-

Maker (MKR) has surged 17% in the last 24 hours, driven predominantly by strong long interest in the Futures market, sparking debate on its sustainability above the critical $2,000 level.

-

Despite the rally, spot market sell-offs exceeding $1 million indicate cautious profit-taking among traders, raising questions about the durability of MKR’s upward momentum.

-

According to COINOTAG analysis, while Futures traders remain bullish with a high Open Interest Weighted Funding Rate, technical indicators suggest a potential retracement could be imminent.

Maker (MKR) rallies 17% fueled by Futures longs, but spot sell-offs and technical signals hint at a possible retracement below $2,000. Key levels to watch ahead.

Futures Market Drives MKR’s Sharp Rally Amidst Spot Market Caution

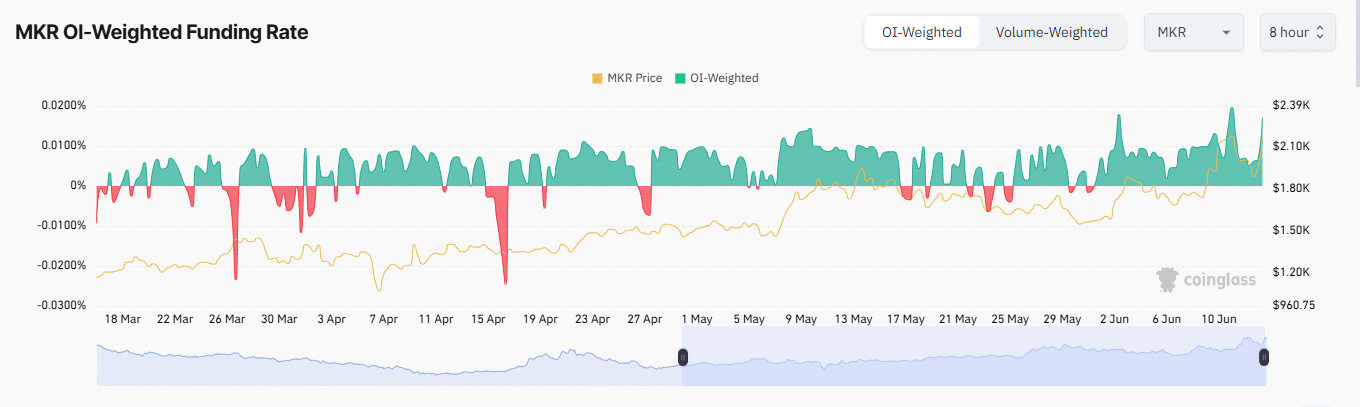

Maker’s recent price surge is largely attributed to aggressive long positioning within the Futures market, where traders are paying premiums to maintain their bullish bets. The Open Interest (OI) Weighted Funding Rate currently stands at a notable 0.0170%, ranking as the third-highest this year, indicating strong confidence among derivatives traders.

