Bloomberg: Peso crisis escalates, stablecoins become a "lifeline" for Argentinians

Original Title: Why Argentines Are Turning to Crypto in the Latest Peso Crisis

Original Author: Maria Clara Cobo, Bloomberg

Translated by: Luffy, Foresight News

As the midterm elections approach, Argentine President Javier Milei is tightening foreign exchange controls to support the peso’s exchange rate, while Argentine citizens like Ruben López are turning to cryptocurrency to protect their savings.

Bitcoin sign outside a cryptocurrency exchange in Buenos Aires

A new strategy has emerged: using stablecoins pegged 1:1 to the US dollar to leverage the difference between Argentina’s official exchange rate and the parallel market rate. Currently, the peso’s value under the official rate is about 7% higher than in the parallel market. Crypto brokers say the trading process works as follows: first, buy US dollars and immediately exchange them for stablecoins; then convert the stablecoins into pesos at the cheaper parallel market rate. This arbitrage operation, known as “rulo,” can quickly earn up to 4% profit per transaction.

Milei at a campaign rally in Buenos Aires on October 17

“I do this trade every day,” said López, a stockbroker in Buenos Aires, who uses cryptocurrency to hedge against inflation.

This crypto operation reflects a shift in how Argentines are coping with a new wave of economic turmoil. Ahead of the October 26 election, Argentina is depleting its US dollar reserves to boost the peso and prevent the exchange rate from breaking out of its trading band. Even with substantial US support, investors still expect the peso to depreciate further after the election.

Recently, the Central Bank of Argentina introduced new regulations prohibiting citizens from reselling US dollars within 90 days to curb rapid arbitrage trading, and the “rulo” arbitrage model emerged almost immediately. On October 9, trading platform Ripio reported, “The trading volume of stablecoins against the peso surged 40% in a single week,” citing that “users are profiting from exchange rate fluctuations and market opportunities.”

For some Argentines, such operations are a necessity. After all, the country has defaulted on its debt three times this century. When Milei was elected in 2023, he promised to end these financial woes. He has indeed achieved some results, such as reducing the annual inflation rate from nearly 300% to about 30%; but the peso’s exchange rate has still depreciated sharply, partly due to Milei’s currency devaluation policy upon taking office, and partly due to increased investor concerns about the upcoming election.

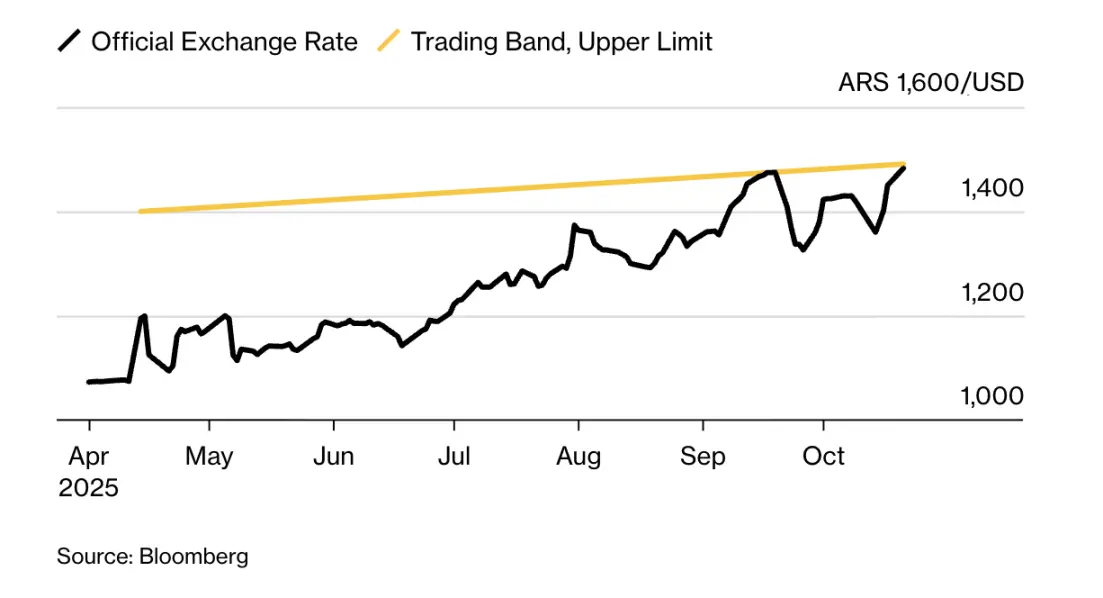

Peso exchange rate approaching the upper limit of the trading band

The “rulo” arbitrage phenomenon shows that the role of cryptocurrency in Argentina has fundamentally changed: from a novelty that once piqued the curiosity of citizens, including Milei himself, to a financial tool for protecting savings. In the US, cryptocurrency is often used as a speculative tool; but in Latin America, it has become a choice for seeking stability. In countries like Argentina, Venezuela, and Bolivia, crypto technology helps people avoid the triple pressures of “currency volatility, high inflation, and strict foreign exchange controls.”

“We provide users with channels to buy crypto with pesos or dollars and then sell for profit—this is our daily business,” said Manuel Beaudroit, CEO of local crypto exchange Belo. “Obviously, the exchange rate difference can bring considerable profits.” He mentioned that in recent weeks, traders could earn 3%-4% per transaction, but also warned that “this level of return is very rare.”

Cryptocurrency exchange services outside a store in La Paz, Bolivia

Other trading platforms have seen similar situations. Another local platform, Lemon Cash, said that on October 1, the day the Central Bank of Argentina’s 90-day ban on dollar resales took effect, its total crypto trading volume (including buying, selling, and exchanging) surged 50% above average levels.

“Stablecoins are undoubtedly a tool for obtaining cheaper US dollars,” said Julián Colombo, Argentina head of another trading platform, Bitso. “Cryptocurrency is still in a regulatory gray area, and the government has yet to clarify how to regulate stablecoins or restrict their liquidity, which has created conditions for the rise of ‘rulo’ arbitrage.”

However, the growth in stablecoin trading is not solely due to arbitrage. As the Milei administration faces a critical election and the economy comes under renewed pressure, many Argentines are also using cryptocurrency as a tool to hedge against further peso depreciation.

“Inflation and political uncertainty have made us more conservative, so I have no peso savings or investments—I only use pesos for daily expenses,” said Nicole Connor, head of the ‘Women in Crypto Alliance’ in Argentina. “All my savings are in crypto and stablecoins, and I try to earn returns through them.”

Exchange rate sign inside a store in Buenos Aires

Nevertheless, crypto operations are not without risks. In Argentina, stock market trading is tax-exempt, but profits from crypto trading are subject to taxes of up to 15%; in addition, frequent trading may attract the attention of banks, which often require proof of funds from users who repeatedly make large transfers.

But analysts believe that as economic difficulties persist, Argentina’s reliance on stablecoins may deepen; across Latin America, more and more people are using such tools to protect their assets against fiscal turmoil and election shocks.

“Stablecoins will always exist,” said stockbroker López. “The US dollar holds an important place in Argentine society and daily life because it is our safe haven against local currency risk.”