Crypto Market Performance: Why November Could Be the Next Big Month

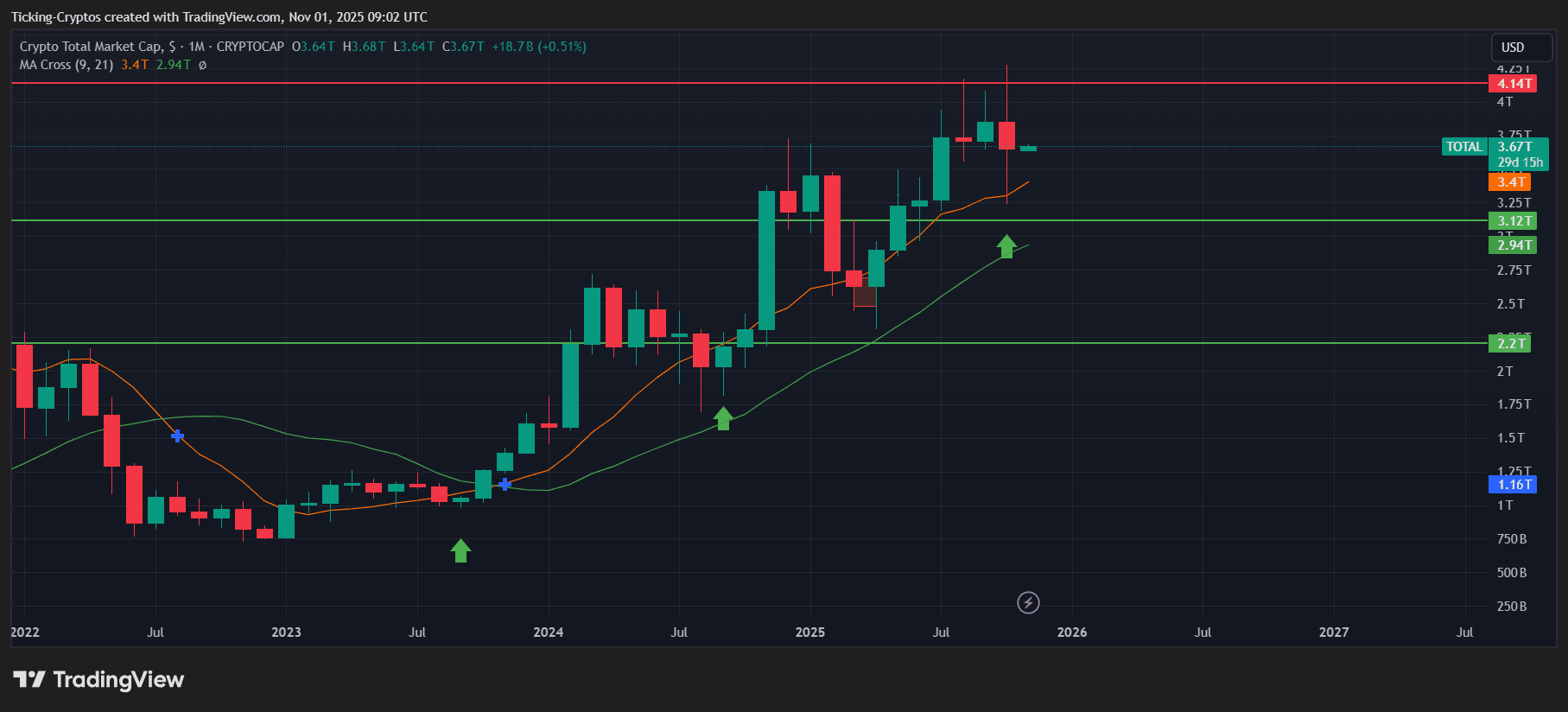

Three-Year Crypto Market Overview

Over the last three years, the crypto market has moved from volatility to consistent strength. From the uncertain conditions of 2023 to the steady expansion in 2024 and the explosive gains of 2025, this three-year cycle reflects growing maturity and institutional confidence across digital assets.

The months from September to November reveal an interesting pattern — often serving as a pivot period between correction and expansion.

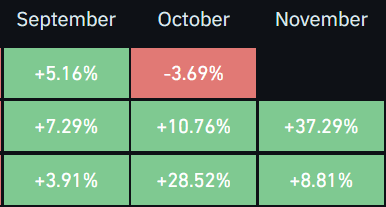

2023: A Year of Caution and Reversal

In 2023, the crypto market was still healing from the bear cycle.

- September 2023: +5.16% — early recovery signs.

- October 2023: -3.69% — market hesitation before the turnaround.

- November 2023: +37.29% — a stunning rebound, signaling renewed liquidity and Bitcoin’s early move above $35K.

This November surge ignited new confidence and set the tone for 2024’s bullish structure.

2024: Steady Growth and Solid Momentum

The following year, 2024, was marked by consolidation, renewed adoption, and ETF-driven inflows.

- September: +7.29% — steady climb led by Bitcoin halving anticipation.

- October: +10.76% — strong mid-quarter rally driven by capital rotation into altcoins.

- November: +8.81% — sustained gains as traders locked in profits without major corrections.

The pattern of “green Septembers and Octobers leading into profitable Novembers” became clear.

2025: Acceleration Toward a Bullish November

Now, 2025 continues the uptrend with larger movements and stronger institutional presence.

- September: +3.91% — moderate, but stable accumulation.

- October: +28.52% — a major jump, reversing last year’s hesitation and proving market strength.

This steep October rise historically precedes another positive November. Based on prior trends, November 2025 could deliver gains between +10% and +20%, led by continued Bitcoin ETF inflows, stronger altcoin cycles, and increased retail participation.

Why November 2025 Could Be the Next Big Month

Historically, November has been one of crypto’s strongest months — often driven by institutional portfolio adjustments and year-end rallies.

Key bullish factors for 2025 include:

- Expanding ETF products in the U.S. and Europe.

- Renewed global adoption following pro-crypto policies.

- Record liquidity rotation into digital assets from traditional markets.

If this pattern holds, Bitcoin could challenge new all-time highs, while altcoins follow with double-digit percentage gains.