AI Coins Boom or Bubble? The Power Play Behind the Hype

The AI revolution has not only inflated the market caps of chipmakers and cloud giants—it’s now rewriting the economics of energy. But here’s the thing: the frothiest corner of the AI trade isn’t in semiconductors or software. It’s in power. Specifically, nuclear power. And that’s where the cracks may already be showing.

Why Are AI Power Stocks Skyrocketing?

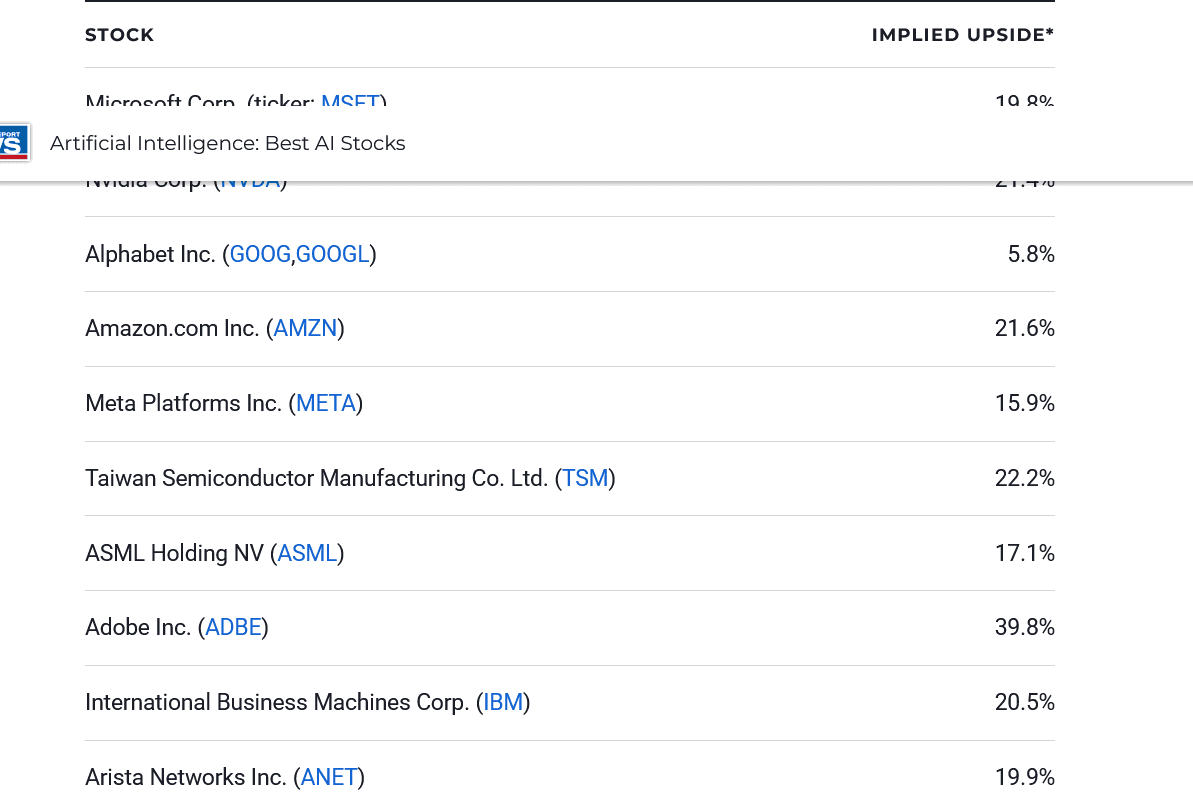

Image Source: US News

Image Source: US News AI models are energy-hungry. Training large language models like GPT or running fleets of inference servers requires massive electricity. Investors, seeing this, have connected the dots—AI equals power demand, and power demand equals profit.

That logic has pushed valuations of power providers through the roof. According to the analysis , the median price-to-sales ratio for AI-exposed power stocks has jumped from 1.52 in 2023 to 4.53 in 2025. That’s nearly a 200% increase in just two years. For comparison, cloud providers—already richly valued—rose from 6.34 to 10.5 in the same period.

