Written by: Maria Clara Cobo

Translated by: Luffy, Foresight News

Bitcoin sign outside a cryptocurrency exchange in Buenos Aires

As the midterm elections approach, Argentine President Javier Milei has tightened foreign exchange controls to support the peso, while Argentine citizens like Ruben López are turning to cryptocurrency to protect their savings.

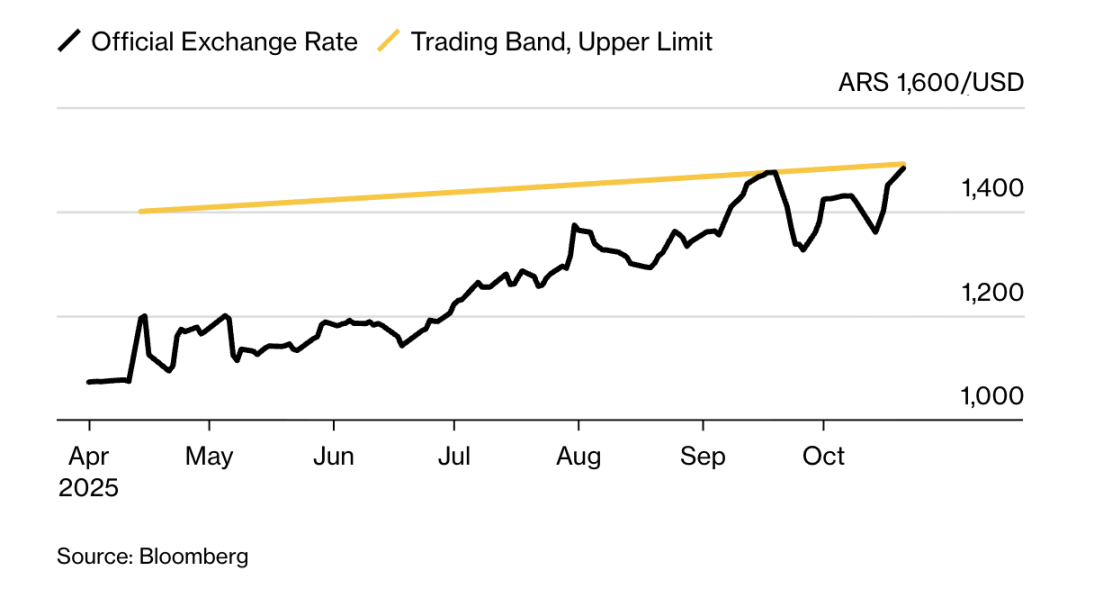

A new strategy has emerged: using stablecoins pegged 1:1 to the US dollar to leverage the difference between Argentina's official exchange rate and the parallel market rate. Currently, the value of the peso at the official rate is about 7% higher than in the parallel market. According to cryptocurrency brokers, the trading process is as follows: first, buy US dollars and immediately convert them into stablecoins; then exchange the stablecoins for pesos at the cheaper parallel market rate. This arbitrage operation, known as "rulo," can quickly earn up to 4% profit per transaction.

On October 17, Milei at a campaign rally in Buenos Aires

"I do this trade every day," said López, a stockbroker in Buenos Aires, who uses cryptocurrency to hedge against inflation.

This cryptocurrency operation reflects a shift in how Argentinians are coping with a new wave of economic turmoil. Ahead of the October 26 election, Argentina is depleting its dollar reserves to boost the peso and prevent the exchange rate from breaking out of its trading band. Even with substantial US support, investors still expect the peso to depreciate further after the election.

Recently, the Central Bank of Argentina introduced new regulations prohibiting citizens from reselling US dollars within 90 days to curb rapid arbitrage trading, and the "rulo" arbitrage model appeared almost immediately. On October 9, trading platform Ripio stated, "The trading volume of stablecoins against the peso surged 40% in a single week," because "users are profiting from exchange rate fluctuations and market opportunities."

For some Argentinians, such operations are a necessity. After all, the country has defaulted on its debt three times this century. When Milei was elected in 2023, he promised to end these financial woes. He has indeed achieved some results, such as reducing the annual inflation rate from nearly 300% to about 30%; but the peso has still depreciated significantly, partly due to Milei's currency devaluation policy upon taking office, and partly due to recent investor concerns about the election.

Peso exchange rate approaching the upper limit of the trading band

The "rulo" arbitrage phenomenon shows that the role of cryptocurrency in Argentina has fundamentally changed: from a novelty that attracted curiosity—including from Milei himself—to a financial tool for people to protect their savings. In the US, cryptocurrency is often used as a speculative tool; but in Latin America, it has become a choice for those seeking stability. In countries like Argentina, Venezuela, and Bolivia, crypto technology helps people cope with the triple pressure of "currency volatility, high inflation, and strict foreign exchange controls."

"We provide users with channels to buy cryptocurrency with pesos or US dollars and then sell for profit—this is our daily business," said Manuel Beaudroit, CEO of local cryptocurrency exchange Belo. "Obviously, the exchange rate difference can bring considerable profits." He mentioned that in recent weeks, traders can earn 3%-4% per transaction, but also reminded that "this level of return is very rare."

Cryptocurrency exchange services outside a store in La Paz, Bolivia

Other exchanges have seen similar situations. Another local platform, Lemon Cash, said that on October 1, the day the Central Bank of Argentina's 90-day ban on selling US dollars took effect, its total cryptocurrency trading volume (including buying, selling, and exchanging) surged 50% above the average level.

"Stablecoins are undoubtedly a tool for obtaining cheaper US dollars," said Julián Colombo, head of Argentina at another trading platform, Bitso. "Cryptocurrency is still in a regulatory gray area, and the government has yet to clarify how to regulate stablecoins or restrict their liquidity, which has created the conditions for the rise of 'rulo' arbitrage."

However, the growth in stablecoin trading is not solely due to arbitrage. As the Milei government faces a crucial election and the economy comes under renewed pressure, many Argentinians are also using cryptocurrency as a tool to hedge against the potential further depreciation of the peso.

"Inflation and political uncertainty have made us more conservative, so I have no peso savings or investments, and only use pesos for daily expenses," said Nicole Connor, head of the Argentine "Women in Crypto Alliance." "All my savings are in cryptocurrency and stablecoins, and I try to earn returns through them."

Exchange rate sign inside a store in Buenos Aires

Nevertheless, cryptocurrency operations are not without risks. In Argentina, stock market transactions are tax-exempt, but profits from cryptocurrency trading are subject to a tax rate of up to 15%. In addition, frequent trading may attract the attention of banks, which often require proof of funds for users who repeatedly make large transfers.

But analysts believe that as economic difficulties persist, Argentina's reliance on stablecoins may deepen; across Latin America, more and more people are using such tools to protect their assets against fiscal turmoil and election shocks.

"Stablecoins will always exist," said stockbroker López. "The US dollar occupies an important place in Argentine society and daily life because it is our safe haven against local currency risk."