With the expectation of Polymarket issuing tokens, which ecosystem projects are worth speculating on?

The Intercontinental Exchange (ICE), parent company of the New York Stock Exchange, recently announced plans to invest up to 2 billion USD in the prediction market platform Polymarket. This news not only marks the recognition of this emerging market by a traditional financial giant, but also lays a solid financial foundation for Polymarket’s future expansion.

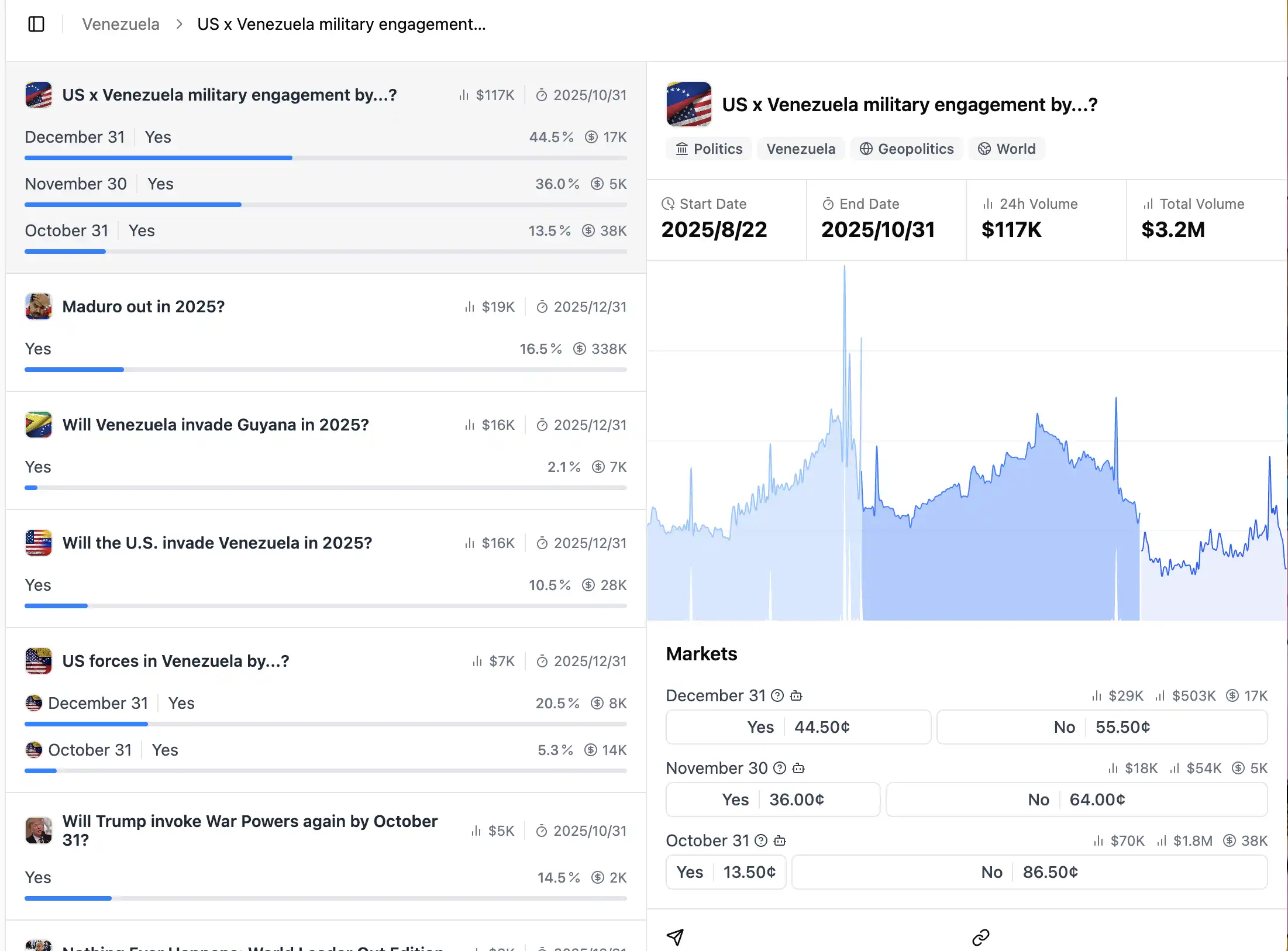

With its re-approval to enter the US market and an endorsement of an approximately 8 billion USD valuation, Polymarket is actively promoting the “Polymarket Builders” program, encouraging third-party teams to build various tools, analytics platforms, trading terminals, and AI agents to jointly prosper the entire ecosystem. Currently, there are already hundreds of ecosystem projects.

