Bitcoin Faces $4B in Short Liquidation Risk at $112,600: Can the Descending Wedge Trigger a Bullish Reversal?

- Bitcoin’s short liquidation risk exceeds $4B, concentrated between $108,000 and $113,000.

- A significant short liquidation cluster appears at $112,600, with $3B in shorts at risk.

- A breakout from a descending broadening wedge pattern suggests potential for a bullish reversal.

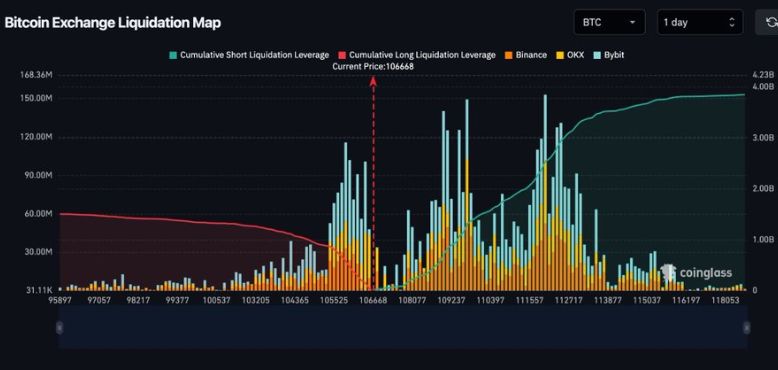

In a recent market development, the Bitcoin Exchange Liquidation Map presents liquidation levels across major exchanges within a one-day timeframe. At the time of observation, the current Bitcoin price is $106,668, positioned near the center of the observed liquidation zones as market analysts observe BTC break out of a descending broadening wedge.

Bitcoin Market Faces Massive Short Liquidation Risk

Whale Insider post reveals that cumulative long liquidation leverage remains under $70 million, showing declining exposure above the current price level. In contrast, cumulative short liquidation leverage exceeds $4 billion, rising steadily beyond $110,000. A significant liquidation cluster appears between $108,000 and $113,000, indicating heavy short positioning on Binance, OKX, and Bybit. At $112,600, over $3 billion worth of short positions face liquidation risk.

Trading volumes rise sharply as prices approach this threshold, particularly across Binance and OKX. The distribution shows shorts dominating the upper price range, while long liquidations concentrate below $105,000. This structure reflects the accumulation of increasing leverage above current market levels. Liquidity concentrations reveal potential volatility zones aligning with high-volume short exposure nearing critical resistance around $112,600.

Bitcoin Breaks Out of Descending Broadening Wedge

As the liquidation risk remains, market analysts have hinted at a market price uptick. According to an observation by Trader Tardigrade, BTC is adhering to a descending broadening wedge pattern. This pattern forms during a downtrend, with the price oscillating between two diverging trendlines. In this case, the upper trendline is sloping downward, and the lower trendline is also downward but at a steeper rate.

The price action shows a series of lower highs and lower lows, reinforcing the pattern’s bearish setup. A noticeable price shift appears near the right end of the chart. The price breaks above the upper trendline, indicating a potential reversal. A bullish signal emerges as the price attempts to move upward following this breakout.

The volume, though not explicitly marked, could play a critical role in confirming the pattern’s validity and potential continuation. Based on this movement, traders monitor the breakout for further confirmation. If the price maintains its upward momentum, it could signal the end of the current downtrend. The breakout may lead to a trend reversal, with Bitcoin’s price targeting higher levels.