When Stablecoins Start Paying for the Network: The New Relationship Between Interest and Fees

The Roller Coaster Experience of Fees

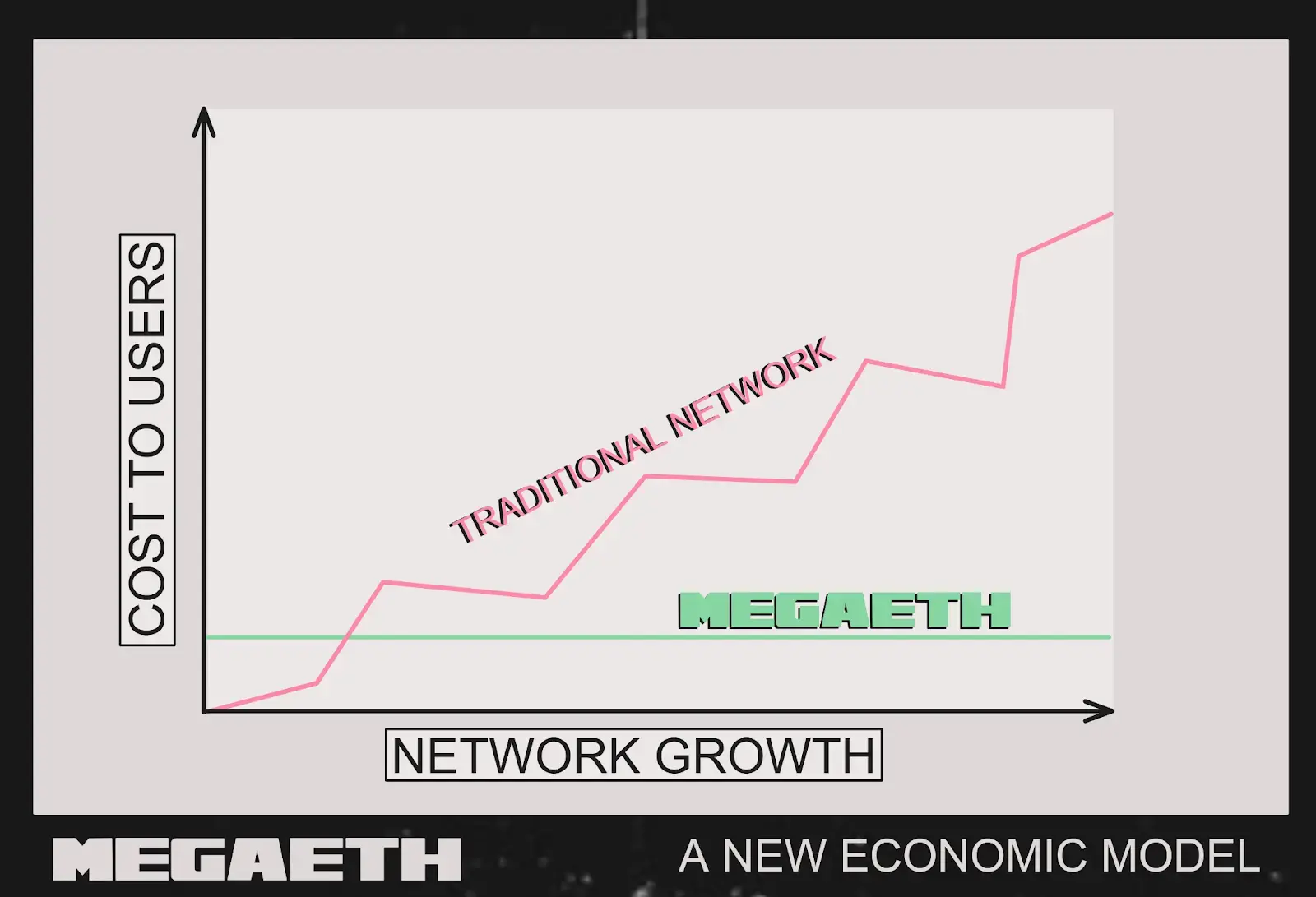

In the on-chain world, many users have experienced this moment: yesterday, it only cost a few cents to complete a transfer, but today, the same operation costs several dollars. Fees are like an emotional roller coaster, often leaving people at a loss. Over the past few years, stablecoins have grown into one of the most watched asset classes in such an environment—they undertake basic functions such as settlement, payment, and store of value, serving as the lifeblood of DeFi and a crucial gateway for external funds to enter the crypto world. Their market cap and user penetration have made them irreplaceable. However, beneath the buzz lies fragility: many projects rely on subsidies and narratives to gather popularity in their early stages, but once the market cools and subsidies become unsustainable, the weaknesses of their models inevitably surface. The most obvious is the volatility of fees, which not only frustrates users but also makes it difficult for developers to build robust business models and accurately estimate end-user willingness to pay.