116 Polymarket ecosystem projects, source: Polymarketbuilders 'X

This article will introduce five Polymarket ecosystem projects, each enriching the prediction market experience from the perspectives of smart trading, sports betting AI, social trading, mobile terminals, and leveraged trading.

Billy Bets

As prediction markets extend into the sports sector, Billy Bets is playing a striking role. This AI sports betting agent, co-founded by serial entrepreneurs bunchu, Jared Augustine, and Clay, aims to completely transform the 250 billion USD sports betting market with artificial intelligence.

In July 2025, Billy Bets completed a 1 million USD seed round, with investors including Coinbase Ventures, Virtuals Ventures, and CMS Holdings. The Billy Bets team points out that the sports betting industry now has an annual transaction volume of hundreds of billions of USD, but bets executed by AI agents account for less than 1%—a huge efficiency gap they are targeting.

“We believe that in the future, all sports bettors will ultimately rely on AI to improve their win rates,” said co-founder Jared Augustine in an interview.

Billy Bets’ architecture is quite unique. Built on the Eliza multi-agent framework, it integrates multiple large models such as Anthropic Claude 3.5, OpenAI GPT-4, Meta’s LLaMA 3.2, and Perplexity, creating an “AI betting personality” with a mocking and humorous style.

By connecting its self-developed SportsTensor AI engine to SportsData.io’s real-time sports data, Billy Bets can analyze the trends of leagues like the NBA, NFL, and MLB, and interact with users on platforms such as X (Twitter), Discord, and Telegram, answering questions or discussing events in real time. More importantly, it automates complex betting strategies: the AI agent can autonomously manage on-chain wallets, execute arbitrage and copy trading, act as a market maker, and cleverly uses the Kelly formula (airdrop hunters rejoice) to dynamically adjust bet sizes, striving to bring the risk-reward ratio close to professional betting standards.

In practice, Billy Bets has already begun to show its power. Professional sports bettors can entrust their funds to Billy for management. According to official disclosures, since its launch in June this year, Billy has processed over 1 million USD in bets.

Billy Bets’ next step is to launch a tokenized membership system and a betting insurance vault to strengthen the value of its native token $BILLY within the ecosystem. For example, holding $BILLY may grant access to premium features or profit sharing, while the insurance vault provides users with fund security.

However, even as its features continue to improve, the market cap of its token BILLY has gradually declined, once falling below its opening price at launch by Virtuals, and is now quoted at a market cap of 3.2 million USD.

With the trend of sports prediction gradually moving on-chain, Billy Bets combines cutting-edge large model AI with decentralized wallets, injecting a professional and highly personalized “brain” for sports betting into the Polymarket ecosystem.

Polycule

For many users who cannot directly access the official Polymarket website or prefer mobile, Polycule offers a brand new and convenient pathway. As a chat trading bot running on Telegram, Polycule allows users to experience Polymarket through a conversational interface—browsing markets, checking odds, placing orders directly, and even managing on-chain wallets, all within a familiar chat window.

Polycule is not just a personal tool; it also incorporates social trading elements. Users can add this bot to their own Telegram groups, and then whenever anyone in the group places an order via Polycule, the trade details are automatically broadcast to all members. This makes betting as contagious as trading Memecoins.

The team even designed a points and leaderboard mechanism to encourage sharing strategies within groups. Meanwhile, newcomers can use Polycule to copy trades with one click, choosing to follow the bets of a “guru” in the group, saving time on their own research.

In addition, Polycule has issued its own PCULE token for ecosystem incentives. Holding a certain amount of PCULE grants trading fee discounts, and the official team will periodically use profits to buy back and burn tokens to increase value.

