BNB, the native token of the Binance ecosystem, has surged past $1,300 for the first time ever, capturing the attention of traders and institutions alike. While the broader market shows signs of cautious optimism, BNB’s breakout appears to be powered by a potent mix of institutional investment, strategic national partnerships, blockchain-level upgrades, and technical momentum.

As investor sentiment improves, crypto-native media coverage intensifies—and firms like Outset PR are tracking these developments closely. Using its in-house intelligence platform, Outset Data Pulse , the agency monitors media performance across the entire Web3 space. This allows campaigns to align with token momentum, community cycles, and macro narratives.

A Nasdaq-Listed Firm Bets on BNB

One of the most notable developments behind BNB’s rise is the aggressive accumulation by CEA Industries, a Nasdaq-listed company that recently disclosed it holds 480,000 BNB—worth approximately $585 million as of October 6.

This isn’t a casual allocation. CEA Industries has made BNB its sole treasury asset, aiming to eventually hold 1% of its total supply. Since September, the company has acquired around 91,112 BNB at an average price of $860, putting it well in the green already.

Such a bold move signals growing institutional confidence in BNB not just as a utility token, but as a core digital asset worthy of long-term allocation. In an industry where few publicly traded firms openly disclose crypto holdings, CEA’s position sets a precedent that could inspire others to follow.

Kazakhstan’s National Crypto Fund Picks BNB as First Investment

Just days before BNB’s breakout, another headline underscored the token’s rising geopolitical relevance. On September 29, Kazakhstan’s Ministry of Artificial Intelligence and Digital Development launched the Alem Crypto Fund, aimed at accelerating the country's involvement in digital assets.

The fund’s strategic partner is Binance Kazakhstan, a regulated local arm of Binance’s global operations. In a symbolic move, the Alem Crypto Fund made BNB its first investment, positioning the token at the center of Kazakhstan’s digital asset strategy.

Binance founder Changpeng Zhao (CZ) acknowledged the significance of the moment, posting on social media about his recent meeting with President Kassym-Jomart Tokayev and commending the progress made in Astana since their last meeting three years ago.

Source: cz_binance

Source: cz_binance

This partnership reinforces Binance’s ability to foster meaningful relationships at the national level, even as it faces increased regulatory scrutiny in other jurisdictions.

Transaction Fees Slashed as BNB Smart Chain Gets More Efficient

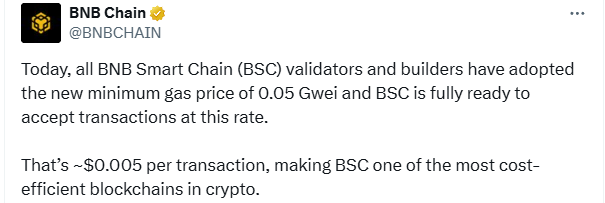

While institutional interest creates strong narrative momentum, fundamentals on the blockchain side are also improving. On October 1, all validators and builders on the BNB Smart Chain (BSC) adopted a new minimum gas price of 0.05 Gwei, officially enabling transactions at this ultra-low rate.

Source: BNBCHAIN

Source: BNBCHAIN

This translates to about $0.005 per transaction, making BSC one of the most cost-efficient smart contract platforms in the crypto space. At a time when Ethereum L2s are trying to bring fees under control, BSC’s move to near-zero transaction costs could drive more users, developers, and projects into its ecosystem.

Momentum Builds on the Charts

Technicals have played a role in fueling the breakout as well. BNB decisively cleared the 23.6% Fibonacci retracement level at $1,148, followed by a push through the key psychological resistance of $1,200. As of writing, the Relative Strength Index (RSI-14) reads 74.08, suggesting strong bullish momentum—though it also places BNB in overbought territory.

The breakout didn’t go unnoticed by algorithmic traders. Once the $1,200 threshold fell, long positions surged across major derivatives platforms. Simultaneously, over $18 million in leveraged shorts were liquidated, marking a 7-day high in short liquidations and adding fuel to the price rally.

Looking ahead, BNB faces its next resistance at $1,347, corresponding to the 61.8% Fibonacci extension. Should profit-taking occur, technical support is expected around $1,183—the former breakout zone and now a likely retest level.

Smart PR in a Fast-Moving Market: The Outset PR Model

As BNB climbs and investor focus intensifies, narrative positioning becomes critical. PR campaigns must align with these inflection points—but without wasting budget. This is where Outset PR’s model proves distinct.

Rather than relying on legacy PR tactics, Outset PR uses Syndication Map, a proprietary media intelligence tool that tracks which crypto-native outlets deliver measurable syndication lift. As Senior Media Analyst Maximilian Fondé explains:

“If a company needs a top list article, we filter for outlets that publish this format, match that with pricing and reach data, and know within minutes where the pitch will perform best. It saves time, money, and delivers targeted exposure.”

The results are clear. Campaigns are leaner, smarter, and more effective. The approach of Outset PR favors quality over volume, optimizing for articles that republish across aggregators like CoinMarketCap and Binance Square, multiplying impact at no extra cost.

For example, a campaign for StealthEX generated 92 republications, reaching over 3 billion views, despite a modest media spend. That is the power of targeted placements, not press release blasts.

Another strength lies in execution. Anastasia Anisimova , head of media relations, emphasizes sincerity and trust as key to securing placements in tier-1 outlets. In a space where relationships often fall to automation, real communication still wins.

Conclusion

BNB’s price surge is not happening in a vacuum. It reflects an intersection of institutional strategy, national policy, and technical optimization. And as attention turns to the token’s long-term role in crypto infrastructure, visibility becomes a competitive edge.

Outset PR recognizes this shift. By watching market patterns through Outset Data Pulse, and deploying campaigns through data-backed tools like Syndication Map, the agency ensures that crypto companies do not just participate in moments like this—they help shape them.