Pi Coin Price Bounce Isn’t Over Yet? Two Bullish Charts Show Why

The Pi Coin price rebound is surprising many traders. Over the past week, it’s up 17.3%, trimming monthly losses to just 5.4%. Even the last 24 hours have seen mild gains of around 0.6%.

The broader setup now hints at a continuation of this recovery. Let’s look at what the charts reveal and why the bounce might still have some room to run.

Daily and 4-Hour Charts Show Momentum Building

The first sign of strength comes from the daily chart. Between October 30 and November 1, PI price made a higher low while the Relative Strength Index (RSI) — which measures buying versus selling strength on a scale of 0 to 100 — made a lower low. This mismatch, called a hidden bullish divergence, often signals that sellers are losing control and the near-term uptrend (the weekly one) might continue.

Pi Coin Flashes Bullishness (daily timeframe): TradingView

Pi Coin Flashes Bullishness (daily timeframe): TradingView Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

This daily RSI pattern aligns with what’s happening on the shorter 4-hour chart. The 50-period Exponential Moving Average (EMA), which tracks the average price weighted toward recent candles, is nearing a crossover above the 200-period EMA.

4-our Chart Teases A Bullish Crossover: TradingView

4-our Chart Teases A Bullish Crossover: TradingView Traders refer to this setup as a “golden crossover,” which typically indicates growing bullish momentum. If this crossover happens, it could strengthen the case for a continued Pi Coin price recovery in the short term.

Retail Money Keeps Flowing

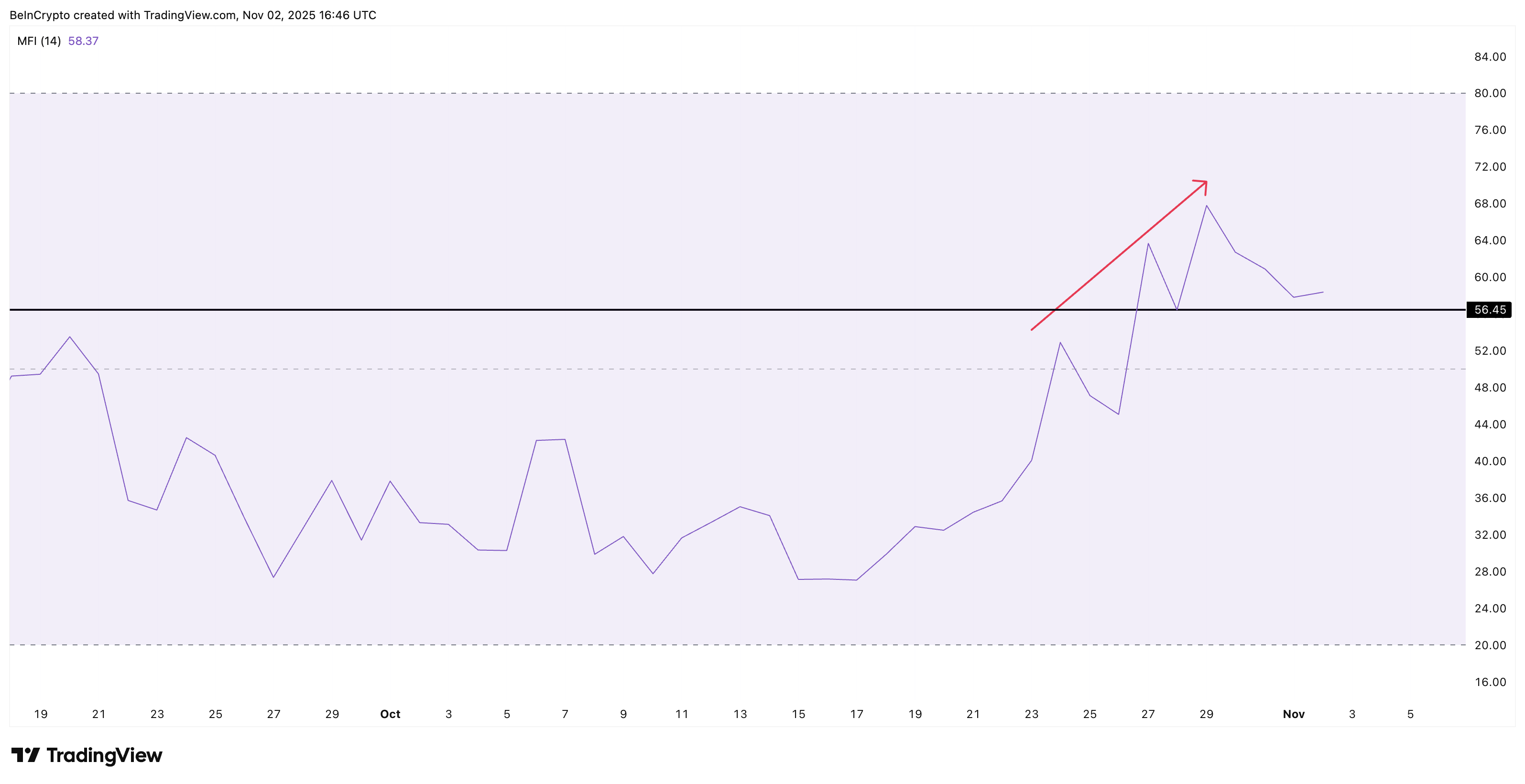

One reason the Pi Coin price hasn’t lost steam yet is continued activity from retail traders. The Money Flow Index (MFI) — which tracks both price and trading volume to measure buying and selling pressure — has been forming higher highs since October 24.

