Two-Thirds of Investors Intend to Increase Crypto Exposure, Says Bitget

The world of crypto is like a roller coaster: it goes up, it plunges, it shakes. Recently, the curve turned red again, with massive liquidations as a result. Another correction in a market used to shocks. However, not everyone is throwing in the towel. According to Bitget’s latest report, an overwhelming majority of investors are not turning their backs on crypto. On the contrary, they want to put tokens back into the machine. A sign that the ecosystem’s resilience remains intact, even when candlesticks turn dark red.

In brief

- 66% of crypto investors plan to strengthen their positions by the end of 2025.

- Emerging markets dominate, with Nigeria, China, and India leading growing allocations.

- 49% expect bitcoin to exceed $150,000 in the next bull run.

- Ethereum remains the favorite crypto, followed by Solana and Layer 2 projects.

Crypto is no longer scary: confidence confirmed worldwide

But then, what are the countries most committed to crypto adoption in 2025 ? This is a question Bitget asked itself in its latest report on global crypto trends. Beyond geographical disparities, the study also highlights a key point: 66% of investors worldwide plan to increase their crypto holdings within the next six months.

In other words, despite the prevailing uncertainty, enthusiasm for digital assets does not wane. The trend is not merely speculative: 43% adopt a long-term savings logic, proof of growing maturity.

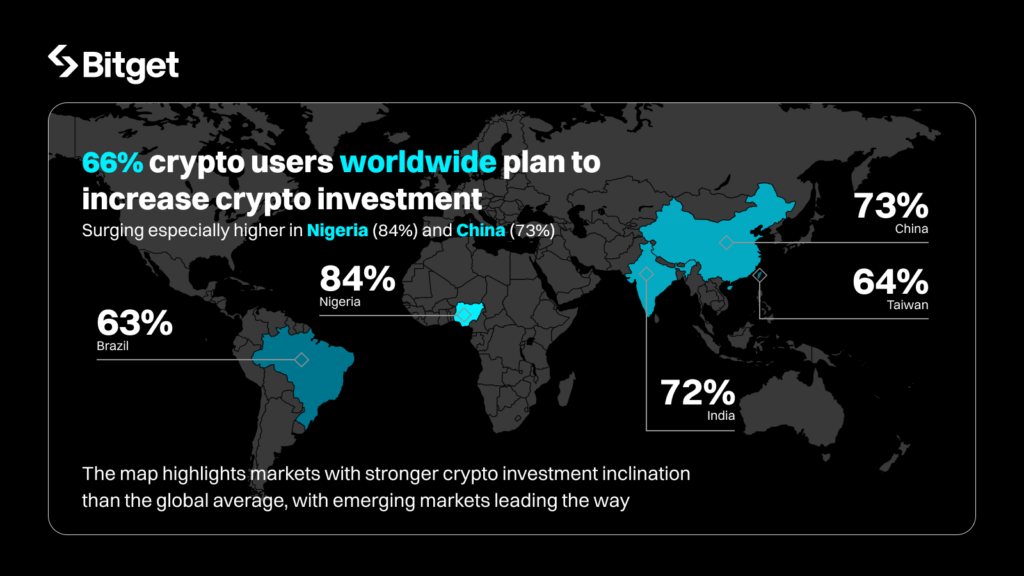

The map highlights markets where cryptocurrency investments are the largest – Source: Bitget

The map highlights markets where cryptocurrency investments are the largest – Source: Bitget In emerging countries, appetite is exploding. Nigeria leads with 84% of respondents ready to increase their allocations, followed by China (73%) and India (72%). Why? Because crypto is seen there as an economic lifeline, a bulwark against inflation and currency devaluations.

Meanwhile, in so-called advanced economies, moods are grim. Germany, France, and Japan remain cautious, held back by regulatory uncertainties and historical hesitancy. In South Korea, 20% of investors even plan to reduce their exposure, a warning sign amid a fractured market.

New investors aren’t afraid of depth

While some experienced traders plan to increase their bitcoin exposure (52%), newcomers show more caution, oscillating between curiosity and prudence. However, the crypto ecosystem has never been more diverse. Ethereum captures 67% of investor attention, Solana 55%. These two giants are not alone: platform tokens, memecoins, and Layer 2 solutions now appeal to a niche but loyal audience.

Profiles emerge: those who trade actively, and those who play the heritage card. According to Bitget:

Investors no longer just chase bull runs—they use crypto as a tool for long-term wealth management, payment, and financial autonomy.

The message is clear: speculation gives way to strategy, and volatility no longer scares away. This paradigm shift reflects a new perspective on Web3, far beyond the simple “moon bag.”

Crypto at the heart of future plans: 5 numbers that say a lot

The data speaks for itself. Here are 5 key facts from the Bitget report:

- 66% of global respondents plan to strengthen their crypto portfolios by the end of 2025;

- 49% expect bitcoin to peak between $150,000 and $200,000 during the next surge;

- 7% of market veterans even imagine BTC surpassing $250,000;

- 67% of investors trust Ethereum as a safe asset;

- Nigeria, China, and India lead the way in adoption, far beyond global averages.

Another notable fact: the growing dominance of multichain blockchains. Ethereum remains the most credible platform, but Layer 2s take a central place in regional strategies, especially in Asia and Africa. This is a strong signal for the future: the future is interoperable, multi-actor, and multichain.

Another Bitget executive summarizes the trend well :

The appetite of emerging markets clearly shows where the future is being built, and this reinforces why our universal platform model is designed to integrate CeFi, DeFi, and on-chain experiences in one place.

Vugar Usi Zade, Chief Operating Officer at Bitget – Source: Bitget

Far from fading, crypto inspires renewed confidence. Some analysts go even further: the United States now ranks second worldwide in adoption , proof that even traditional financial strongholds no longer want to miss the Web3 train. The cycle continues, but faith in blockchain does not waver.