EMC Labs September Report: Logical Analysis of BTCsh Cycle Initiation, Operation, and Conclusion

Author: 0xWeilan

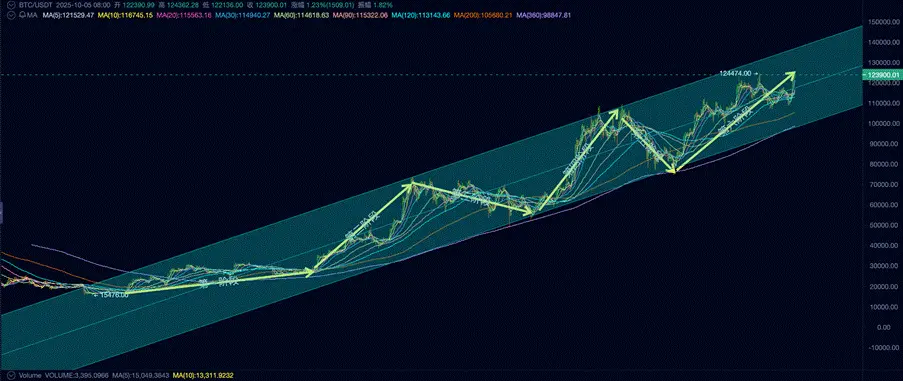

According to Coinbase quotes, BTC reached a 4-year low of $15,460.00 per coin on November 21, 2022. We consider this day as the end of the previous cycle and the start of the current cycle.

From that day until September 30 of this year, BTC has been running for 1,044 days amid volatility, which is already close in time to the peaks of the previous two cycles (about 1,060 days after the low). If we calculate mechanically, BTC will reach the peak of this cycle in October 2025.

Comparison of BTC price trends across 5 cycles

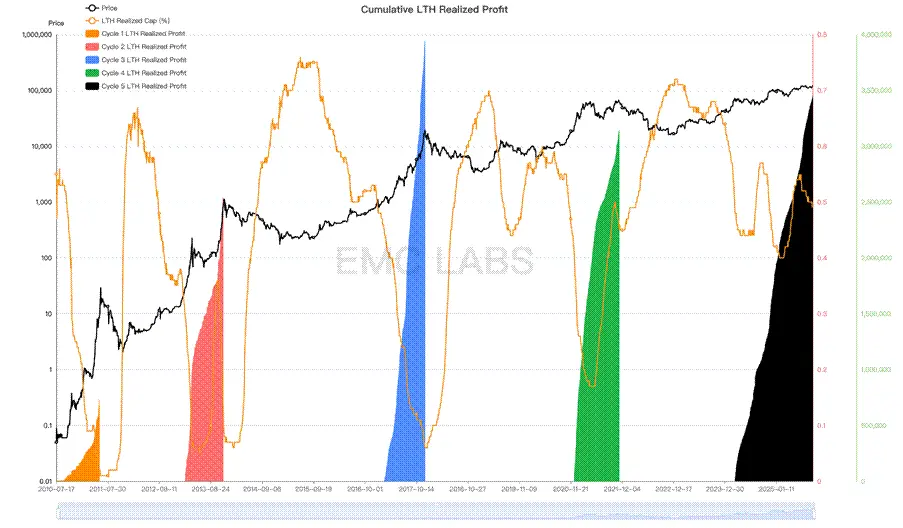

This so-called “cycle law” of BTC originates from the speculative frenzy brought about by consensus diffusion and halving, and to this day remains the most valued cycle indicator for traditional large BTC holders. This group has played a decisive role in shaping past BTC tops. It is precisely their frenzied profit-taking and selling that drains liquidity and ultimately forges the market cycle peak.

Currently, this group is accelerating their selling, and it appears the “peak” is imminent. However, other top indicators such as rapid price surges and sudden increases in new addresses have not appeared. This is confusing—will this cycle law continue to suppress the market and shape the cycle top, or will it fail? Will this BTC bull market, which started in November 2022, end in October?

In this report, EMC Labs uses its self-developed “BTC Cycle Multi-Factor Analysis Model” to comprehensively analyze BTC price trends since the start of this cycle, clarify which market forces and underlying logic have truly driven the cycle, and finally provide our analysis and judgment on whether BTC will peak in October.

Phase One (2022.11~2023.09): Long-Term Holders Accumulate

Looking back, the bankruptcy of major buyers in the previous cycle such as FTX and its lender Voyager Digital marked the completion of the cycle's clearing. After FTX went bankrupt, BTC price fell from the bottom range of $20,000 to $15,476 (Coinbase data, same below), with the lowest point appearing on November 21, 2024.

