Date: Fri, July 18, 2025 | 05:40 AM GMT

The cryptocurrency market has crossed a historic milestone, surpassing a $4 trillion total market cap for the first time ever. Ethereum (ETH) continues to drive momentum, posting a 21% weekly gain and now approaching the $3,650 level. This strong bullish trend is spilling over into major altcoins , including Chainlink (LINK).

LINK has surged 14% in the last 24 hours, extending its 30-day gains to an impressive 44%. But beyond the price action, the latest harmonic setup on LINK’s chart is drawing significant attention, hinting that the rally might not be over yet.

Source: Coinmarketcap

Source: Coinmarketcap Harmonic Pattern Hints at Bullish Continuation

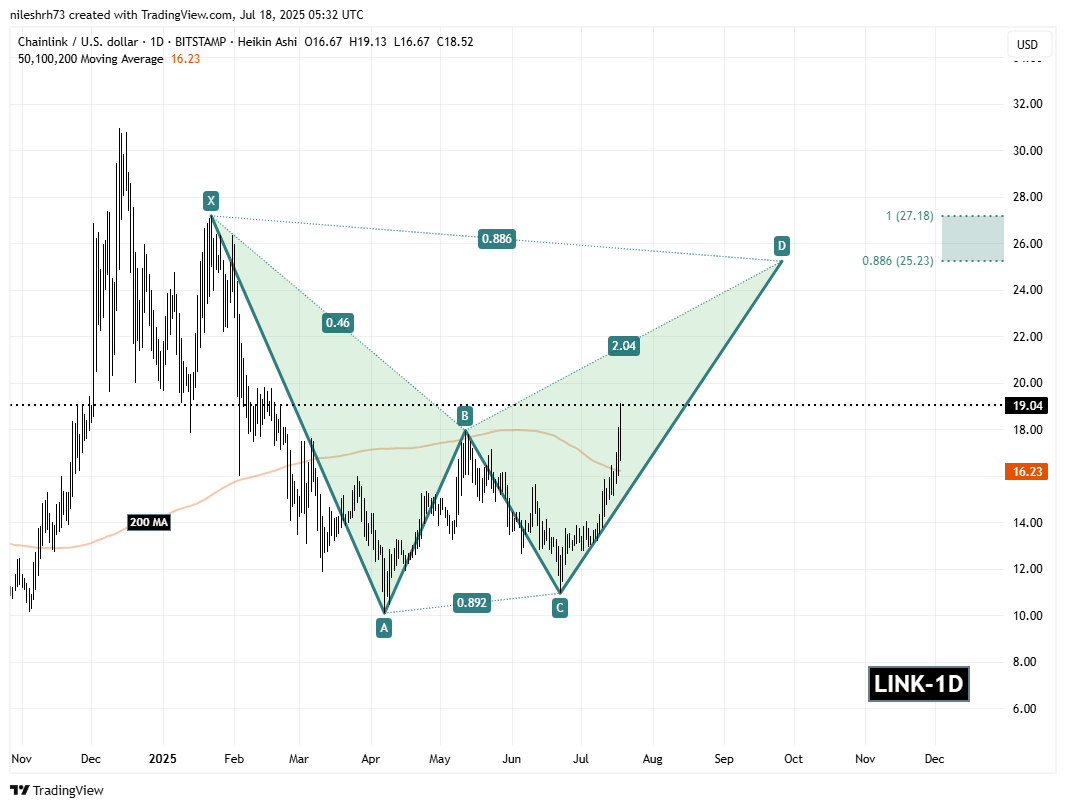

On the daily timeframe, LINK is forming a Bearish Bat harmonic pattern — a respected formation in technical analysis that often signals strong price movement during its final stages. Despite its name, the Bat pattern frequently drives bullish momentum as the CD leg unfolds, pushing price toward the “D” completion point.

This particular Bat pattern began at point X near $27.18 before dropping to point A, rallying to point B, and then retreating to point C around the $10.95 level. Since bottoming out, LINK has reversed sharply and is now trading near $19.00, reclaiming key ground and showing a bullish trajectory.

Chainlink (LINK) Daily Chart/Coinsprobe (Source: Tradingview)

Chainlink (LINK) Daily Chart/Coinsprobe (Source: Tradingview) What’s Next for LINK?

If this harmonic structure completes, the Potential Reversal Zone (PRZ) lies between $25.13 and $27.18. These levels align with the 0.886 and 1.0 Fibonacci extensions, typical targets for this setup. A rally into this zone would represent an additional 43% upside from current levels.

For the pattern to remain intact, LINK needs to hold above its 200-day moving average, currently near $16.23. A brief retest of this support is possible before the final leg completes, but maintaining that level would keep the bullish outlook valid.

With the broader market pushing higher and LINK’s structure pointing toward a clear target zone, the altcoin could be primed for its next breakout.