An altcoin season is when altcoins consistently outperform Bitcoin, driven by capital rotation and a falling Bitcoin Dominance; signs include range-bound BTC, rising TOTAL3, and a high Altcoin Season Index—prepare by researching selective projects, sizing positions, and setting clear risk limits.

-

Altcoin season signals: range-bound BTC + falling BTC Dominance

-

Key on-chain cues: TOTAL3 making new highs and rising altcoin market cap

-

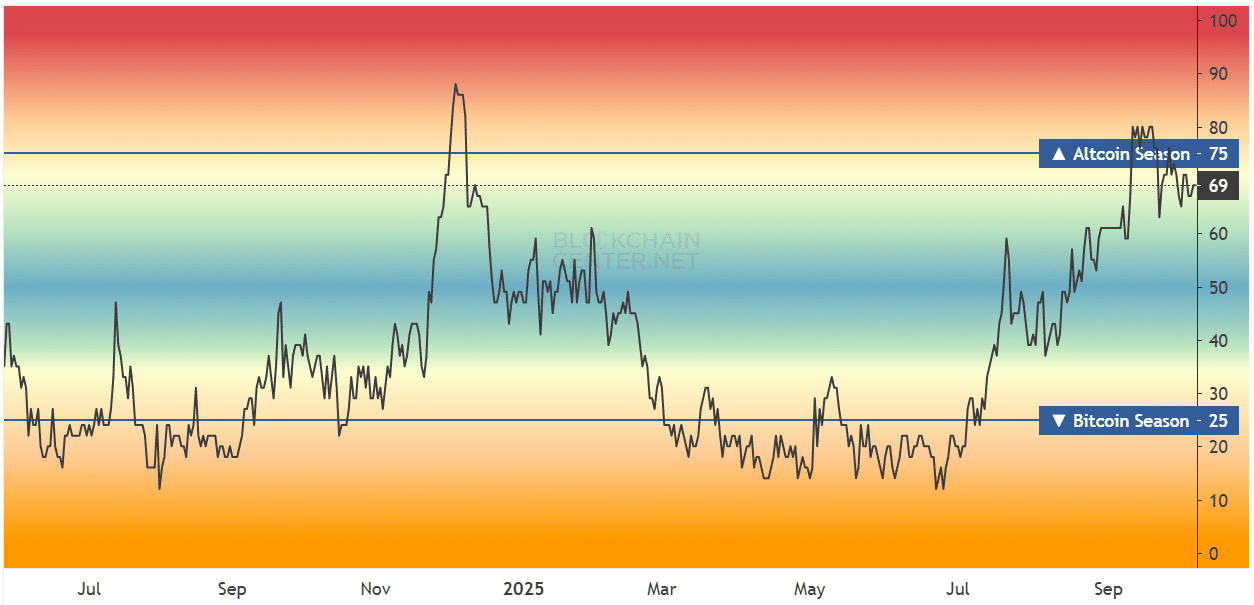

Data point: Altcoin Season Index near 75 and altcoin market cap more than doubled in 2021

Meta description: Altcoin season is triggered by falling Bitcoin Dominance and rising TOTAL3—learn the signals, risks, and steps to prepare for selective altcoin exposure. Read now.

What is an altcoin season and what signals confirm it?

An altcoin season is a market phase where altcoins outpace Bitcoin in returns. The clearest signals are a range-bound BTC price, a marked drop in Bitcoin Dominance (BTC.D), rising TOTAL3 and a high Altcoin Season Index. These indicators together show capital rotating from BTC into altcoins.

How is the Altcoin Season Index and TOTAL3 used as evidence?