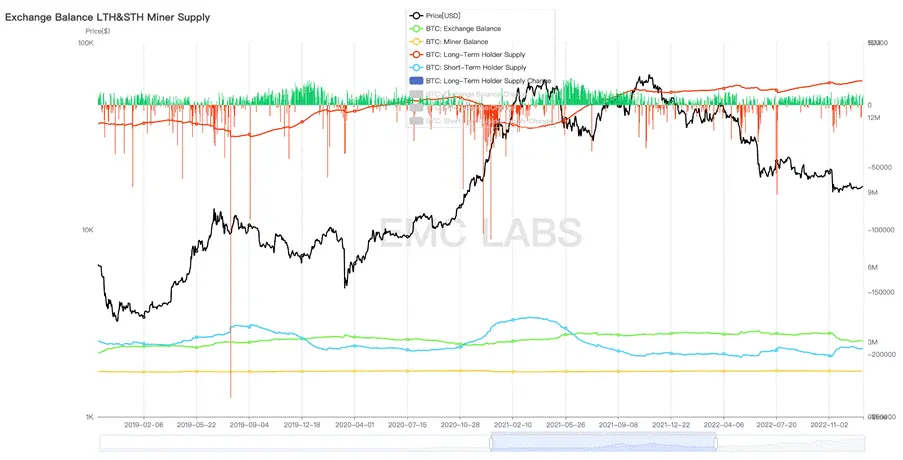

The bankruptcies of FTX and other institutions intensified the market bottoming, but the fundamental force that determined the end of the cycle was the profit-taking and selling by long-term holders. During market frenzy, short-term holders scramble to buy while long-term holders sell; when the market cools, short-term holders sell at a loss while long-term holders start to accumulate.

Statistics of long-term holders' position changes in the previous cycle

As in previous cycles, long-term holders began accumulating during the bear market phase of the previous cycle. Entering the bottom stage, the scale of loss-selling by short-term holders began to decrease, and the buying power of long-term holders started to push prices upward, driving BTC and the crypto market out of the bottom and into a new cycle.

Meanwhile, in the post-pandemic era, the Federal Reserve's rate hike cycle was nearing its end and officially concluded on July 26, 2023. Due to forward-looking trading, the Nasdaq Composite Index bottomed on October 13, 2022, and exited the bottom range in January 2023. BTC price basically synchronized with this, about 9-10 months ahead of the official end of rate hikes.

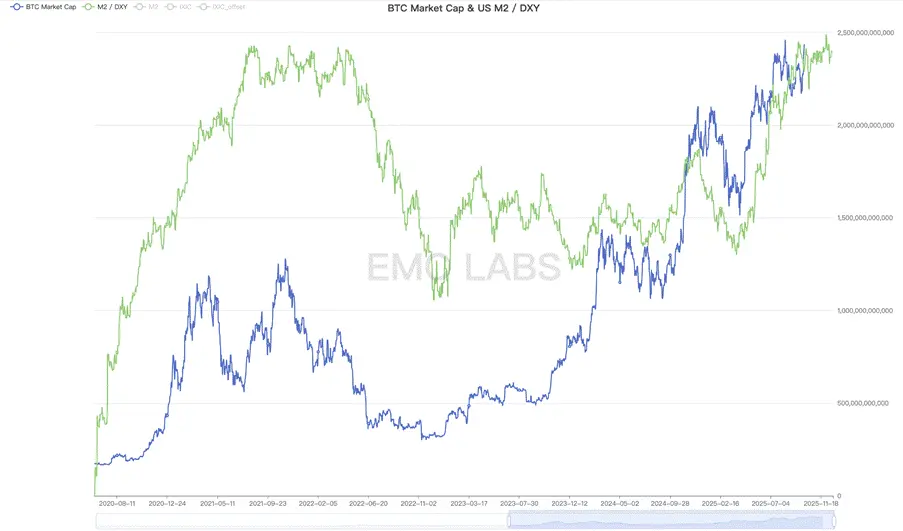

As the rate hike cycle neared its end, tightening liquidity led to bankruptcies of US regional banks (Silicon Valley Bank, First Republic Bank), forcing the US government to urgently inject liquidity. The US M2/DXY index began to rebound from the bottom, providing an external environment for the rebound of the US stock market and BTC.

US M2/DXY

We define “2022.11~2023.09” as the first phase of this cycle. Coupled with improving macro liquidity, the internal tension in crypto market holding structure became the fundamental driver of BTC price increases during this phase.

