Will Chainlink’s MegaETH Integration Trigger the Next Big Rally?

Chainlink (LINK) is once again in the spotlight after launching its first native, real-time oracle integration with MegaETH — a high-speed Ethereum Layer 2 built for sub-millisecond execution. This move could redefine how DeFi handles live data, but the market doesn’t seem impressed just yet. LINK dropped 3.13% to around $17.9 despite the bullish fundamentals. Let’s break down what’s happening — on the chart and behind the scenes.

Chainlink News: What Does the MegaETH Integration Mean for Chainlink Price?

This is not another routine integration. Chainlink Data Streams are now embedded directly into MegaETH’s protocol layer, letting smart contracts fetch live market data “just in time.” In simple terms, this means DeFi apps — like perpetuals and prediction markets — can now match centralized exchange speeds.

That’s a big deal. Oracle latency has long been DeFi’s Achilles’ heel. Delayed data leads to liquidations, missed arbitrage, and MEV exploits. Chainlink is effectively solving that by cutting redundant updates and only pulling new data when needed.

With MegaETH promising up to 100,000 transactions per second, this integration sets the stage for DeFi trading platforms that feel as fast as Binance or Coinbase but fully on-chain.

Still, investors are cautious. The question is: will this fundamental upgrade offset the current bearish price setup?

Chainlink Price Prediction: What Is the Chart Telling Us?

