After the Curve team’s new venture, will Yield Basis become the next phenomenal DeFi application?

Original Author: Saint

Translated by: AididiaoJP, Foresight News

Every once in a while, a DeFi blockbuster product emerges in the crypto market.

Pumpfun has made token issuance easy, while Kaito has changed content distribution.

Now, YieldBasis is set to redefine how liquidity providers profit: by turning volatility into yield and eliminating impermanent loss.

In this article, we will explore the basics, analyze how YieldBasis works, and highlight related investment opportunities.

Overview

If you have ever provided liquidity to a dual-asset pool, you may have experienced impermanent loss firsthand.

But for those unfamiliar with the concept, here’s a quick recap:

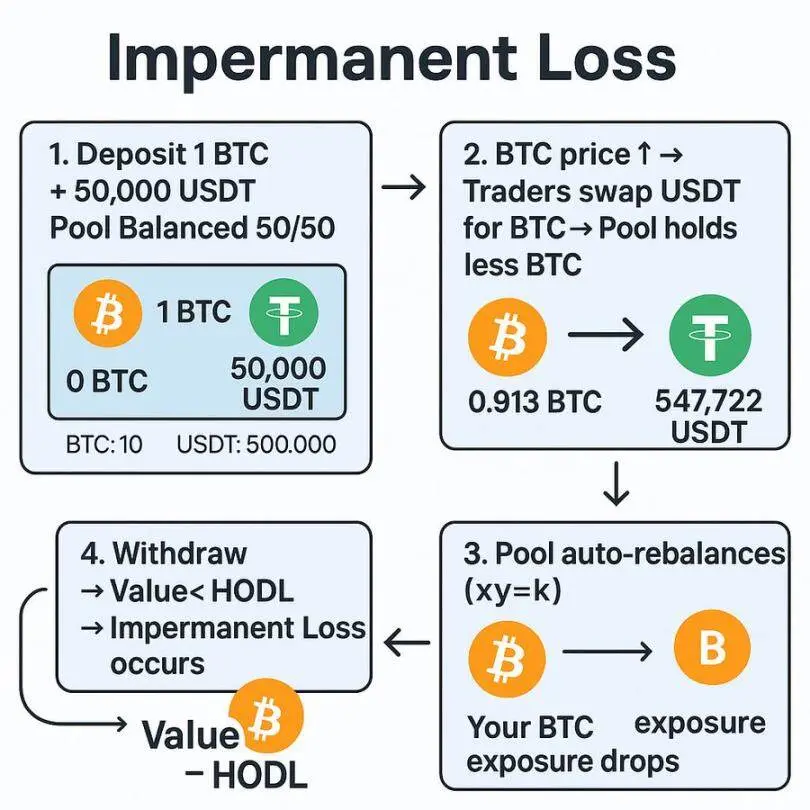

Impermanent loss is a temporary loss of value that occurs when providing liquidity to a pool containing two assets.

As users trade between these assets, the pool automatically rebalances, which often results in liquidity providers holding more of the asset that is being sold.

For example, in a BTC/USDT pool, if the price of BTC rises, traders will sell BTC to the pool for profit, and liquidity providers will end up holding more USDT and less BTC.

When withdrawing funds, the total value of the position is usually less than simply holding BTC.

Back in 2021, high annual percentage yields and liquidity incentives were enough to offset this.

But as DeFi has matured, impermanent loss has become a real drawback.

Various protocols have introduced remedies, such as concentrated liquidity, delta-neutral liquidity provision, and single-sided pools, but each approach comes with its own trade-offs.

YieldBasis adopts a new approach, aiming to make liquidity provision profitable again by capturing yield from volatility while completely eliminating impermanent loss.

What is YieldBasis?

