How We Earned $5 Million with an Arbitrage Bot on HyperEVM

From discovering the 2-second price difference vulnerability in HyperEVM blocks, to building an arbitrage bot that outperformed competitors, and finally introducing perpetual contracts to achieve $5 million in profits, we completed this crypto arbitrage battle in 8 months.

Written by: CBB

Translated by: Saoirse, Foresight News

It is now March 2025, and the cryptocurrency industry appears to be on shaky ground, with severe tariff shocks. We have been searching for the next quality opportunity—at that time, 40% of HYPE tokens were still to be distributed to the community, which we saw as a potential breakthrough. As early as February, we had tested some market-making strategies on UNIT assets, but these were small-scale and not yet systematic.

When HyperEVM first launched, several decentralized exchanges (DEXs) were introduced alongside it. My brother suggested, "Why don't we try arbitrage between HyperEVM and Hyperliquid? Even if it costs us something, we might be able to participate in Hyperliquid Season 3 activities." We immediately started experimenting and did find arbitrage opportunities, but we weren't sure if we could be competitive.

Why Are There Arbitrage Opportunities on HyperEVM?

HyperEVM generates a new block every 2 seconds, which means the price of HYPE tokens only updates every 2 seconds. During those 2 seconds, HYPE's price may have already fluctuated, so compared to the Hyperliquid platform, HYPE on HyperEVM often appears "undervalued" or "overvalued."

Initial Attempts and Results

We built the first version of our arbitrage bot, which was fairly basic: whenever there was a price difference between the HyperEVM AMM DEX liquidity pool and the Hyperliquid spot market, it would initiate a trade on HyperEVM and hedge on Hyperliquid.

For example:

- If HYPE's price rises on Hyperliquid, it will be undervalued on HyperEVM;

- Arbitrage process: buy "low-priced" HYPE with USDT0 on HyperEVM → sell HYPE for USDC → convert USDC back to USDT0 on Hyperliquid.

In the first few days, our daily trading volume on Hyperliquid was about $200,000 to $300,000. Not only did we not lose money, but we also made a few hundred dollars in profit. At first, we set the arbitrage threshold so that after deducting AMM DEX and Hyperliquid trading fees, only trades with a profit above 0.15% would be executed.

Two weeks later, as profits continued to grow, we saw greater potential and also discovered two competitors operating exactly the same way as us—though they were small in scale, and we were determined to eliminate them.

In April 2025, Hyperliquid launched a HYPE staking rebate mechanism (staking tokens could reduce trading fees), which was a great opportunity for us—our capital was already larger than our competitors, so we staked 100,000 HYPE, received a 30% trading fee reduction, and lowered our arbitrage profit threshold from 0.15% to 0.05%.

Our goal was clear: force competitors out by maximizing pressure and monopolize the market; at the same time, we planned to increase trading volume to over $500 million within two weeks to upgrade our trading fee tier on Hyperliquid.

Ultimately, both trading volume and profits soared—when trading volume broke $500 million, our competitors were completely passive. I still remember that day: my brother and I were flying from Paris to Dubai, watching the bot "print money" like crazy, making $120,000 in 24 hours, while both competitors shut down their bots.

Nevertheless, some competitors did not give up; they endured higher fees, forcing us to compress our arbitrage profit margin to about 0.04% (basically equal to the fee difference between us and them). Even so, our trading volume remained strong, with daily profits stabilizing between $20,000 and $50,000.

Problems and Solutions During Scale Expansion

As our business scaled up, we encountered new limitations: HyperEVM's gas limit per block was 2 million, and each arbitrage transaction consumed about 130,000 gas, meaning only 7-8 arbitrage trades could be completed per block. Especially as more liquidity pools and DEXs launched on HyperEVM, this limitation became more pronounced, even causing some transaction delays—we had to solve this quickly to avoid transaction queues and order book imbalances.

To address this, we took four measures:

- Activated over 100 wallets, each initiating arbitrage trades separately to avoid transaction queuing from a single wallet;

- Limited to a maximum of 8 arbitrage trades per block;

- Gas price control: when HyperEVM gas prices soared, we raised the required ROI for arbitrage to avoid sending transactions that would get stuck due to high gas costs;

- Transaction rate limiting: if the number of transactions sent in the past 12 seconds exceeded a set amount (x trades), we increased the profit requirement for new trades.

The Era of Optimization and Upgrades: From "Taker" to "Market Maker"

As our profits continued to grow and our trading volume reached 5-10 times that of our competitors, we became obsessed with further optimization—after all, in the crypto industry, you might be making easy profits today and be eliminated by new players tomorrow.