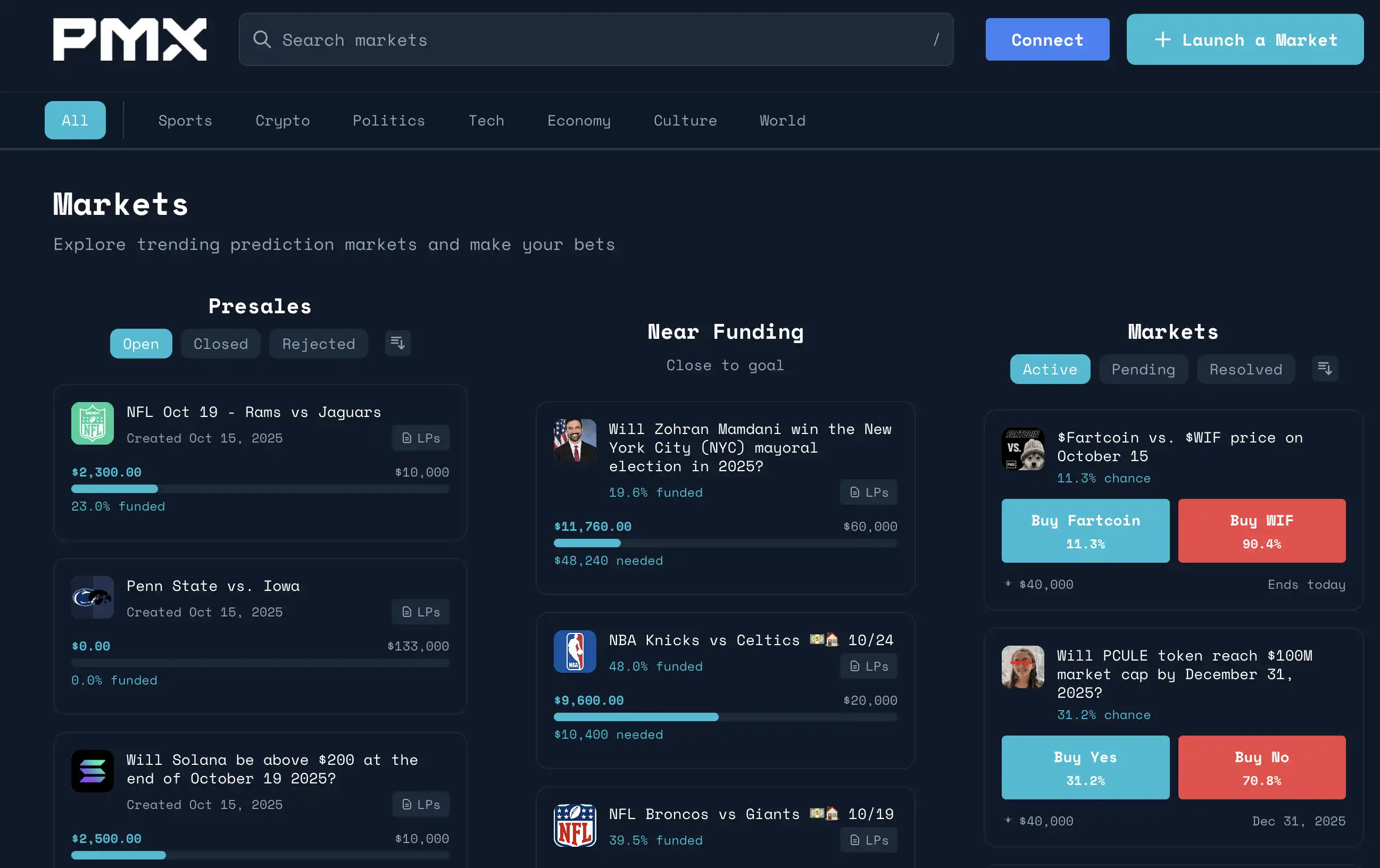

When PCULE launched in May this year, its market cap once reached about 15 million USD, and in June it won a 560,000 USD seed investment from AllianceDAO. On October 1, PCULE was officially renamed PMX, and the team also announced the launch of a permissionless prediction market for topic creation (similar to an internal Memecoin market, which can be bet on after being listed externally).

The market is still relatively early, and most topics are related to on-chain verifiable information like Crypto, making it something of a crypto futures playground.

