BIG Chainlink News: $1M Reserve Launched

Chainlink just dropped a game-changing update: it's building a reserve funded by real revenue —both onchain and offchain. With over $1 million in LINK already stacked, the market just got a reason to pay attention. Is this the fuel LINK price needs to break past $20 again?

Chainlink News: What Is the Chainlink Reserve and Why It Matters?

Chainlink just rolled out a strategic LINK reserve , aimed at long-term sustainability. It’s not just a marketing term. The Chainlink reserve is already backed by over $1 million worth of LINK, accumulated through both onchain service fees and offchain enterprise payments. Think Swift, Mastercard, UBS — not just your typical DeFi projects.

This isn’t a short-term liquidity pool or a rainy-day fund. Chainlink says it won’t touch the reserve for years. The goal is to funnel institutional adoption and revenue into LINK accumulation, strengthening its token economy without relying on inflationary emissions.

The model is smart. Enterprises can pay in stablecoins or fiat, and Chainlink will programmatically convert that revenue into LINK via DEXs. Over time, as adoption grows, this could create consistent buy pressure on LINK from real revenue.

Chainlink News: What the Daily Chart Is Saying Right Now

LINK/USD Daily Chart- TradingView

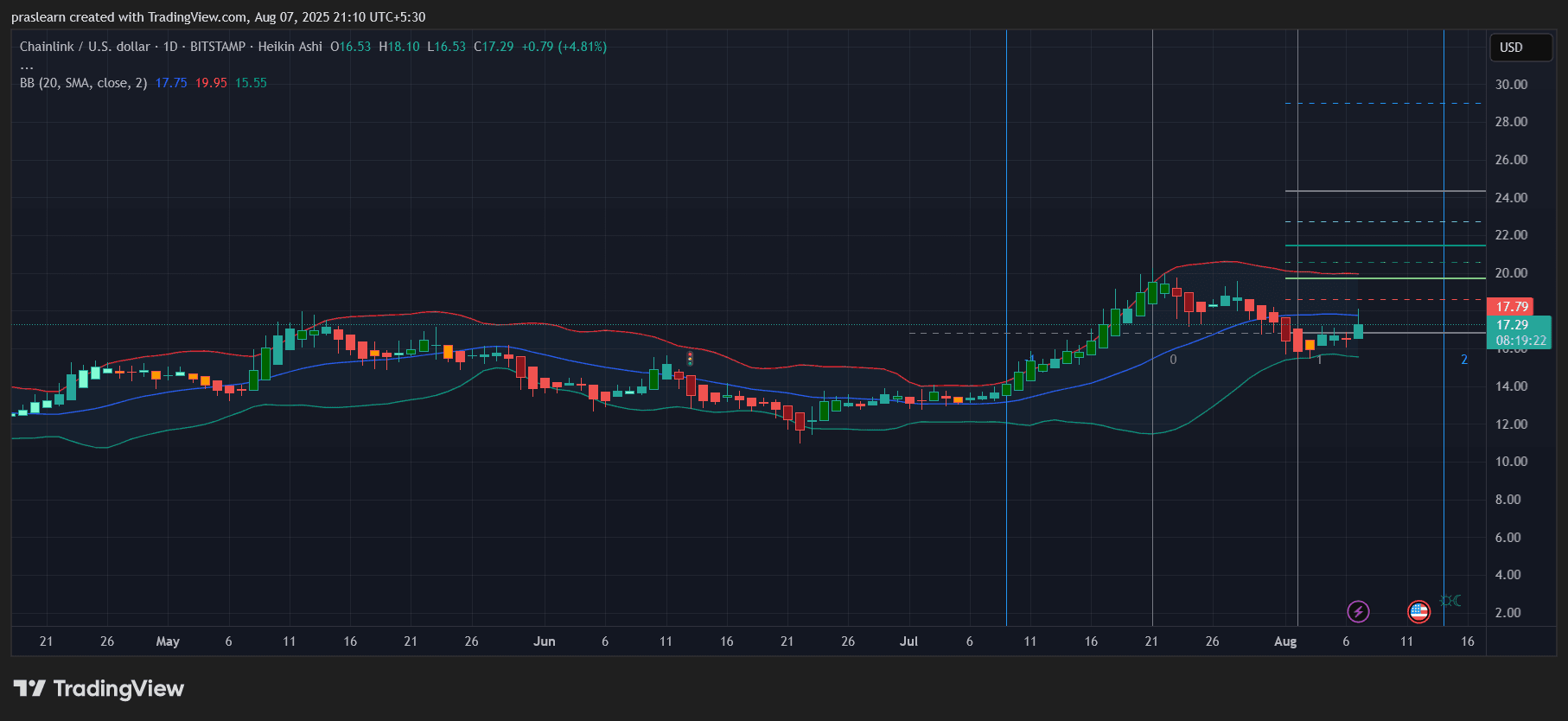

LINK/USD Daily Chart- TradingView Looking at the daily chart, LINK price closed at $17.29 with a 4.81 percent gain on the day. The candle broke above the 20-day moving average (blue midline on Bollinger Bands), signaling a potential trend reversal after a recent correction.

The Chainlink price is now attempting to reclaim the upper Bollinger Band area. The last strong rally peaked near $22, and the red upper band is now sitting around $19.95. A move past that would confirm bullish momentum returning.

What really stands out is the Heikin Ashi candle structure. After several days of bearish or indecisive candles, today’s strong green close shows increasing momentum and reduced selling pressure. This aligns with the psychological impact of the reserve news — long-term support from institutional flows gives investors confidence to hold or buy more.

Can the Chainlink Reserve News Actually Move the Market?

The launch of the reserve doesn’t immediately inject capital into LINK’s trading volume. But what it does do is shift sentiment. When traders see that Chainlink is building a sustainable treasury from real revenue — not just grants or VC funds — it reframes the token's utility. LINK isn’t just a gas token for oracles anymore. It becomes a revenue-backed digital asset.

In the short term, the announcement gives bulls a reason to return. In the medium to long term, it sets the foundation for stronger tokenomics. More revenue means more LINK accumulated into the reserve. If market supply stays fixed or limited, this becomes a basic supply and demand equation.

Key Levels to Watch

- Support: $15.55 and $17.75 (lower and middle Bollinger Bands)

- Resistance: $19.95 (upper band) and $22.00 (previous local high)

If LINK price can close above $18.50 in the next two sessions, a push to test $20 seems likely. On the flip side, a failure to hold above $17 could drag it back into the $15.50–$16.50 consolidation zone.

Final Thoughts

The reserve launch changes the narrative. Instead of just another Oracle project, Chainlink is positioning LINK as a token backed by real enterprise use and actual revenue flows. That won’t pump the price overnight, but it does lay the groundwork for more sustainable growth.

The chart reflects that optimism. Chainlink price is trying to recover from its dip, and today’s breakout candle adds fuel. If momentum holds and volume picks up, $20 could come back into play sooner than expected.