Will the US Government Shutdown Crisis Trigger a Short-Term Bitcoin Crash? In-Depth Analysis of Its Chain Reaction on the Crypto Market

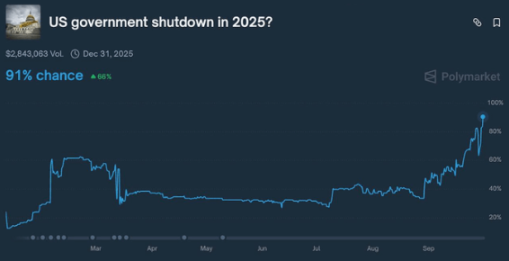

As the standoff over the US government’s fiscal budget intensifies, market concerns about a potential “government shutdown” are rising. According to the latest data, the probability of a shutdown occurring in the next 12 hours is as high as 91%. This macro uncertainty will not only impact traditional financial markets but is also highly likely to become a short-term bearish trigger for bitcoin and the cryptocurrency market.

1. Cracks Emerging in the Macroeconomy

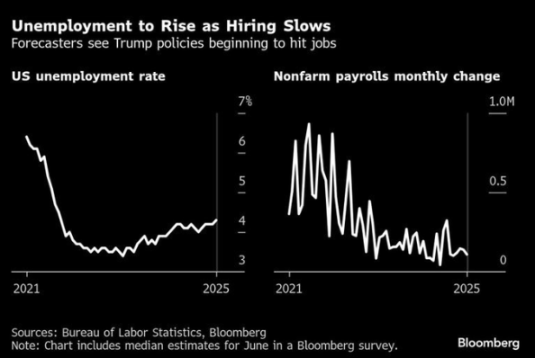

The US economy has recently shown multiple signs of pressure:

Inflation rate at 2.9%—although easing, it still remains above the Federal Reserve’s target.

Unemployment rate has climbed to 4.3%, indicating a cooling job market.

Real estate demand is rebounding, but insufficient employment support is intensifying internal economic contradictions.

Meanwhile, the Federal Reserve has lowered interest rates to the 4.0–4.25% range, which the market generally interprets as a signal of weak economic growth. If the US enters a shutdown on October 1, the deterioration of the macro environment will accelerate further.

2. Direct Impact of a Government Shutdown on the Crypto Market

Historical experience shows that shutdown events usually trigger immediate selling pressure on risk assets. The reasons are:

Sharp increase in uncertainty — Investors’ risk aversion rises, leading to sell-offs in BTC and altcoins.

Weakened confidence in the US dollar and Treasuries — Some funds may treat BTC as “digital gold,” but this effect is often delayed.

Market patterns — The first reaction is almost always “drop first, then stabilize,” with short-term capital choosing to liquidate and wait.

At the same time, a shutdown will trigger a series of institutional chain reactions:

SEC approval delays: Applications including bitcoin and ethereum ETFs may be forced to postpone, dampening market expectations.

Decline in institutional liquidity: Institutional funds are more inclined to hold cash, resulting in increased volatility.

3. Historical Review and Reference

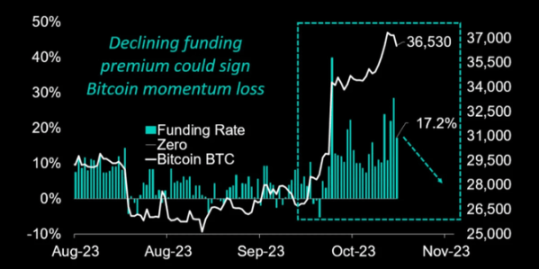

When the risk of a US government shutdown approached in 2023, panic sentiment was already reflected in the market in advance:

BTC dropped from around $27,000 to $23,000;

Altcoins also experienced significant declines.

However, as the shutdown crisis was resolved, the market rebounded quickly. This shows a clear divergence between short-term bearishness and mid- to long-term logic.

4. Key Technical Levels

If the shutdown risk truly materializes, bitcoin may test the following key ranges:

Main support range: $106,000–$108,000

Deep retracement range: $99,000–$104,000

These price levels will become important indicators for market participants to observe capital flows and changes in confidence.

Conclusion

If the US government shutdown occurs as scheduled, it is highly likely to trigger a sharp short-term decline in bitcoin and the crypto market, mainly due to risk aversion and liquidity withdrawal. However, both historical experience and macro logic indicate that the mid- to long-term impact is not purely negative. As trust in the US dollar and government system continues to erode, bitcoin’s “hedge narrative” may actually be strengthened.

In other words, the shutdown event is more likely to become a turning point for short-term risk and long-term bullishness. For investors, the key is to understand the cyclical rhythm: short-term defense, mid- to long-term positioning.