Transitioning to Market Maker: Capturing More Opportunities

In June 2025, my brother proposed an idea he had been brewing for weeks: to conduct arbitrage on Hyperliquid as a "market maker" rather than a "taker" (Note: market makers provide liquidity and place limit orders; takers execute against existing orders). This transition had two major advantages:

- It allowed us to capture more arbitrage opportunities from rapid HYPE price fluctuations;

- Each trade saved 0.0245% in fees, directly boosting profits.

But the transition also came with risks: as market makers, we had to place orders on Hyperliquid first, but couldn't guarantee we could complete the reverse trade on HyperEVM (competitors might be faster), which could lead to order book imbalances and even losses.

During initial testing, we experienced ±10k HYPE imbalances every time—we sometimes sent 100 trades in 20 seconds, but without data analysis tools, we couldn't identify the cause of the imbalance, and things were chaotic.

To solve this, we introduced a series of concepts and turned them into code and parameters:

- Profit range: clearly define when to create orders, when to keep orders, and when to cancel and re-place orders;

- Market maker trading range: limit which AMM liquidity pools we were willing to market-make in (e.g., the 0.05% fee HYPE/USDT0 pool on HyperSwap, the 0.3% fee HYPE/UBTC pool on PRJX);

- Single pool trade size and order count: set maximum trade size and order count for each AMM liquidity pool.

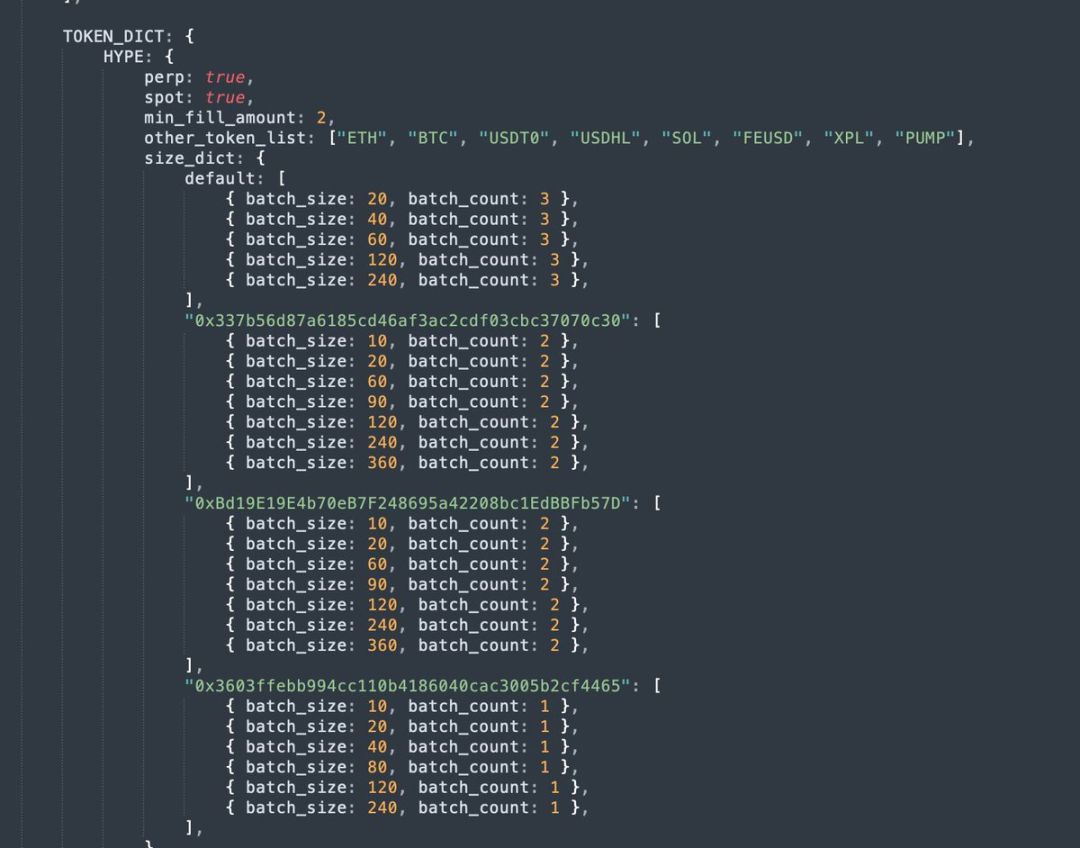

The parameters for market maker trading were as follows:

After several days of fine-tuning, we finally solved the imbalance problem; even if imbalances occasionally occurred, we could quickly adjust using "time-weighted average price" (TWAP) to control risk. This transition was a true "game changer"—while competitors were still stuck in "taker" mode, our trading volume reached 20 times theirs.

