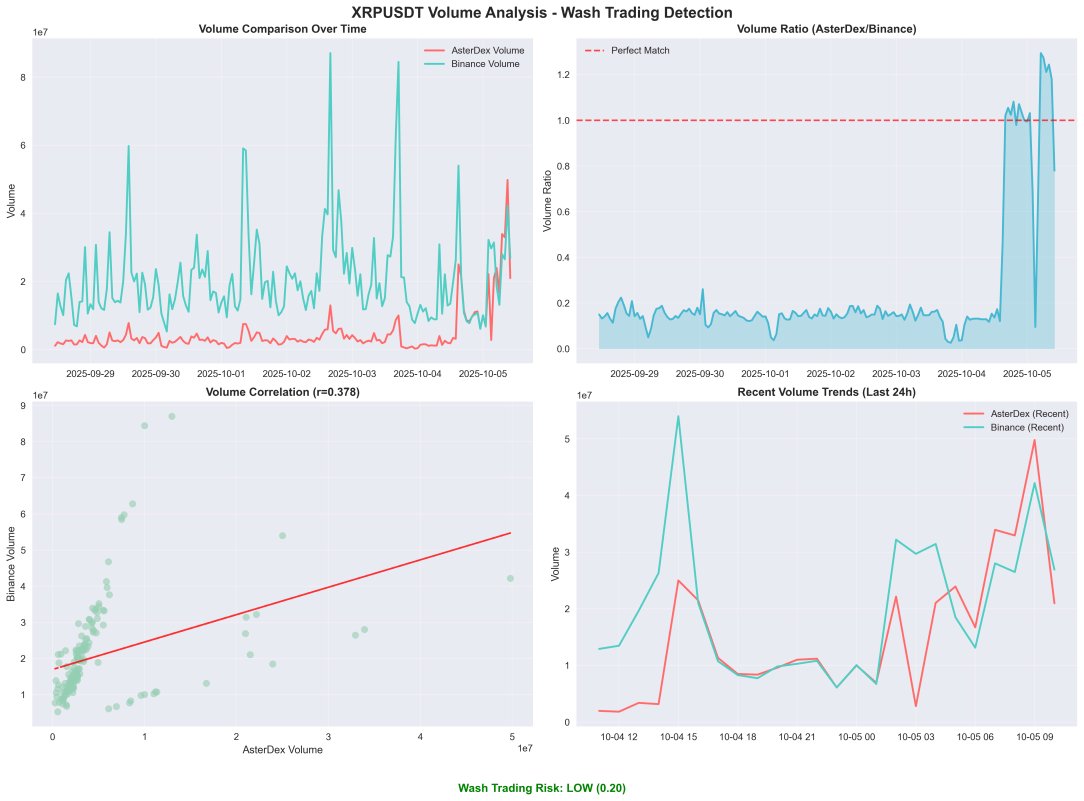

DefiLlama’s founder, 0xngmi, announced the removal of Aster’s perpetual futures trading volume metrics from the platform, citing suspicions of possible wash trading and a lack of data transparency. Following this decision, the altcoin bearing the same name as the exchange saw its price plummet by approximately 10%. The decision was based on graphics shared by 0xngmi on his X account, which highlighted that Aster’s recent perpetual futures trading volumes mirrored those on Binance . This correlation was notably absent on Hyperliquid, as per the shared observations. CoinMarketCap data revealed that the altcoin’s price took a sharp dive post-announcement.

DefiLlama’s Decision Strikes Aster

0xngmi provided visual evidence showing Aster’s volume closely matching Binance’s perpetual futures trading volume starting Saturday night. The founder pointed out that key data like order placements and who fulfilled them were not accessible, leading to the suspension of Aster’s perpetual futures trading metrics on DefiLlama until proper verification is available. He also mentioned not holding any long or short positions in ASTER coin or HYPE.

Aster ve Binance Hacim Metrikleri

Aster ve Binance Hacim Metrikleri DefiLlama’s decision has reignited the debate on the tendency of data providers to temporarily disable metrics that are suspicious or unverifiable. While high-frequency matching alone does not constitute evidence of manipulation, it raises questions about market quality and genuine liquidity. Aster’s volume metrics will not be reinstated on DefiLlama unless transparency demands are met.

ASTERT Coin’s Value Declines Post-Decision

Before the delisting decision, Aster had been among the top ranked in terms of daily fees and volume among DefiLlama-tracked perpetual futures DEXs. The sudden correlation signals increased risk premiums in investor sentiment, contributing to a double-digit decline in ASTER coin’s price over the last 24 hours. This price pressure suggests that discussions around volume quality could affect Aster’s competitive stance in DEX markets.

The involvement of Binance’s co-founder, Changpeng Zhao, as an advisor to the project has shifted attention back to governance and oversight standards. Market participants are demanding more transparency from the Aster team, particularly regarding order flow and matching data. In contrast, the lack of similar correlations on Hyperliquid highlights the data access limitations on Aster’s side.