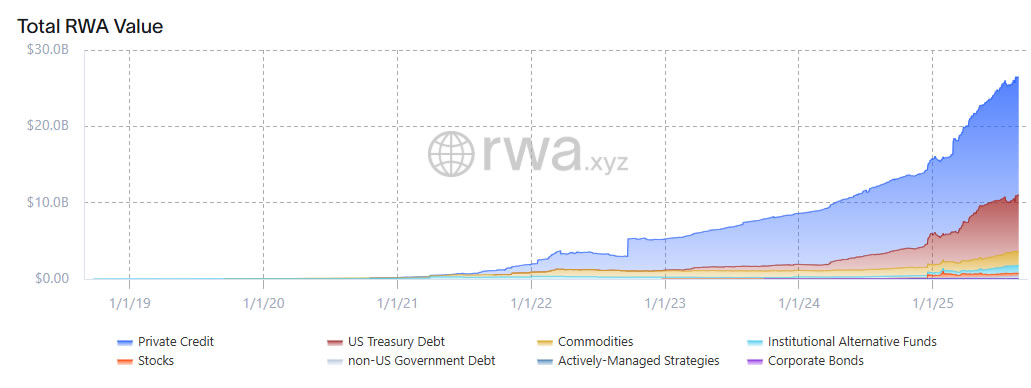

RWA tokenization is the process of representing real-world financial assets as onchain tokens, enabling fractional ownership, faster settlement, and broader liquidity. Recent data shows tokenized real-world assets reached an all-time high near $26.5 billion, signaling institutional interest and long-term growth potential.

-

RWA tokenization reached ~$26.5B at its ATH, up 70% year-to-date.

-

Ethereum leads with ~55% market share; inclusion of L2s raises that to ~76%.

-

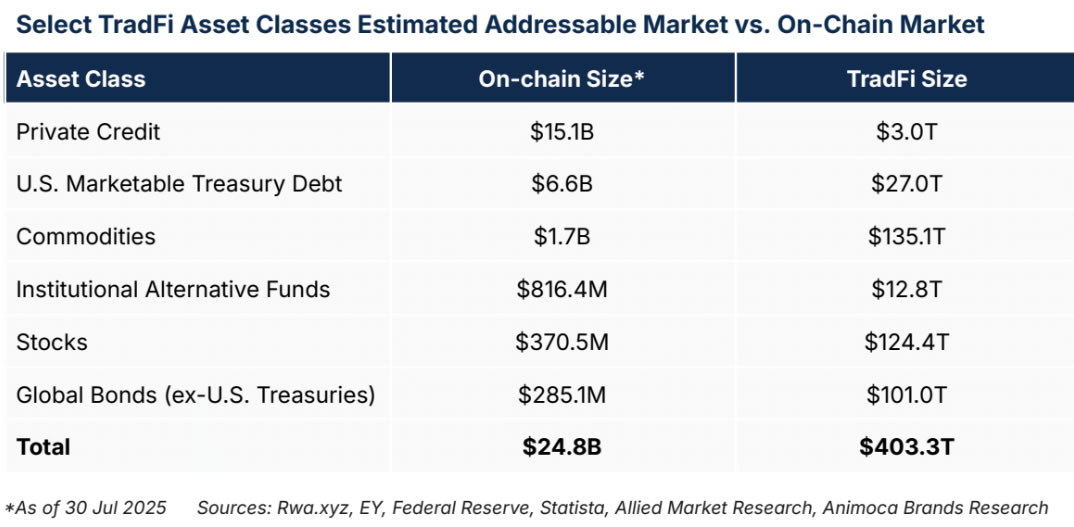

Animoca Brands estimates a $400 trillion TradFi addressable market, highlighting vast upside.

RWA tokenization: Tokenized real-world assets hit $26.5B ATH; learn why institutional interest is rising and what to watch next. Read the full analysis now.

RWA tokenization value recently surged to an all-time high, with more to come from TradFi’s $400 trillion addressable market, researchers say.

Tokenized real-world assets could eventually represent trillions of dollars worth of traditional finance assets in a multichain future, according to Animoca Brands researchers.

