Revolution

KAIA is the native utility token that powers every corner of the network — from governance and staking to transaction fees and ecosystem growth.

Tokenomics that Drive Growth

- Inflation rate: 5.2% annually, with each new block minting KAIA tokens.

- Block rewards distribution:

- 50% to network participants: 20% for block creators (CNs), 30% for staking rewards.

- 25% to the Kaia Ecosystem Fund (KEF) to fuel dApp development and innovation.

- 25% to the Kaia Infrastructure Fund (KIF) for sustaining and expanding the network.

Decentralized & Inclusive Governance

- On-chain voting system: Every staked KAIA token counts as voting power.

- Delegated governance: Users can assign their voting rights to trusted representatives.

- Transparency: All proposals, expenses, and results are recorded and visible on platforms like Square and Kaiascan.

Security & Trust

- Verifiable Random Function (VRF) ensures unpredictable and secure committee selection.

- Validator key separation prevents theft and tampering.

- Real-time monitoring and transparent block verification ensure network health and resilience.

Kaia Price History

Late last year, KAIA soared by nearly 300%, catapulting from around $0.111 to a peak of $0.415 in December 2024. This marked its all-time high, but what goes up often tests gravity, and so did KAIA. After peaking, the token faced heavy resistance, triggering a 55% pullback into the $0.197–$0.188 range.

This area initially held as a strong support zone, enabling a temporary 41% bullish rebound. However, momentum faded, and KAIA tumbled further, breaching previous supports and spiraling down to an all-time low of $0.090 by April 2025. That low, however, seems to have lit a spark.

Source: TradingView

Source: TradingView Supported by a strong demand zone between $0.106 and $0.090, KAIA began forming a rounding bottom pattern—a classic technical signal of a trend reversal. This gradual, bowl-shaped recovery suggests that bearish pressure is fading and bullish momentum could be mounting.

Currently trading around $0.117, KAIA is eyeing its first resistance zone between $0.137 and $0.154. A successful breakout above this range could pave the way for a push toward $0.239–$0.266, possibly even a retest of its previous highs if bullish sentiment continues.

However, caution remains key. Failure to hold current levels could see the token retest support near $0.106–$0.090 or, worse, breach into uncharted lows if bears regain control.

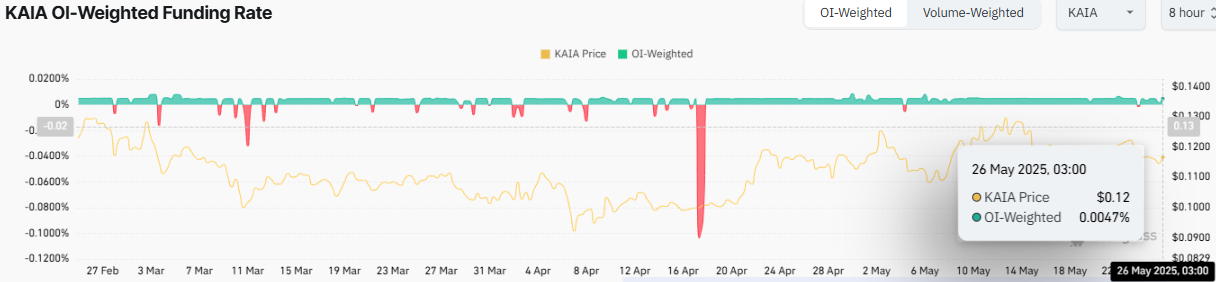

Funding Rates Turn Green: Bullish Confidence Grows for KAIA

The bullish sentiment surrounding KAIA isn’t just reflected in price recovery — it’s also echoed in the funding rate dynamics. Since rebounding from its all-time low near $0.090, the OI-weighted funding rate has consistently stayed in positive territory, with the latest reading at 0.0047% as of May 26, 2025.

Source: Coinglass

Source: Coinglass This prolonged stretch in the green zone suggests a significant behavioral shift in the market: long-position holders are increasingly confident and willing to pay funding premiums to maintain their positions.

This simply means that when the funding rate stays positive for an extended period, it reflects bullish dominance in perpetual futures markets. Traders betting on price increases are not only outweighing short-sellers, but they’re also ready to pay a fee to stay in the game — a clear indication of growing demand and market optimism.

Related: Arweave Price Prediction 2025-35: Will It Hit $300 by 2035?

