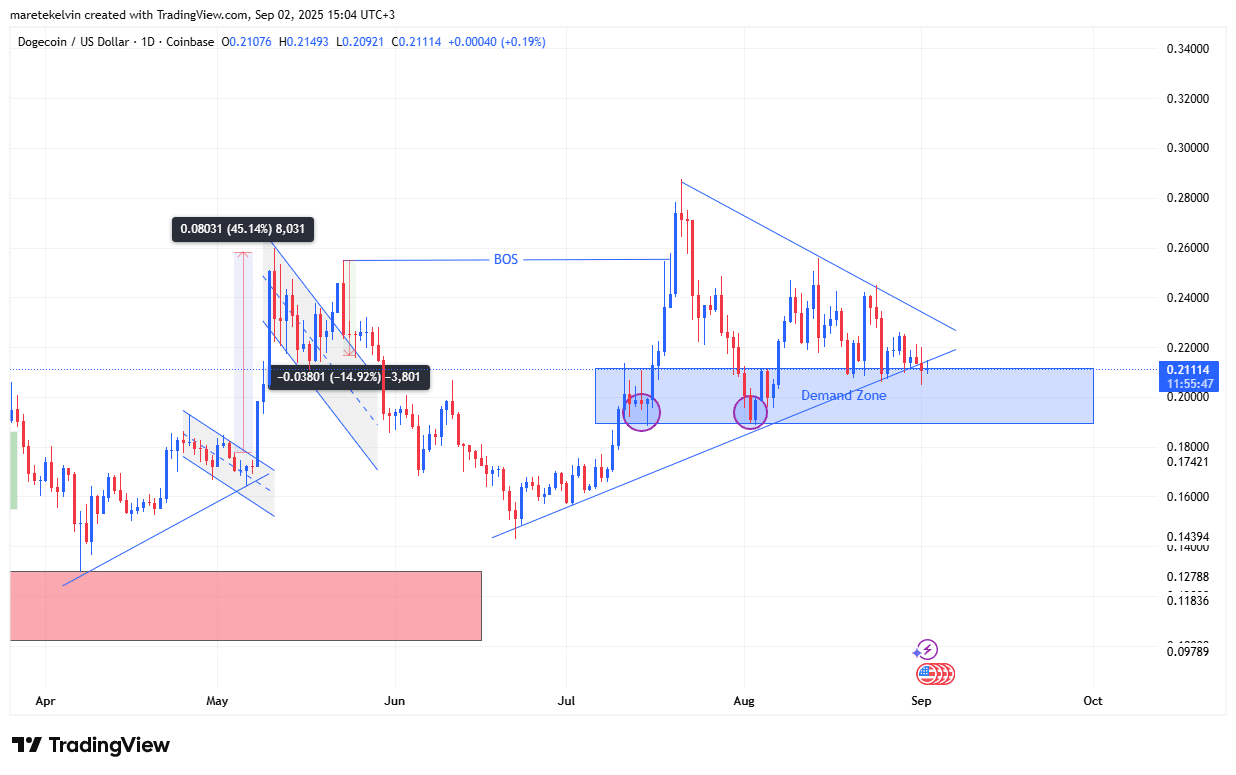

Dogecoin breakout: DOGE is trading inside an ascending triangle near $0.20 with rising volume and a circulating market cap around $31.7B. This pattern points to a likely technical resolution — a confirmed breakout on strong volume or a false break toward lower supports; monitor triangle resistance and volume for confirmation.

-

Ascending triangle near $0.20 after two months of consolidation

-

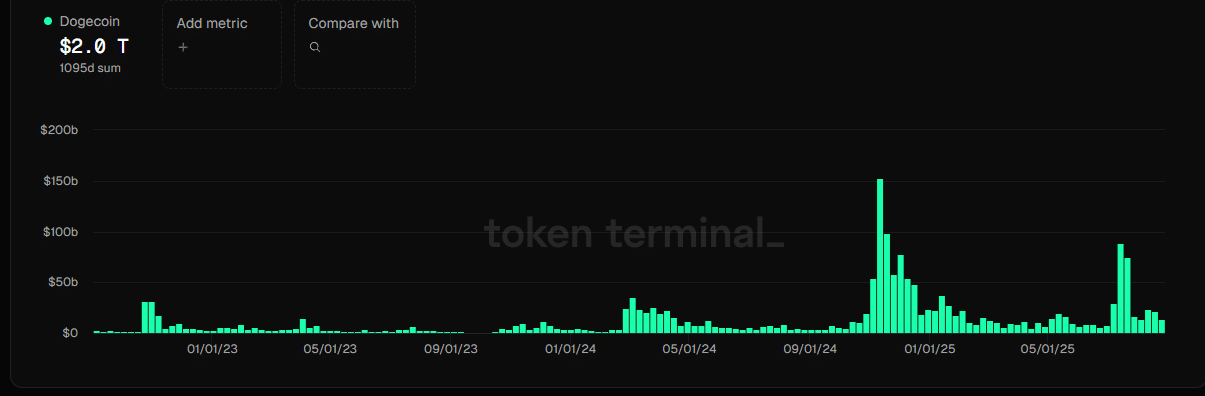

Weekly trading volume spiked to $13.49 billion, signaling fresh positioning.