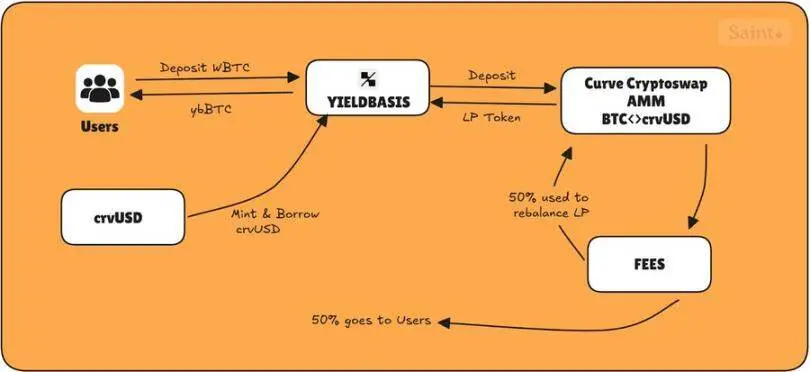

Simply put, YieldBasis is a platform built on Curve that uses Curve pools to generate yield from price volatility while protecting liquidity provider positions from impermanent loss.

At launch, Bitcoin is the primary asset. Users deposit BTC into YieldBasis, which allocates it to Curve’s BTC pool and uses a unique on-chain structure to apply leverage, thereby neutralizing impermanent loss.

It was founded by the same team behind Curve, including @newmichwill.

YieldBasis has already achieved significant milestones:

• Raised over $50 million from top founders and investors

• Recorded over $150 million in committed funds in the Legion sale

• Filled its BTC pool within minutes of launch

So, how does this mechanism actually work?

Understanding the YieldBasis Workflow

YieldBasis operates through a three-step process designed to maintain a 2x leveraged position while protecting liquidity providers from downside risk.

Deposit

The user’s first step is to deposit BTC into YieldBasis to mint ybBTC, a receipt token representing their share in the pool. Currently supported assets include cbBTC, tBTC, and WBTC.

Flash Loan and Leverage Setup

The protocol flash loans an amount of crvUSD equal to the USD value of the deposited BTC.

The BTC and borrowed crvUSD are paired and provided as liquidity to the BTC/crvUSD Curve pool.

The resulting LP tokens are deposited as collateral into a Curve CDP (collateralized debt position) to obtain another crvUSD loan, which is used to repay the flash loan, making the position fully leveraged.

This creates a 2x leveraged position with a constant 50% debt ratio.

Leverage Rebalancing

As the price of BTC fluctuates, the system automatically rebalances to maintain a 50% debt-to-equity ratio:

- If BTC rises: LP value increases → protocol borrows more crvUSD → risk exposure resets to 2x

- If BTC falls: LP value decreases → redeem part of LP → repay debt → ratio returns to 50%

This keeps BTC risk exposure constant, so you don’t lose BTC even if the price fluctuates.

Rebalancing is handled by two key components: the rebalancing automated market maker and the virtual pool.

The rebalancing automated market maker tracks LP tokens and crvUSD debt, adjusting prices to encourage arbitrageurs to restore balance.

Meanwhile, the virtual pool wraps all steps—flash loan, LP token mint/burn, and CDP repayment—into a single atomic transaction.

This mechanism prevents liquidation events by keeping leverage stable, while giving arbitrageurs small profit incentives to maintain equilibrium.

The result is a self-balancing system that continuously hedges impermanent loss.