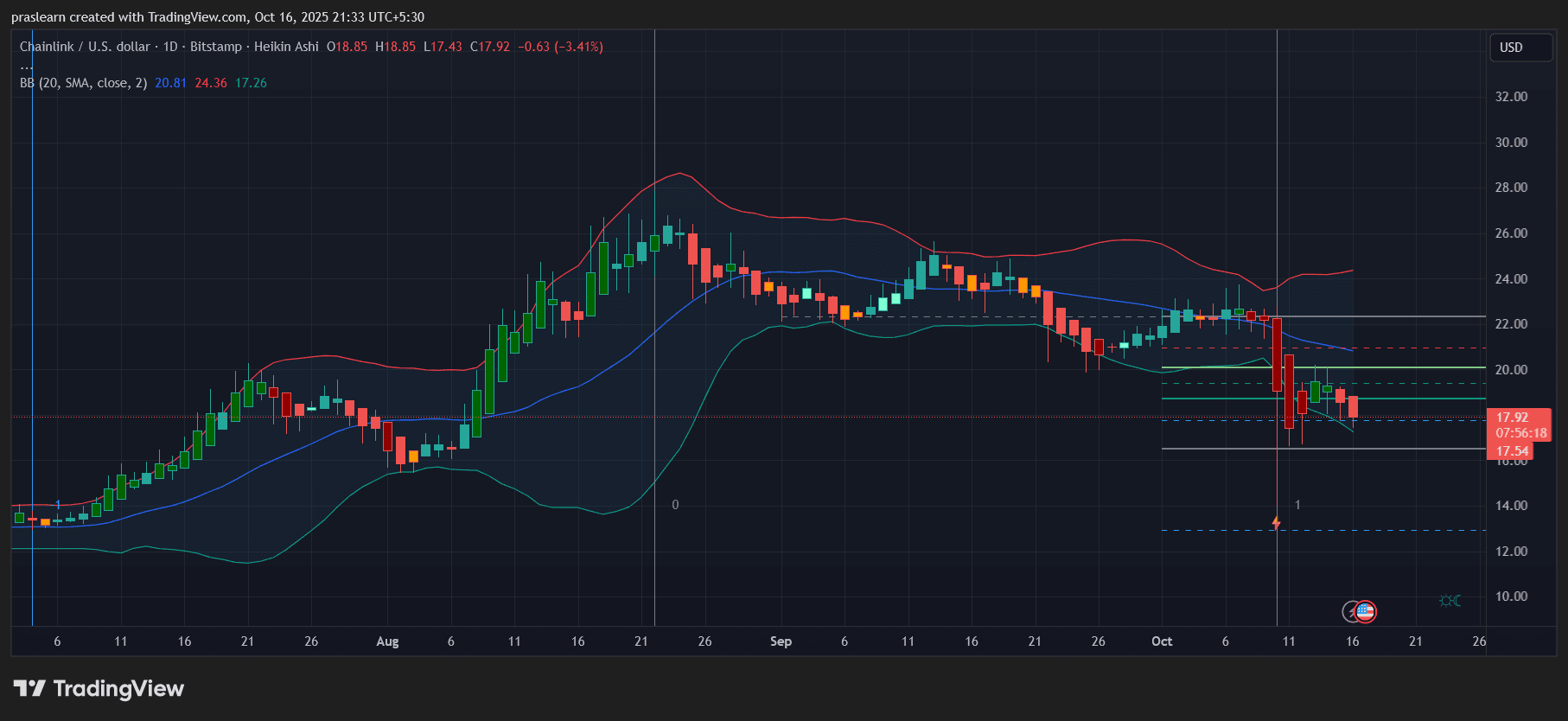

LINK/USD Daily Chart- TradingView

LINK/USD Daily Chart- TradingView The LINK price daily chart (Heikin Ashi candles) shows a clear bearish structure after a steep correction from above $22 to the $17 zone. The Bollinger Bands (BB 20,2) reveal widening volatility, but the current price is hugging the lower band — a typical signal of continued selling pressure.

The 20-day SMA sits around $20.8, far above the current level, confirming that LINK remains below short-term resistance. If buyers can’t reclaim the mid-band soon, LINK could face another leg down toward the $15.8–$16 support range, where the previous wick (flash low) sits.

Volume profiles also suggest exhaustion — no strong reversal candles, no long wicks showing demand. Traders seem to be waiting for confirmation that the MegaETH hype translates into real on-chain usage.

Is a Bounce Coming or Just a Dead Cat Rally?

Here’s where it gets tricky. While LINK price looks technically weak , the fundamentals suggest accumulation might follow once price stabilizes. Historically, Chainlink tends to consolidate after major integrations before a momentum surge.

If the price manages to close above $19.5 and hold that zone, we could see a short-term bounce toward $21–$22 — aligning with the upper Bollinger midline and Fibonacci retracement area. That’s where heavy resistance lies.

But failure to hold above $17 could drag LINK to test the psychological $15 support, possibly extending to $14.3 in a broader correction phase.

Momentum indicators (from the Heikin Ashi pattern) show continued bearish sentiment — with small-bodied candles and no clear trend reversal signal yet. Traders should wait for a bullish engulfing or strong green candle above $19 before confirming a turnaround.

Why the Market Isn’t Reacting to Good Chainlink News Yet

It’s a classic case of fundamentals versus liquidity. Chainlink’s integration news is fundamentally bullish — it cements LINK as the go-to oracle for next-gen DeFi infrastructure . But in the short term, market sentiment is risk-off. Bitcoin dominance is rising, altcoins are bleeding, and DeFi tokens have underperformed as liquidity drains from speculative plays.

Institutional buyers will likely wait for stability before rotating back into oracle and infrastructure plays. LINK, despite its strong ecosystem presence ($100B+ secured value, 18B messages delivered), remains a long-term bet in a market still digesting macro and liquidity shifts.

Chainlink Price Prediction: What Happens Next?

Chainlink’s MegaETH integration is a milestone that could unlock new DeFi architectures. But the chart says traders aren’t ready to price that in yet.

- Bullish scenario: Break and close above $19.5 with strong volume — LINK rallies toward $21–$22, potentially starting a mid-term recovery.

- Bearish scenario: Failure to hold $17 leads to a drop toward $15.5 or even $14, where long-term buyers may re-enter.

For now, $LINK sits in the “wait and see” zone — fundamentals screaming bullish, charts whispering caution.