Bitcoin Price Slips Below $110,000 As Conviction Continues To Erode

Bitcoin (BTC) extended its decline this week, slipping below the key $110,000 mark as investor conviction weakened amid shifting market conditions.

The crypto king’s failure to sustain its previous recovery attempts reflects fading bullish momentum and growing uncertainty over near-term support levels. With selling pressure intensifying, Bitcoin’s path to recovery may face delays.

Bitcoin Holders Are At Fault

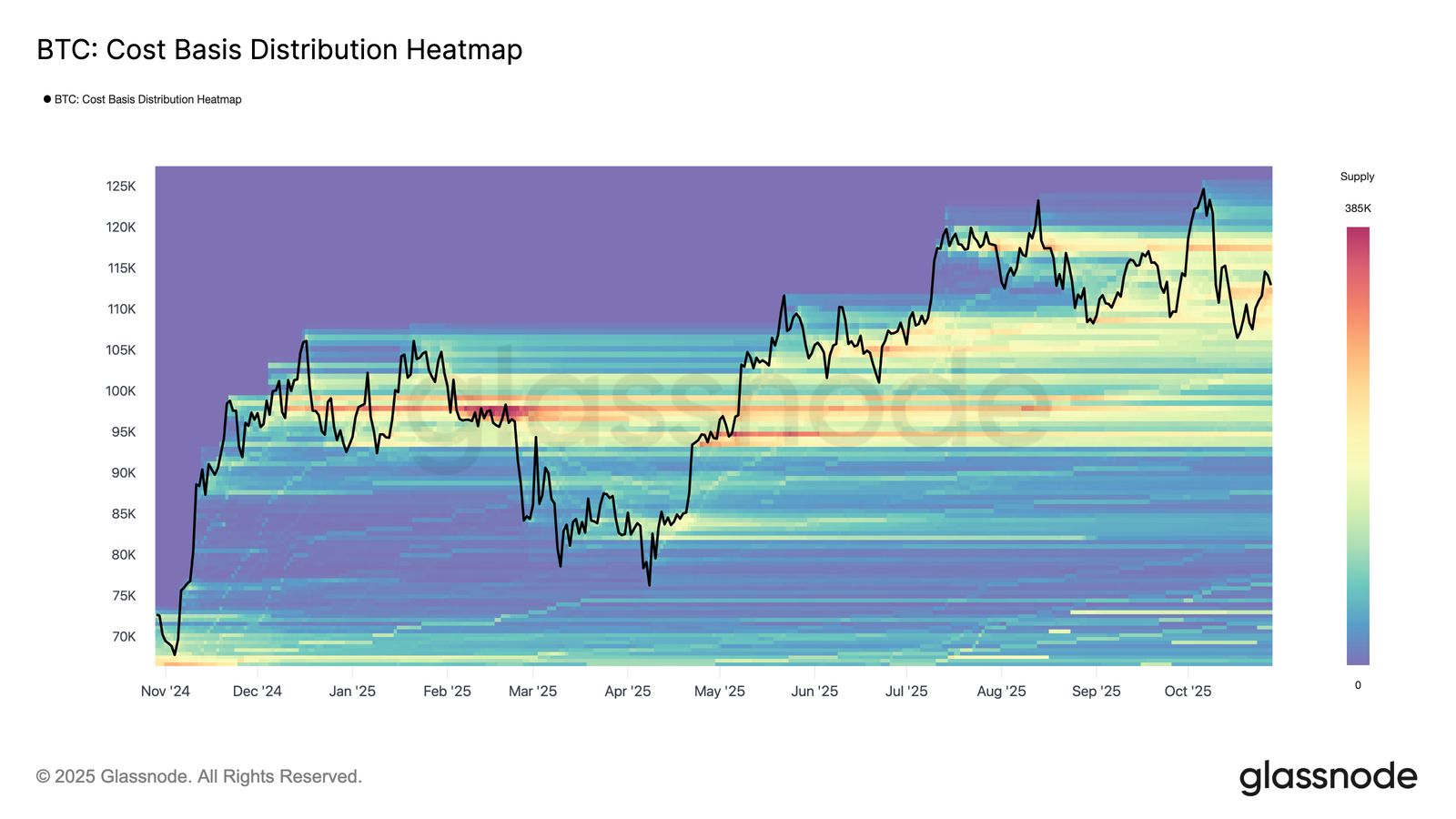

The Cost Basis Distribution Heatmap highlights how Bitcoin’s price rebounded from the midline near $116,000 before retreating to around $113,000. This pattern closely resembles previous post-all-time-high (ATH) bounces observed in Q2–Q3 2024 and Q1 2025. In those instances, short-lived rallies were quickly met with heavy supply, capping any meaningful upward movement.

