Both mainstream and crypto markets have played with the model of ‘Bowie Bonds’, a financial instrument tapping the value of IP rights. Crypto projects are re-emerging with the goal of tokenized IP rights, aiming to make payments and monetization seamless.

Demand for yield has brought back ‘Bowie Bonds’, as funds raised $6.7B backed by the IP of top songs. Previously, Bowie Bonds only tapped the revenue streams from the albums and performances of David Bowie. Now, the concept is spreading to a wider pool of intellectual property.

The new wave of IP bonds was backed by Blackstone, Carlyle and Michigan’s state pension fund, reported the FT.

IP rights bonds expanded in 2025

The latest rounds of IP rights products show a trend of acceleration for the last few years.

Music-backed bonds raised an estimated $4.4B to $6.7B, compared to $3.3B in 2025. The music-backed bonds started returning in 2021, with a tentative $300M in new deals. In 2020, there were virtually no music-backed bonds.

The asset class has been known as an exotic and niche investment, but has made a return as markets are redefining the lines of investable assets in search of yield. The field has expanded beyond Bowie’s 1997 deal, which raised $55M at 7.9% annualized. Since then, the model has been taken over by some of the biggest players, issuing financial instruments for stars such as The Beatles, or newer generations of artists like Justin Bieber and Lady Gaga.

The bond market is also a way for companies that hold large IP catalogues to tap the value of those assets through bond issues. In the summer of 2025, Recognition Music Group raised $372M for its IP catalogue. Concord financialized a part of its music catalogue in 2022, raising $1.8M. As significant liquidity in the global markets seeks out assets, the music bond model is a potential source of growth.

The music bonds are already getting rated by the leading agencies, offering a clearer estimation of risk and a shift to mainstream markets.

Crypto projects attempt tokenized IP rights

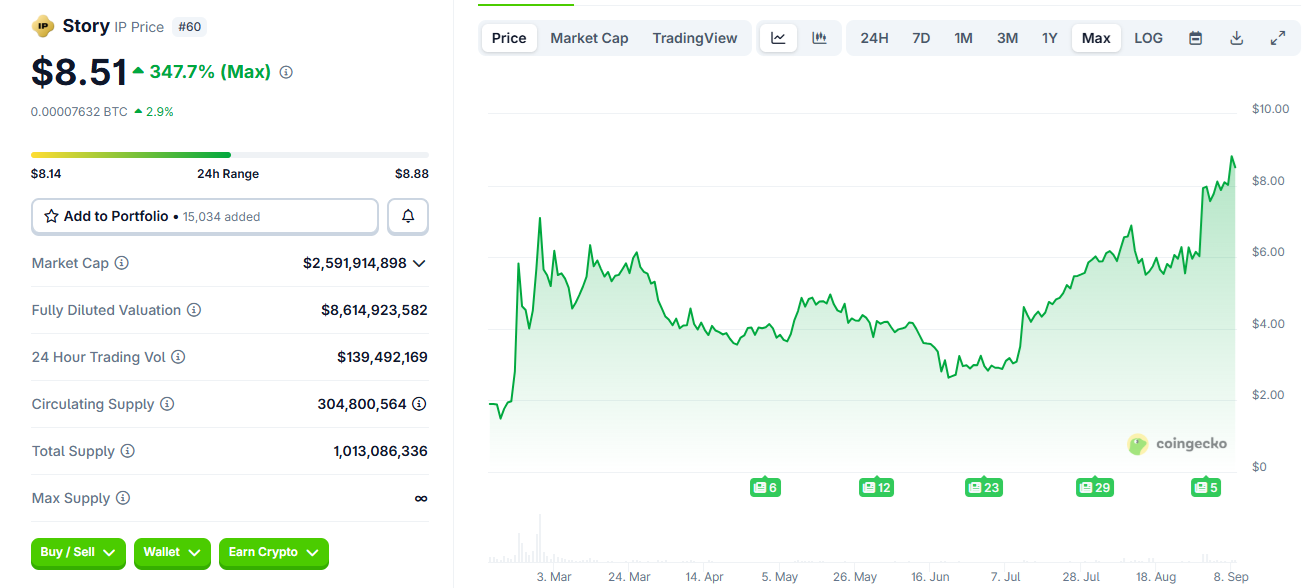

The same problem of artist liquidity has been solved in several crypto startups, though at a smaller scale. The Web3 boom led to multiple attempts to tokenize music rights, coinciding with the NFTs boom. There is no common standard on music tokenization, and the niche nature of those projects meant not all were successful. IP tokenization has been around in crypto space, led by Story Protocol. Recently, the revival of IP rights narratives brought Story Protocol (IP) to a new all-time high.

Story Protocol (IP) rallied to a new all-time peak as the IP rights narrative revived. | Source: CoinGecko .

Story Protocol (IP) rallied to a new all-time peak as the IP rights narrative revived. | Source: CoinGecko . Some of the projects tried to tokenize small-scale creators. The biggest setback for crypto projects is that they lack access to large IP portfolios from established artists.

Despite this, the crypto space has shown it can also carry tokenized versions of mainstream bonds. The new type of asset may be added to the general growth of RWA tokenization , which now focuses mostly on money markets.

For now, a new batch of startups has emerged to attempt IP tokenization once again. Recently, the Aria project raised $15M to tokenize IP rights, allowing all holders to acquire fractions of songs and royalties, similar to Bowie Bonds.

Another project, Rialo , has attempted tokenization, but has not managed to solve the issue of delayed payments. While on-chain interactions can be instant, not all Web3 projects achieve immediate value transfers, and still require intermediaries.

As asset markets try to absorb increasing liquidity, music bonds both in mainstream venues and in crypto are making a return. However, available liquidity and access for investors may vary, and new crypto startups may hold additional risks.

Don’t just read crypto news. Understand it. Subscribe to our newsletter. It's free .