The Fed's rate hikes officially ended in July 2023, and long-term holders' accumulation continued until the end of September 2023.

At this time, influential DATs companies and BTC Spot ETF had not yet become dominant forces, and retail investors chasing the rally had not awakened. Stablecoin issuance was shrinking, and capital was still flowing out of the crypto market. The cyclical accumulation by long-term holders was the main force driving the market upward.

In the first phase, BTC rebounded from a low of $15,476.00 to a high of $31,862.21, a maximum increase of 105.88%.

Phase Two (2023.10~2024.03): BTC Spot ETF

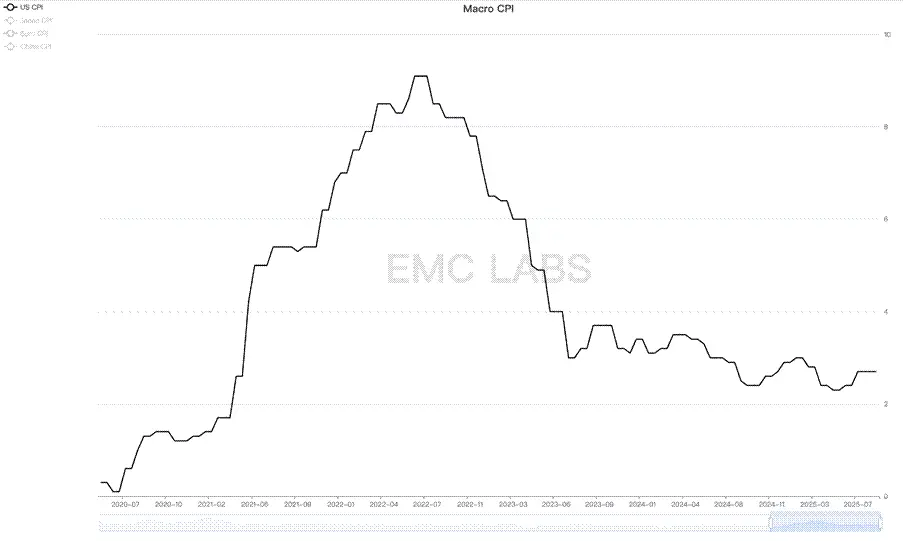

US inflation continued to fall, and the brief rebound in CPI from July to September 2023 was considered a false alarm. July was ultimately confirmed as the end month of the Fed's rate hike cycle.

With changing market expectations, risk assets began to attract capital, and the shift in risk appetite prepared the ground for BTC to enter the second phase of its rally.

US CPI

The real driver of BTC's second phase rally was the anticipation of BTC Spot ETF approval and the fifth BTC halving in April 2024.

Wall Street asset management giants like BlackRock and Fidelity submitted BTC Spot ETF applications to the SEC in June 2023, and speculative capital began to gather in anticipation.

Taking the SEC's approval of the BTC Spot ETF on January 10, 2024 as the dividing line, the second phase can be split into two halves: the first half (2023.10~2024.01.10) was dominated by speculative capital betting on ETF approval, while the second half (2024.01.10~2024.03.14) was driven by incremental capital inflows through the ETF channel (over $12 billion).