After transforming from a tool to a platform, its token PMX also soared in value, skyrocketing from 18 million USD to 57 million USD in market cap, before correcting to 23 million USD.

Polymtrade

Although Polymarket has become the largest prediction market platform by trading volume, it has long relied mainly on its web interface and has not launched an official mobile app. This has caused inconvenience for many power users, as the mobile browser experience is not as smooth as a native application.

One user even complained on a community forum that they would “pay hundreds of dollars” just for a good mobile app, highlighting the urgent demand for mobile access.

Polymtrade emerged in this context as a third-party mobile trading terminal. The project claims to be the first complete mobile trading app designed for Polymarket, focusing on speed, ease of use, and comprehensive professional tools, aiming to redefine the user’s mobile trading experience.

Upon opening Polymtrade, users are greeted by a clean, mobile-optimized interface and real-time market updates. Thanks to targeted technical improvements, Polymtrade loads Polymarket data nearly four times faster than the mobile web. Considering that many users like to reference data before betting, Polymtrade has a built-in AI prediction assistant. The team trained the model on as many as 55,000 settled historical market data points to provide probability forecasts and trading suggestions for current markets.

For example, when new news breaks on a hot topic, the AI model may promptly adjust its probability estimate for the “yes/no” outcome and alert users to potential betting opportunities. This intelligent assistance, to some extent, gives ordinary users a “prophet’s” perspective.

In terms of trading flow, Polymtrade has also made many optimizations to enhance mobile convenience. Users can connect their crypto wallets and authorize transactions via signature; Polymtrade never custodians user funds throughout the process, ensuring self-custody.

To reduce the cost of frequent trading, Polymtrade covers the Polygon chain’s gas fees for users, effectively waiving all on-chain fees. This is undoubtedly good news for high-frequency traders, who no longer need to worry about being constrained by on-chain fees. At the same time, Polymtrade integrates the previously cumbersome betting steps into a one-click process—from selecting the market, entering the amount, to confirming the trade (in cooperation with ok.bet, trades can be initiated directly from Telegram)—all steps are bundled into a single submission, greatly simplifying operations.

It also comes equipped with auxiliary tools. Polymtrade has built-in search and monitoring dashboards, allowing users to quickly find markets by keyword or tag, subscribe to real-time news alerts, and view fee income and trading volume rankings for each market, making it easier to judge which sectors are hottest. For professional players, the app also provides community comments and strategy discussion sections.

The emergence of Polymtrade fills the long-standing mobile gap in Polymarket. For users accustomed to trading anytime, anywhere, it offers desktop-level depth while simplifying features for mobile, allowing quick bets even on the commute.

