Solana treasury interest is rising as institutional demand could lift SOL price; a Solana-only fund and bids from major crypto firms increase bullish long-term outlook, but short-term technicals leave room for a pullback to ~$170–$192.

-

Institutional flows and a dedicated Solana treasury boost long-term SOL demand

-

Short-term risk: a liquidation pocket and a rising-wedge pattern could pull SOL toward $192 or $170.

-

On-chain metrics (MVRV) show holders in profit, supporting a constructive medium-term outlook.

Solana treasury interest lifts SOL outlook; watch $197 support and $170 downside risk — read analyst take and levels to monitor.

What is the impact on SOL?

Solana treasury interest improves SOL’s medium- to long-term demand profile as institutional vehicles and a Solana-only fund concentrate supply into dedicated treasuries. In the short term, SOL may still test lower supports near $197, $192, or $170 due to liquidity clusters and bearish chart structure.

How do institutional moves affect SOL price?

Institutional approvals and fund conversions concentrate large amounts of SOL into corporate treasuries, reducing available float and supporting higher prices over months. Sol Strategies’ Nasdaq approval and reported interest from firms attempting to build a $1B Solana treasury signal growing institutional demand. These developments are constructively priced over time but do not guarantee immediate upside.

Frequently Asked Questions

Could Sol Strategies’ Nasdaq approval push SOL higher immediately?

Nasdaq approval (announced 5 September) increases institutional access to SOL exposure, improving sentiment. Immediate price impact is often muted; the main effect is gradual as fund flows materialize and treasury allocations accumulate.

What technical levels should traders watch for SOL this week?

Watch $197 as near-term support, a liquidity cluster around $196–$199.5 that can attract price, and $192.3 as a secondary pullback zone. A breakdown of the rising wedge could extend losses toward $160–$170.

Analysis and context

Solana (SOL) remained above the $200 mark amid increased institutional interest. A Canadian investment firm, Sol Strategies, received Nasdaq approval (announced 5 September) and expects trading under ticker STKE. In July 2024 the company converted to a Solana-only investment vehicle and now holds one of the largest corporate SOL treasuries.

Market reports indicate firms such as Galaxy Digital, Jump Crypto, and Multicoin Capital explored assembling a roughly $1 billion Solana treasury via public vehicles. This concentration would create the largest dedicated SOL treasury and could materially reduce circulating supply over time. (Source references: Bloomberg-style reporting, market disclosures.)

What are the short-term technical risks?