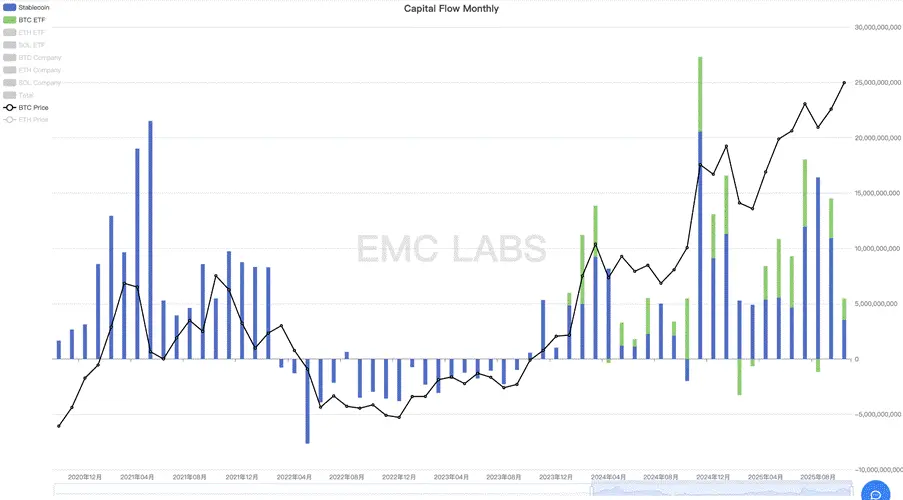

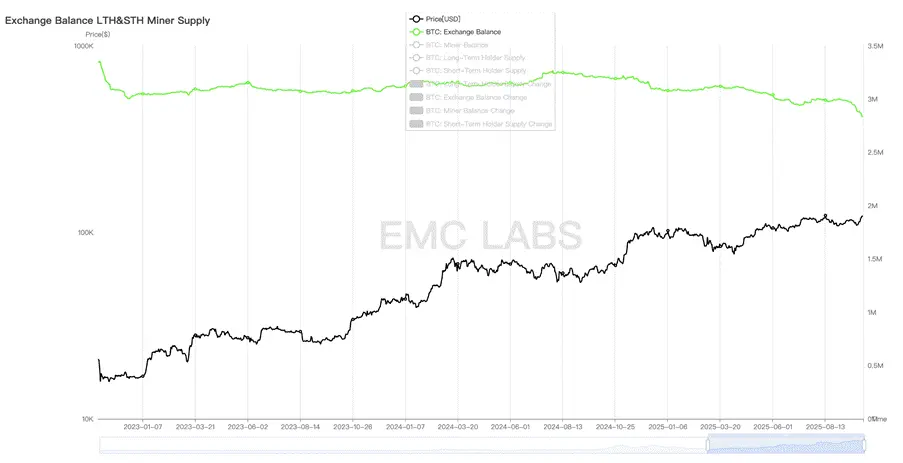

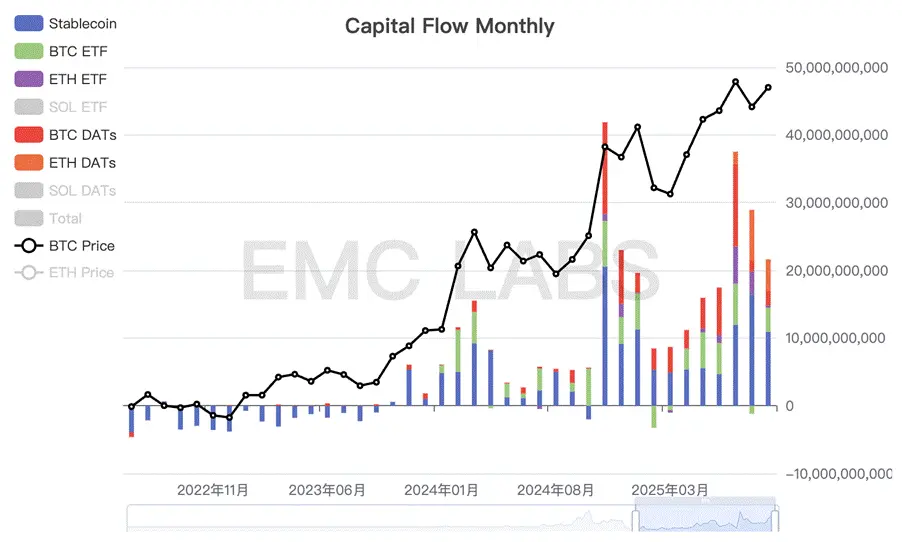

BTC Spot ETF and stablecoin channel monthly capital flow statistics

In addition, the stablecoin channel also completely reversed its outflow trend in October, returning to inflows. By the end of March, more than $26 billion in new stablecoins had been issued, making it one of the main driving forces in the first half.

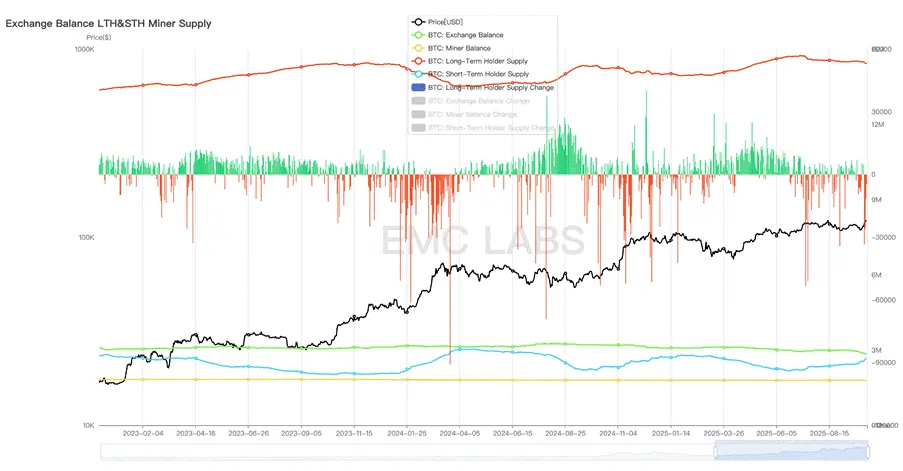

From the start of this phase in October 2024, long-term holders began reducing their positions, with the scale of reduction reaching as much as 900,000 coins by the end of the rally.