Source: CoinGlass

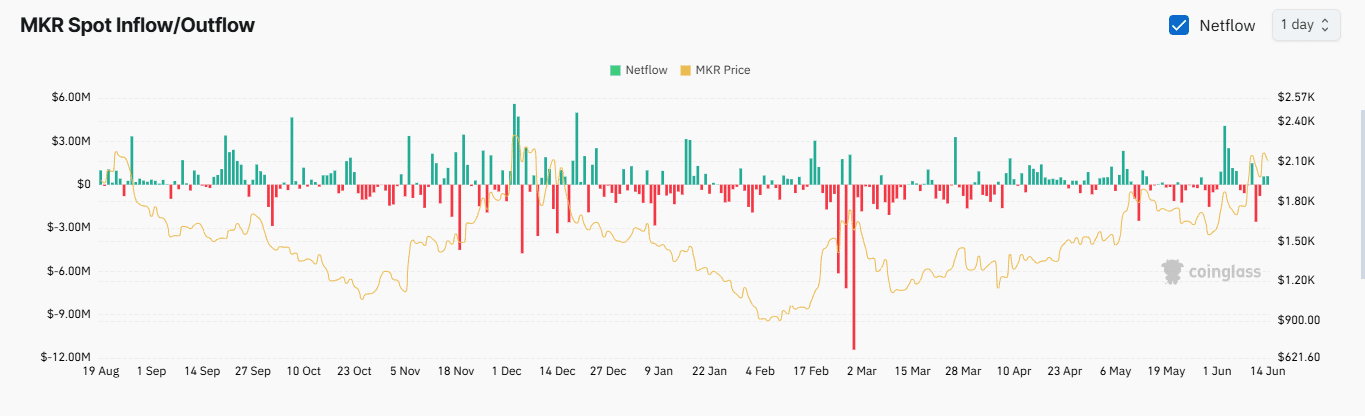

Conversely, spot market activity reveals a contrasting narrative, with traders offloading over $1 million in MKR, likely capitalizing on recent gains. This divergence between Futures and spot markets underscores a cautious sentiment among holders, possibly anticipating short-term volatility or a price correction.

Source: CoinGlass

Technical Indicators Signal Possible Support Retest for MKR

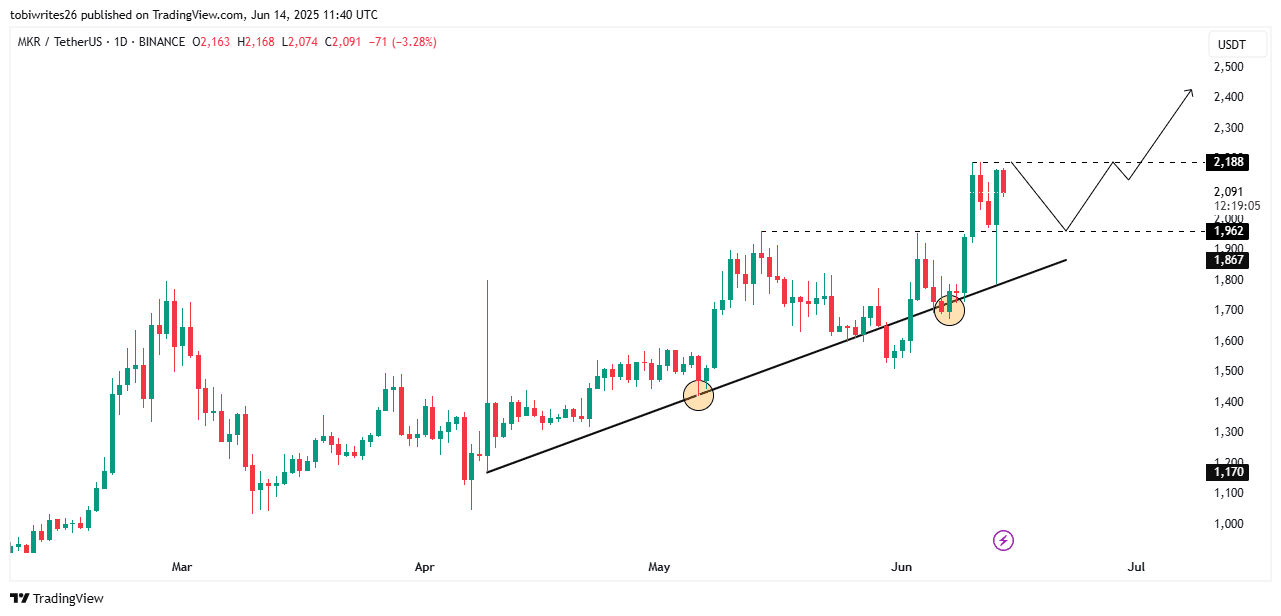

On the daily timeframe, MKR has successfully converted its recent high of $1,962 into a support level, a critical development for maintaining bullish momentum. However, the price action suggests a potential retest of this support zone may occur as short-term momentum wanes and spot selling persists.