Renewed selling from long-term holders (LTHs) is now amplifying resistance within this zone. Many investors who accumulated during prior highs appear to be taking profits, creating additional headwinds for BTC. As a result, each attempt to recover toward $115,000 has been absorbed by overhead supply, suggesting that sentiment remains fragile.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Bitcoin Cost Basis Distribution Heatmap. Source: Glassnode

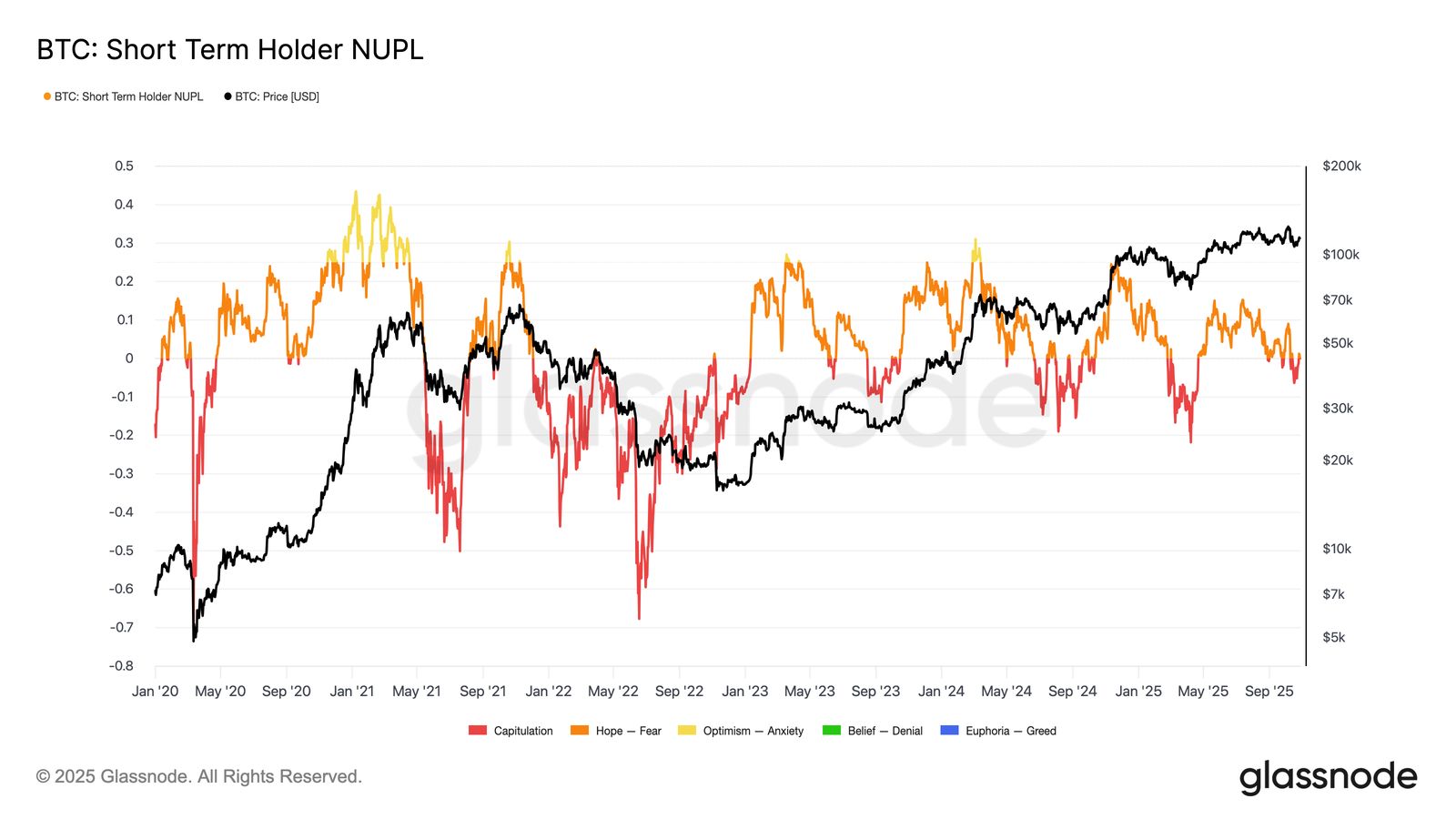

Bitcoin Cost Basis Distribution Heatmap. Source: Glassnode Bitcoin’s Short-Term Holder Net Unrealized Profit/Loss (STH-NUPL) metric shows that the market sits in a delicate balance. Conditions have not yet entered full capitulation, but bullish momentum is fading as conviction erodes.