This phase was jointly dominated by speculative/investment capital through the BTC Spot ETF channel, on-chain speculative/investment capital (manifested as a large increase in stablecoin issuance), and long-term holder reduction. Buying power exceeded selling power, BTC price rose sharply, and the rally was very fierce.

In the second phase, BTC rose from a low of $26,955.25 to a high of $73,835.57, a maximum increase of 173.92%.

Phase Three (2024.04~2024.09): Halving Rebalancing

In the analysis of the second phase, we pointed out that investment/speculative capital based on the traditional BTC halving narrative is also a key factor in determining the rally. This is clearly reflected in the third phase.

On April 19, 2024, BTC completed its fourth halving, with block rewards dropping from 6.25 BTC to 3.125 BTC. Although over 95% of BTC has already entered circulation and the actual supply impact of halving has greatly diminished, the speculation around halving did indeed exhaust BTC's upside potential. From April 2024 to September, BTC entered a seven-month period of oscillating adjustment.

Capital statistics show that after BTC reached a stage high in March, capital inflows through the BTC Spot ETF channel shrank but remained at a high level, while the stablecoin channel shrank even more, even turning to outflows at times.

BTC Spot ETF and stablecoin channel monthly capital flow statistics

During this period, although the Fed had stopped raising rates, rate cuts had not yet begun, and ETF channel inflows had clearly decreased. Coupled with on-chain capital leaving as halving approached, the exhausted rally had to be revised downward to seek a new price equilibrium.

The market was able to rebalance without falling into a bear market thanks to the stabilizing force of long-term holders. We note that after April, as liquidity receded, long-term holders stopped reducing their positions and began accumulating again after July. Their behavior is consistent with past patterns, outlining a stage bottom range for the market.

In the third phase, the highest price was $109,588, the lowest was $74,508, and the maximum drop was 32.01%, not exceeding the typical BTC bull market correction threshold.

Phase Four (2024.10~2025.01): Trump’s Crypto-Friendly Policies

Since the Fed stopped rate cuts in July 2023, the federal funds rate remained high at 5.25~5.50 to suppress CPI. High rates gradually hurt the job market, and the Fed finally restarted rate cuts at the September 2024 FOMC meeting, completing 75 basis points of cuts by year-end.

Rate cuts boosted risk appetite across the market, and capital flooded into the crypto market via BTC Spot ETF and stablecoin channels. By the end of January 2025, the 11 US BTC Spot ETF products managed over $100 billions, setting multiple records. This shows that the BTC “digital gold” narrative has been embraced by Wall Street, and BTC is transitioning from an alternative asset to a mainstream asset.

Besides rate cuts, another catalyst for BTC's rise was the US presidential election. In this campaign, Republican candidate Donald John Trump made a 180-degree turn in his attitude toward crypto, becoming the most “crypto-friendly” US presidential candidate. His family business even issued the MEME token Trump after his victory.

After taking office, Trump signed executive orders supporting digital assets and blockchain technology, established an interdepartmental task force to review existing regulatory policies, announced the creation of a “Bitcoin Strategic Reserve” and “US Digital Asset Reserve,” and signed the “GENIUS Act” to promote compliant stablecoin development. He also appointed “crypto-friendly” figures as Treasury Secretary and SEC Chairman, effectively advancing crypto assets and blockchain technology in the US. The friendliness and intensity of these policies are unprecedented—even Satoshi Nakamoto would find it hard to believe.

With Trump’s campaign, massive capital quickly flowed into the crypto market through ETF and stablecoin channels, forming the largest capital inflow of this cycle so far. Meanwhile, long-term holders began selling again to lock in profits.