-

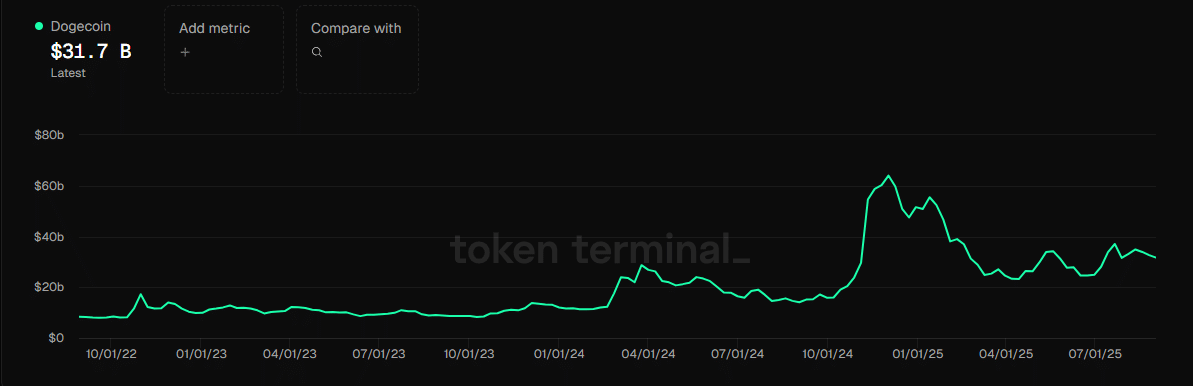

Circulating market cap reached ~$31.7 billion vs July peak near $40 billion, raising retail participation risk.

Dogecoin breakout: DOGE trades in an ascending triangle near $0.20 with rising volumes and a $31.7B market cap. Read technical signals and trading steps.

What is driving the Dogecoin breakout setup?

Dogecoin breakout setup is driven by an ascending triangle that has formed over two months, where higher lows meet a horizontal resistance near $0.20. Short-term momentum is building as trading volume rises, suggesting traders are positioning for a decisive move once the pattern resolves.

How are volumes and market cap influencing DOGE’s outlook?

Weekly trading volume surged to $13.49 billion during the week of 25 August, per Token Terminal data, which often precedes sharp directional moves. Increased circulating market cap (~$31.7 billion on 01 September) points to renewed retail interest and higher potential volatility around any breakout.

Rising volume plus higher market cap typically confirms conviction when price breaks pattern resistance. Conversely, low-volume breakouts should be treated as higher-risk false moves.

Source: TradingView

How likely is a true breakout versus a false breakout?

A decisive breakout is more likely if price clears triangle resistance with above-average volume and sustained follow-through over 24–72 hours. False breakouts occur frequently in narrowing ranges, especially with high retail exposure; watch for quick volume fade or price rejection at resistance as signs of a trap.

Traders should require confirmation: a breakout candle close above resistance plus volume higher than the prior weekly average. If price fails and returns inside the triangle, the odds shift toward a breakdown scenario.

Source: Token Terminal

What technical levels should traders watch?

Primary levels: triangle resistance at ~ $0.20 and immediate support formed by the ascending trendline. A confirmed breakout target is the height of the triangle projected above resistance. Stop levels should be below the ascending trendline to limit downside in case of a false breakout.

| Confirmed breakout | Close above $0.20 on strong volume | Measured move equal to triangle height; trailing stops on momentum |

| False breakout / trap | Rejection at resistance with volume fade | Retracement toward lower supports; increased volatility |

Source: Token Terminal

Frequently Asked Questions

How can I confirm a genuine DOGE breakout?

Confirm a DOGE breakout by waiting for a daily close above triangle resistance with above-average volume and follow-through in subsequent sessions. Use volume and price action together — a breakout without volume confirmation is higher risk.

What risks should traders consider around this setup?

Risks include false breakouts, sudden retail-driven volatility, and broader market declines. Set conservative risk management: predefined stop-loss levels, position sizing, and a plan for both breakout and breakdown outcomes.

Key Takeaways

- Pattern: Ascending triangle near $0.20 after two months of consolidation.

- Volume: Weekly volume spike to $13.49B signals position build-up.

- Action: Require volume confirmation and a daily close above resistance to validate a breakout; otherwise anticipate possible retracement.

Conclusion

Dogecoin is at a technical inflection point with an ascending triangle, rising volume, and a circulating market cap near $31.7B. Monitor resistance, volume, and price confirmation to distinguish a true breakout from a trap. COINOTAG will track developments and update technical signals as the pattern resolves.