Bitcoin all-time high: Bitcoin reached a new all-time high of $125,599 on October 5, 2025, driven by steady demand, heavy short liquidations and strong ETF inflows; near-term momentum points to a next bullish target around $133.5k based on STH realized price bands.

-

New ATH recorded: $125,599 on Oct 5, 2025

-

Large short liquidations—$131.96M of $148.47M total BTC liquidations in 24h (CoinGlass data)

-

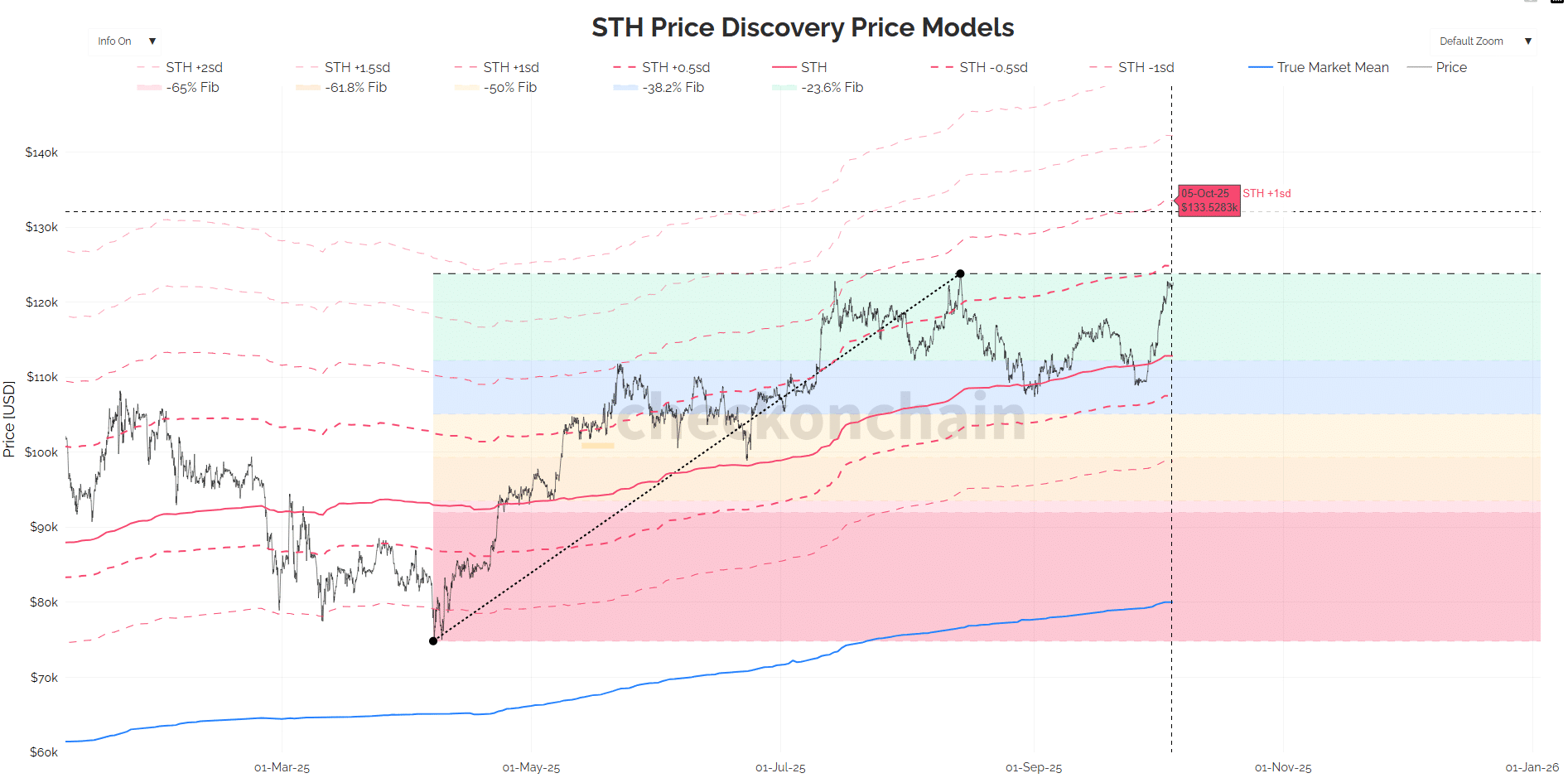

STH realized price support at $112.8k; next resistance STH +1σ ~ $133.5k (checkonchain model)

Meta description: Bitcoin all-time high: BTC hit $125,599 on Oct 5, 2025; STH model sets a $133.5k target. Read the latest analysis and short-term targets.

How did Bitcoin reach a new all-time high?

Bitcoin all-time high momentum came from steady demand, concentrated short-liquidation events and ETF inflows. BTC pushed to $125,599 on October 5, 2025, after two key supply zones were cleared and $131.96 million in short liquidations occurred in 24 hours.

On the 5th of October, Bitcoin [BTC] set a new all-time high at $125,599, per data from CoinMarketCap. At the time of writing, BTC was trading near $125k and appeared likely to continue upward momentum.