Historically, such transitions often precede prolonged consolidation periods, especially when investor confidence weakens. If time continues to work against the bulls, BTC may face deeper corrections. The lack of sustained accumulation or renewed inflows could result in additional selling, especially as traders move to secure profits before volatility increases further.

Bitcoin STH-NUPL. Source: Glassnode

Bitcoin STH-NUPL. Source: Glassnode BTC Price Is Looking to Reclaim Its Losses

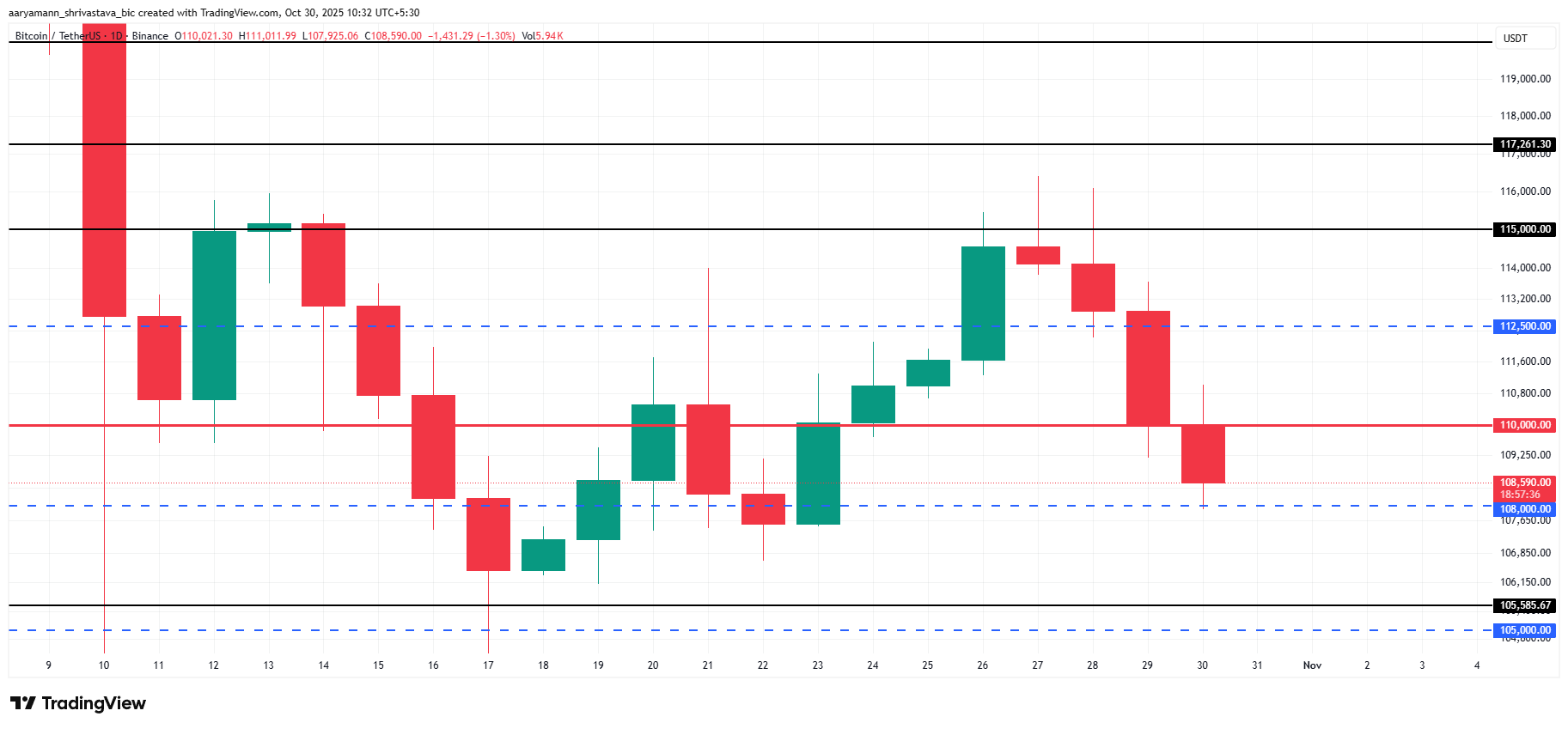

At the time of writing, Bitcoin trades at $108,590, holding slightly above the critical $108,000 support. The decline follows another failed attempt to break past $115,000 — the second in less than a month.

Continued selling by long-term holders is likely restricting Bitcoin’s growth. For now, BTC’s immediate goal is to maintain its position above the $105,000 support. A stable base here could prevent deeper losses and attract new buyers at discounted levels.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView To invalidate the bearish thesis, Bitcoin must reclaim $110,000 as a support floor and breach $115,000 decisively. Doing so could restore momentum and push prices toward $117,261, opening the door for renewed optimism heading into November.