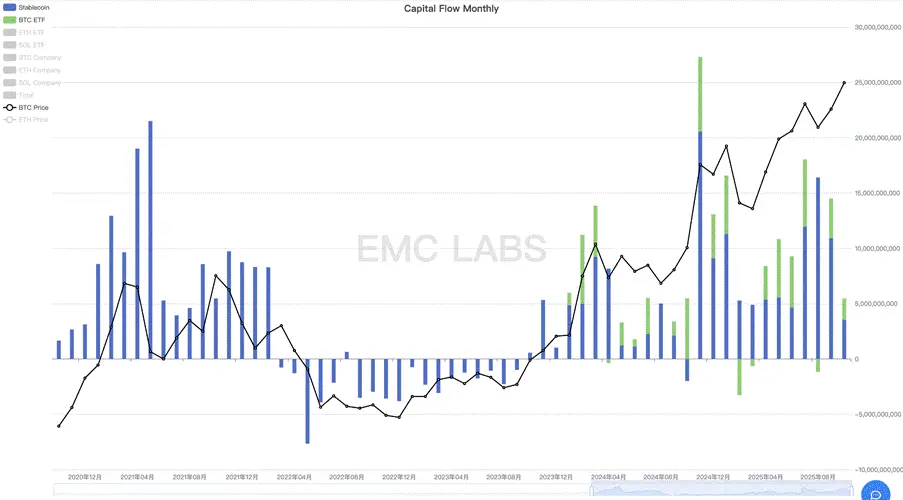

On-chain realized value statistics for the Bitcoin network

Driven by US crypto-friendly policies, crypto assets gradually became mainstream US assets. In addition to BTC Spot ETF, dozens of DATs companies led by Strategy joined the battle to accumulate BTC and other crypto assets. These two groups have become the largest buyers in the BTC market.

BTC Spot ETF and DATs companies now hold more than or close to 5% of BTC.

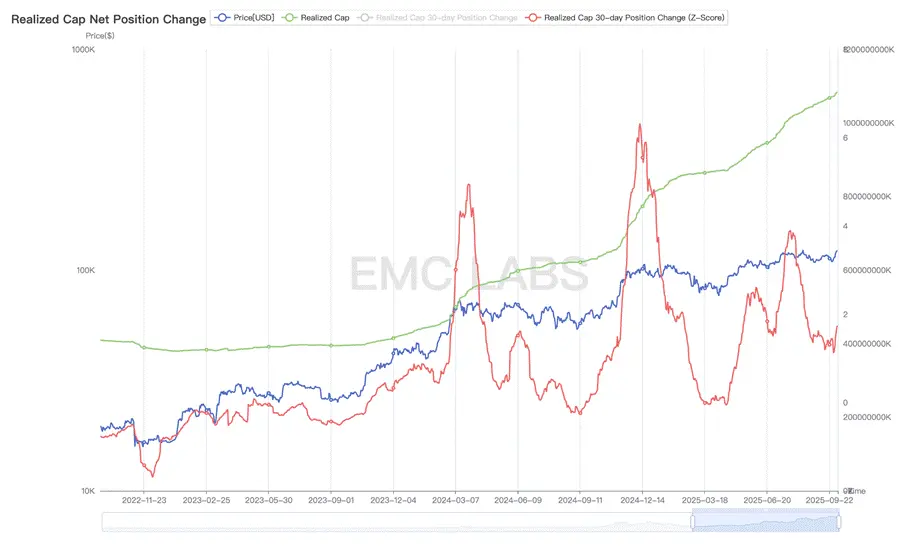

With the massive involvement of BTC Spot ETF and DATs companies, BTC entered an era of major turnover. A large amount of BTC is moving from early holders to the custody accounts of BTC Spot ETF and DATs companies. As a result, the amount of BTC held by centralized exchanges, which early crypto holders commonly used, began to decline sharply in this phase. By the end of September 2025, more than 400,000 BTC had flowed out of centralized exchange addresses, worth over $40 billions at $100,000 per coin.

Major crypto asset exchange BTC inventory statistics

This outflow continues in this phase and beyond, showing that BTC is currently undergoing a historic turnover. Early investors (including those holding for more than 7 years) are cashing out huge profits and exiting, while traditional capital is becoming long-term investors in this asset. Early investors’ behavior is heavily influenced by the halving cycle, while DATs companies seem to prefer continuous buying and long-term holding, and BTC Spot ETF holders are more influenced by US stock market trends.

This change in holding structure makes the shaping of BTC cycles more complex.

The market momentum in this phase comes from speculation driven by expectations of rate cuts and Trump’s crypto-friendly policies, resulting in record capital inflows into the crypto market.

In the fourth phase, BTC price rose from a low of $63,301.25 to $109,358.01 (recorded on Trump’s inauguration day, January 20, 2025), a maximum increase of 72.76%.

