Something Big Is About to Happen to Bitcoin Price

The U.S. government shutdown has now dragged into its fourth week, shaking investor confidence across Wall Street and spilling into the crypto market. As equities fade and Treasury yields retreat, Bitcoin price has entered a tense consolidation near $108K, teetering between macroeconomic anxiety and regulatory uncertainty. The question now is: does this setup mark the bottom before a breakout—or the calm before another leg down?

How Is the Broader Market Setting the Tone for Bitcoin Price Prediction?

Stocks have turned defensive. The Nasdaq, Dow, and S&P 500 all finished lower as traders absorbed fresh headlines about export restrictions to China and weak corporate earnings. Gold, after suffering its worst daily loss in a decade, managed only a small rebound. Treasury yields eased to 3.95%, suggesting a mild shift to safety, but not outright panic.

In this environment, Bitcoin’s dip from $112K to around $108K mirrors the broader risk-off sentiment. However, unlike equities, crypto traders are also digesting a political subplot: a heated confrontation in Washington over digital asset regulation.

What’s Going On in Washington and Why It Matters for Bitcoin Price?

Crypto executives and U.S. lawmakers met this week in D.C., and it wasn’t pretty. Senate Democrats, frustrated by earlier leaks and perceived lobbying bias, vented at industry leaders in what one senator called a “pissed” meeting. The tension centers around how to regulate decentralized finance (DeFi) and define “control” under the new digital asset bill.

The mood was slightly more relaxed at the Republican meeting, but timing remains critical. With midterms looming in 2026, political gridlock could delay meaningful regulation—keeping uncertainty high for institutional investors.

For BTC price, this tug-of-war is double-edged: clarity could unlock new capital, but prolonged infighting risks another round of policy-driven volatility.

What Does the Chart Say? Is $108K the Line in the Sand?

