Written by: Lawyer Pang Meimei

"In fact, many web3 practitioners that Lawyer Pang Meimei has come into contact with—those who genuinely want to do legitimate business in the web3 world—are very dedicated to maintaining the reputation of virtual currencies. In reality, regardless of the form of virtual currency crime, the core of legal judgment always lies in the harmfulness of the act itself, not in the attributes of the technology or tool."

The cryptocurrency industry has always been a dark forest, where one must guard against both on-chain security threats and the sharp sword of real-world law. Even when using usdt for remittance and currency exchange, some people help friends and gain "favors," while others are convicted of "illegal business operations."

1. Regulatory Signals Behind the Upgraded Jurisdiction of a Virtual Currency Case in Sichuan Province

In the 2024 annual typical cases of upgraded jurisdiction released by the Supreme People's Court on July 29, 2025, [Case 200]—the case of Wan Mouyuan and others convicted of illegal business operations—can be seen as a guiding case for the entire field. The case was initially accepted by the People's Court of Muchuan County, Sichuan Province. The court believed that the case involved the determination of the nature of foreign exchange transactions using virtual currency as a medium. Due to differences in the understanding of the legality of virtual currency across regions and divergent views in practice, the case was reported to the Intermediate People's Court of Leshan City, Sichuan Province for upgraded jurisdiction.

After searching relevant data, Lawyer Pang Meimei found that since 2023, over 30% of criminal cases involving virtual currency and foreign exchange have adopted upgraded or designated jurisdiction. This means such cases have become a new type of financial crime under close judicial scrutiny, and the courts have clarified the adjudication rules for these cases through this example. For cases where virtual currency is deliberately used to evade national foreign exchange controls, the courts will peel back the layers, unveil the "veil" of virtual currency transactions, expose the substance of the case, and severely punish all illegal foreign exchange activities. Ultimately, the court found that Wan Mouyuan and others conducted foreign exchange transactions through the "RMB—USDT—USD" method and sentenced the principal offender to 13 years and 6 months in prison for illegal business operations.

2. Legal Analysis: How Did USDT Currency Exchange Become the Crime of Illegal Business Operations?

Many people might say, "I've helped friends exchange currency too, how is that illegal business?"