Skipping USDT0/USDC Conversion to Reduce Costs

Another major challenge was related to stablecoins: the main stablecoin on Hyperliquid was USDC, while on HyperEVM it was USDT0; the largest trading volume and most arbitrage opportunities on HyperEVM were in the HYPE/USDT0 pool. But because the stablecoins differed across platforms, we had to execute two extra trades on Hyperliquid to complete asset hedging. For example, when HYPE's price surged:

- Market maker order filled → sell HYPE for USDC at zero fee;

- Buy HYPE with USDT0 on HyperEVM;

- Sell USDC for USDT0 as a taker on Hyperliquid (incurring a 0.0245% fee).

The downside of the third step was obvious: not only did we pay taker fees (reducing profits and competitiveness), but the USDT0/USDC market on Hyperliquid was not mature (with spreads and pricing deviations).

To address this, we designed new parameters and logic to skip this step whenever possible:

- USDC balance threshold: only skip USDT0→USDC conversion when USDC balance exceeds $1.2 million;

- USDT0 balance threshold: only skip USDC→USDT0 conversion when USDT0 balance exceeds $300,000;

- Real price data source: call the Cowswap API every minute to get the real USDT0/USDC price, instead of relying on Hyperliquid's order book price.

Introducing Perpetual Contracts to Expand Revenue Sources

First, a disclaimer: throughout our crypto investment journey, we had never used leverage or perpetual contracts (except for a failed attempt on Bitmex in 2018), and we knew little about how they worked.

But we found that HYPE perpetual contracts had much higher trading volume than spot, and lower fees (spot 0.0245% vs perpetual 0.019%). So we decided to try combining arbitrage strategies with perpetual contracts—at the time, no competitors were using this model, so we didn't have to compete for liquidity in the same order book.

More importantly, during testing we found that using perpetual contracts not only earned us arbitrage profits, but also allowed us to profit from the "funding rate"; when HYPE perpetuals traded at a premium or discount to spot, we could capture even more arbitrage opportunities—these were areas our competitors hadn't touched.

We designed new system parameters for this:

- Position limit: set the maximum long/short position size for HYPE perpetuals to avoid liquidation or depleting USDC/HYPE balances;

- Premium/discount monitoring: track the premium or discount of perpetuals relative to spot in real time;

- Premium/discount cap: if the premium is too high, stop opening longs and switch to spot trading;

- Progressive ROI: the larger the position size, the higher the required arbitrage profit, to avoid quickly falling into risky positions;

- ROI calculation formula: combine the perpetual premium/discount and position size for a comprehensive calculation.

Here is an example of the interface/parameter settings for configuring a HYPE token short as a taker:

Introducing perpetual contracts was one of the most critical upgrades—just from funding rates, we earned about $600,000, and we captured even more arbitrage opportunities through premiums/discounts.

Brother Partnership: Collaboration Model and Complementary Strengths

People often ask how we divide work and collaborate. Outsiders seem to think I'm just a "meme guy" who chats on crypto Twitter (CT), while my brother is just a "tech nerd" who writes code. But the reality is much more complex—our collaboration model is similar to when we participated in Blur mining.

In running the arbitrage bot, new problems arise every day that need to be solved promptly. We discuss optimization plans constantly, and any decision must be agreed upon before execution. My brother writes the code, but also develops tools so I can adjust parameters independently; I can't code at all, and my brother isn't good at configuring bot parameters—we complement each other perfectly.

Interestingly, our working styles are completely opposite: my brother likes to push updates and try new features (which I think is excessive); I'm very conservative (he thinks I'm too conservative), and as long as the bot is making stable profits, I don't want to change the current version.

Our daily conversations often go like this:

- Me (impatiently): "The bot is acting weird... Did you change something?"

- Brother: "No... at most I tweaked some minor, irrelevant stuff."

Also, as a two-person team without formal company processes, after the bot iterated through over 250 versions, we sometimes felt that the thing we built became harder and harder to fully understand and control; every update made it difficult to predict what chain reactions it might trigger.

Summary

For the past 8 months, we devoted ourselves entirely to building and optimizing this arbitrage bot—especially in June 2025, when crypto market maker Wintermute entered with massive liquidity and a team, making the competition even fiercer.

I still remember those 5 days in July: my brother and I planned to relax on vacation in Istanbul and Bodrum (Turkish cities), but ended up spending the whole time focused on optimizing the bot.

In the end, our bot maintained the number one position in HyperEVM arbitrage for 8 consecutive months. By October, as our market share gradually declined, we felt it was time to exit.

Key data from this experience:

- Total profit: $5 million;

- Total trading volume on Hyperliquid: $12.5 billion;

- Gas fees paid on HyperEVM: $1.2 million (20% of all gas fees since HyperEVM launched);

- Total time invested: over 2,000 hours;

- Accounted for 5% of total trading volume in the UNIT ecosystem.

Looking forward to Hyperliquid Season 3 and UNIT Season 1.