Phase Five (2025.02~2025.04): Black Swan

In our research framework, the fifth phase is another mid-term adjustment formed by the combination of external black swan events and the emotional pullback after speculative frenzy. The market turmoil caused by the pause in rate cuts and the tariff war reached a threshold in both time and space, ultimately forming this special phase.

Crypto market monthly capital flow statistics

Because the US stock and crypto markets had fully priced in continued rate cuts, when the Fed stopped cutting rates in January 2025 and stated it would refocus on reducing inflation, both the US stock market and BTC at historic highs entered a precarious state. When Trump announced tariff rates far exceeding expectations, the market plunged into a crash.

The Nasdaq saw a maximum correction of nearly 17% from its high, and BTC corrected by as much as 32%. Although BTC's drop was large, it did not exceed the typical correction threshold in a BTC bull market.

Ultimately, as panic from the tariff war and concerns about a US economic hard landing subsided, both the US stock and crypto markets achieved a V-shaped reversal in April, and continued to hit new highs after July.

Behind the V-shaped reversal, DATs companies, BTC Spot ETF channels, and stablecoin channel funds rushed to buy, and long-term holders returned to accumulation after the drop, once again acting as market stabilizers.

In the fifth phase, the highest price was $73,777, the lowest was $49,000, and the maximum drop was 33.58%, not exceeding the scale of BTC bull market corrections.

Phase Six (2025.05~): Old Cycle and New Cycle

The market crash caused by the black swan was gradually recovered by bottom-fishing funds and long-term accumulation, and by July, BTC had reached a new all-time high of $123,000.

At this point, long-term holders began the third major sell-off of this cycle, which continues to this day. The buyers are DATs and BTC Spot ETF channel funds.

Before the rate cut in September, forward-looking trading continued to dominate the market. From July to September, capital inflows were large but decreasing, causing BTC to experience a slight adjustment after the rate cut. Long-term holder selling became the main market-moving activity.

BTC long-term holder position change statistics

Since the start of this cycle, with the third wave of increases, long-term holders are conducting the third round of large-scale selling. According to on-chain data, long-term holders have locked in profits on more than 3.5 million BTC this cycle, reaching the threshold seen in previous cycle tops. As of today, long-term holders are still selling BTC heavily.

BTC long-term holders realized profit (BTC) statistics

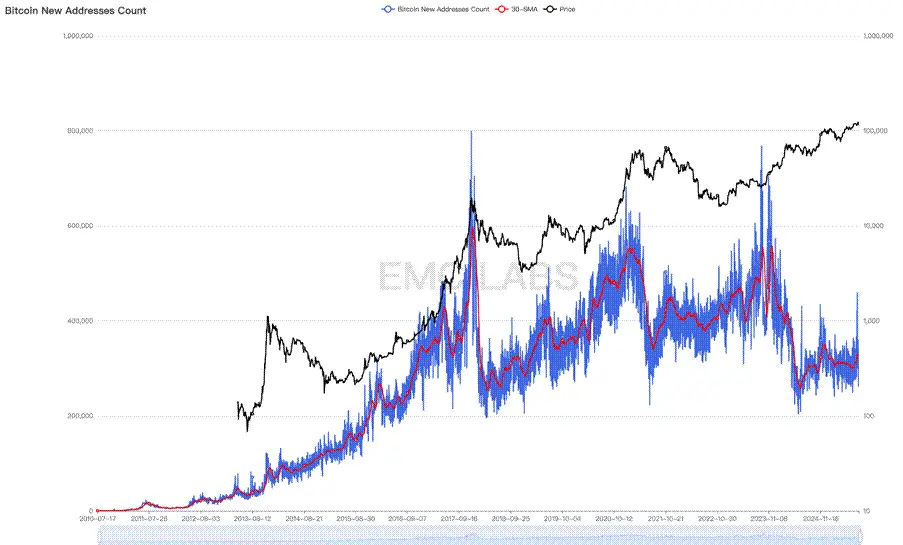

In previous bull-bear cycles formed by BTC halvings, BTC halving and long-term holder accumulation and distribution were decisive factors, while the speculative sentiment around halving that drove new investors into the market was a necessary condition for cycle tops. In previous cycles, this influx of new speculators was reflected in a surge of new Bitcoin network wallet addresses.

However, as BTC consensus spreads, the number of new addresses created in each cycle has stagnated, and since 2024, new BTC addresses have fallen to levels seen during previous bear markets. Of course, this cannot simply be interpreted as a decrease in new participants, because after the approval of 11 US BTC Spot ETF products in January 2024, many investors began participating via ETF channels, greatly reducing the creation of BTC wallet addresses.