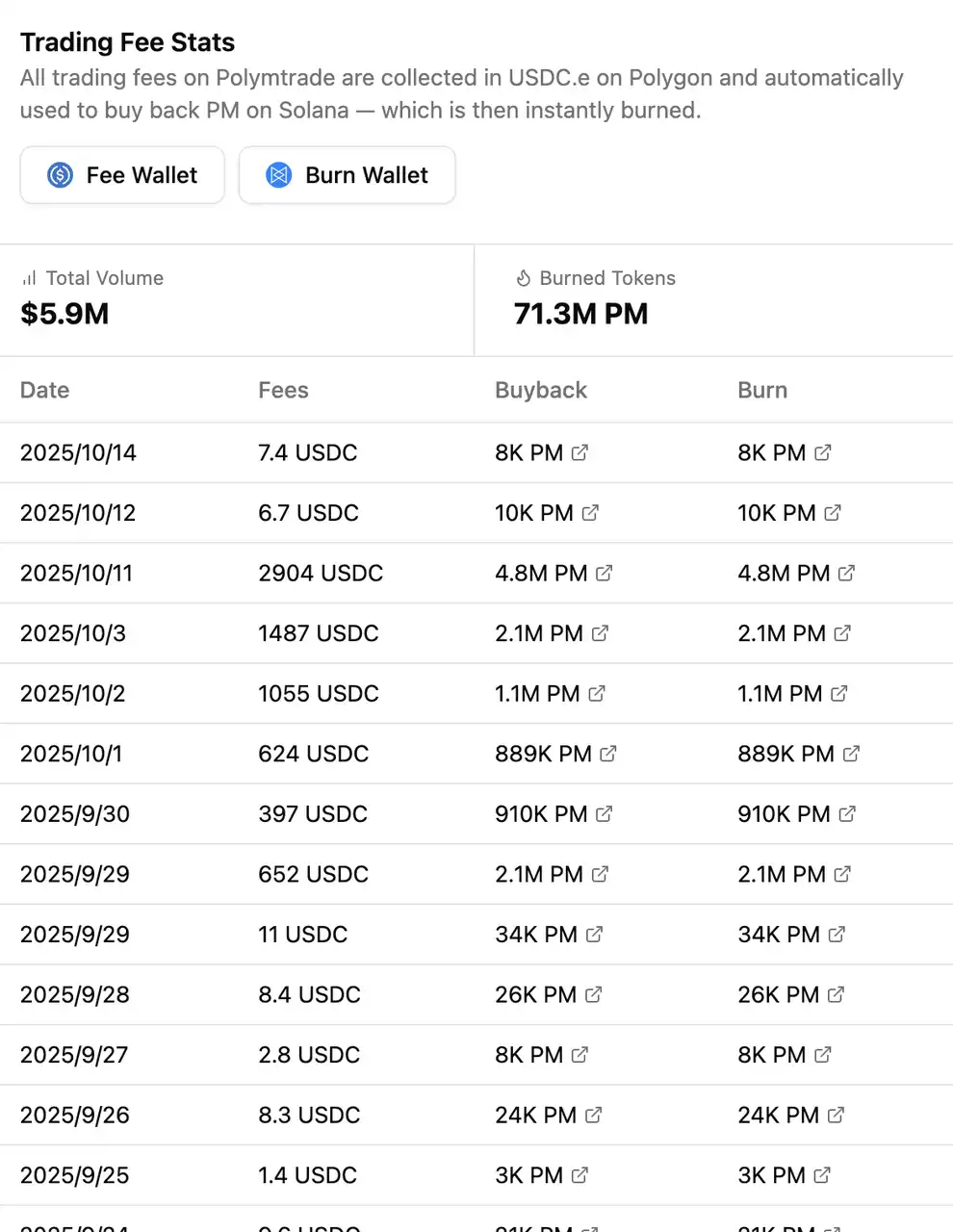

Currently, its trading fees are used as user incentives and for daily token buybacks, with 71 million $PM already burned.

PM currently has a market cap of only 800,000 USD, but thanks to the buyback mechanism, its price has risen relatively steadily. Whether the project can be sustained will ultimately depend on whether its mobile features can reach a sufficiently broad user base.

Flipr

The emergence of Flipr has taken prediction market gameplay to a new level. If Polycule embeds trading into chat software, then Flipr directly integrates trading commands into social media posts, making every tweet a potential real bet. This new protocol, described by Messari as “the leverage layer of prediction markets,” fully leverages Polymarket’s existing infrastructure while layering on social and DeFi elements, making it truly unique.

Flipr has two core functions. First, it has launched the X-based trading bot @fliprbot. Users only need to post or reply to a tweet containing a Polymarket market link on X, and state their betting intention in natural language (for example, “@fliprbot bet $50 YES” plus the market link and condition). Fliprbot will read this instruction and automatically execute the trade for the user in that market.

The entire process requires no additional websites or apps, similar to the functionality of Base’s BANKR, truly achieving “tweet to bet.” When you see a hot event on Twitter, you can not only comment but also place a bet right away.