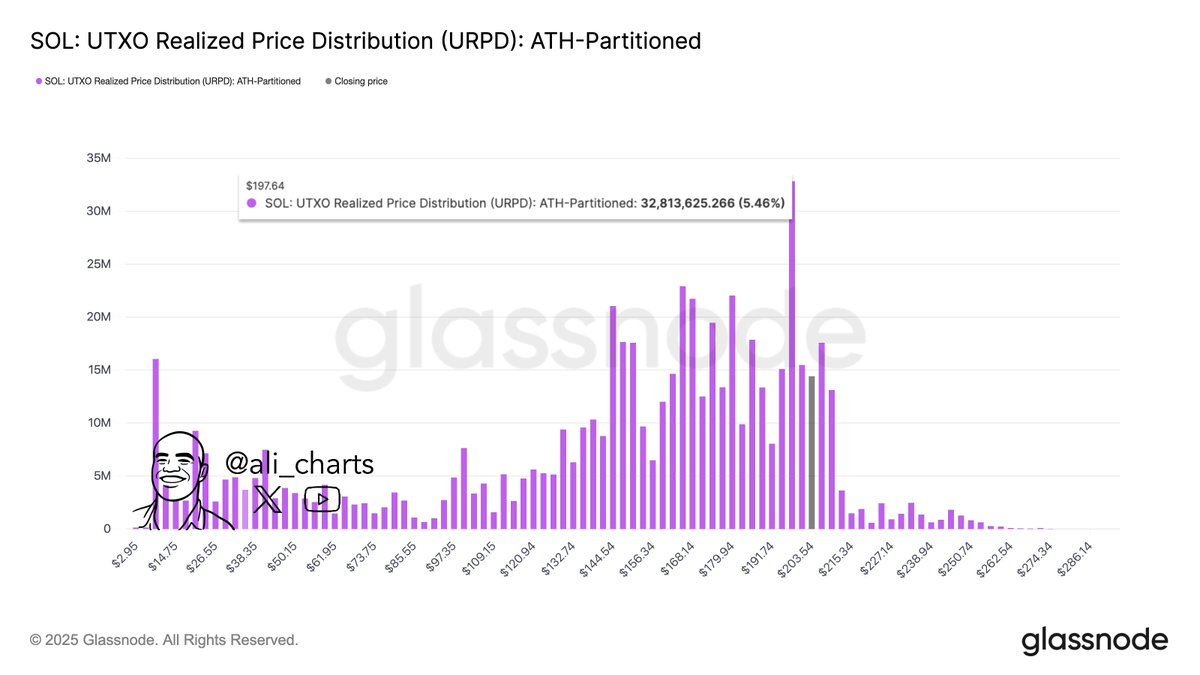

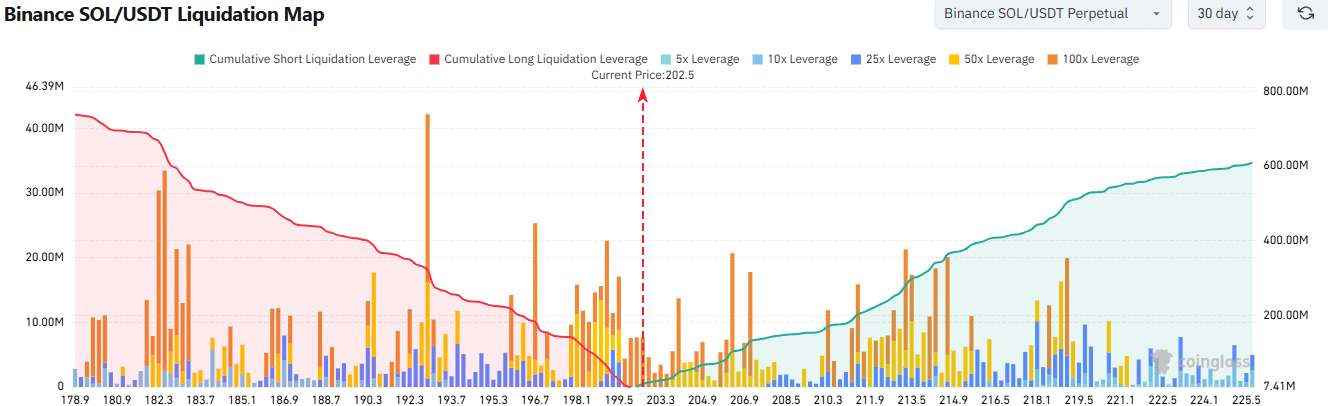

A cluster of leveraged longs sits between $196 and $199.5, creating a liquidity pocket that can pull price into that range before buyers step in. Crypto analyst Ali Martinez highlighted SOL trading marginally above a key $197 level.

The liquidation map highlighted a cluster of high-leverage liquidations in the $196–$199.5 region. This means price may be attracted lower to absorb those positions before any sustained rally.

