Pump.fun’s Revenue-Sharing Plan Faces Criticism Over Fees and Rug Pull Risks

Pump.fun expected its revenue-sharing program to revolutionize how creators monetize, curb “pump-and-dump” behaviors, and foster more sustainable projects.

However, after about a month since its introduction, is this a game-changer or just a tactic to attract more users?

Challenges and Controversies

Despite being promoted as a groundbreaking initiative, Pump.fun’s revenue-sharing program has not escaped criticism. A recent report from SolanaFloor highlights several controversies surrounding the program.

First, some have deemed the fee structure inefficient. Posts on X suggest that the 0.05% fee is essentially a new “transaction tax” imposed on users. Pump.fun does not sacrifice its own profits.

Specifically, PumpSwap’s previous fee model included 0.2% for liquidity providers and 0.05% for the platform. Post-update, Pump.fun introduced an additional 0.05% fee to compensate creators, which increased the total transaction cost. This has raised concerns that higher fees could make PumpSwap less appealing compared to other exchanges like Raydium.

Second, some argue that the new fee structure may inadvertently encourage “rug pulls.” Such criticisms highlight concerns that this revenue model could undermine community-driven initiatives to revive tokens abandoned by creators.

“I think this is a horrible move. 99 % of coins are legit CTO coins. People dont want the dev and now we are giving the dev money that he rugged this is super bad imo but we see how it goes,” an X user commented.

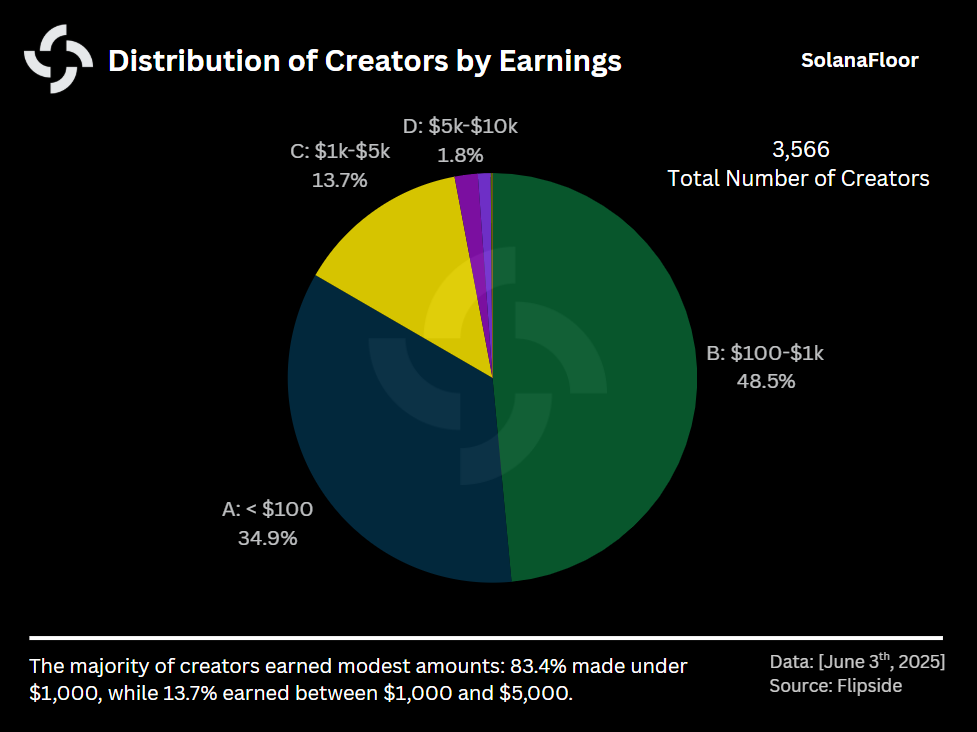

Only 35% of Creators Earn Less Than $100. Source: SolanaFloor

Only 35% of Creators Earn Less Than $100. Source: SolanaFloor Third, the revenue-sharing program appears to lack efficiency. Data from SolanaFloor shows that only 1.8% of creators earn between $5,000 and $10,000, while 48% earn between $100 and $1,000. This suggests the program may not significantly benefit most creators, given that 98% of tokens on Pump.fun are suspected to be “pump-and-dump” projects.

In summary, while offering creators an opportunity for passive income, the program still faces significant limitations, from increased transaction fees to uneven profit distribution.

Moreover, higher fees could impact PumpSwap’s competitiveness, particularly as rivals like Raydium develop alternative platforms like LaunchLab.

In the volatile meme coin market, with Pump.fun’s revenue declining sharply, this program needs adjustments to balance the interests of creators, traders, and the platform itself. Another X user also argued that the program should have “happened a long time ago and would not be enough to maintain market share” for Pump.fun in a competitive field.