Bitcoin Mining Difficulty Drops, Offering Temporary Relief to Struggling Miners

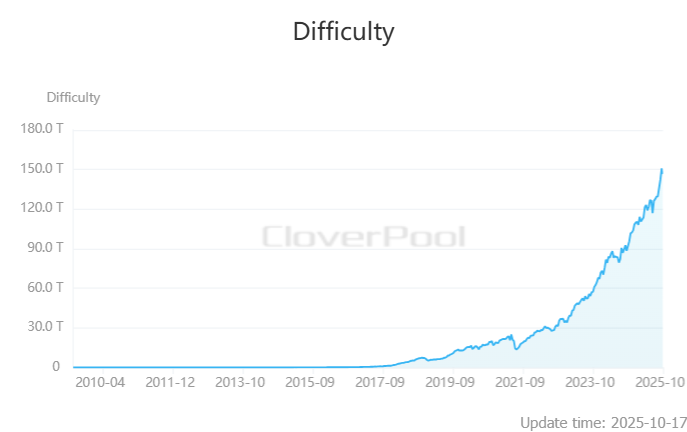

Bitcoin miners are getting a brief reprieve after months of mounting pressure. At block height 919,296, the Bitcoin network recorded its first difficulty drop since June—a 2.73% decrease to 146.72 trillion. The adjustment offers temporary relief after a prolonged period of rising computational demand that pushed many miners to the brink.

In brief

- Bitcoin’s mining difficulty fell 2.73% to 146.72T, marking the first drop since June after months of rising network pressure.

- The decline follows a record difficulty of 150.84T, capping a 29.6% increase in 2025 as competition among miners intensified.

- Hashprice has dropped 11% since mid-September, squeezing miner profits even as network hashrate stays near 1,104.55 EH/s.

- Analysts predict a 3.39% rise in difficulty by late October, meaning this short-term relief could end if network power continues to climb.

Bitcoin Difficulty Falls 2.73% Following Record High

Earlier this month, mining difficulty hit an all-time high of 150.84 trillion, marking a 29.6% increase since January. The sustained climb mirrored a surge in network hashrate and highlighted intensifying competition among mining operations, even as Bitcoin’s market price weakened.

However, with the latest decline, it is now 2.73% easier for miners to discover new blocks than it was during the previous 2,016-block cycle.

For context, Bitcoin mining difficulty measures the level of difficulty in solving the cryptographic puzzle that adds a new block to the blockchain. The network adjusts this level roughly every two weeks to maintain an average block time of around 10 minutes.

Bitcoin’s mining difficulty adjusts based on how quickly miners discover new blocks—rising when blocks are found too fast and falling when they’re found too slowly. This self-correcting mechanism maintains Bitcoin’s block production stability and ensures the network operates smoothly.

Network Hashrate Nears Record High Despite Dip in Mining Revenue

While the recent drop in difficulty provides a breather for miners, mining revenue remains under pressure.

Here are some notable trends in mining revenue:

- As of October 16, 2025, the hashprice—or estimated revenue per petahash per second (PH/s) of hashrate—is about $47.92.

- On September 16, the hashprice was 11% higher, at $53.85.

- Despite declining revenue, the network’s total computing power continues to increase.

The Bitcoin network’s hashrate —a measure of total mining power competing for block rewards—is hovering near its record level of 1,109 exahash per second (EH/s), currently estimated at 1,104.55 EH/s.

Despite having near-peak computational strength, blocks are taking slightly longer to confirm, averaging 10 minutes and 21 seconds instead of the ideal 10-minute target.

At the current rate, analysts expect the next difficulty adjustment, scheduled for around October 30, 2025, to increase by about 3.39%. However, this early projection could change significantly, as only a small portion of the new difficulty epoch’s blocks have been mined.

The recent difficulty drop offers miners brief relief. Yet, with network power still climbing and Bitcoin prices weak , the respite may be short-lived. Unless market conditions improve, the industry could soon face renewed pressure as mining difficulty rises again toward the end of October.