Fees and Token Distribution

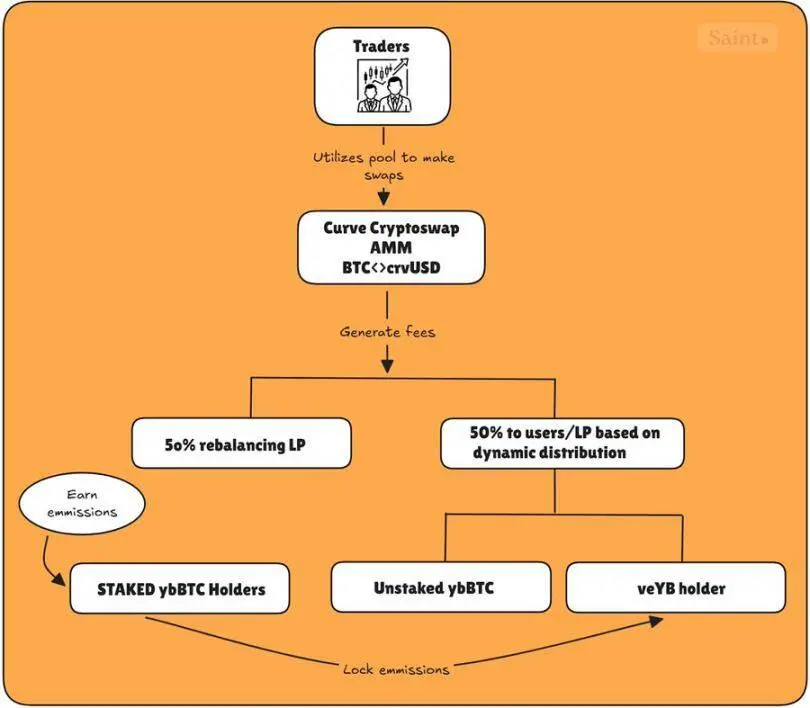

YieldBasis has four main tokens that define its incentive system:

- ybBTC: Claim on the 2x leveraged BTC/crvUSD LP

- Staked ybBTC: Staked version that earns token emissions

- YB: Native protocol token

- veYB: Vote-locked YB, granting governance rights and boosted rewards

All trading fees generated from the BTC/crvUSD pool are split as follows:

- 50% to users (shared between unstaked ybBTC and veYB holders)

- 50% to the protocol, funding the rebalancing mechanism

The 50% returned to the rebalancing pool ensures there are no liquidation calls due to a lack of arbitrageurs to balance the pool; thus, the protocol uses 50% of the protocol fees to do it itself.

The remaining 50% allocated to users is shared between unstaked ybBTC and veYB governance, following a dynamic allocation.

In short, the protocol tracks the amount of staked ybBTC and uses the following formula to adjust the fees each holder (unstaked ybBTC and veYB) can earn:

When no one is staking (s = 0)

Thus, 𝑓ₐ = 𝑓𝑚𝑖𝑛 = 10%, veYB holders get only a small portion (10%), and unstaked ybBTC holders get the rest (90%).

When everyone is staking (s = T)

Thus, 𝑓ₐ = 100%, veYB holders get all the user-side fees, as no one is left to earn trading fees.

When half the supply is staked (s = 0.5 T), the management fee rises (≈ 36.4%), veYB gets 36.4%, and unstaked holders share 63.6%.

For staked ybBTC holders, they receive YB emissions, which can be locked as veYB for a minimum of 1 week and a maximum of 4 years.

Staked ybBTC holders can lock the emissions they receive to enjoy both the fees and emissions as veYB holders, creating a flywheel effect that allows them to earn the maximum fees from the protocol, as shown below.

Since launch, yieldbasis has had some interesting statistics:

- Total trading volume reached $28.9 million

- Over $6 million used for rebalancing

- Generated over $200,000 in fees.

Personal Thoughts

YieldBasis represents one of the most innovative designs in liquidity provision since Curve’s original stable swap model.

It combines proven mechanisms—vote-escrowed tokenomics, automated rebalancing, and leveraged liquidity provision—into a new framework that could set the next standard for capital-efficient yield strategies.

Given that it is built by the same team behind Curve, the market’s optimism is unsurprising. With over $50 million in funding and pools filling instantly, investors are clearly betting on its future token issuance.

Nevertheless, the product is still in its early stages. The relatively stable nature of BTC makes it an ideal test asset, but introducing highly volatile trading pairs too soon could challenge the rebalancing mechanism.

That said, the foundation looks solid, and if the model can scale safely, it could open up a whole new frontier of yield for DeFi liquidity providers.