HBAR Price May Repeat History As Bearish Squeeze Strengthens

HBAR has seen significant volatility in recent days, as the altcoin grapples with broader market developments. After briefly testing its month-long support at $0.230, HBAR has faced downward pressure.

If the current bearish trend continues, the altcoin could drop below this key level, signaling further weakness.

HBAR Faces Turbulence

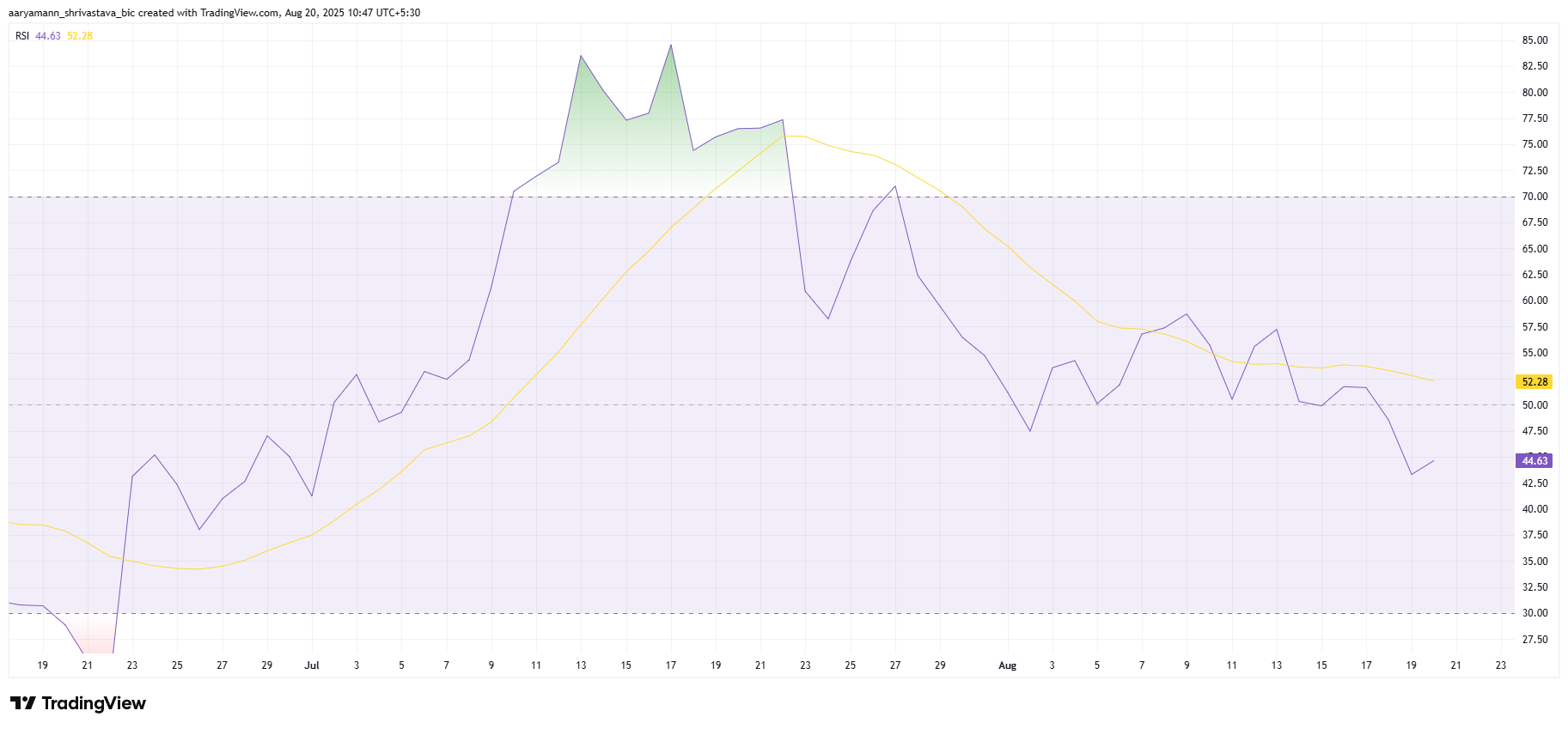

The Relative Strength Index (RSI) for HBAR is signaling growing bearish momentum. Currently below the neutral 50.0 level, the RSI marks a near-monthly low, suggesting that selling pressure is increasing. This shift indicates that the momentum for HBAR has turned negative, which could intensify the altcoin’s price decline.