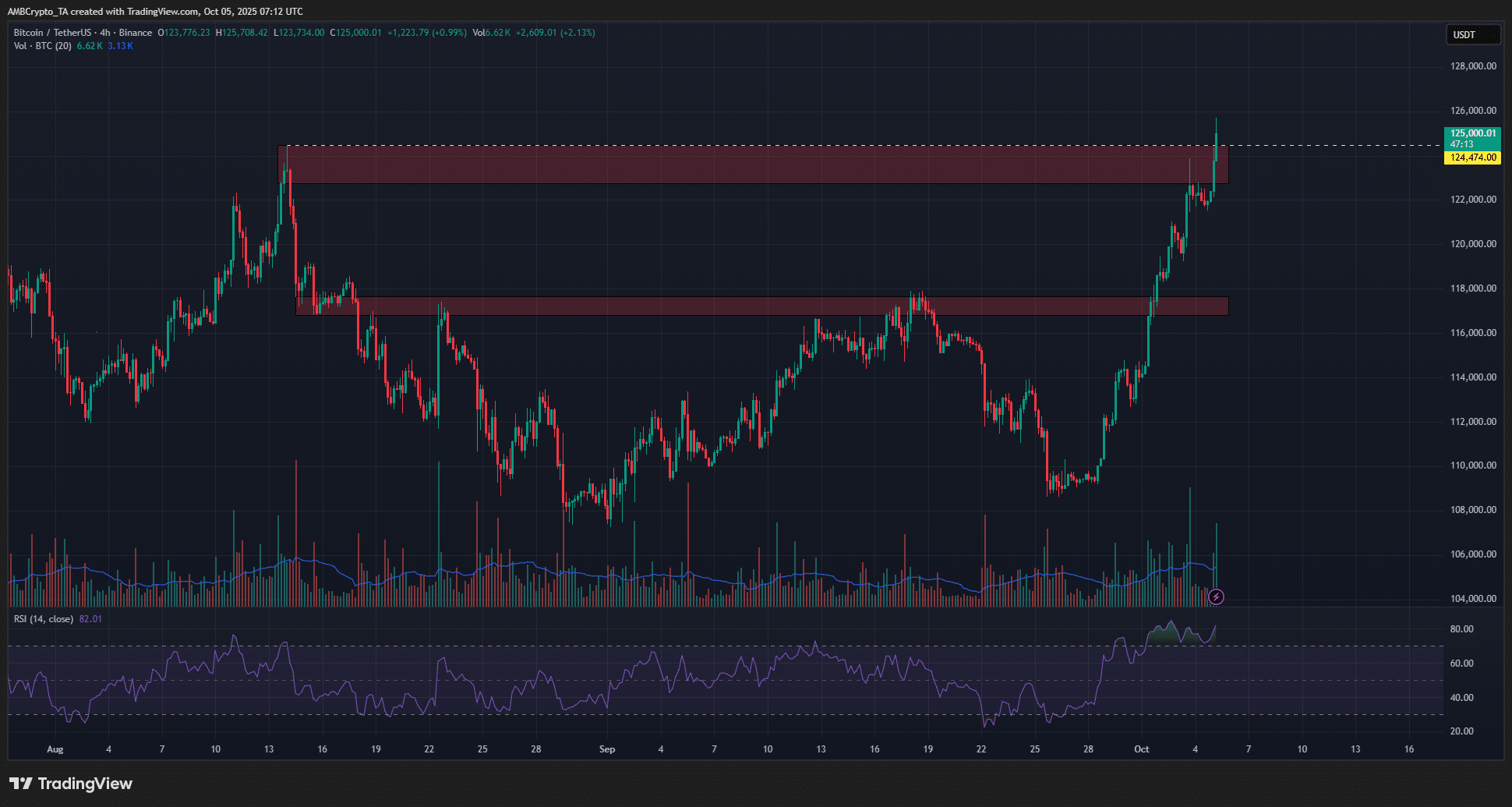

Source: BTC/USDT on TradingView

What role did liquidations and supply zones play?

Two supply zones near $117k and $124k were cleared, opening space for momentum. CoinGlass recorded $148.47 million in Bitcoin liquidations in 24 hours, with $131.96 million being short liquidations. These concentrated stops accelerated price discovery and reduced sellers at key levels.

How do ETF inflows and exchange flows influence short-term price action?

Spot ETF inflows remained strong, reinforcing buyer demand. Low BTC inflows to major spot exchanges (reported by market trackers) reduced available on-exchange supply, supporting higher prices. ETF purchases paired with buyer dominance often amplify short-covering moves.

Short-term Bitcoin price targets

Demand for Bitcoin has been steady recently. Spot exchange-traded funds (ETFs) saw strong inflows last week, a trend that should continue if prices climb past $125k.

Using the checkonchain STH (short-term holder) realized price model gives statistically informed bands for near-term targets. The STH realized price is currently at $112.8k, acting as short-term support.

Source: checkonchain

The immediate resistance band at $124.8k has been overcome. The STH +1σ (standard deviation) band sits around $133.5k and is the next bullish price target. Historically, STH +1σ acted as resistance in May and July, so market reaction near $133.5k will matter.

How might macro and political factors affect the rally?

Short-term political events, such as the U.S. government shutdown, introduced uncertainty, but Q4 expectations stayed bullish. Historically, October has been positive for crypto performance—a pattern some market participants refer to as “Uptober.”

Frequently Asked Questions

What should traders watch this week?

Watch the $133.5k STH +1σ level for potential resistance, monitor ETF inflows and on-exchange supply, and track liquidation heatmaps for short-covering risk. Short-term support is near the STH realized price at $112.8k.

Key Takeaways

- New ATH confirmed: Bitcoin hit $125,599 on Oct 5, 2025, marking fresh price discovery.

- Liquidation-driven acceleration: $131.96M in BTC short liquidations helped fuel the move.

- Next target: STH +1σ at ~$133.5k is the immediate bullish target; traders should watch liquidity and ETF flows.

Conclusion

Bitcoin all-time high momentum is supported by tangible on-chain and market flow signals: cleared supply zones, significant short liquidations and persistent ETF demand. Short-term models point to $133.5k as the next logical resistance. Monitor on-chain metrics, ETF flows and liquidation data for confirmation.

Publication date: 2025-10-05 | Author: COINOTAG