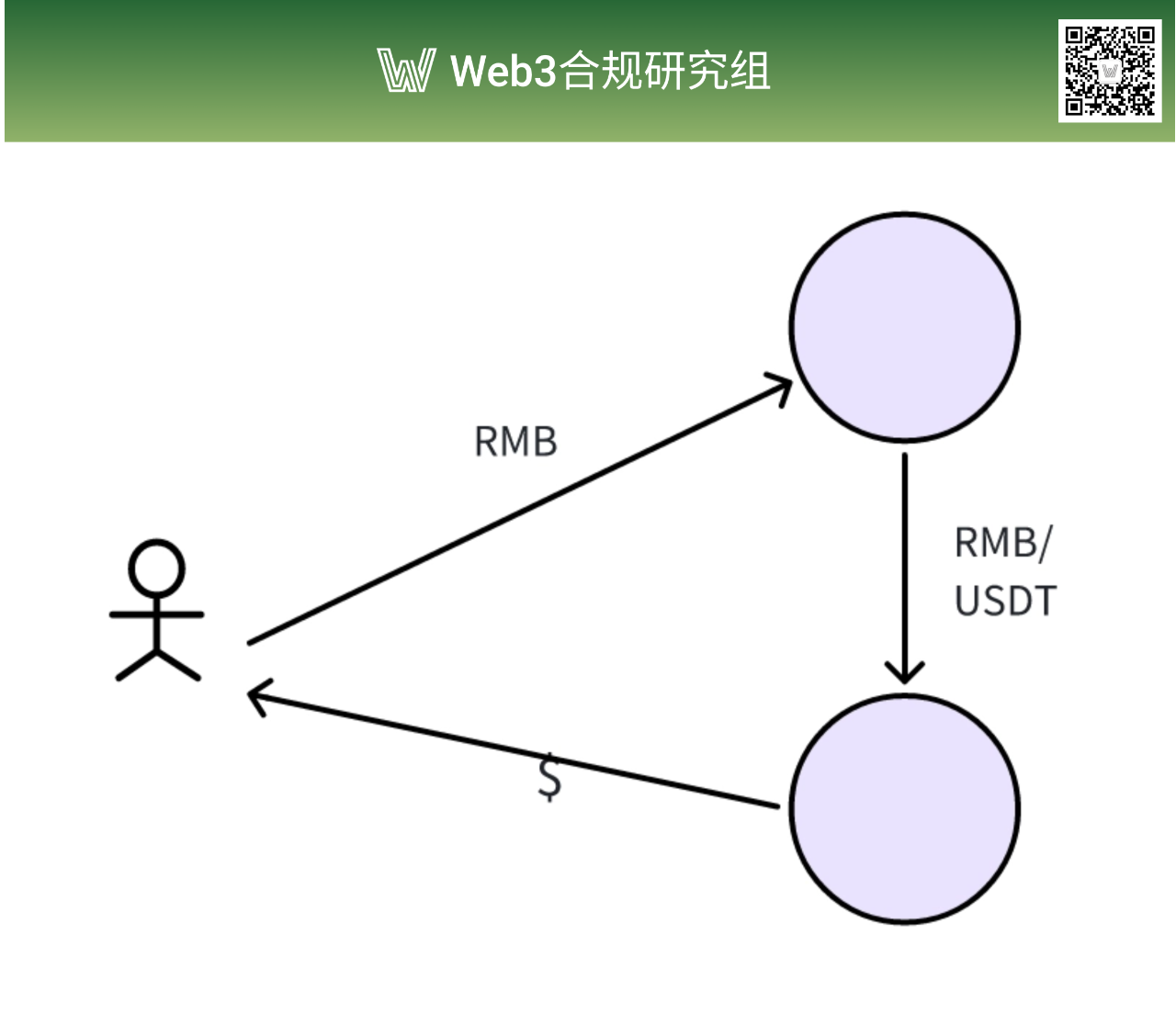

This needs to be explained from the operational model. The core operation of Wan Mouyuan's group was: domestic clients transferred RMB to designated accounts, and the group exchanged an equivalent amount of usdt for USD abroad, which was then transferred to the client's overseas account. This achieved a three-step operation chain of "domestic RMB - overseas USDT - target currency," with USDT acting as a "currency converter" in the middle.

The Supreme Procuratorate specifically pointed out in its 2023 typical cases that using virtual currency as a medium to convert RMB and foreign currency is essentially an illegal transaction to evade foreign exchange controls. Even without direct contact with foreign currency, one can still be convicted. In practice, this is called "knock-off type currency exchange," which simply means the entire process forms a closed loop of "RMB in, USD out."

The principal offender in this case was sentenced to 13 years and 6 months in prison, which is considered a heavy sentence for similar cases. In practice, illegal currency exchange involving virtual currency often results in harsher sentences than traditional underground banking cases. In addition to clear legal sentencing standards, judicial authorities also consider the concealment and harmfulness of the criminal methods when sentencing. Due to the anonymity, convenience, and cross-border nature of virtual currency, tracking funds becomes much more difficult, and the harmfulness of such cases is naturally amplified, leading to heavier sentences.

3. What Are the Main Forms of Crimes Involving Virtual Currency?

The decentralized and anonymous nature of virtual currency has provided ideas for the development of the digital economy, but in recent years, it has also been seen by criminals as a "natural safe haven." Based on the different roles virtual currency plays in criminal activities, Lawyer Pang Meimei divides them into the following categories:

1. Crimes targeting virtual currency itself: Directly targeting virtual assets. The core goal of the crime is the illegal possession of virtual currency, which is essentially no different from the theft or robbery of traditional property, except the object has shifted from tangible to virtual assets. Typical charges include robbery, theft, and illegal acquisition of computer information system data. For example, in case (2021) Hu 02 Xing Zhong 197, the defendant used technical means to alter the recipient account and contact information, transferring bitcoin under someone else's name to an account under their control and cashing it out. The act met the elements of theft—"secretly taking another's property for the purpose of illegal possession"—and the data tampering also constituted the crime of illegal acquisition of computer information system data. The court ultimately convicted and sentenced the defendant for theft, showing that the property attributes of virtual currency are already a consensus in the judiciary.