But unlike Big Tech , many of these energy firms aren’t making money yet. Five of the fourteen companies in the “AI power basket” are expected to post losses this year. This is the red flag—when valuations rise faster than earnings, corrections can be brutal.

The Nuclear Frenzy: Efficiency or Euphoria?

Tech giants like Microsoft, Amazon, Google, and Meta are signing billion-dollar deals with established nuclear power firms such as Constellation Energy and Vistra. The appeal is clear: nuclear energy offers carbon efficiency and long-term reliability.

However, the real speculation lies in the nuclear startups. NuScale Power, for instance, was valued at over $15 billion despite generating just $37 million in revenue and expecting profitability only by 2029. Oklo went even further—its market cap hit $25.7 billion earlier this month without a single dollar of revenue and no operational reactors.

That’s not a boom—that’s belief. Investors are treating future energy dreams like present-day cash flows. And when sentiment flips, gravity hits hard.

The Echo of Dotcom Euphoria

This isn’t the first time markets have mixed innovation with irrational exuberance. The AI sector’s structure mirrors parts of the Dotcom era: early-stage firms raising billions on potential rather than performance, while established giants like Nvidia and Microsoft soak up real profits.

The difference? Today’s AI buildout is financed by highly profitable megacaps with real cash flow. That makes the overall system more stable—but it doesn’t protect every corner of the trade. The speculative zones, like nuclear startups and AI infrastructure firms with little revenue, could face steep revaluations when the optimism fades.

The Volatility Signal: Sentiment Rules

The recent market swings show how fragile this optimism is. Constellation, Vistra, and GE Vernova all lost over 10% midweek before recovering. Upstarts like NuScale, Oklo, and Fermi fell more than 25% in two days, then clawed back some ground.

That pattern—sharp drawdowns followed by partial recoveries—signals speculative money at work. These stocks are sentiment-driven, not earnings-driven. In other words, they trade on hype cycles rather than financial fundamentals.

The Rise of AI Coins: Fueling the Same Mania?

While equity markets chase AI exposure through energy and semiconductors, the crypto world has found its own version of the trade—AI coins. Tokens like Fetch.ai (FET) , SingularityNET (AGIX) , Ocean Protocol (OCEAN) , and Bittensor (TAO) have rallied hundreds of percent this year on the promise of merging blockchain and artificial intelligence.

Here’s what’s really happening: investors are betting on decentralized AI networks to challenge the dominance of centralized models like OpenAI. These projects claim to offer privacy, distributed computing, and token-based incentives for AI development. But most of them are still in experimental phases, with little real-world adoption or stable revenue models.

The total market capitalization of AI coins has soared past $30 billion, but most of that value is driven by narrative, not fundamentals. Much like nuclear startups, these coins are speculative proxies for a future that hasn’t arrived yet.

The connection between AI power stocks and AI cryptocurrencies is psychological—both are fueled by the same optimism that the AI revolution will create new economic empires. But when enthusiasm runs ahead of utility, history shows how fast capital retreats.

What This Means for Investors

Here’s the uncomfortable truth: the most hyped part of the AI ecosystem isn’t chips or software—it’s electricity and, now, tokens. Nuclear power providers are being priced like tech stocks, and AI cryptocurrencies are being treated like early-stage venture capital bets.

That doesn’t mean the long-term vision is wrong. AI will need enormous amounts of power and possibly decentralized data layers to operate securely. But timing matters. Both the infrastructure buildout and blockchain-AI integration will take years to mature. The current valuations reflect emotion more than execution.

So, Boom or Bubble?

Both. The AI economy itself is real and transformative. The energy demands it creates are undeniable. The idea of tokenized AI systems is fascinating. But the speculative layers built on top—nuclear startups with no reactors and tokens with no working products—look increasingly fragile.

Think of it like the early 2000s: the internet wasn’t a fad, but not every dotcom survived. The same logic applies here. AI’s long-term winners will be those combining real earnings, functional products, and sustainable energy integration—not those priced purely on dreams.

AI is powering a new industrial and financial cycle, but in the rush to fund its future, both Wall Street and crypto investors may be inflating a familiar bubble—this time glowing nuclear and minted on blockchain.