EUR/USD Weekly Forecast: US Dollar plunges ahead of European Central Bank decision

The EUR/USD pair closed a third consecutive week little changed, a handful of pips away from the 1.1700 mark. It kick-started September with a positive tone, peaking on Monday at 1.1736, but falling afterward to flirt with the 1.1600 mark.

The pair posted a fresh weekly high on Friday, hitting 1.1759 for the first time since late July. The fact that the pair holds near the latter hints at additional US Dollar (USD) weakness ahead.

Government bonds turmoil

For once, USD rallying on risk aversion had little to do with the United States (US). Turmoil in the United Kingdom (UK) put financial markets on the defensive at the beginning of the week, as the 30-year UK government bond yield hit 5.680%, its highest level since 1998, spurring echoes among global government bonds. UK gilts have been at the eye of the storm amid a myriad of local factors.

Changes in pension funds, excessive government spending, and speculation of potential higher taxes all combined to unwind this latest crisis. The dust settled quickly, and market participants turned their eyes to US data for direction.

Tepid US employment and growth

The focus shifted to US data, particularly focused on employment-related data, ahead of the Nonfarm Payrolls (NFP) released on Friday.

The US reported that the number of job openings on the last business day of July stood at 7.18 million, according to the Job Openings and Labor Turnover Survey (JOLTS) report. The reading was below the 7.35 million (revised from 7.43 million) openings recorded in June and came in below the market expectation of 7.4 million.

Also, the August Challenger Job Cuts showed that US-based employers announced 85,979 job cuts in August, up 39% from the 62,075 figure announced in July, and the highest monthly reading since 2020.

The ADP Employment Change came next, showing that the private sector added a modest 54,000 new job positions in the same month, much worse than the revised 106,000 from July and worse than the 65,000 anticipated. Finally, Initial Jobless Claims for the week ended August 31 rose to 237,000 from the previous 229,000 and worse than the 230,000 expected.

In the meantime, the US Institute for Supply Management’s (ISM) Manufacturing Purchasing Managers Index (PMI) printed at 48.7 in August, improving from the 48 posted in July but missing the expected 49. Also, the ISM Services PMI for the same period printed at 52, up from 50.1 in the previous month. In both cases, inflation sub-indices ticked lower while employment ones posted modest advances.

The figures had a limited impact on the USD, but weighed on it as the numbers sort of confirmed an upcoming Federal Reserve (Fed) rate cut this month.

Then came the NFP report. The Greenback plummeted on Friday, on news that the country created a modest 22,000 new jobs in August, much worse than the 75,000 expected. The Unemployment Rate edged higher to 4.3% from 4.2% in July, meeting expectations, while the Labor Force Participation Rate ticked up to 62.3% from 62.2%. Finally, annual wage inflation, as measured by the change in the Average Hourly Earnings, declined to 3.7% from 3.9%.

Speculative interest increased bets on upcoming rate cuts. According to the CME FedWatch Tool, the odds for a September interest rate cut increased slightly, with some investors betting on a 50-basis-point cut. The chances for an October and December trim also increased sharply. Pretty much, rate cuts are now seen in the three Fed meetings pending before the year-end.

Heading into the weekend, Wall Street advanced on fresh hopes for multiple rate cuts, while the Greenback fell on the same reasoning.

Mixed European data weighed on the Euro

In the meantime, the Euro (EUR) had little life of its own. Macroeconomic releases were mostly soft, but not overly concerning. The Eurozone released the Harmonized Index of Consumer Prices (HICP), which rose by more than anticipated in August, up 2.1% on a yearly basis. The core annual figure printed at 2.3%, matching the July reading yet above the expected 2.2%. The monthly HICP came in at 0.2%, up from the 0% posted in July.

Also, the July Producer Price Index (PPI) rose at an annualized pace of 0.2%, higher than the 0.1% anticipated yet below the 0.6% posted in June.

Finally, Eurozone Retail Sales were down 0.5% in July, easing from the 0.6% gain posted in June and worse than the -0.2% anticipated by market participants. Retail Sales annual gain was 2.2%, below the 2.4% forecast and the previous 3.5%.

European Central Bank to hold ground

The European Central Bank (ECB) is scheduled to meet on Thursday and is widely anticipated to keep interest rates on hold. The Governing Council will also release fresh macroeconomic projections. The central bank is likely to acknowledge that risks have continued diminishing after the European Union (EU) and the US trade deal, while revisions to inflation perspective are likely to remain little changed. For the most part, market participants will be looking for confirmation that the loosening cycle is over.