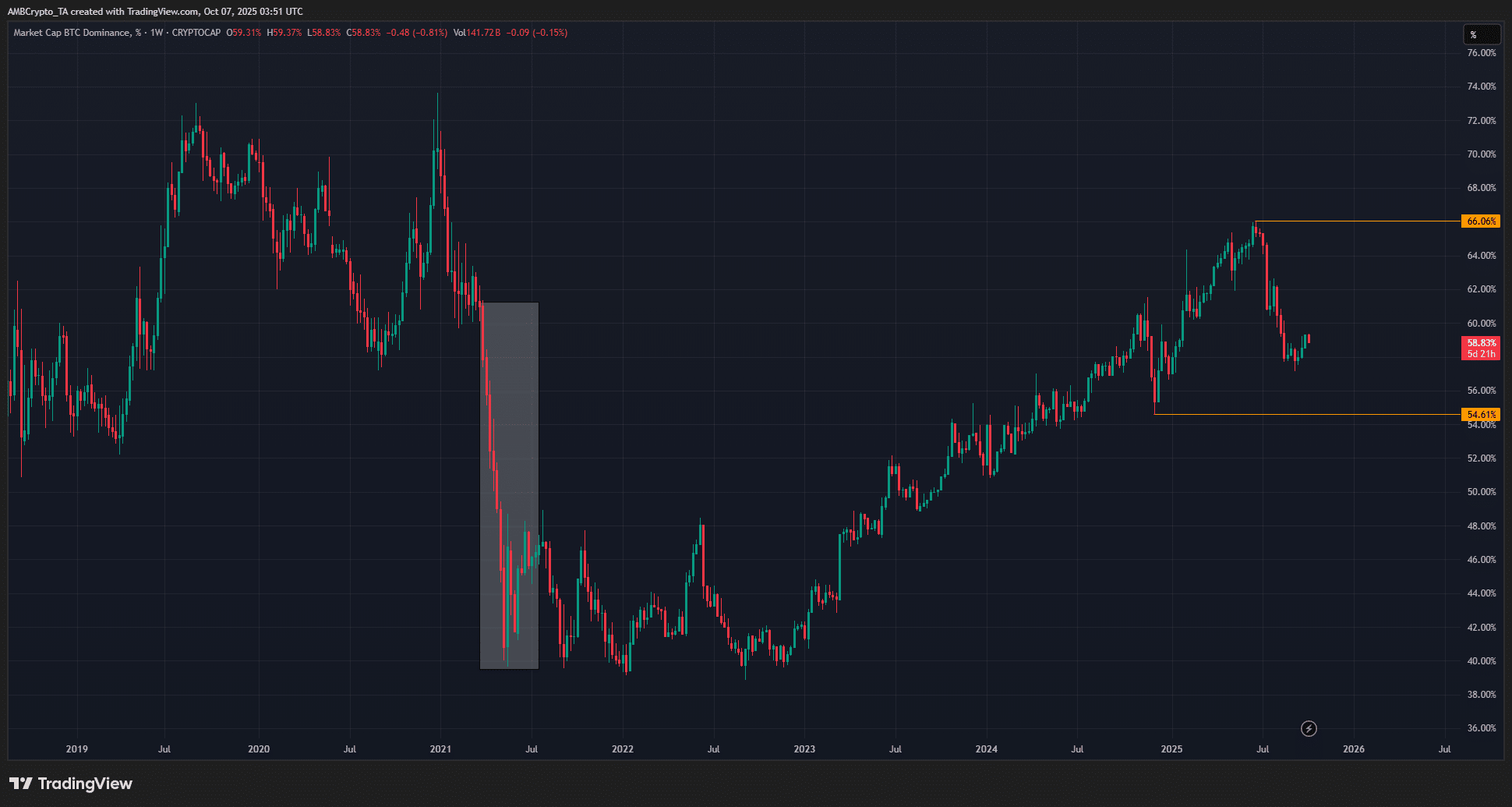

The Altcoin Season Index near 75 signals broad altcoin strength. TOTAL3 (the combined market cap of mid-to-small caps excluding ETH) making new highs indicates money flowing into non-BTC, non-ETH tokens. Historical data: in 2021 BTC.D fell from ~62.9% to ~40.87% while altcoin market cap (ex-ETH) rose from $406.8B to $857B in two months.

In a public post on X, analyst Mags explained rotating part of BTC holdings into altcoins to capture superior returns, highlighting increased altcoin volume and improving market breadth. Source: Blockchain Center for Altcoin Season Index; TOTAL3 and BTC.D chart data from TradingView (plain text references).

The market structure today differs from 2017: fewer tokens will rally simultaneously. Expect selective, liquidity-driven winners rather than uniform token-wide moves. Investors should combine on-chain signals with project-level fundamentals.

Why does Bitcoin Dominance falling matter for altcoins?

Bitcoin Dominance (BTC.D) measures BTC’s share of the total crypto market cap; a falling BTC.D signals capital leaving BTC for altcoins. Historically, substantial BTC.D drops coincide with strong altcoin rallies because capital rotates into smaller, higher-beta assets as BTC price plateaus.

When should traders increase altcoin exposure?

Traders should consider increasing exposure when multiple signals align: BTC consolidates or moves sideways, BTC.D declines, TOTAL3 sets new highs, and altcoin volumes increase. Entering earlier — before full mainstream recognition — typically yields better risk/reward, but requires disciplined risk management.

Frequently Asked Questions

What indicators confirm an altcoin season is underway?

Primary indicators: falling Bitcoin Dominance, rising TOTAL3 and Altcoin Season Index above ~70, increasing altcoin trading volume, and BTC price moving sideways or range-bound while altcoins appreciate.

How can investors limit risk during an altseason?

Use position sizing, stop-losses, diversified allocations across vetted projects, and monitor liquidity metrics. Focus on projects with clear use cases and active development to reduce idiosyncratic risk.

Key Takeaways

- Signal alignment: BTC range-bound + falling BTC.D + rising TOTAL3 = high probability of altcoin season.

- Selective exposure: Not all altcoins will rally; prioritize liquidity and fundamentals.

- Risk management: Size positions, set stops, and monitor volume and on-chain flows before scaling.

Conclusion

Current signals — an Altcoin Season Index near 75, TOTAL3 making new highs and returning altcoin volume — point to a rising likelihood of an altcoin season. Traders should combine these macro indicators with project-level research and strict risk controls. For timely decisions, track BTC.D, TOTAL3 and volume trends closely and maintain discipline as market dynamics evolve.

Byline: COINOTAG — Published: 2025-10-06 — Updated: 2025-10-06