Yearly Highs and Lows of Kaia

| Year | Kaia Price | |

| High | Low | |

| 2025 | $0.26642 | $0.09078 |

| 2024 | $0.415 | $0.11181 |

Kaia Technical Analysis

The MACD on Kaia’s (KAIA) daily chart is currently bearish, with the MACD line at 0.00062, trailing below the signal line at 0.00141. This crossover signals downward momentum. Additionally, the MACD histogram prints red bars, confirming the bearish pressure, although the bars are gradually fading, indicating a weakening bearish trend and a potential upcoming shift in momentum.

Source: TradingView

Source: TradingView Meanwhile, the Relative Strength Index (RSI) stands at 50.10, just above the neutral 50 mark, and is sloping upward. This upward RSI movement suggests that bullish momentum is quietly building beneath the surface, even as the price consolidates around the $0.117 level. The RSI remains far from the overbought threshold of 70, indicating ample room for further upward movement without facing immediate exhaustion.

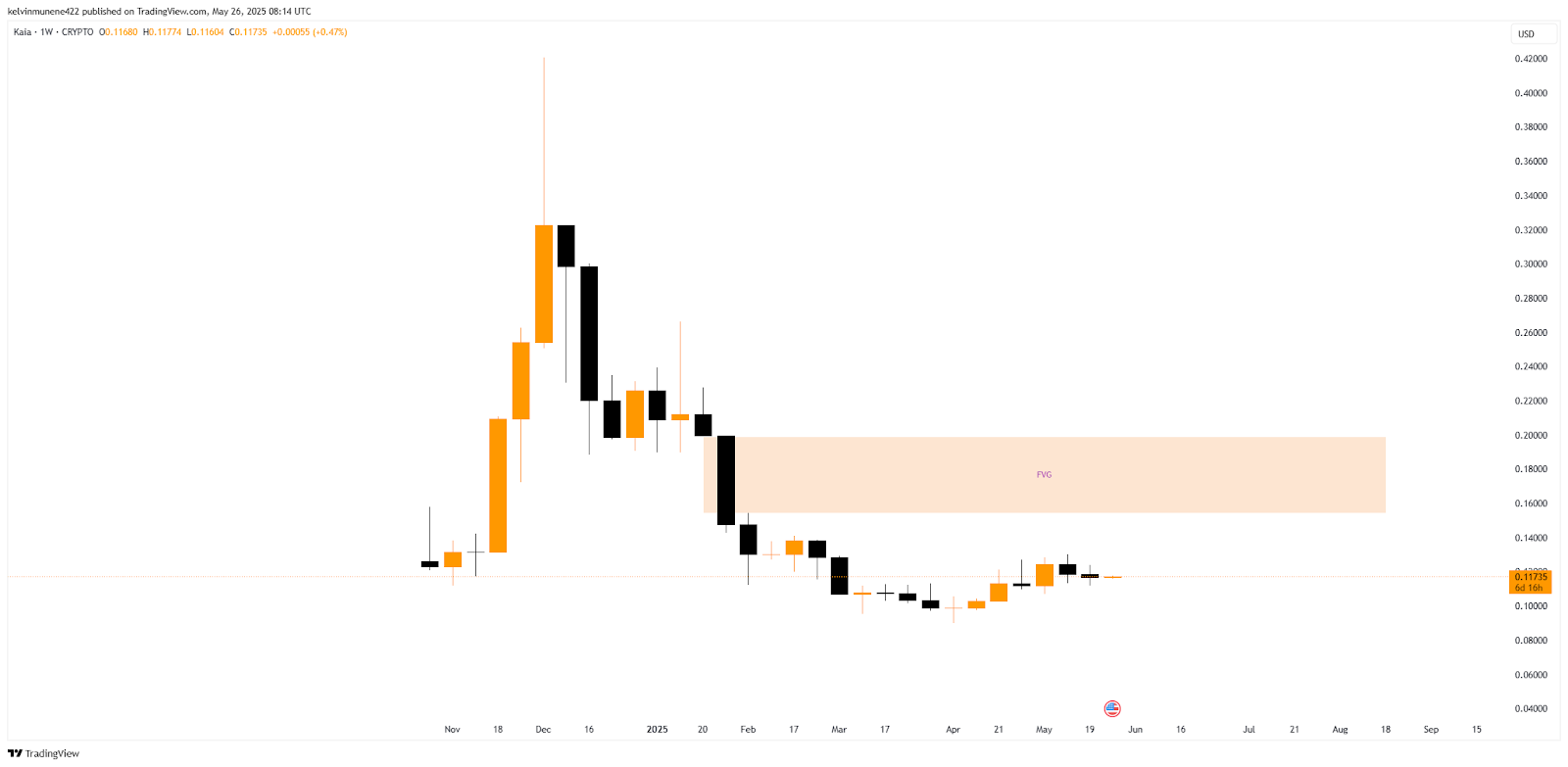

Kaia (KAIA) Price Forecast Based on Fair Value Gap

The Fair Value Gap (FVG) on KAIA’s weekly chart spans from $0.154 to $0.199, clearly above the token price of $0.117. This FVG was created during a sharp downward move in 2025, leaving behind an unbalanced price area that has yet to be revisited by price action.

Fair Value Gaps typically act as magnetic zones for price, as markets tend to fill inefficiencies created by high volatility. In this case, the FVG suggests that buyers may eventually drive KAIA upward to revisit this untested region.

Source: TradingView

Source: TradingView A complete filling of this gap could mark a shift in sentiment, transforming the FVG into a support zone. This would reinforce a bullish continuation and pave the way for higher targets. It would also confirm that buyers have absorbed selling pressure, reclaiming a previously unstable region.

However, failure to fill this gap may result in the opposite: the FVG could act as a firm resistance, rejecting price and possibly triggering renewed downward pressure. Such a scenario would suggest that market confidence remains weak, with sellers still dominating within that inefficiency zone.

Kaia (KAIA) Price Forecast Based on MA Ribbon Analysis

KAIA is currently nestled between key moving averages, with the 200-day MA sitting well above the token’s price at $0.15862 — a level that marks the upper threshold of long-term resistance. Below it lies the 20-day MA at $0.11979, closely hovering near the current price, acting as a dynamic short-term resistance.

Source: TradingView

