leanVM is a minimal zkVM designed to boost Ethereum scalability and execution efficiency by reducing commitment costs and enabling fast recursion with multilinear STARKs. Early benchmarks show sub-3 second recursion and targeted tenfold improvements, positioning Ethereum for long-term resilience and broader Layer-2 adoption.

-

leanVM cuts commitment costs versus Cairo, enabling faster, cheaper proofs.

-

Early recursion benchmarks report 2.7s times, with a roadmap to 10x speedups.

-

Ethereum price saw $447M ETF redemptions on Sept 5, 2025; development momentum remains intact.

Ethereum leanVM update: leanVM improves scalability and execution efficiency; read the latest benchmarks and ETF impact — COINOTAG analysis and next steps.

What is leanVM and why does it matter for Ethereum?

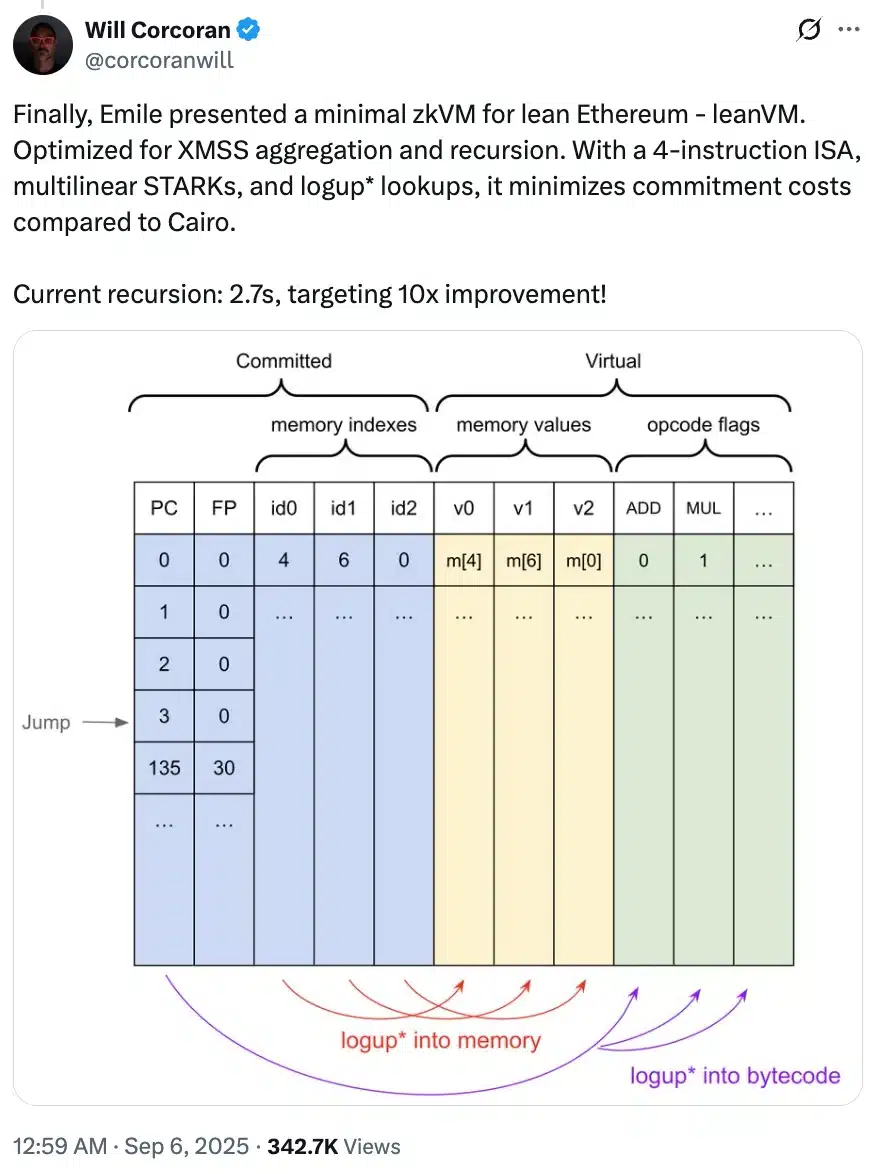

leanVM is a minimal zkVM tailored for Ethereum that reduces proof commitment costs using a 4-instruction ISA, multilinear STARKs, and logup lookups. It matters because it targets substantial execution efficiency gains, enabling higher throughput and lower costs while preserving decentralization.

How does leanVM fit into the zkVM ecosystem developments?

Central to this progress is leanVM’s focus on XMSS aggregation and recursion. The design emphasizes a compact instruction set and optimized proof composition to lower on‑chain footprint.

Benchmarks indicate recursion times of 2.7 seconds today, with a target of ~10x improvement. These gains help Layer‑2s and rollups by reducing verifier costs and improving finality economics.

Source: Will Corcoran / X (plain text)

How do leanVM technical choices improve proof economics?

leanVM uses a streamlined 4-instruction ISA to minimize prover complexity and commitment sizes. Multilinear STARKs and logup lookups further compress witness commitments, directly lowering gas-equivalent verifier costs.

That combination reduces on-chain calldata and verification time, which benefits rollups and Layer‑2 networks that rely on succinct proofs.

How is Ethereum price action responding to development news?

Ethereum’s price remains sensitive to macro flows and ETF activity. At press time ETH traded near $4,304, up 0.23% in 24 hours per CoinMarketCap (plain text source).

On Sept 5, 2025, Ethereum spot ETFs recorded nearly $447 million in redemptions in a single day, contributing to short-term volatility. Despite this, on‑chain development momentum and long-term scaling work continue unabated.

Frequently Asked Questions

What are the main benefits of leanVM for Layer‑2 networks?

leanVM reduces proof sizes and verifier costs, enabling rollups to publish cheaper, faster commitments. This improves finality economics and could lower fees for Layer‑2 users while maintaining security.

Will recursion improvements change developer choices?

Yes. Faster recursion and smaller commitments make zk-rollups and zkVM-based chains more attractive for complex smart contracts, shifting developer focus toward zk-native tooling and optimized execution paths.

Key Takeaways

- Technical progress: leanVM’s 4-instruction ISA and multilinear STARKs reduce commitment costs and improve recursion speed.

- Market context: Short-term price volatility followed a $447M ETF redemption day, but core development remains focused on long-term scaling.

- Practical action: Track recursion benchmarks, Layer‑2 adoption signals, and protocol releases to assess when efficiency gains translate to lower user costs.

Conclusion

leanVM represents a targeted step in Ethereum’s evolution, combining compact VM design with advanced STARK techniques to lower proof costs and raise execution efficiency. Coupled with ongoing Layer‑2 work and monitored ETF flows, these developments support Ethereum’s long-term scaling and resilience. Stay updated with COINOTAG analysis for follow-ups and benchmarks.

Published: 2025-09-07 | Author: COINOTAG | Updated: 2025-09-07