Bitcoin network new address statistics

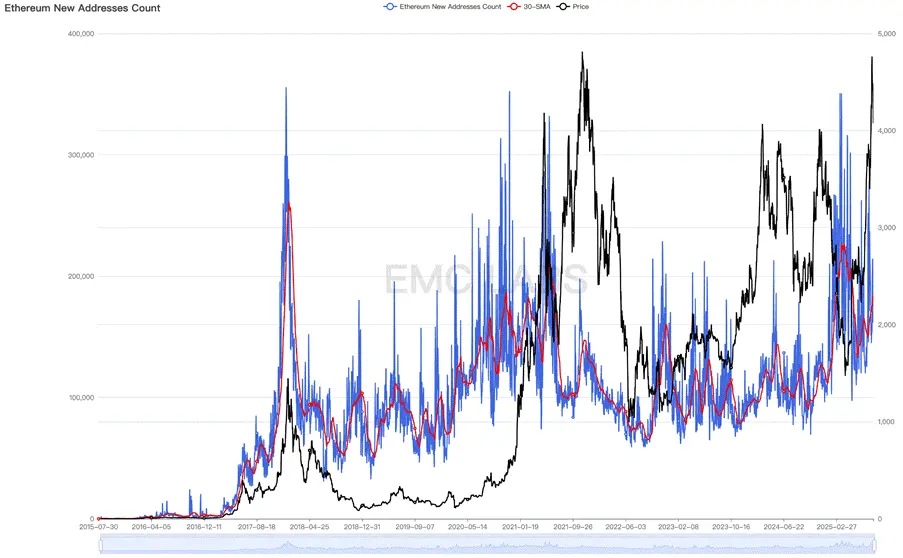

But when we observe the largest SCP platform, Ethereum, we can see the same phenomenon in new addresses this cycle.

Ethereum new address statistics

This forces us to believe that the BTC market structure has undergone a dramatic change, and the entire crypto market is entering a new stage of development. Simply predicting market tops based on the cycle law, or blindly chasing hot coins and expecting high returns, is now outdated.

It is even possible that BTC has already exited the old cycle and entered a new one, with its topping method, timing, and bear market correction magnitude potentially changing completely.

Conclusion

From the above review and observations, we draw a preliminary conclusion: the main driving force behind this bull market comes from industrial policy incentives and incremental capital from traditional channels. Halving and industry innovation have not brought massive capital inflows as before, nor triggered a comprehensive bull market with all coins soaring in the Crypto market.

Although during this bull market, the industry also saw innovations in areas such as Ethereum Layer 2, BTC Ordinals, Restaking, Solana revival, and DePhin, the capital attracted by these innovations was pulsed and extremely limited compared to the previous DeFi boom.

This means that since BTC restarted a new cycle bull market in November 2022, most Coin and Token prices in the crypto market have only seen pulsed, stage-wise increases, and even the most widely accepted and used SCP platform token ETH saw its price in 2025 fall back to pre-bull market levels.

BTC is moving out of the old cycle and into a new one. Funds from DATs companies and BTC Spot ETF channels, driven by market sentiment and their own logic, are trying to reshape the logic and form of the cycle. However, the BTC long-term holder group, which has played a decisive role in cycle movements over the past 16 years, still holds more than 15 million BTC, accounting for as much as 70% of issued BTC, and this group still acts according to the cycle law.

Factors supporting the view that the top has not yet been reached, or that a new cycle has begun, include: the outstanding fundraising ability and long-term holding strategy of DATs companies, the continued rollout and implementation of crypto-friendly policies in the US, and the high-risk asset allocation trend triggered by the restart of the rate cut cycle.

Will long-term holders drain liquidity and complete the old cycle top, or will buying power in a rate-cut environment bury selling pressure and follow the US stock market into a long bull new cycle? This game is still ongoing.

We tend to believe the cycle will be appropriately extended, and a BTC top in October is still a small probability event. However, if long-term holders persist in continuous selling, it is highly likely that the bull market will end this year. The time and space for the bear market adjustment after the bull market may be greatly reduced, depending on the behavior of new buyers.

The end has already begun.

EMC Labs was founded in April 2023 by crypto asset investors and data scientists. Focusing on blockchain industry research and Crypto secondary market investment, with industry foresight, insight, and data mining as core competencies, it is committed to participating in the booming blockchain industry through research and investment, promoting blockchain and crypto assets for the benefit of humanity.