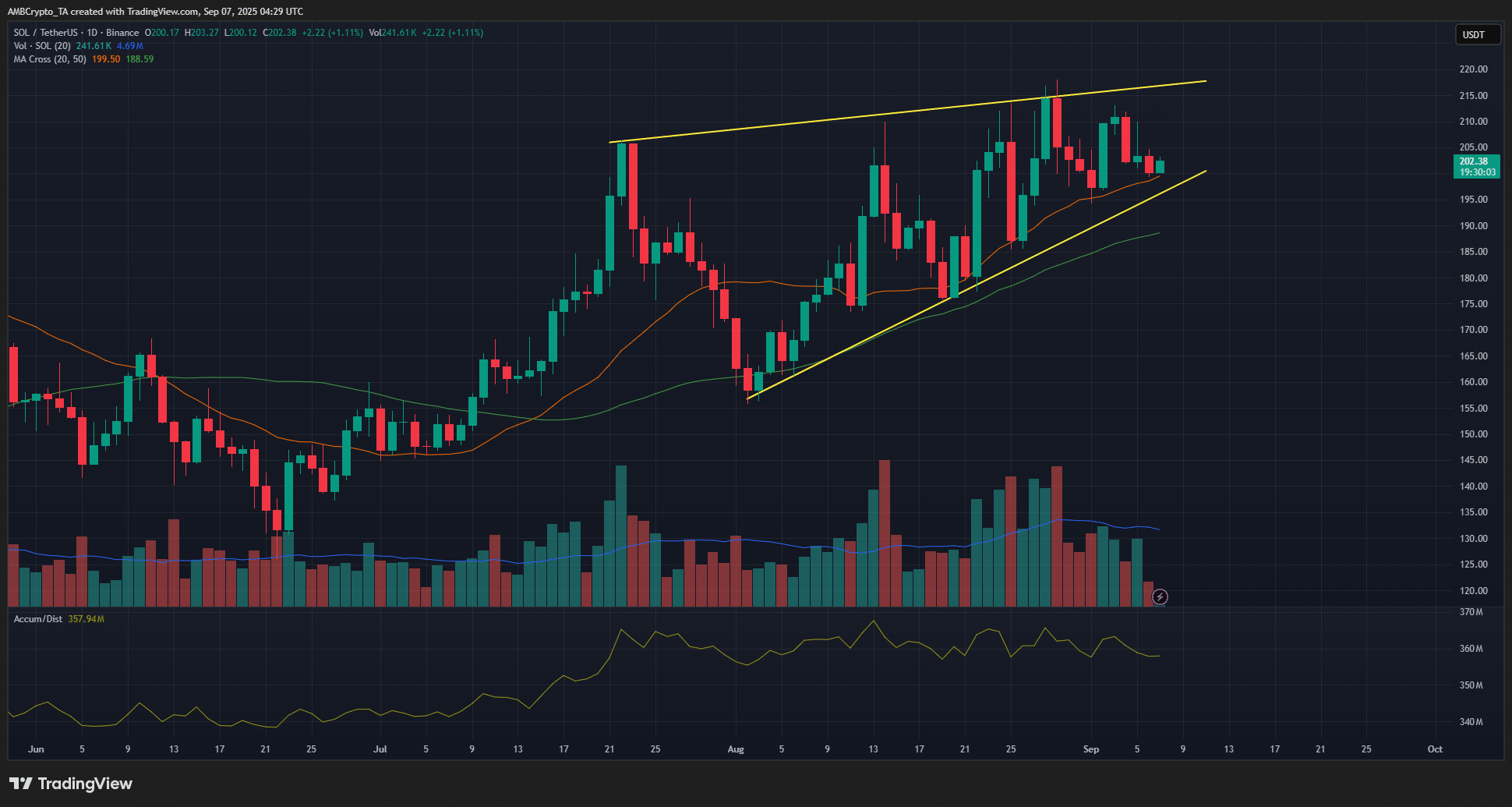

On the daily chart, SOL exhibited a rising wedge pattern. Rising wedges often resolve downward; a confirmed breakdown could extend losses to $160–$170, while a hold above $197 preserves bullish potential.

What do on-chain metrics show?