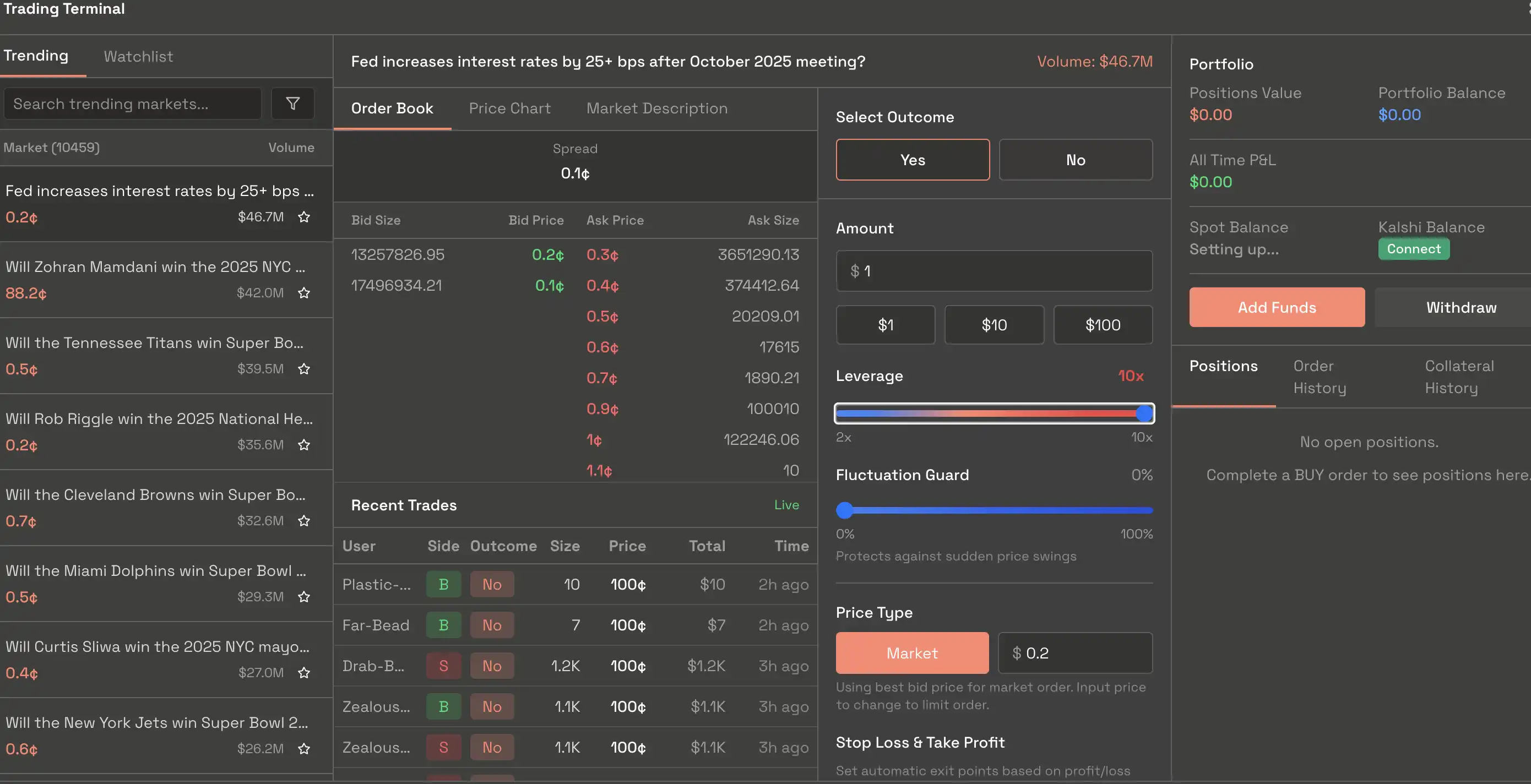

Flipr’s other function is the introduction of rare leverage in prediction markets. Generally, platforms like Polymarket or Kalshi use $0-$1 pricing to buy binary options contracts, which settle at $1 based on the outcome, with no extra leverage. Flipr, however, allows users to take positions with up to 10x leverage.

High leverage brings the possibility of high returns, but also higher risk, as even small price fluctuations can trigger liquidation. Therefore, Flipr has also prepared take-profit and stop-loss functions (contractualizing prediction markets). It has also designed DeFi modules such as lending and staking (not yet launched), so in the future, users may be able to use their prediction contracts as collateral to borrow funds from the Flipr protocol.

Since its launch in June, the $FLIPR token reached a peak market cap of 30 million USD, but has since cooled down to around 4.3 million USD.

At present, Flipr is still in its early stages, mainly supporting highly liquid popular contracts, while niche markets are not fully covered due to slippage and liquidation mechanism issues. But if Flipr can solve capital and risk control issues and continue to provide a smooth social trading experience, it could become a relatively mature integrated platform for social prediction markets and DeFi functions.