“The estimated $400 trillion addressable TradFi market underscores the potential growth runway for RWA tokenization,” said researchers Andrew Ho and Ming Ruan in an August research paper from Web3 digital property firm Animoca Brands.

The researchers found that the tokenized real-world asset (RWA) sector is just a small fraction ($26 billion) of the total addressable market currently, which is over $400 trillion.

These asset classes include private credit, treasury debt, commodities, stocks, alternative funds and global bonds.

There is currently “a strategic race to build full-stack, integrated platforms” by large asset managers, and long-term value will accrue to those who can “control asset lifecycle,” the researchers said.

Size of TradFi addressable asset market is 16,000 times larger than the current onchain market. Source: Animoca.

What is RWA tokenization and why does it matter?

RWA tokenization is the process of encoding ownership rights in traditional financial assets as digital tokens on blockchain networks. This enables fractional ownership, automated settlement, and broader investor access while preserving links to underlying legal and custodial frameworks.

As institutional frameworks and custody solutions mature, tokenized real-world assets are positioned to reduce friction across settlement, compliance, and capital formation processes.

How large is the TradFi addressable market for RWA tokenization?

Animoca Brands researchers estimate a $400 trillion TradFi addressable market, compared with a current onchain RWA market of roughly $26–26.5 billion. That gap highlights the potential scale-up opportunity for tokenized real-world assets.

Current tokenized categories include private credit, US Treasurys, commodities, equities, alternative funds, and global bonds, with private credit and treasury holdings representing the lion’s share of present value.

Why did RWA value hit an all-time high?

Industry tracker RWA.xyz reports the nascent RWA market reached an all-time high of approximately $26.5 billion, up about 70% year-to-date. This jump reflects new issuance and increased institutional confidence.

Private credit and US Treasurys account for nearly 90% of tokenized market value today, underscoring that early growth is driven by traditional fixed-income instruments moved onchain for efficiency and fractionalization.

Total RWA value at ATH. Source: RWA.xyz

Related: Centrifuge tops $1B TVL as institutions drive tokenized RWA boom: CEO (plain text reference).

How is the RWA market evolving toward a multichain future?

Ethereum remains the market leader for RWA tokenization with a reported 55% share when measuring onchain activity, rising to ~76% when Ethereum layer-2 networks are counted. This reflects Ethereum’s liquidity, security, and developer ecosystem.

However, researchers note that high-performance, purpose-built networks and private blockchains are increasingly hosting RWA projects. Interoperability and cross-chain settlement will be key success factors as the market scales.

The RWA trend has also driven demand for related crypto infrastructure: Ether (ETH) and oracle solutions such as Chainlink (LINK) have seen price performance that outpaced broader market moves in recent weeks, highlighting how real-world asset flows can influence crypto asset demand.

Animoca Brands also launched its NUVA tokenized RWA marketplace earlier this month as part of the growing infrastructure layer for onchain real-world assets.

Frequently Asked Questions

How secure is ownership in tokenized real-world assets?

Security depends on smart contract audit quality, custody arrangements, and legal frameworks tying tokens to offchain asset registries. Institutional-grade custody and audited contracts are essential for trustworthy token ownership.

Can tokenized RWAs drive demand for crypto tokens like ETH?

Yes. RWA issuance and settlement often require native chain liquidity and oracle services; increased RWA activity can raise demand for settlement tokens (e.g., ETH) and infrastructure tokens (e.g., Chainlink), supporting ecosystem value.

Key Takeaways

- Market momentum: Tokenized real-world assets reached roughly $26.5B, up 70% YTD, signaling growing institutional adoption.

- Large addressable market: Animoca Brands estimates a $400T TradFi opportunity, indicating vast long-term upside for tokenization.

- Multichain future: Ethereum leads today, but layer-2s, specialized chains, and interoperability will shape long-term market structure.

Conclusion

RWA tokenization is moving from pilot to scale, driven by private credit and treasury issuance and supported by Ethereum and layer-2 networks. As institutional frameworks, custody, and interoperability improve, tokenized real-world assets could capture a meaningful slice of TradFi’s multi-hundred-trillion-dollar opportunity. Monitor issuance trends and platform integrations as primary indicators of progress.