Pi Coin Retail Still Active: TradingView

Pi Coin Retail Still Active: TradingView Although MFI dipped slightly after October 29, it has since rebounded, indicating renewed inflows. It currently holds around 58, above the neutral 50 line. As long as it stays above 56.45 and doesn’t make a lower low, it suggests traders are still buying dips, helping the Pi Coin price sustain its bounce.

Key Levels To Watch For Pi Coin Price

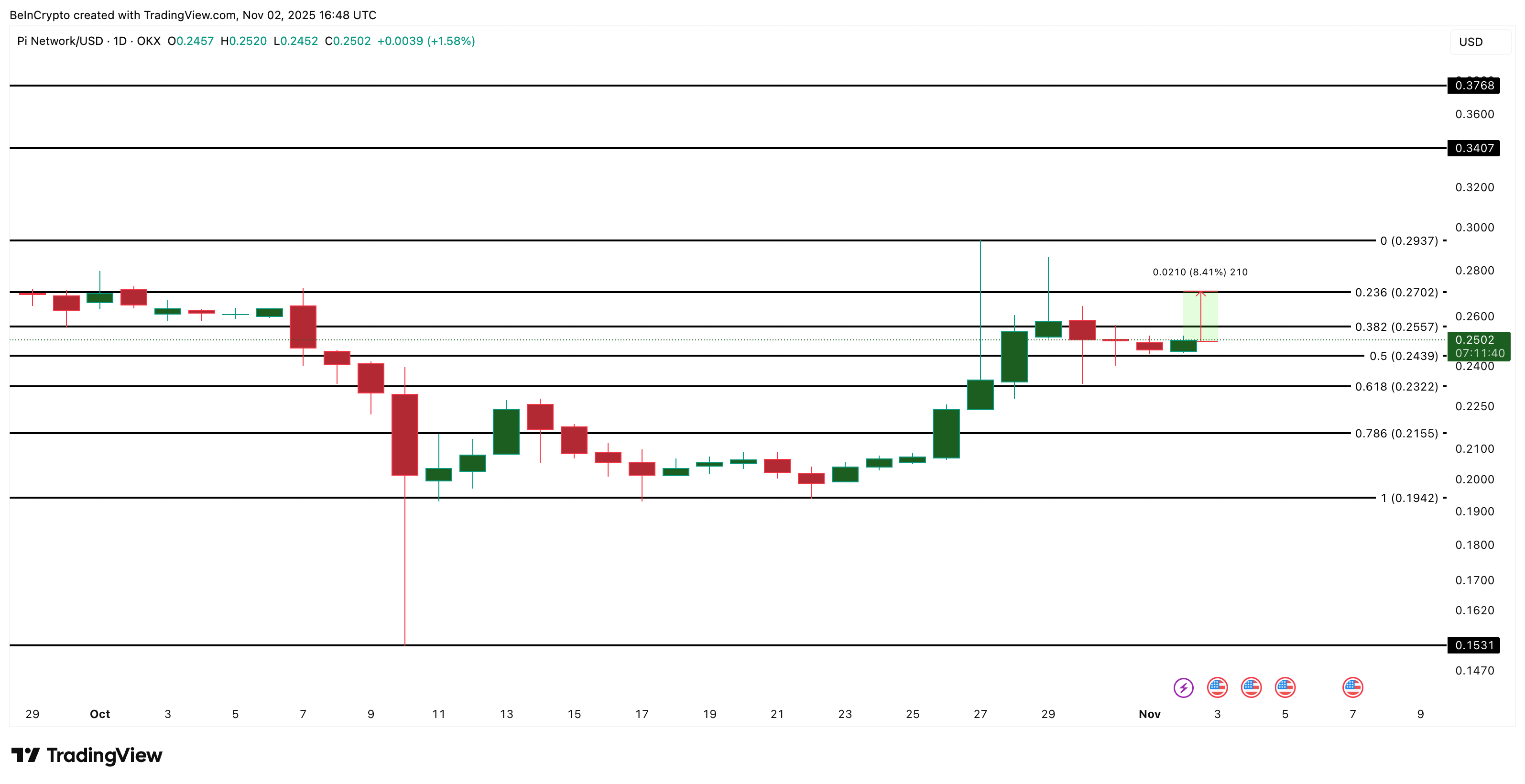

On the Pi Network price chart, the first major resistance sits at $0.255. A clean daily close above that could push Pi toward $0.270, marking an 8.4% move from current levels. If that range breaks, the next target becomes $0.293, followed by $0.340 and $0.376 as extended upside levels.

On the downside, $0.21 serves as the first major level of support. Below that, $0.194 remains a strong floor for now. However, if $0.194 fails to hold, it would invalidate the current bullish setup and expose Pi Coin to a deeper correction toward $0.153.

Pi Coin Price Analysis: TradingView

Pi Coin Price Analysis: TradingView For now, momentum indicators and retail activity hint that Pi Coin’s bounce still has some life — but sustaining it depends on holding above $0.243 and breaking through $0.255 in the coming days.