Source: TradingView

If MKR maintains support above $1,962 or even the lower trendline near $1,867, it could preserve its bullish structure and set the stage for a renewed push toward the $2,400 resistance level. Traders should monitor these key zones closely for signs of strength or breakdown.

Bollinger Bands and Money Flow Index Suggest Rebound Potential

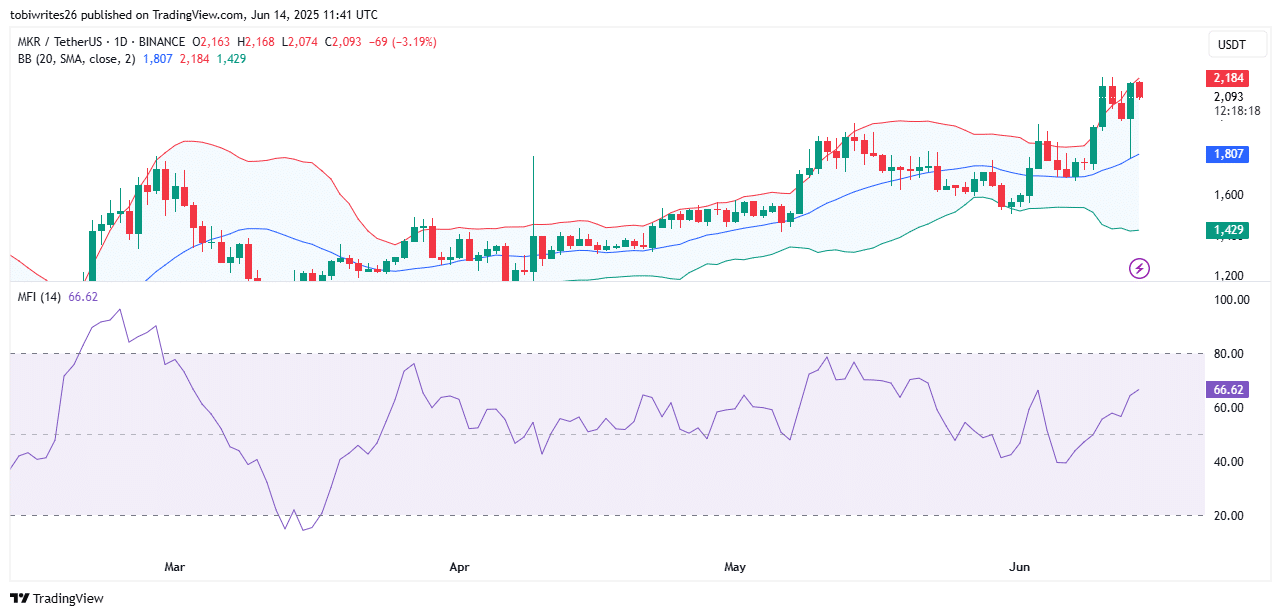

Market momentum indicators provide additional context to MKR’s price dynamics. The Bollinger Bands reveal that MKR has recently touched the upper band, a zone historically associated with short-term pullbacks toward the middle or lower bands, which often act as support.

Source: Trading View

Simultaneously, the Money Flow Index (MFI) stands at 66.62, indicating robust liquidity inflows and sustained buying interest. This combination suggests that any short-term dip could attract renewed accumulation, supporting a potential rebound and continuation of the uptrend.

Conclusion

Maker’s recent 17% rally, powered by Futures market enthusiasm, highlights strong bullish sentiment but is tempered by spot market profit-taking and technical signals pointing to a possible retracement. Key support levels at $1,962 and $1,867 will be critical in determining whether MKR can sustain its momentum and target the $2,400 resistance. Traders should remain vigilant, balancing optimism with caution as market dynamics evolve.