Source: TradingView More significantly, the 100-day MA at $0.11380 and the 50-day MA at $0.11305 are tightly clustered just below current levels, forming a layered support zone. This convergence signals an area where price is likely to find buying interest, helping to prevent further downside, a pattern often seen before upward movements.

The MA ribbon is gradually compressing on the broader scale, a phenomenon that typically precedes a breakout. If KAIA closes above the 20-day MA, it could challenge the 200-day MA at $0.15862, a critical area to watch. Breaking this level may flip the long-term trend bullish.

Kaia (KAIA) Price Forecast Based on Fib Analysis

KAIA is currently positioned well below its key Fibonacci retracement levels, which mark potential resistance zones for any bullish recovery. The 23.6% Fib level, at $0.16818, acts as the first significant hurdle. A breakout above this zone could initiate momentum toward higher levels, confirming bullish intent.

Above that, the 38.2% level is at $0.21642, aligning with prior consolidation areas and historical resistance, making it a critical mid-term target. If price action maintains upward strength, the 50.0% retracement at $0.25541 becomes a major level of interest, potentially attracting buyers and reinforcing broader trend reversal signals.

Source: TradingView

Source: TradingView Further ahead, the 61.8% Fib level at $0.29439 represents a golden ratio and a historically reliable reversal area. A rally to this level would reflect a significant trend shift, suggesting that bullish sentiment has firmly taken hold. The 78.6% level at $0.34990 and the full retracement at its all-time high remain distant targets but highlight the long-term upside potential if accumulation continues.

Kaia (KAIA) Price Prediction 2025

As per CryptoTale’s projections, 2025 marks the market peak following 2024’s BTC halving hype. KAIA could surge past its previous resistance, potentially trading within the $0.09-$0.35 range amid euphoria, institutional onboarding, and strong Asian adoption. However, volatility may follow late in the year.

Kaia (KAIA) Price Prediction 2026

According to our forecast, 2026 will be a recession and correction year. Following 2025’s hype, KAIA will likely retrace heavily, falling back into the $0.20–$0.30 range. Weak market sentiment and macroeconomic tightening could hinder further growth this year.

Kaia (KAIA) Price Prediction 2027

CryptoTale expects 2027 to be the bottoming phase of the cycle. KAIA may dip to around $0.10-$0.25 before gradually recovering as user engagement rises and attention builds ahead of the next halving. Infrastructure progress keeps long-term hope alive.