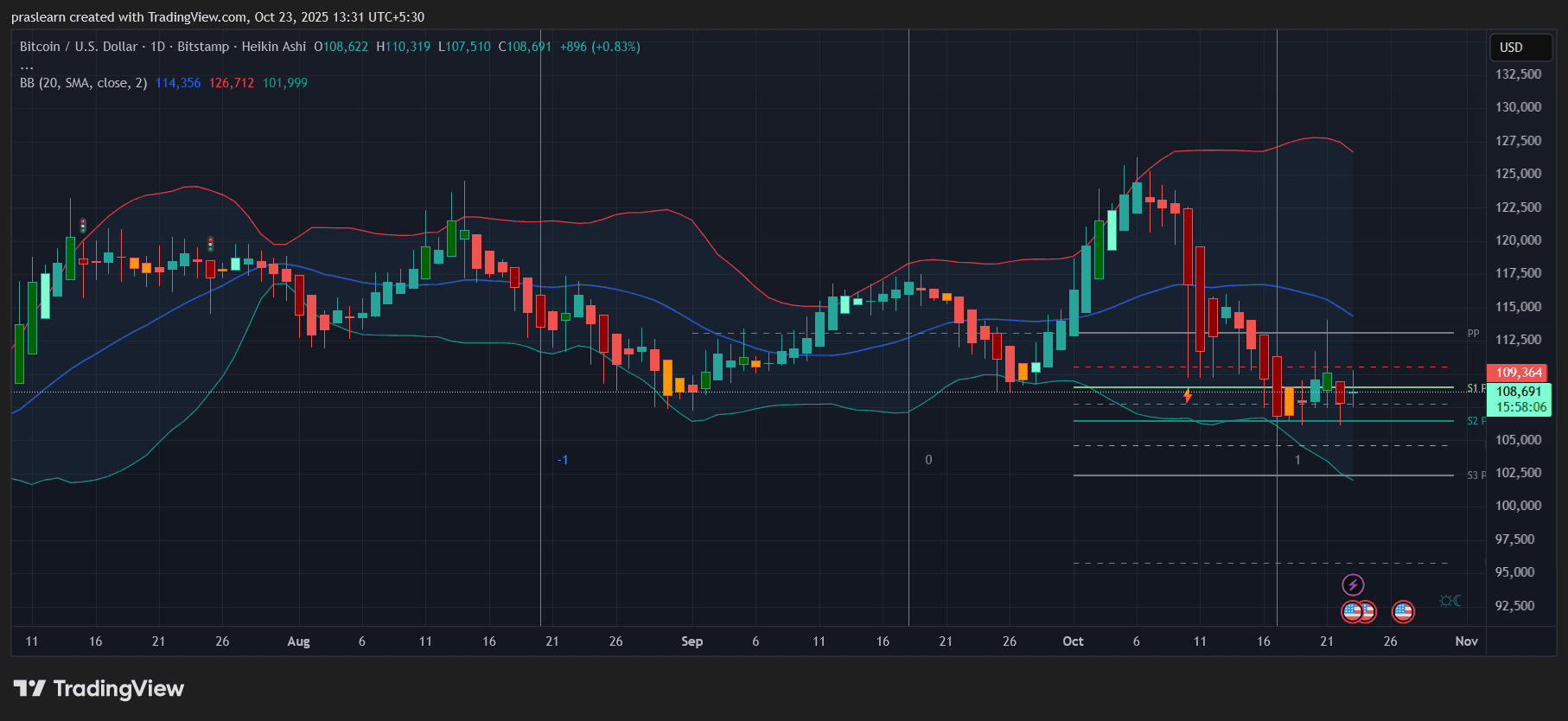

BTC/USD Daily Chart- TradingView

BTC/USD Daily Chart- TradingView On the daily chart, BTC price prediction is locked between the middle and lower Bollinger Bands, with the price hovering around $108,600. The Bollinger squeeze is narrowing, which often signals an impending volatility burst.

Key technical observations:

- Support: Around $105K–$106K, near the lower Bollinger band.

- Resistance: $111K–$112K, aligned with the 20-day moving average.

- Momentum: Heikin Ashi candles show indecision—small-bodied candles with both wicks suggest traders are waiting for a trigger.

- Trend Bias: Still bearish in the short term, as the price remains below the midline of the Bollinger Band and 50-day SMA (~$114K).

If Bitcoin price holds above $107K and reclaims $111K, it could test $115K quickly. But if $105K breaks, the next strong support doesn’t appear until $101K—and below that, the psychological $95K region looms.

Could Regulation or Macroeconomics Trigger the Next Move?

Yes—and both could hit simultaneously. The stalled government shutdown raises fears of delayed federal salaries and reduced liquidity. At the same time, any aggressive move by Senate Democrats to tighten DeFi oversight could cool speculative inflows into crypto.

On the flip side, if the market perceives bipartisan progress on a digital asset framework—especially around exchange registration and stablecoin clarity—Bitcoin could catch a relief rally. Add a dovish Fed tone, and the next breakout could be swift.

What’s the Bitcoin Price Prediction for the Coming Weeks?

The setup suggests that Bitcoin price is in a coiled phase—momentum is compressing, and volatility is about to expand. The bias remains mildly bearish unless Bitcoin reclaims the 20-day SMA.

- Bullish scenario: A close above $112K could open the path to $115K–$118K.

- Bearish scenario: A breakdown below $105K could drag BTC toward $100K–$95K.

Macro triggers like the resolution of the shutdown, regulatory clarity, and next week’s CPI data will likely dictate the direction. Traders should brace for sharp movement within days, not weeks.

$Bitcoin is sitting on the edge of a breakout zone defined by politics, policy, and pressure. The macro winds are shifting, regulation is tightening, and sentiment is cautious—but this kind of compression rarely lasts long. Whether the next major move is up or down depends less on charts and more on whether Washington finds clarity faster than traders lose patience. If $BTC price can weather the noise and hold above $107K, the next stop might not be $95K—but $120K.