2. Crimes using virtual currency as a tool or means: Using its characteristics to achieve illegal purposes. In such cases, virtual currency is no longer the target but is used as a "medium" to transfer funds and evade regulation. As a tool, its untraceable nature makes it a key link in the black and gray industry chain, such as in the crimes of operating casinos, concealing or disguising criminal proceeds, and providing assistance in information crimes. For example, in operating casinos, cross-border casinos require domestic gamblers to convert their funds into virtual currency and transfer them to designated wallets, using the anonymity of virtual currency to cut off the flow of funds from themselves. Suspects then use coin mixing and cross-chain transfers to launder the illicit funds. In such cases, judicial authorities recognize virtual currency as an equivalent or a settlement method.

3. Crimes using virtual currency as a "concept": Committing fraud under the guise of "innovation." These crimes are the most deceptive. Criminals often use the banner of blockchain decentralization and virtual currency appreciation, but in essence, their actions have nothing to do with the technical characteristics of virtual currency. They simply package virtual currency as a gimmick to attract investors, such as in fraud, illegal absorption of public deposits, or organizing and leading pyramid schemes. In these cases, virtual currency is more like a beautifully packaged stage prop.

In fact, virtual currency itself is not a monster. The blockchain technology behind it has broad application scenarios in data certification, cross-border payments, and other fields. Virtual currency is not only a product of technological innovation but also a convergence point of law and finance. It is only because criminals use it for illegal activities that virtual currency has become the "scapegoat" of the black and gray industry.

In fact, many web3 practitioners that Lawyer Pang Meimei has come into contact with—those who genuinely want to do legitimate business in the web3 world—are very dedicated to maintaining the reputation of virtual currencies. In reality, regardless of the form of virtual currency crime, the core of legal judgment always lies in the harmfulness of the act itself, not in the attributes of the technology or tool.

4. Pitfall Avoidance Guide

For ordinary crypto traders, while pursuing profits, it is even more important to stick to the bottom line of compliance. Remember Lawyer Pang Meimei's practical advice—this is your "protective talisman":

1. Choose compliant platforms and use legal trading channels. Avoid using private channels, unlicensed underground trading platforms, or community trading;

2. Keep transactions small-scale and personal. Understand the laws and regulations of your country. In China, the attitude toward virtual currency is "individuals can play freely," but large-scale, commercial transactions or providing related services (such as OTC trading or brokerage) may be considered illegal business operations. Avoid frequent, large transactions to prevent being identified as engaging in "profit-oriented" business activities. I recommend that crypto traders first study the "Regulations on Foreign Exchange Administration";

3. Keep all transfer records and chat logs to prove the legality and personal nature of your transactions. The crypto space is only suitable for "quietly making a fortune." Avoid publicly promoting virtual currency investments, recruiting others, or organizing trading activities, even if you have a keen investment eye;

4. If you plan to make large investments or engage in virtual currency-related business, it is recommended to consult a professional lawyer in advance to assess the legality and safety of your transactions. Compliance is more important than profitability. Before engaging in any innovative business, clarify the boundaries of compliance, or else what you see as a business model may be seen by the court as a criminal offense.

At present, although mainland China has strict regulation of virtual currency, Hong Kong's pilot explorations also indicate a promising future. The era of web3 calls for legal professionals with a forward-looking vision. The author also looks forward to the day when web3 practitioners and web3 lawyers can join hands to tear off the fig leaf of virtual currency!