Key Notes

- Ethereum briefly reclaimed $3,900 but remains in a high-risk zone.

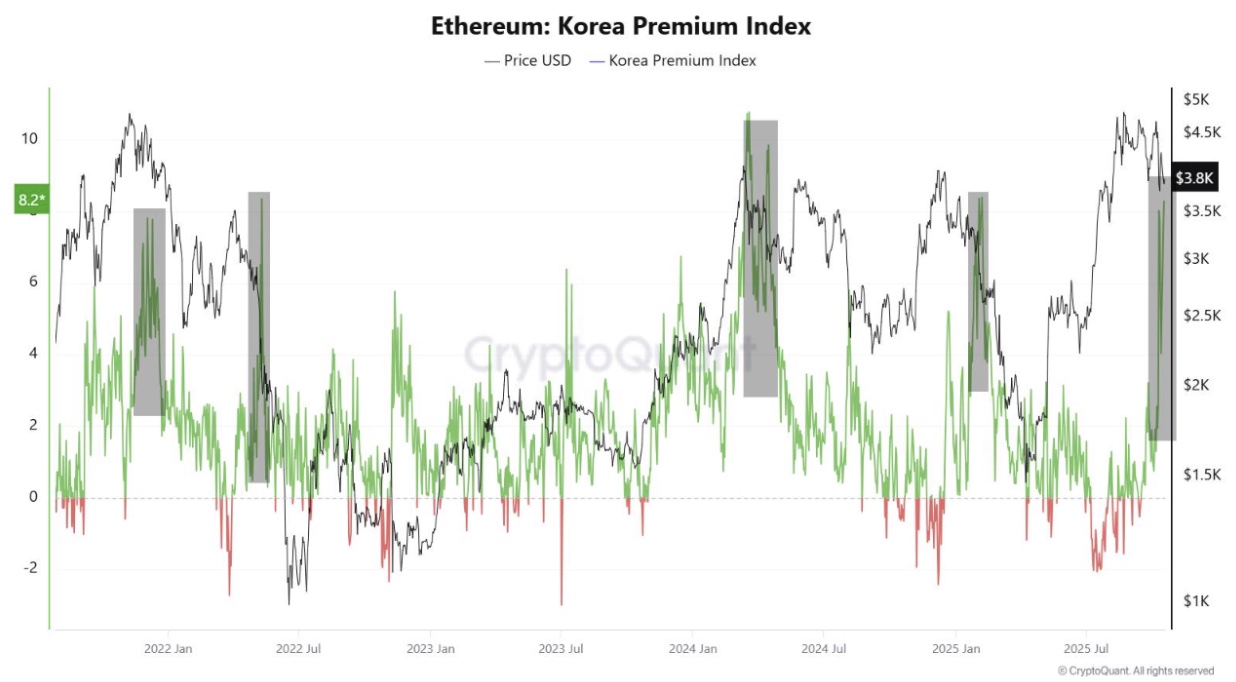

- The Korea Premium Index surged to 8.2%, historically signaling local tops.

- Resistance lies between $3,870 and $3,920, with breakout targets at $4,160-$4,425.

Ethereum (ETH) briefly found its way back above $3,900 on Saturday, a mild rebound after a volatile week that saw price action testing key support levels near $3,600. However, ETH is down 15% monthly, as per CoinMarketCap.

Also, CryptoQuant analysts have warned that ETH now trades in a “high-risk zone” marked by overheated retail sentiment and resistance levels.

At press time, ETH trades at $3,877.40, up 3.4% in the past 24 hours and 1% over the week. The bounce came after prices dipped to a daily low of $3,678.62 before hitting $3,927, just shy of the crucial $4,000 mark .

Trading volume, however, fell sharply by 25% in the same period, suggesting limited activity behind the move, i.e., the rally might not last long.

The Korea Premium Flashes Red

On-chain data from CryptoQuant shows that the Ethereum Korea Premium Index (KPI) has surged to 8.2%, a level historically linked to local market tops and imminent corrections.

The index, which measures the price gap between South Korean and global exchanges, indicates heightened FOMO among Korean retail traders, a warning sign that the rally could be losing fundamental support.

Ethereum: Korean Premium Index | Source: CryptoQuant

Historically, similar spikes in the KPI have preceded sharp retracements. When the premium hit comparable highs in late 2021 and early 2024, Ethereum experienced significant pullbacks in the following weeks.

Analysts state that such elevated readings typically signal excessive retail buying pressure while larger holders use the opportunity to take profits.

$3,870–$3,920: The Key Battle Zone

According to crypto analyst Ted Pillows, Ethereum is now attempting to reclaim a critical support zone between $3,870 and $3,920. His chart suggests that this range will determine whether ETH can regain upward momentum or slip back into a deeper correction.

$ETH is trying to reclaim a key support level.

It had a bullish bounceback from the $3,600-$3,700 level and is now trending higher.

If Ethereum is able to reclaim the $4,000 level, it'll be the first sign of strength. pic.twitter.com/fP0KFDUmSF

— Ted (@TedPillows) October 18, 2025

A clean break above $3,920 could open the door to $4,160 and $4,425, while rejection from this level might send ETH tumbling toward $3,700 and, in a more bearish case, $3,350.

The chart also shows multiple reaction zones aligning with historical demand levels, indicating that ETH is in a broad consolidation pattern. Bulls need a sustained daily close above $4,000 to re-establish a short-term uptrend.

Whale Buys the Dip

Meanwhile, some deep-pocketed investors appear to be quietly buying the dip . A newly activated address accumulated over 4,300 ETH (worth roughly $17 million) in just three days, with purchases near both $4,096 and $3,892.

🦈 A new whale is quietly stacking $ETH again.

a fresh address (0xAeA…DD5fD) has accumulated 4,332 $ETH (~$17.17M) over the past 3 days.

On Oct 15, the whale withdrew 1,506 ETH from OKX at $4,096.82, and today added another 2,825 ETH at $3,892.21, bringing the average cost… pic.twitter.com/vMFdrJCmaF

— Followin (@followin_io) October 18, 2025

This accumulation brings the whale’s average cost to around $3,963, almost at breakeven levels, indicating medium-term confidence in Ethereum’s resilience.