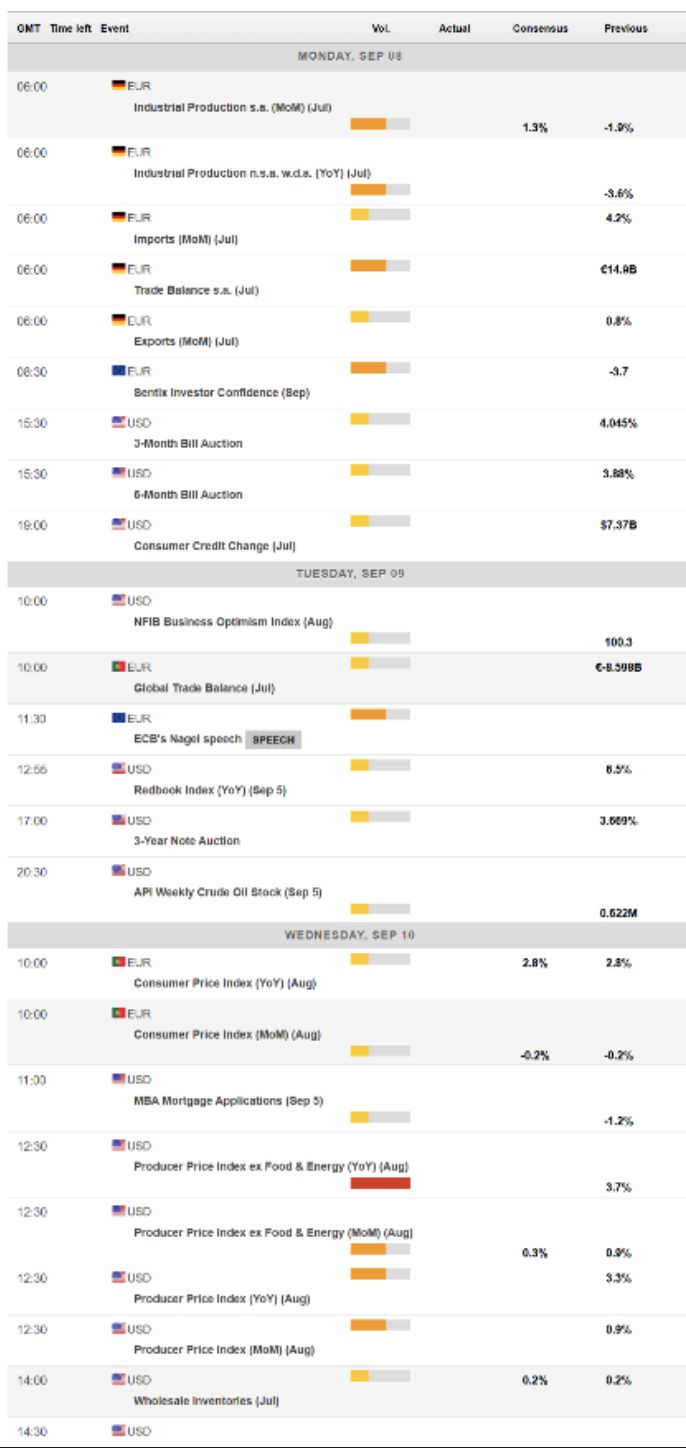

Other than the ECB, the macroeconomic calendar will include on these days a couple of relevant US figures. The country will publish August Consumer Price Index (CPI) figures, last standing at 3.1% YoY. It will also release July PPI figures and the preliminary estimate of the Michigan Consumer Sentiment Index for September.

Finally, Germany will release the final estimate of the August HICP.

EUR/USD technical outlook

The weekly chart for the EUR/USD pair shows the risk skews to the upside, although the momentum remains limited. The pair is developing a handful of pips above its August low, suggesting buyers are still hesitating. At the same time, EUR/USD keeps holding well above a bullish 20 Simple Moving Average (SMA), with deeps towards it resulting in sharp bounces. The 100 and 200 SMAs, in the meantime, grind marginally higher, far below the shorter one.

Finally, technical indicators ticked higher after a period of consolidation within positive levels, favoring an upward extension without confirming it.

The daily chart for the EUR/USD pair shows technical indicators turned higher, but the Momentum indicator remains stuck at neutral levels. The Relative Strength Index (RSI) indicator, in the meantime, aims north at around 56, reflecting the latest run.

At the same time, the pair has spent the week hovering around a flat 20 SMA, now providing dynamic support at around 1.1665. Finally, the 100 SMA has lost its upward strength and stands pat at around 1.1525.

The pair would need to clearly settle above the current 1.1740 area to extend its advance towards the next relevant resistance at 1.1830, the yearly high. Further advances expose the 1.1900 threshold. Support, on the other hand, comes at the mentioned 1.1665, en route to the 1.1590 area, followed by the mentioned 20-week SMA at 1.1530.