Date: Mon, Sept 15, 2025 | 05:30 PM GMT

The cryptocurrency market is experiencing slight volatility ahead of the US Federal Reserve meeting this week, with Ethereum (ETH) trading below the $4,500 mark after a 2% intraday drop. This has weighed on several altcoins — including XRP.

Despite today’s red trading session, XRP’s chart is sending a more important signal. The token has recently confirmed a textbook breakout and retest setup, suggesting that more upside momentum could soon unfold.

Source: Coinmarketcap

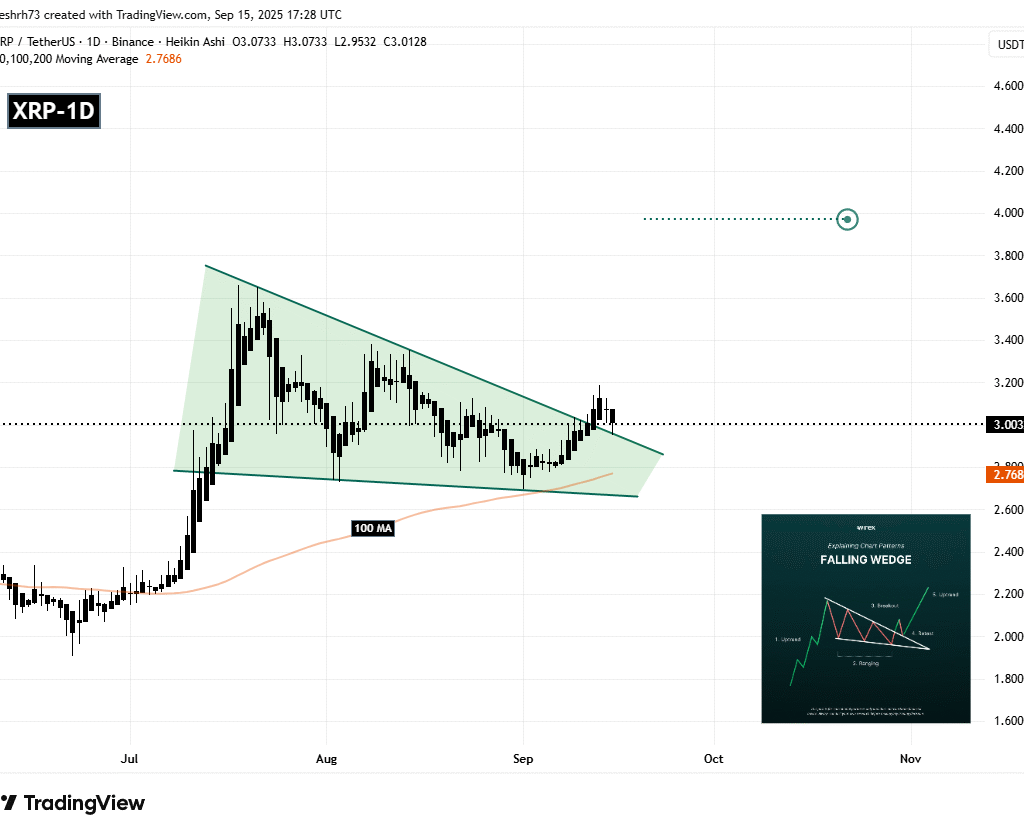

Source: Coinmarketcap Retests Falling Wedge Breakout

For several weeks, XRP was trading inside a falling wedge — a classic bullish reversal pattern that often precedes significant rallies. The token found support near $2.69, which aligned closely with its 100-day moving average, and then rebounded sharply.

This rebound pushed XRP above the wedge’s descending resistance line, confirming a breakout at around $3.02. True to pattern behavior, XRP then pulled back for a retest of the breakout zone near $2.95, where buying pressure quickly re-emerged.

XRP Daily Chart/Coinsprobe (Source: Tradingview)

XRP Daily Chart/Coinsprobe (Source: Tradingview) The chart now shows XRP stabilizing back around $3.0, indicating that the retest has likely validated the breakout structure.

What’s Next for XRP?

The current setup looks constructive, but XRP still needs to clear short-term resistance to confirm bullish momentum. If the token decisively breaks above its recent local high of $3.1858, it could trigger a stronger rally. Based on the wedge breakout projection, XRP’s potential upside target lies near $3.96, which would mark a substantial move higher from current levels.

Until this confirmation occurs, traders may remain cautious, as any drop below this trendline support could act as a fake breakout.