Sam Bankman-Fried says his single biggest mistake was handing control of FTX to new management on Nov. 11, 2022, which he claims prevented a last‑minute external investment and cost him the chance to avert the exchange’s collapse.

-

Key point 1: SBF attributes the FTX collapse to relinquishing leadership to John J. Ray III on Nov. 11, 2022.

-

Key point 2: FTX’s bankruptcy revealed an $8.9 billion shortfall tied to Alameda Research fund transfers.

-

Key point 3: The FTX estate has repaid $7.8 billion so far and estimates up to $16.5 billion in recoverable assets.

Sam Bankman-Fried biggest mistake: SBF says handing FTX to new management cost a rescue chance — read creditor repayment updates and legal aftermath.

Sam Bankman‑Fried claimed that handing over FTX to its current CEO was the “single biggest mistake” that prevented him from saving the exchange.

What was Sam Bankman‑Fried’s biggest mistake that led to the FTX collapse?

Sam Bankman‑Fried’s biggest mistake was signing over control of FTX to new management on Nov. 11, 2022, a decision he says removed his ability to accept a possible external investment minutes later. This transfer preceded the Chapter 11 filing and accelerated the exchange’s bankruptcy process.

How did the leadership handover affect the bankruptcy process?

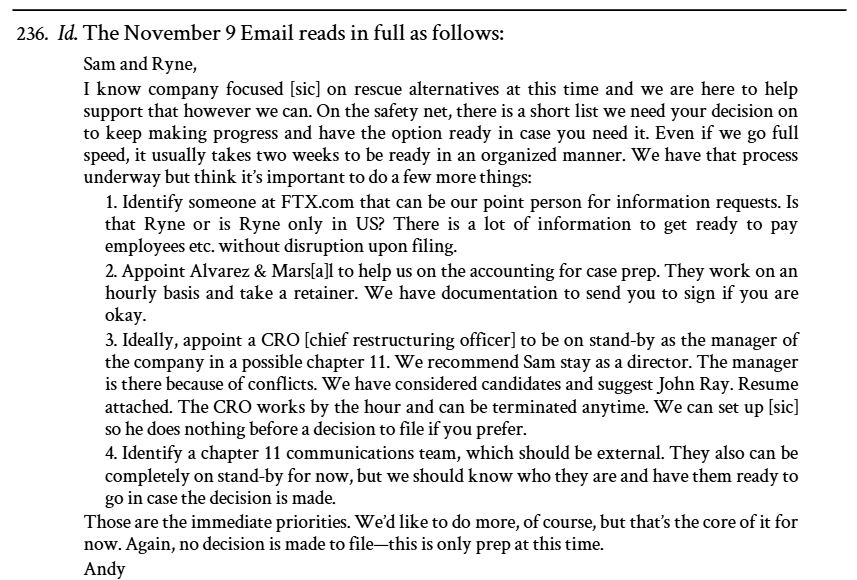

The leadership handover on Nov. 11, 2022, allowed John J. Ray III to assume control and quickly pursue Chapter 11 protections. Under new direction, the estate engaged Sullivan & Cromwell for restructuring and legal representation. Plain‑text reporting by Reuters and coverage in Mother Jones document timelines and legal filings surrounding these decisions.

Why did FTX collapse and how large was the investor shortfall?

FTX collapsed after internal transfers of customer funds to Alameda Research produced trading losses now described as the “Alameda gap.” Criminal convictions established that unauthorized transfers created an estimated $8.9 billion shortfall and triggered mass withdrawals, liquidity failure, and bankruptcy.

Who was appointed and what legal actions followed?

John J. Ray III was appointed chief executive and filed Chapter 11 the same day. Sullivan & Cromwell subsequently provided legal services and, according to legal filings reviewed by Reuters, earned over $171.8 million in fees by mid‑2024. A creditors’ suit naming the law firm was filed and later voluntarily dismissed in October 2024.

Source: Documentcloud.org

How much have FTX creditors been repaid and what remains outstanding?

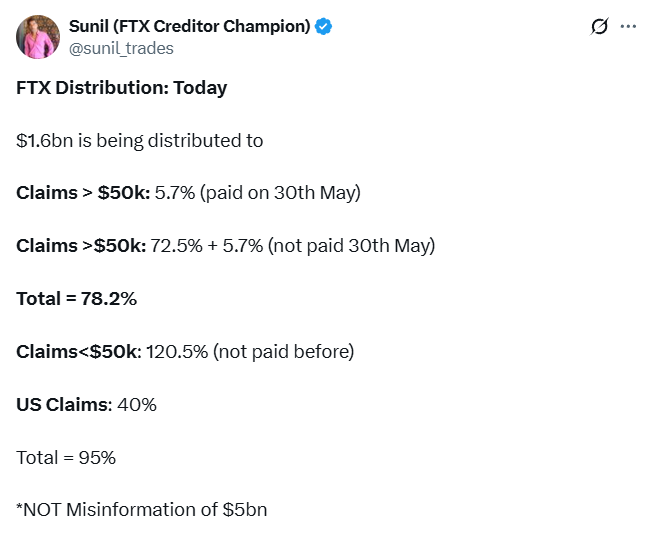

The FTX estate began distributions in February and, through September, has returned a cumulative $7.8 billion to creditors. Recovery efforts estimate up to $16.5 billion in assets available, leaving roughly $8.7 billion outstanding. The estate projects repaying most customers at or above 98% of their account values as of November 2022.

When were the latest repayments delivered and who reports them?

On Sept. 30 the estate executed a $1.6 billion distribution, reported by a creditor committee member known as Sunil via social posts. Official repayment schedules and totals are documented in court filings and estate communications; independent reporting has tracked these milestones since the first $1.2 billion payout in February.

Source: Sunil

Frequently Asked Questions

What caused the Alameda Research shortfall?

The Alameda gap resulted from unauthorized transfers of customer funds to Alameda Research to cover trading losses, creating a multibillion‑dollar deficit between customer balances and available assets.

How can creditors track future FTX repayments?

Creditors should monitor official court filings, trustee notices, and estate distributions published by the FTX estate. Independent coverage and creditor committee posts provide supplementary updates.

Key Takeaways

- SBF’s assessment: Handing FTX to new management on Nov. 11, 2022, is described by SBF as his biggest mistake.

- Scale of loss: The collapse revealed an $8.9 billion shortfall tied to Alameda Research transfers and triggered Chapter 11 proceedings.

- Repayments ongoing: The estate has returned $7.8 billion so far and estimates up to $16.5 billion in recoverable assets, aiming for near‑full customer recovery.

Conclusion

Sam Bankman‑Fried’s public statement that relinquishing control of FTX was his “single biggest mistake” frames the legal and financial aftermath of the exchange’s failure. Ongoing estate recoveries and creditor distributions continue to unfold, while regulators, litigants, and industry participants evaluate reforms to prevent similar collapses. Follow official estate filings and creditor updates for the latest developments.