With the RSI’s recent move, HBAR faces heightened pressure. The lower reading suggests that investors may remain cautious, especially as the broader market struggles. If the RSI continues to track below the neutral line, HBAR could experience even more downside, potentially breaching the month-long support.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

HBAR RSI. Source: TradingView

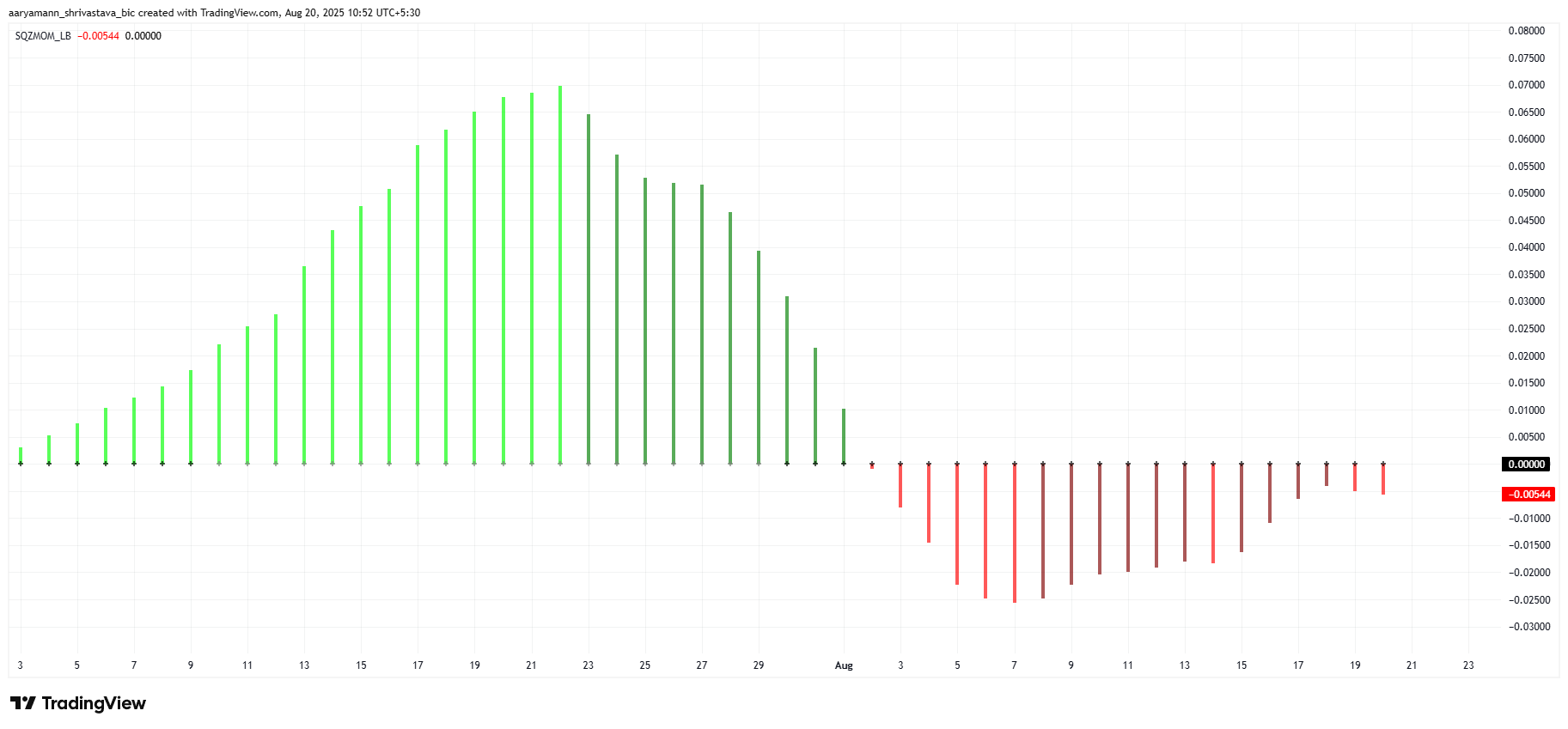

HBAR RSI. Source: TradingView The Squeeze Momentum Indicator (SMI) is currently forming a squeeze, with bearish momentum gaining strength. The indicator’s black dots confirm the ongoing bearish trend, signaling that the price could experience increased volatility once the squeeze is released. If the selling pressure persists, HBAR is at risk of facing deeper losses.

The current squeeze suggests that the market may experience a sharp move in either direction once the volatility is unleashed. Given the increasing bearish momentum, it is likely that HBAR could face a further decline, reinforcing the negative outlook for the cryptocurrency.