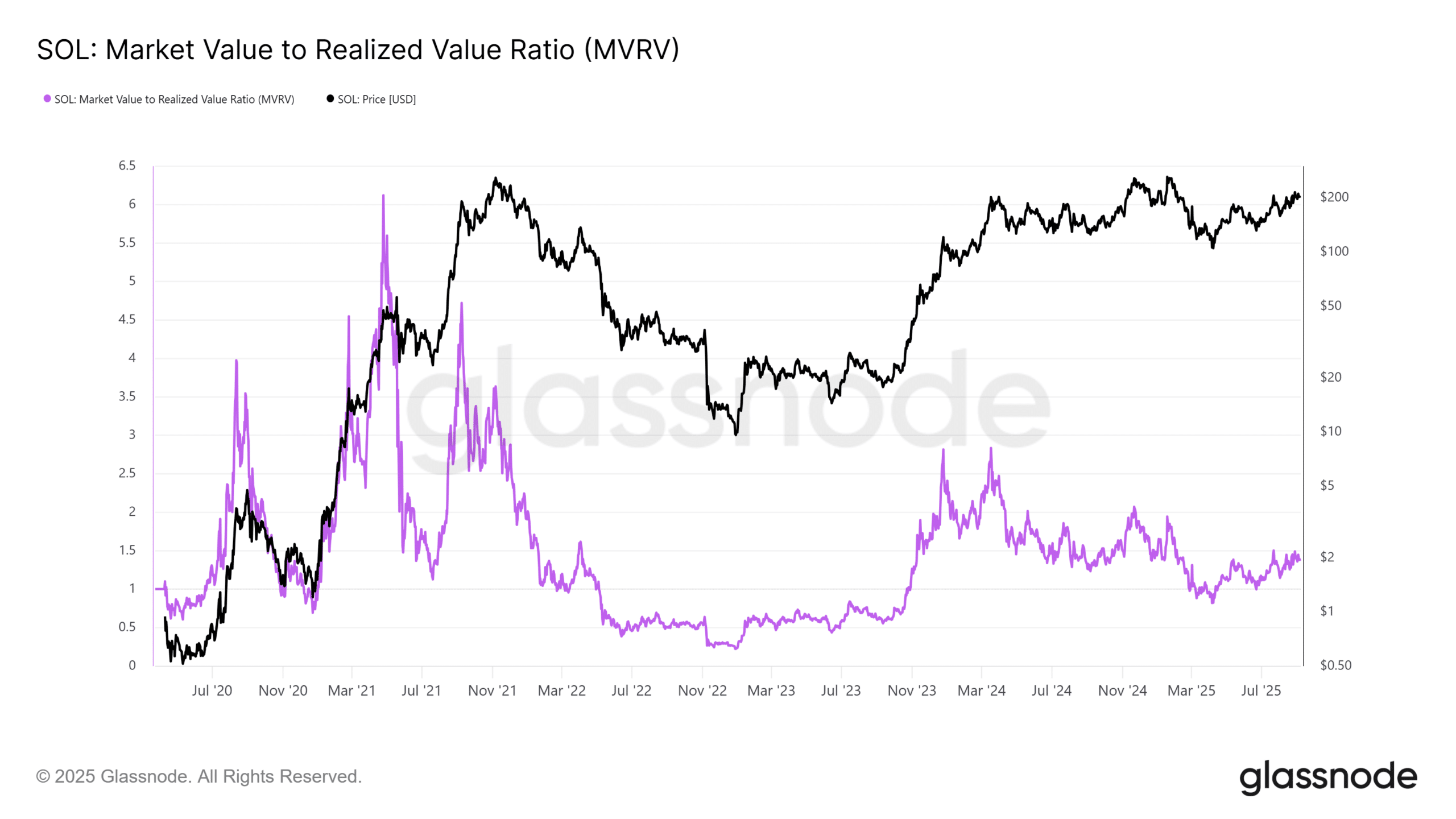

MVRV data suggest holders are, on average, profitable, with the metric above 1. Since February, MVRV has mostly stayed below 1.5 — a range historically consistent with steady, non-euphoric bullish markets. The metric is far from 2.4+ levels that signal overvaluation and exuberance, indicating structural health in SOL demand.

Key Takeaways

- Institutional treasury demand: Converting firms and planned treasuries concentrate SOL supply and support medium-term price strength.

- Short-term technical risk: Liquidity around $196–$199.5 and a rising wedge pattern create downside scenarios to $192 and $170.

- On-chain health: MVRV above 1 indicates holders are profitable, suggesting a constructive backdrop versus euphoric extremes.

Conclusion

Growing interest in a Solana treasury and approved Solana-focused funds strengthens the long-term narrative for SOL, while clustered liquidations and chart structure create short-term downside risk. Monitor $197, $192, and the $160–$170 range for decisive moves; institutional flows will likely dictate recovery timeline.