Polyfactual

Among the Polymarket ecosystem Builders projects, Polyfactual, like Polytrader and Billy Bets, is an important component built by community developers. The Polyfactual team initially interacted with the community via X and Telegram, regularly live-streaming market trend discussions. In September 2025, Polyfactual began rolling out its product prototype, and in the early days, they gained a loyal user base by providing in-depth weekly live analyses of Polymarket hot topics.

In October 2025, Polyfactual launched a prediction event analysis AI Chrome extension connected to Polymarket. This plugin allows traders to get real-time AI interpretations and data insights while browsing Polymarket market pages, improving decision-making efficiency. This was an important step in solidifying Polyfactual’s tool attributes.

Polyfactual’s uniqueness lies in its deep integration of artificial intelligence, social sentiment, and prediction markets, creating a new paradigm of “Truth Markets.” Simply put, Polyfactual hopes to make truth valuable through financial mechanisms, making the spread of rumors low-profit or even unprofitable. Its core operations can be divided into several modules: fact verification, real-time intelligence feeds, cross-platform arbitrage, and “truth endorsement” tokens.

First is fact verification and intelligence analysis. The Polyfactual platform integrates massive information from news and social media (especially X), using custom AI models for semantic analysis and credibility assessment. When a rumor spreads in the community, Polyfactual’s AI quickly assesses its source reliability and supporting data, and feeds the results back to users.

For example, if a rumor about a politician suddenly causes odds to fluctuate sharply in a hot market, Polyfactual’s real-time intelligence feed will immediately push analysis results to clarify the information’s authenticity, preventing users from being misled. Polyfactual acts as a “fact checker” in prediction markets, ensuring market pricing is closer to reality by timely distinguishing true from false information.

As summarized by a co-founder in an article a few days ago, “The mindset of prediction markets ultimately provides not certainty, but clarity. Not fearlessness, but calibrated attention. Not the elimination of risk, but the wisdom to distinguish between dangers that should change our behavior and those that should not.”