Kaia (KAIA) Price Prediction 2028

With BTC’s next halving, 2028 should ignite a recovery-to-accumulation phase. It could rise toward $0.30-$0.60, fueled by onboarding Asian SSS game companies, stablecoin expansion, and increasing Web3-to-Web2 conversions across LINE and Kakao platforms.

Kaia (KAIA) Price Prediction 2029

Kaia is projected to expand strongly in 2029 due to post-halving tailwinds. Growing DeFi infrastructure, native stablecoin utility, and large-scale tokenization of Web2 assets could drive KAIA to new local highs in the $0.55–$1.00 range.

Kaia (KAIA) Price Prediction 2030

CryptoTale predicts 2030 to be a market correction year. After years of expansion, KAIA may return to $0.35–$0.75. Though fundamental growth remains intact, overvaluation, profit-taking, and early macro tightening could trigger downside.

Kaia (KAIA) Price Prediction 2031

As the market stabilizes and recovers, KAIA may rebound to $0.45-$90, supported by maturing DeFi tools, fiat on/off ramps across Asia, and real-world asset (RWA) onboarding. Developer traction and governance participation also play key roles.

Kaia (KAIA) Price Prediction 2032

With BTC’s 6th halving event, 2032 will likely see renewed bullish energy. CryptoTale expects KAIA to breach $1 again, aiming for $1.00-$3.50, driven by global IP collaborations, improved infrastructure, and mainstream stablecoin usage.

Kaia (KAIA) Price Prediction 2033

Fueled by a post-halving rally and mass adoption, 2033 could push KAIA into price discovery, reaching between $2.50 and $6.00. AI dApp onboarding and Asian community growth further support ecosystem-wide value appreciation.

Kaia (KAIA) Price Prediction 2034

As per CryptoTale, 2034 may face a moderate correction due to profit-taking and cooling enthusiasm. KAIA could retrace toward $2.00-$5.00, though sustained usage in tokenized Web2 platforms and DeFi will keep it well above previous cycle highs.

Kaia (KAIA) Price Prediction 2035

CryptoTale anticipates 2035 to be a breakout year for KAIA, with a potential new ATH between $5.50 and $10.00. Institutional adoption, regulatory clarity, and anticipation of the 2036 BTC halving will likely drive explosive growth and broader ecosystem maturity.

Related: AIOZ Price Prediction 2025-35: Will It Hit $50 by 2035?

FAQs

KAIA is a high-performance Layer 1 blockchain designed for Web3 adoption in Asia. It merges Kakao’s Klaytn and LINE’s Finschia blockchains.

You can buy KAIA using fiat or crypto through supported cryptocurrency exchanges and then transfer it to a personal wallet for secure storage.

KAIA shows strong long-term potential due to its Web3 focus, Asian market integration, and strategic partnerships, but like any crypto investment, risks remain.

Use a reputable hardware wallet or secure software wallet that supports EVM-compatible tokens to store KAIA safely and protect it from online threats.

KAIA was formed through a merger, not a single founder, in 2024 by combining efforts from Kakao and LINE’s blockchain teams.

KAIA was officially launched in 2024, following the merger of Klaytn and Finschia blockchains to form a unified Layer 1 platform.

KAIA’s circulating supply is approximately 6.02 billion tokens, matching its total supply as of the latest available data.

If adoption continues and the ecosystem grows, KAIA could surpass its $0.415 all-time high during upcoming bullish market cycles.

KAIA’s all-time low is $0.09078, reached in April 2025 during a broader crypto market correction.

KAIA is projected to trade between $0.09 and $0.35 in 2025, driven by the hype surrounding the post-BTC halving and early institutional adoption momentum.

KAIA could reach $0.30–$0.60 in 2028 as bullish momentum returns with BTC halving and growing utility in Asian Web3 markets.

KAIA may range between $0.35 and $0.75 in 2030 due to profit-taking and correction after several years of expansion.

KAIA is forecasted to trade between $1.00 and $3.50 in 2032, fueled by BTC halving hype, infrastructure maturity, and global partnerships.

In 2035, KAIA could reach a new ATH between $5.50 and $10.00, supported by institutional adoption and anticipation of the next BTC halving.

Disclaimer: The information provided by CryptoTale is for educational and informational purposes only and should not be considered financial advice. Always conduct your own research and consult with a professional before making any investment decisions. CryptoTale is not liable for any financial losses resulting from the use of the content.

The post Kaia Price Prediction 2025-35: Will It Hit $10 by 2035? appeared first on Cryptotale.