After experiencing a “bloodbath”-like correction, the price of Bitcoin once fell below the $101,500 mark, and the entire cryptocurrency market was shrouded in an atmosphere of panic and uncertainty. According to data, Bitcoin’s Open Interest has recently plummeted by about 30%.

I. What does a 30% plunge in Open Interest actually mean?

What is “Open Interest” (OI)? You can think of it as the total amount of all unsettled bets in a gambling game. When OI is at historical highs, it means the market is crowded with highly leveraged speculators. The market may appear prosperous, but in reality, it’s like a tower of blocks propped up by matchsticks—any slight price fluctuation could cause the entire structure to collapse.

This plunge in OI is essentially a thorough “market detox” process. It directly reflects the following facts:

* High-leverage longs have been wiped out: Speculative positions that previously entered the market at highs using high leverage have been massively liquidated (i.e., “liquidated”) during this downturn.

* Systemic risk has decreased: A 30% drop in OI means the total potential “gunpowder” in the market has been reduced by nearly a third. Even if prices fall again, the amount of leveraged positions that could be triggered has greatly decreased, making another round of tens-of-billions-level liquidations highly unlikely.

* Funding rates have returned to normal: Along with the drop in OI, the futures market’s “funding rate” has also normalized. Reports indicate that the previously abnormally high positive rate (longs paying shorts) has returned to normal, signaling that the extremely bullish sentiment has receded and the market has returned to rationality.

In other words, the market has just undergone a “physical cooling” after a high fever. Although the process was painful, the body (market structure) has become healthier as a result.

II. From “Leverage-Driven” to “Spot-Driven”

1. Price and Trading: Volatility Narrows, Signs of Bottoming Emerge

* Short-term crash risk eliminated: The biggest positive is that, with the leverage bubble squeezed out, a waterfall-like decline led by derivatives “longs killing longs” is unlikely to repeat in the short term.

* Entering a consolidation and bottom-building phase: The market is likely to move from a “startled bird” state into a period of consolidation and bottom-building. Prices may fluctuate within a range, using time to accumulate upward momentum again.

2. On-chain Fundamentals: A “Clear-out, Not a Failure”

* Investor behavior is rational: On-chain data shows that investors are mostly engaging in stop-loss operations rather than panic selling at any cost. This is a defensive and disciplined approach to capital management.

* Laying the foundation for a new bull market phase: Every bull market needs to go through several deep corrections to clear out weak hands. A healthy, low-leverage environment lays a solid foundation for the next round of more sustainable, spot demand-driven growth.

3. Capital and Liquidity: Opportunities Hidden Amid Institutional Divergence

Despite the gloomy market sentiment, the capital side presents a complex picture:

| Capital Flows | Specific Performance | Market Interpretation |

| ETF Capital Flows | Bitcoin spot ETFs have seen consecutive days of net outflows | Some institutional investors and profit-takers are cashing out, creating short-term selling pressure |

| Long-term Capital Deployment | Funds such as Bitmine are still making long-term, infrastructure-level deployments | Long-term capital has not left the market; instead, it sees the correction as a buying opportunity and remains confident in the industry’s future |

This divergence precisely indicates that the market is shifting from being dominated by short-term hot money to being supported by more stable, long-term capital.

4. Industry and Sentiment: A Tug-of-War Between Panic and Wait-and-See

Optimists believe: “When open interest falls to such an ‘extreme fear’ zone, it often signals a market bottom and exhaustion of selling, creating conditions for the end of a major liquidation cycle and a potential rebound.”

Cautious voices warn: “Although open interest has decreased, any sharp drop in spot prices could trigger a new round of cascading liquidations, and the possibility of testing the $100,000 key support level still exists.”

III. Do Not Be Blindly Optimistic—Two Major “Hidden Reefs” Remain

1. Macro “Black Swan” Shock Risk. The cryptocurrency market is not an isolated island. If there is a sudden change in the global macro economy—such as the Federal Reserve releasing unexpected hawkish signals, escalation of geopolitical conflicts, or key economic data falling far short of expectations—it could trigger a collective sell-off of global risk assets. In this scenario, while Bitcoin may not face the risk of internal leverage collapse, it could still fall into a “slow decline” based on spot selling due to external shocks.

2. Liquidity Drought Risk. The sharp drop in open interest also means that market depth and liquidity may weaken. In a low-liquidity environment, any large sell order is more likely to trigger severe price slippage, leading to a vicious cycle of “small declines causing large volatility.”

IV. How Should Investors Position Themselves?

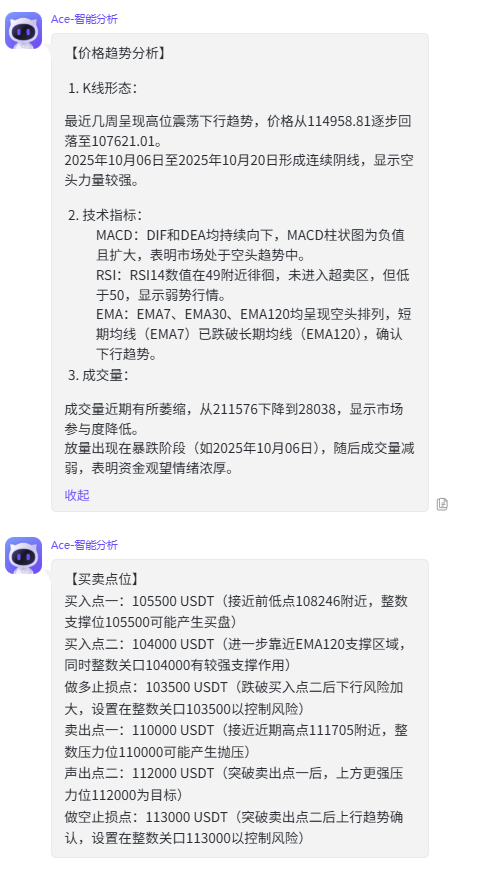

* Short-term traders: You can look for long opportunities near key support levels, as the reduction in liquidation risk has made the trading environment somewhat safer. Set stop-losses to capture rebound profits.

* Long-term investors: This should be seen as a positive “bottoming signal.” You can adopt a “dollar-cost averaging” strategy to gradually establish or increase core positions. The market’s focus will return to spot demand, ETF capital flows, and industry fundamentals.