CZ and Peter Schiff Ignite Debate Over the True Nature of Tokenized Gold

The recent surge in gold prices has drawn increased attention to tokenized gold. However, experts remain deeply divided over whether it represents “real gold” or merely a risky promise.

Some analysts describe tokenized gold as a unique intersection of technological innovation and financial tradition. Others see it as an outdated concept disguised as progress.

Peter Schiff Plans to Launch Tokenized Gold Platform

The discussion erupted after economist Peter Schiff, a well-known Bitcoin critic, revealed plans to launch his tokenized gold product.

In a live stream with Threadguy, Schiff said he is building a blockchain platform and neobank dedicated to tokenized gold. Last month, he disclosed the token’s name: Tgold. He also predicted that tokenized gold would eventually take market share from Bitcoin.

“I’ve always said that tokenized gold was where blockchain and crypto would ultimately end up. Tokenizing real assets, to increase liquidity and portability, adds value. Tokenizing worthless strings of numbers does not,” Schiff said.

Schiff’s move comes as gold prices have climbed for three consecutive years, recently hitting an all-time high of $4,380 in October before correcting to around $4,100.

Some crypto investors reacted positively, calling this a strong bull case for real-world asset (RWA) tokenization, despite Schiff’s long-standing opposition to Bitcoin.

CZ Criticizes the Concept of Tokenized Gold

Former Binance CEO Changpeng Zhao (CZ) quickly criticized the idea. In a post on X, he emphasized that tokenized gold is not actual “on-chain gold,” but rather a token representing a third party’s promise.

“Tokenizing gold is NOT ‘on-chain’ gold. It’s tokenizing that you trust some third party will give you gold at some later date, even after their management changes, maybe decades later, during a war, etc. It’s a ‘trust me bro’ token. This is the reason no ‘gold coins’ have really taken off,” CZ wrote.

Financial analyst Shanaka Anslem Perera agreed with CZ, expanding the argument to include custodial risks. In a detailed post on X, Perera called tokenized gold “the great custodial lie” — a 20th-century product dressed in 21st-century technology.

He cited historical examples such as the 1933 Gold Confiscation, the 1971 closure of the gold window, and the 2023 LBMA delivery failures to illustrate the risks tied to third-party storage and management.

These expert opinions have fueled growing skepticism among investors toward the tokenized gold sector, which currently holds a market capitalization exceeding $3.8 billion.

Bitwise Highlights the Growing Tokenization Trend

Despite the controversy, Bitwise Investments remains optimistic about tokenizing real-world assets. Its latest Q3 market report emphasized that tokenized assets have reached new highs and are emerging as stablecoins’ “cousins, ” offering global liquidity and 24/7 trading potential.

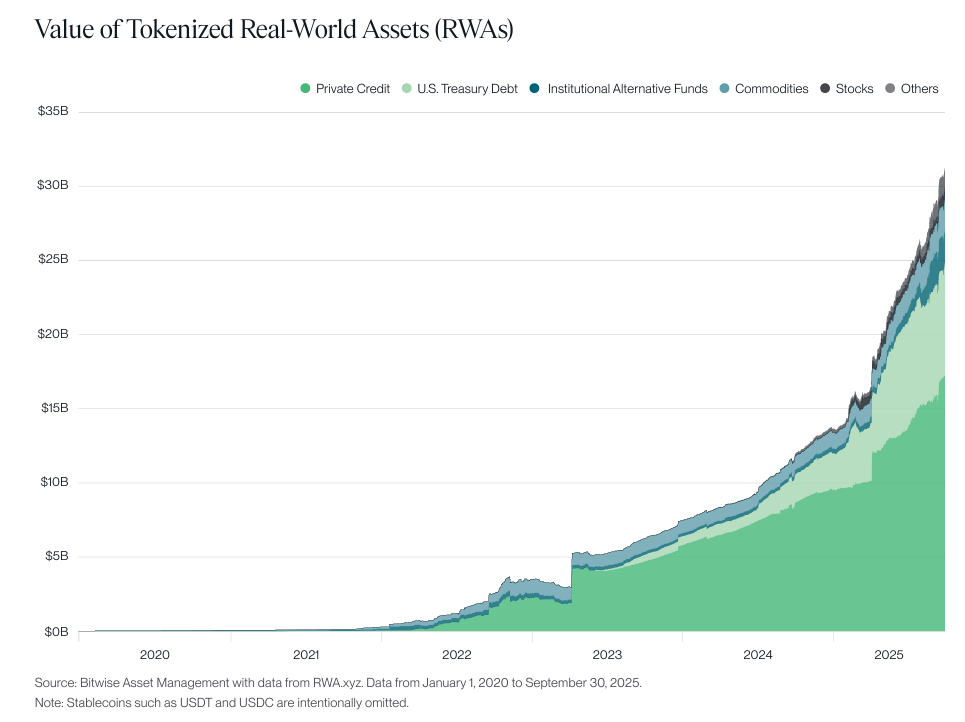

Value of Tokenized Real-World Assets. Source: Bitwise

Value of Tokenized Real-World Assets. Source: Bitwise “For the past fifteen years, crypto has been largely synonymous with Bitcoin. That’s changing. Q3 2025 will go down as the quarter that crypto firmly got a second story, with ‘stablecoins and tokenization’ taking its place alongside ‘digital gold’ as a key narrative for crypto,” Matt Hougan, Chief Investment Officer of Bitwise Asset Management, said.

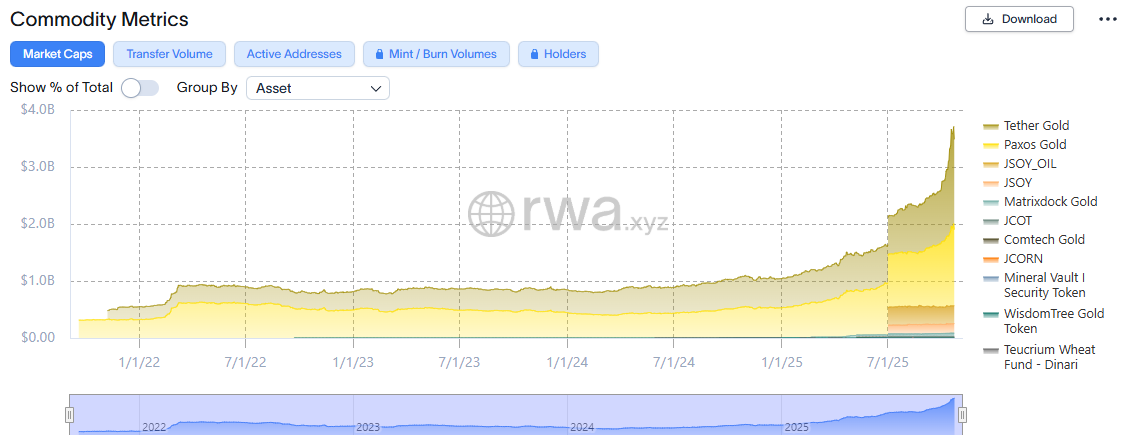

Data on the RWA sector further illustrates the rapid growth of tokenized gold. Charts show Tether Gold (XAUT) and PAX Gold (PAXG) leading the category, with market caps surpassing $1.5 billion and $1.3 billion, respectively, in Q3.

Tokenized Commodities Market Cap. Source: RWA.xyz

Tokenized Commodities Market Cap. Source: RWA.xyz Regardless of ongoing debates among industry leaders, the sector continues to expand — as the numbers clearly show.