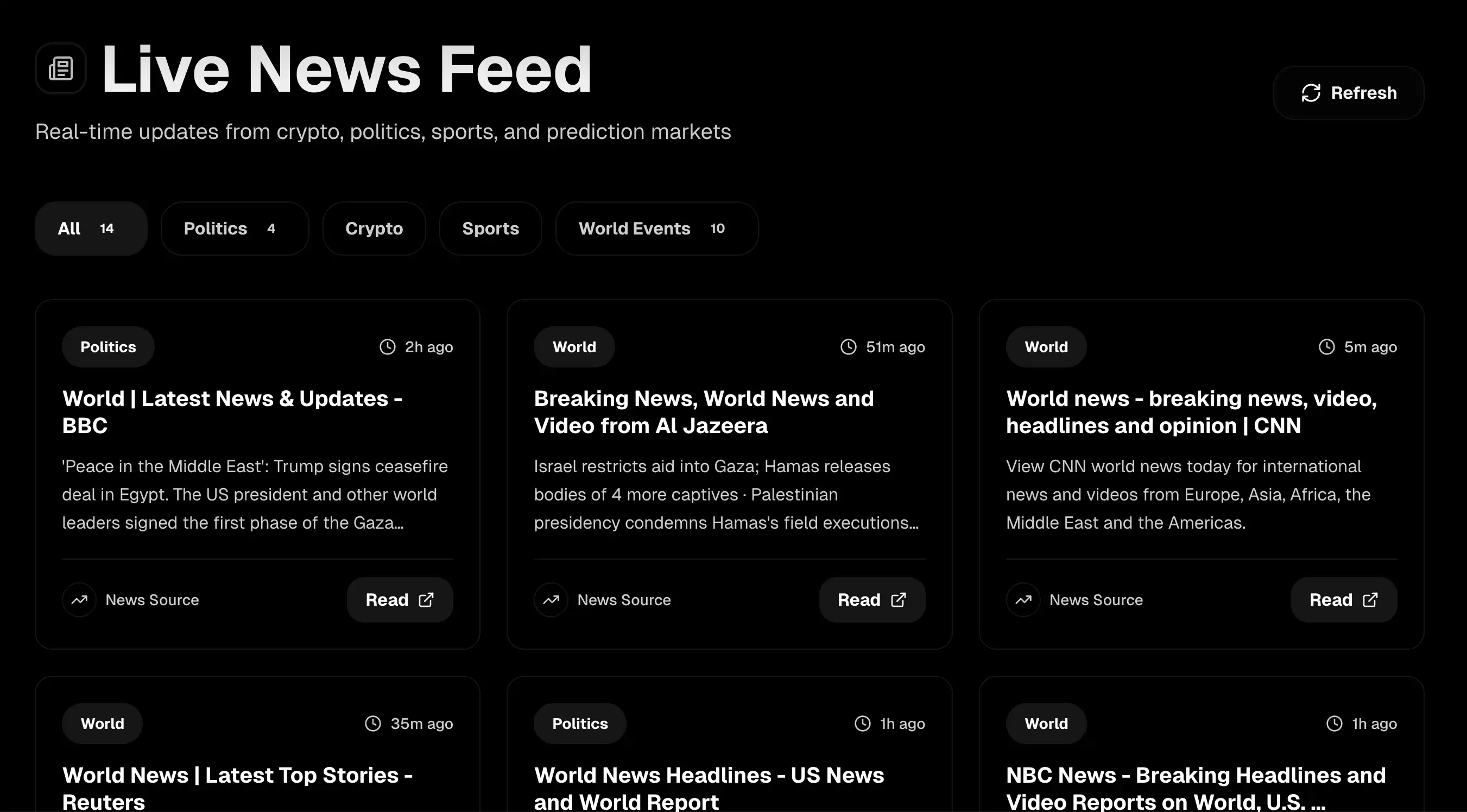

To date, the official Polyfactual website has integrated an AI news feed, tracking developments in crypto, politics, sports, and more, and can filter out key news related to Polymarket markets. Users can browse the live feed on the website for news summaries, or use the aforementioned browser plugin to view AI interpretations in the Polymarket web sidebar.

In October this year, Polyfactual announced the launch of a built-in AI market analyzer: “Introducing AI market analysis on the site—paste any Polymarket link or ask a question, and the AI will instantly analyze market sentiment and risk. Each analysis requires burning 10 $POLYFACTS tokens.”

This feature allows users to directly converse with Polyfactual’s AI assistant and obtain in-depth analysis reports on specific markets (such as market sentiment, reasons for odds fluctuations, etc.), but requires a small token fee. Through this token consumption mechanism, Polyfactual integrates its token into product usage scenarios, incentivizing token holding on one hand and controlling AI service abuse on the other.

On the other hand, Polyfactual is exploring a “truth endorsement” token mechanism. In an interview with MCG on October 10, Polyfactual’s founder also discussed this idea, aiming to directly convert prediction market results into tradable tokens. Veteran community observer fififish vividly described this concept as “Polyfactual wants to issue tokens based on the final result—‘Yes’ or ‘No’ on Polymarket—as facts.”

For example, if an event has two possible outcomes, A or B, Polyfactual plans to pre-mint two tokens (such as Fact-A and Fact-B) at the start of the event. If the final result is A, then Fact-A tokens are officially issued and given value, while Fact-B is voided; and vice versa. These tokens, to some extent, represent “legitimacy” backed by real outcomes.

More importantly, this legitimacy is backed by the consensus of market participants who have put real money on the line. Therefore, holding a “truth token” is akin to holding proof or rights to the actual outcome. Polyfactual envisions that in the future, these truth tokens can circulate in secondary markets or be used for specific community governance, allowing the reliability of information to be measured by market price. The team is already developing an “oracle”-like product called Facts, which will officially launch on November 26.

In addition, this model will also enable the development of cross-platform arbitrage bots, focusing on price differences between Polymarket and other platforms. Part of the profits will be returned to POLYFACTS holders through token buybacks or dividends, allowing the community to share in the gains.

After its official token POLYFACT launched, it was mistakenly thought to have been acquired due to being labeled as an “affiliate” by Polymarket’s official account, causing its market cap to briefly soar to 19 million USD, before fluctuating between 4 and 6 million USD.