So where is the problem, and what is the way forward?

The current misalignment is obvious: stablecoins place their reserves off-chain in US Treasuries and money market funds to earn steady interest; but blockchains require real money to operate, concentrated in on-chain sequencers, nodes, and data settlement for daily operations. The profits are made off-chain, while the expenses are on-chain, with no channel in between. As a result, many networks have to raise fees to "support themselves," but users and developers need a low-fee environment, creating a scissor gap. The data costs on Ethereum mainnet are getting lower, and the "markup space" is being squeezed: raising prices hurts the experience, but not raising them makes it hard to sustain operations, so it can't last long.

A more direct approach is to treat the interest earned from stablecoin reserves as the network's "utility bill." Users deposit dollars to mint stablecoins, the funds are used to buy safe, highly liquid assets, and regularly generate auditable interest; this interest does not stay with the issuer but is directly used to pay for the costs of sequencers and nodes. This way, the network doesn't need to survive by "charging more fees," and fees can approach real costs, bringing a stable, low-fee experience. Low fees → more transactions and applications → larger reserves → more interest → a more stable network, forming a positive cycle. Its advantages are: transparent path, sustainability (as long as there are reserves, there is interest), and better experience, making high-frequency, small-amount scenarios such as social messaging, in-game economies, and micropayments truly possible.

Implementation: The First Step from Theory to Reality

This idea is not just theoretical. Recently, MegaETH and Ethena jointly launched USDm, attempting to put this new path into practice. MegaETH has strong backing, supported by top individuals and institutions such as Vitalik and DragonFly, and is positioned as a "real-time blockchain" capable of ultra-high performance with 10-millisecond latency and 100,000 TPS, with transactions confirmed almost instantly. But performance alone is not enough; low network fees are the key to large-scale application growth. Just as Memecoin was born on Ethereum but ultimately exploded in the Solana ecosystem, cheap fees often determine the success or failure of applications.

In practice, USDm is issued by Ethena's stablecoin infrastructure, with reserves mainly invested in BlackRock's tokenized US Treasury fund BUIDL, while retaining some liquid stablecoins as a redemption buffer. BUIDL is a transparent, compliant, institutional-grade investment target, subject to custody and compliance requirements, and can generate stable returns. The key is that these returns do not sit idle on the books, but are directly used through programmable mechanisms to cover MegaETH sequencer operating costs. As a result, the network does not need to "charge more fees" to survive and can price for users at cost, so end users see predictable, sub-cent level gas fees. This completely overturns the traditional model: previously, "the more users pay, the more the network earns," but now it becomes "the faster the network grows, the more reserve income, and the more stable the fees."

Choosing to cooperate with Ethena is also deliberate. Ethena is currently the third largest US dollar stablecoin issuer, managing over 13 billions dollars, with a very solid user base in the DeFi community. This interest-alignment mechanism truly achieves a positive cycle: as network transaction volume expands, USDm reserves rise, interest flows back more abundantly, and for the first time, network revenue and ecosystem growth form a virtuous interaction—not relying on users to bear more costs, but letting growth itself sustain the network. Combined with MegaETH's real-time performance and cost-price fees, this provides ideal soil for developers to build real-time interactive applications. If this model works, a sub-cent fee environment will make many previously "unthinkable" high-frequency applications a reality, such as on-chain high-frequency trading, real-time game interactions, micropayments, and more.

Source: MegaETH

How to Face Future Challenges?

First, let's look at the big picture. Most of the interest from stablecoins comes from US Treasuries and money market funds. When interest rates are high, the interest is sufficient and can subsidize network fees; when rates are low, interest decreases, and whether low fees can be maintained becomes a real challenge. This dependence on external rates carries cyclical risks and requires a "buffer" to be designed in advance. Next, technology and scale: in theory, the more transactions, the larger the interest pool, and the more room there is for fees to decrease; but when faced with cross-chain, high-frequency applications, and ecosystem expansion, the mechanism is more easily stressed, and stability must be maintained. Then there's competition: USDT, USDC, and DAI all have solid user bases. Even if the new model looks smarter, it takes time to educate, build the ecosystem, and win the trust of developers and users.

In the end, the roller coaster of fees exposes the old problem of "income" and "expenses" not being aligned. The buzz built on subsidies often doesn't last. Using interest directly to "support the network" is an exploration of a more sustainable path: letting stablecoins not only handle payment and settlement but also feed back into the network. The real test ahead is whether this design can pass the tests of governance transparency, long-term sustainability, and scaling up. If it can, those high-frequency, cheap, and easy-to-use applications suppressed by high fees will finally have a chance to enter daily life.