HBAR Squeeze Momentum Indicator. Source: TradingView

HBAR Squeeze Momentum Indicator. Source: TradingView HBAR Price May Repeat History

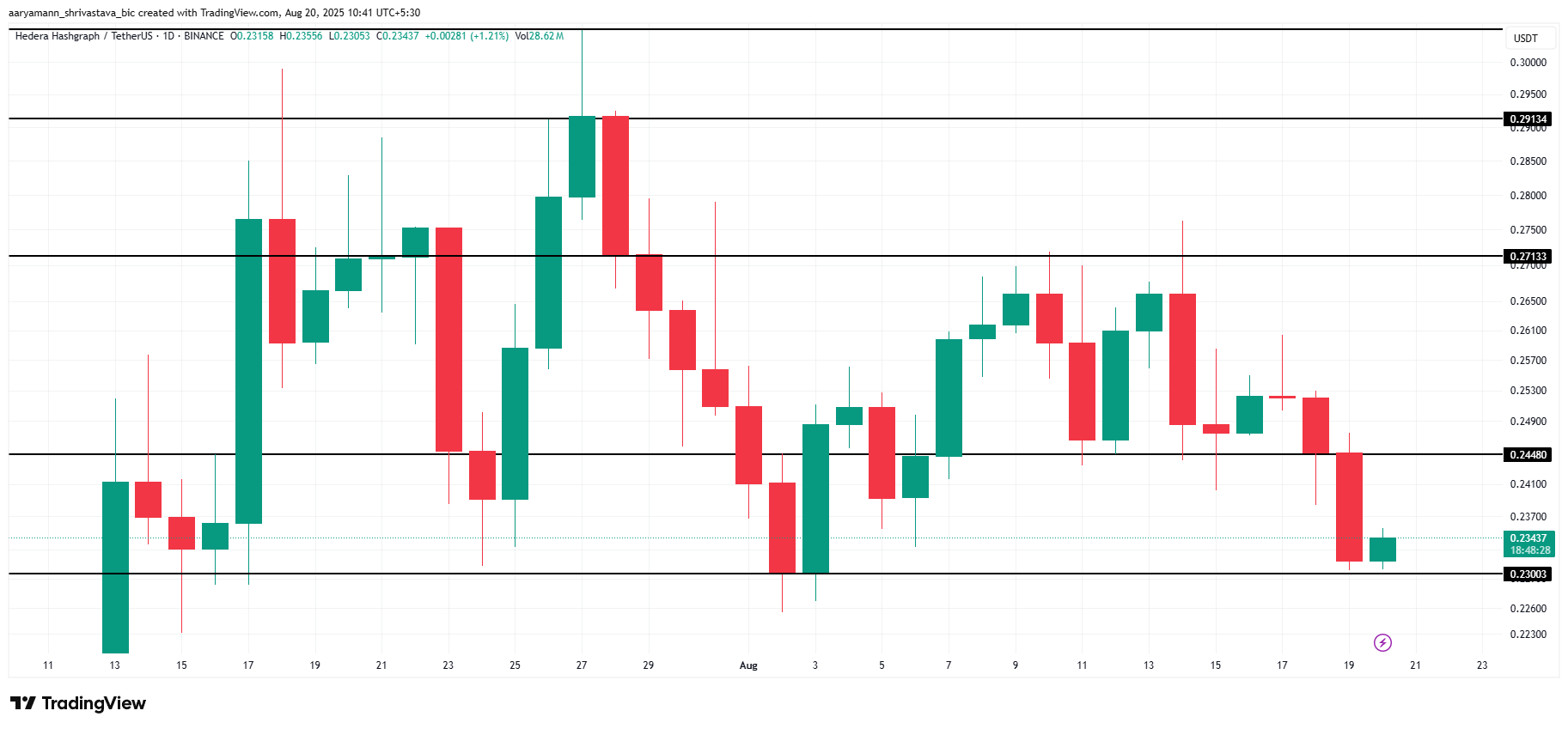

HBAR is currently trading at $0.234, testing its monthly support level of $0.230. This marks the third time the altcoin has dropped to this support, but this time may be different. With the increase in bearish momentum, HBAR’s ability to hold the $0.230 level could determine whether the price continues to decline.

The combination of factors signals that the negative momentum is gaining strength, making it more likely for HBAR to fall below $0.230. A break of this support could lead to further losses, with $0.210 as the next potential support level. If the market conditions worsen, HBAR could decline even further.

HBAR Price Analysis. Source: TradingView

HBAR Price Analysis. Source: TradingView However, if history repeats itself and HBAR bounces off the $0.230 support level, the price could recover to $0.244. If it manages to flip this resistance into support, it would invalidate the bearish thesis and open the door for a potential rise toward $0.271, signaling a shift in momentum.